5 Accounting for Retail Business (Theory)

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

100 Terms

What is a retail business?

(1) buy merchandise from suppliers or vendors and sell them to consumers

What are suppliers or vendors?

(1) companies selling the merchandise to retailers

B2B Transactions

(1) business-to-business transactions

(2) transactions between suppliers and retailers

B2C Transactions

(1) business-to-consumer transactions

(2) transactions between retailers and consumers

What is an operating cycle?

(1) process by which a company spends cash, generates revenues, and receives cash from customers

What is the operating cycle of a retail business?

(1) purchase of merchandise

(2) merchandise is delivered or transported

(3) sales

(4) accounts receivable

(5) collection

(6) cash

Repeat.

How long do operating cycles usually last?

(1) it varies depending on the kind of business

What are sales?

(1) sales are the revenues earned from selling merchandise to customers

(2) when merchandise is sold, the revenue is reported as sales

What are cost of goods sold?

(1) the cost of the merchandise that was sold to customers

What is gross profit?

(1) gross profit = sales - cost of goods sold

(2) the profit before deducting operating expenses

What is operating income?

(1) operating income = gross profit - operating expenses

What is inventory?

(1) current asset that is essentially merchandise on hand (existing merchandise on hand)

New Accounts for Retail Businesses

(1) Inventory

(2) Estimated Returns Inventory

(3) Customer Refunds Payable

(4) Estimated Coupons Payable

(5) Sales

(6) Cost of Goods Sold

(7) Delivery Expense

What kind of account is inventory?

Asset

What kind of asset is inventory?

Current Asset

What kind of account is estimated returns inventory?

Asset

What kind of asset is estimated returns inventory?

Current Asset

What kind of liability is customer refunds payable?

Current Liability

What kind of liability is estimated coupons payable?

Current Liability

What kind of account is sales?

Revenues

What kind of account is cost of goods sold?

Expense

What kind of account is delivery expense?

Expense

3 Digit Account Classification

(1) First Digit — Major Financial Statement Classification (assets, liabilities, etc.)

(2) Second Digit — Subclassification (current assets, noncurrent, etc.)

(3) Third Digit — Specific Account (cash, store equipment, etc.)

2 Types of Ledgers

(1) general ledgers

(2) subsidiary ledgers

General Ledger

(1) the parent ledger

(2) traditional ledger, where all main transactions are recorded

Subsidiary Ledger

(1) groups together a large number of individual accounts with a common characteristic, which is then summarized into a controlling account found in the general ledger

What is a controlling account?

(1) an account assigned in the general ledger that summarizes balances from the subsidiary ledger so as not to overwhelm the general ledger

3 Common Subsidiary Ledgers

(1) accounts receivable — customer

(2) accounts payable — creditor

(3) inventory — merchandise

What are special journals?

(1) are accounting journals used to record repetitive, similar types of transactions in separate journals — such as all sales, all purchases, all cash receipts, or all cash payments

What are the two systems for accounting for merchandise transactions?

(1) perpetual inventory system

(2) periodic inventory system

What is a perpetual inventory system?

(1) continuous inventory system

(2) each purchase and sale of merchandise is recorded in the inventory account and related subsidiary ledger in real time

Perpetual Inventory System in the Age of Technology

(1) bar codes, radio frequency identification, optical scanners, radio frequency devices; easier to keep track of your inventory

(2) widely used

The balance of the physical inventory aids in the computation of two things. What are they and when are they computed?

(1) cost of inventory on hand — end of the period

(2) cost of goods sold — during the period

Journal Entry for Transaction: Cash Purchases of Merchandise from Supplier; Purchase of Inventory from Supplier via Cash

Purchase of Inventory w/ Cash | |

Inventory | |

Cash | |

Journal Entry for Transaction: Purchase of Inventory on Account

Purchase of Inventory on Account | |

Inventory | |

Accounts Payable | |

What is an invoice?

(1) a document issued by the seller to the buyer, sent to request payment for goods or services provided

What are credit terms?

(1) the terms for when payments for merchandise are to be made

Payment Required on Delivery

(1) cash on delivery, cash, net cash

Credit Period

(1) amount of time in which to pay

When does the credit period begin?

(1) begins with the date of the sale as shown on the invoice

How are credit terms usually expressed?

(1) n/15, n/30 — net 15, net 30

(2) 2/10, n/30 — “2% discount if paid within 10 days

What are purchase discounts?

(1) discounts taken by the buyer for early payment of an invoice

What does this mean? “2/10, n/30” written under credit terms.

“2% discount if paid within 10 days, net amount due within 30 days

What does this mean? “n/eom” written under credit terms?

“payment is due 30 days after the end of the month of the invoice”

Formula for Computing Net Savings for Taking Purchase Discount

Net Savings = Discount Amount - Interest Cost

Formula for Calculating Discount Amount

Discount Amount = P x d

P — Invoice price

d — Discount rate (decimal)

In English:

Discount Amount = Invoice Price x Discount Rate

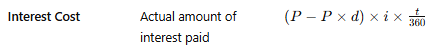

Formula for Calculating Interest Cost

Interest Cost = Principal x Rate x Time

Principal = Invoice Price - Discount Amount

Rate — Annual interest rate

Time — In days

Calculating for the Cost of NOT Taking the Discount — Estimated Annual Rate

Equivalent Annual Rate = Discount Rate x 360/days difference between full payment and discount period

Journal Entry for Transaction: Purchase Inventory Invoice on Account

Invoice on Account | |

Inventory | |

Accounts Payable | |

Journal Entry for Transaction: Payment of Invoice on Account With Discount at End of Discount Period

Payment of Invoice at End of Discount Period (Discount) | |

Accounts Payable | |

Cash | |

Inventory | |

Journal Entry for Transaction: Payment of Invoice on Account Without Discount at End of Discount Period

Payment of Invoice at End of Discount Period (No Discount) | |

Accounts Payable | |

Cash | |

Purchase Return

(1) merchandise that is returned

Purchase Allowance

(1) price allowance for damaged or defective merchandise

Technicalities for Availing Purchase Returns and Allowances

(1) for returns and allowances, the buyer normally sends the seller a debit memorandum to notify the seller of reasons for the return (for returns), or request a price reduction for allowances

Debit Memorandum

(1) debit memo, issued by the buyer, informs the seller of reason for the return or to request a price reduction

(2) informs the seller of the amount the buyer proposes to debit to the account payable, or reasons for the return or the request for the price allowance

Journal Entry for Transaction: Return of the Inventory

Accounts Payable | |

Inventory |

Journal Entry for Transaction: Return of the Inventory for Payment Within the Discount Period

Accounts Payable (Remaining) | |

Inventory (Discount) | |

Cash |

What are cash sales?

(1) sales for when retail businesses sell merchandise for cash

Journal Entry for Transaction: Cash Sales

2 Entries for Perpetual Inventory System

Cash | |

Sales | |

Cost of Goods Sold | |

Inventory |

Are debit cards and/or credit cards recorded as cash sales or not?

Yes. Bank cards in general are recorded as cash sales.

Journal Entry for Transaction: Processing Fees

Processing fees are recorded as an expense.

Credit/Debit Card Expense | |

Cash |

Why do retailers offer sales incentives, promotions, and discounts? — Customer Promotions

(1) To increase sales

(2) Marketing tactics to encourage customers to buy sooner

(3) Getting cash sooner is a good thing for any business; pay back debt, stay on top of operating cycle

What is the main objective for the accounting of customer promotions?

(1) to just estimate the amount of coupons that will be redeemed; to estimate returns, refunds, and allowances, etc.

What are coupons?

A coupon provides the customer a discount when purchasing the product; presented when the product is bought

What are rebates?

A rebate provides the customer a refund after the product is purchased

Point-of-Sale Coupons

Discounts or offers given to customers at checkout to encourage immediate or future purchases

What are immediate discount point-of-sale coupons?

The coupon is applied right away at checkout. Redeemed at the time of purchase, reduce the revenue at the time of sale

What are future liability point-of-sale coupons?

(1) The coupon is printed or issued during the sale but redeemable later. Creates a liability.

(2) Creates a liability. Coupons that appears at the bottom of the customer’s sales receipt and may be redeemed for future purchases

(3) Require the retailer to estimate the dollar value of rebates that will be redeemed, reduce sales, and record a related liability

Journal Entry for Transaction: Point-of-Sale Coupons for Immediate Discount

Accounts remain the same. Subtract the coupon from the cash and the sale; cost of goods sold remains the same. Coupon reduces revenue at the time of sale

Cash | |

Sales | |

Cost of Goods Sold | |

Inventory |

Journal Entry for Transaction: Point-of-Sale Coupons for Future Liability

Creates a liability. Estimated coupons payable.

Cash | |

Sales | |

Estimated Coupons Payable | |

Cost of Goods Sold | |

Inventory |

Formula for Estimated Coupons Payable

(total sales receipts) × (discount in $) × (estimated percent of coupons (receipts) that will be redeemed)

Journal Entry for Transaction: When Customers Redeem Future Liability Point-of-Sale Coupons

Estimated Coupons Payable is debited because it decreases. Recorded at the end of the period.

Cash | |

Estimated Coupons Payable | |

Sales | |

Cost of Goods Sold | |

Inventory |

Formula for Future Liability Point-of-Sale Coupons Redeemed

(actual coupons redeemed) × (discount in $)

Journal Entry for Transaction: Adjusting Estimated Coupons Payable Post Coupon Period (Positive Balance, Overestimating Percent of Coupons Redeemed)

Estimated Coupons Payable credit balance is added back to the sales.

Estimated Coupons Payable | |

Sales |

**Revenues normal balance is credit. Liability normal balance is credit. Add it back to the sales by crediting sales, liabilities are absolved*

— Estimated Coupons Payable should have zero balance after the coupon period

Journal Entry for Transaction: Adjusting Estimated Coupons Payable Post Coupon Period (Negative Balance, Underestimating Percent of Coupons Redeemed)

Estimated Coupons Payable debit balance is decreased from the sales

Sales | |

Estimated Coupons Payable |

**Revenues normal balance is credit. Liability normal balance is credit. Reduce it from the sales by debiting sales; liabilities remain as is*

— Estimated Coupons Payable should have zero balance after the coupon period

What are instant rebates?

(1) Redeemed at the time of purchase, reduce the revenue at the time of sale

(2) The coupon is applied right away at checkout.

(3) Equivalent to immediate discount point-of-sale coupons

What are mail in rebates?

(1) Require the retailer to estimate the dollar value of rebates that will be redeemed, reduce sales, and record a related liability

(2) Equivalent to future discount point-of-sale coupons

Three Types of Customer Return Settlement Options

If a customer returns goods that are defective, damaged, or not what they wanted, and they already paid, the seller can do three things:

(1) Cash refund — money back

(2) Offset against accounts receivable — deduct debt

(3) Price Allowance — keep merchandise, partial refund or price allowance

2 Adjusting Entries of Returns, Refunds, and Allowances Estimates

(1) Customer Refunds Payable

(2) Estimated Returns Inventory

Adjusting Journal Entry for Transaction: Customer Refunds Payable

Customer Refunds Payable, liability account. Current liability for refunds and allowances that will be granted to customers.

Sales | |

Customer Refunds Payable |

Adjusting Journal Entry for Transaction: Estimated Returns Inventory

Estimated Returns Inventory, asset account. Current asset for merchandise that is expected to be returned to customers.

Estimated Returns Inventory | |

Cost of Goods Sold |

What is a credit memo?

(1) credit memo indicates the intent to offset against accounts receivable

(2) sales allowance granted against customer’s accounts receivable

Journal Entry for Transaction: Offset Against Accounts Receivable for Sales Allowance

Customer Refunds Payable | |

Accounts Receivable - Customer Name |

What is freight?

(1) terms of sale when ownership (title and control) of the merchandise passes from the seller to the buyer

What is freight cost?

(1) the cost of delivering the product or the item

(2) the cost of delivery or shipping of goods

FOB (Shipping Point)

(1) free on board shipping point

(1) the buyer pays the freight costs from the shipping point to the final destination

Journal Entry for Transaction: FOB (Shipping Point)

Inventory | |

Cash |

Appears on the buyer’s books

FOB (Destination)

(1) free on board destination

(2) the seller pays the freight costs from the shipping point to the buyer’s final destination

Journal Entry Transaction: FOB (Destination)

Delivery Expense | |

Cash |

Appears on the sellers books

Journal Entry Transaction: Prepaid Freight by Seller for FOB (Shipping Point)

Accounts Receivable | |

Cash |

Appears on the seller’s books

“Your company paid freight of $$, which was added to the invoice”