4.2.2 Inequality

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

income

money that a firm or person receives for producing a good or service

wealth

accumulation of all your assets

income inequality

unequal distribution (flow) of income to households

welath inequality

differences in the amount of assets that households own

examples of income

wages,salaries,dividends,benefits,interest

examples of wealth

property

art

shares

cash

life assurance

bank deposits

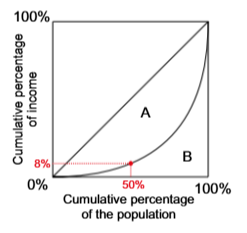

what is lorenz curve used for

used to demonstrate distribution of income

lorenz curve

diagonal line represents complete equality

the further the Lorenz curve is away from the diagonal the greater the inequality in the curve

how is gini coefficient calculated from lorenz curve

area A/(area A + area B)

gini coefficient

measure of inequlity

gini coefficient 0

complete equality

gini coefficent 1

complete inequality

change in gini coefficient in UK 1979 to 2019

increased from 0.27 to 0.33

causes of rising inequality

tax system in uk is less progressive than 20 years ago

high company profits and surging executive pay

regressive effects of high inflation

widening urban-rural income divide

market failures in education and housing

rising real income for most skilled workers

causes of income inequality

wealth income

hiusehold composition

skills and qualifications

differences in earning

tax and state benefits

different regions

causes of wealth inequality

inheritance

marriage

income equality

chance

assets increase in value quicker than income

wealth not taxed

cause sof wealth and income inequality

education,trainging and skills

trade unios

benefit systems

wage rates

employment legislation

tax structure

economic and social cost sof inequality

social unrest,tensions,civil disobedience

self perpetuating poverty cycle becomes embedded

inequality and loss of allocative efficiency

impaact of conomic change and development on inequality

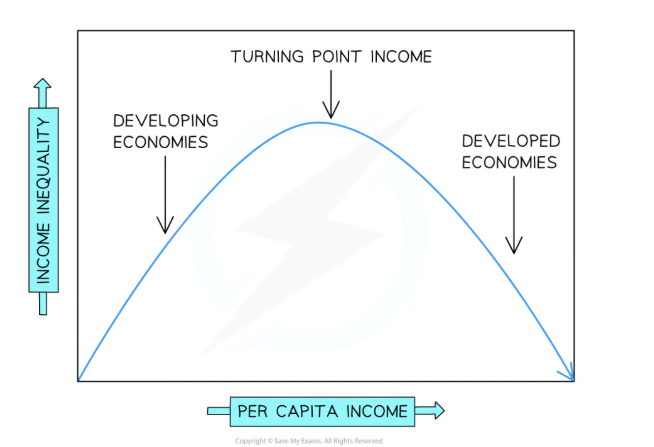

In the 1950's Simon Kuznets developed a hypothesis that described how income inequality changed as an economy went through stages of industrialisation and development

This hypothesis was explained using the Kuznets Curve

Industrialisation results in increased inequality as some workers move from the lower productivity, lower paid agricultural sector into the higher productivity manufacturing sector

There is now greater income inequality with the workers left behind

However, at some point, inequality starts to decrease

This is most likely due to government intervention/support funded by increased state tax revenue brought about as a result of the increased production in the economy

kuznets curve

As a country changes sectors from primary (farming) to secondary (manufacturing), productivity increases and the per capita income increases

However, inequality is also increasing as the gap in wages between the primary and secondary sector is significant

At some point, the economy will reach a turning point of income where inequality begins to fall

This often occurs as the primary sector diminishes while the secondary and tertiary (services) sectors increase

Developed economies tend to generate more income from secondary and tertiary sectors

capitalism on inequality

nder Capitalism, inequality is inevitable

Workers with higher skills receive higher wages

Workers with little to no skills receive little to no wage

Individuals with higher income will acquire more assets leading to higher levels of income

In turn, they can keep on acquiring assets

Individuals with lower income will find it hard to acquire assets

long term cost of capitalism

factors of production become concentrated in ownership with relatively few individuals developing extreme wealth, at the expense of many who lose out

equality

everyones is treated completely equally

equity

more about fariness

horizontal equity

people with the same circumstances are trated fairly

veertical equity

people with different circumstances are treated fairly but differently

negative of unequal distribution of income

high absolute and relative poverty

restricts economic growth

as incomes rise even higher spending on imports tend to increase

social impacts

positives of unequal distribution of income

lower earners may feel if they work harder theyll earn higher income to increase prodctvity

incentive for people to start new business

some economists argue tjat higher incomes for richer people eoncourage more investmene in business creating jobs so soms of the wealth makes its way to poorer people-trickle down effect

ways government can intervene to alleviate poverty

benefits

state provision

progressive taxation

economic growth

national minimum wage

how could benefits alleviate poverty

Benefits are used to redistribute income — tax revenue (mostly from those with higher incomes) is used to pay for the benefits of those who need them.

However, as means-tested state benefits can contribute to the poverty trap (see p.166), governments might:

Remove means-tested benefits completely. This would encourage more people to work. However, people who can’t work could end up with no income, and relative and absolute poverty would increase.

Change means-tested benefits to universal benefits. But the cost of these extra benefits might mean that those on low incomes are taxed more.

Reduce an individual’s means-tested benefits gradually as their income rises, so they’re not worse off.

how could state provision alleviate poverty

State-provided services, such as health care and education, help to reduce inequalities caused by differences in income — e.g. someone on a low income can receive the same health care as someone on a high income.

State-provided services also redistribute income because a lot of the money to pay for them comes from taxing people with higher incomes. But free access is expensive to provide.

how could progressive taxation alleviate poverty

Progressive taxation means a bigger percentage of tax is taken from workers with high incomes than those with low incomes. It helps to reduce the difference between people’s disposable incomes, reducing relative poverty.

But progressive taxation can contribute to the poverty trap. Also, if high income earners are taxed too much, some may move to a country where they’re taxed less. This will mean a loss of labour and money from the economy.

how could economic growth alleviate poverty

Perhaps the most effective way of reducing poverty is through economic growth. This will mean jobs are created and unemployment will be reduced. It also tends to lead to higher wages, meaning the government will gain more tax revenue, which it can use to provide services and state benefits.

However, economic growth can be difficult to achieve. It can also result in larger inequalities in income — for example, economic growth might mainly benefit the rich so that they become even richer. It can also cause problems such as the using up of finite resources, which might mean more poverty and inequality in the future.

how could NMW alleviate poverty

A national minimum wage, if it’s set at a sensible level, will reduce poverty among the lowest paid workers. It will provide an incentive to work, and will help those on low incomes to afford a reasonable standard of living. A NMW can also counteract monopoly power (see p.63) — e.g. if an employer was paying low wages, resulting in workers being paid below relative or absolute poverty.

However, the NMW might mean some employers give fewer people. This would mean a rise in unemployment, and therefore a rise in poverty. A NMW also doesn’t take into account that the cost of living varies depending on where someone lives, so the standard of living for people who are earning the NMW will vary depending on where they live, while anyone who’s unemployed won’t benefit from a NMW at all.