Business Management - Topic 3

1/194

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

195 Terms

What is finance?

The process of acquiring and managing money for a business

What is accoutning?

The process of recoding money flows and assets for a business

What is procurement?

The act of purchasing goods and services for a business

What is the job of a finance department?

Allocating funds for other departments, ensuring the business stays within budget and meets financial targets, planning financial future and monitoring external changes

What is capital expenditure?

Spending on the company’s fixed assets

What are fixed assets?

Something that will be used for more than 1 year and usually requires long-term investment (land, buildings, factories, machines, tech, production equipment, vehicles)

How are fixed assets funded?

Through long-term finances as they tend to be expensive

What is revenue expenditure?

Spending on a company’s general operational costs/things that have to be paid daily, weekly, or monthly (utility, wages, salaries, taxes, debts)

How are revenue expenditure funded?

Short or medium-term finances

What are the time periods of short, medium, and long-term finance?

Short-term is repaid within a year, medium-term is 1 to 5 years, long-term is more than 5 years

What is the purpose of short-term sources of finance?

Solve cash flow problems or to pay for revenue expenditure

What is the purpose of medium-term sources of finance?

Finance capital expenditures or purchase a fixed asset

What is the purpose of long-term sources of finance?

Finance large capital expenditures

What are internal sources of finance?

Money that is raised from the business’s or owner’s existing assets, doesn’t have to be repaid

What are benefits of internal sources of finance?

Less risk, maintains controlW

What are the 3 internal sources of finance?

Personal funds, retained profits, sales of assets

When are personal funds used?

Start of business or when in crisis

Why would a business want to sell an asset?

Need quick money or want to use the money to replace the asset

What are disadvantages of internal sources of finance

Slower to get funds, use of personal funds is risky for the owner, using retained profits results in a lower dividend value, selling assets has opportunity costs

What are external sources of finance?

Finance that comes from outside the business

What is equity finance?

The provider of finance receives part ownership of the business in exchange for the finance

What is an advantage of equity finance?

Don’t have to be repaidW

What are disadvantages of equity finance?

Loss of ownership and control

Who are business angels?

A successful, wealthy person who invests their money into a new business to provide funding to a business that is not yet listed on the stock exchange

What to business angels want out of a business?

High growth and large returns on investment

What is an advantage of having a business angel?

They can be mentors

What is a disadvantage of having a business angel?

Conflicts may occur if parties want to set up a business differentlyW

Who are venture capitalists?

Companies that use money from clients to fund a new business

What do venture capitalists want out of a business?

They want the business to grow so that they can sell their stake at a higher price

What is share capital?

Money raised through shares on the stock market, shareholders get a portion of profits as dividends

What is the benefit of share capital?

Easy to access large amounts of financial capital

What is debt finance?

Money that is borrowed from a bank or other financial institutions

What is the benefit of debt finance?

Ownership is maintained

What is the disadvantage of debt finance?

Money must be paid back, likely to have interest

What is loan capital?

Medium to long-term finance used to buy fixed assets

What must the business give up to get a loan?

Provide a collateral, an asset, in the event that the business doesn’t pay back the loan

What is a mortgage?

A special type of loan used to purchase land or buildings, tend to be repaid over 25 years

What are advantages of loan capital?

Money is available immediately, repaid in small chunks, used to buy profit-generating assets which will repay itself

What are overdrafts?

High cost, short term loans attached to a bank account which allows the account holder to withdraw more money than they have in their account

What is microfinancing?

Providing financial services to individuals who have very limited income and assets and are not able to get services from traditional banks

What is microcredit?

Small loans that can allow someone to start or continue to finance a small-scale business

What are the benefits of microcredit?

No collateral, low interest rates

What are disadvantages of microcredit?

Loans are small, loan period is short

What is trade credit?

A business receives goods and services from a supplier immediately but pays at a later date, normally 30, 60, or 90 days with no interest

Why would both parties benefit from trade credit?

Customers stay happy, business will have extra cash on hand for production, business will want to pay in a timely manner to maintain good relationships

What is leasing?

Renting a fixed asset over a period of time instead of buying it

Why would a company want to lease?

Don’t need to worry about maintenance or repair, lower cost of production, can always lease the latest model

What is crowdfunding?

Many people investing small amounts of money to fund a project

What is peer-to-per lending?

Investors provide a loan that earns interest

What is equity crowdfunding?

Investors acquire a small share of ownership in the business

What is rewards-based crowdfunding?

Investors receive a non-financial reward at a later date, normally a good or service produced by the business

What is donation-based crowdfunding?

Donors don’t receive anything in return

Where does crowdfunding occur?

A platform that a business pays a fee to use

What is taken into consideration when choosing a source of finance?

Ownership type and size of business

Purpose of the business

What finance is needed for

Risk tolerance

What are costs?

All the expenses needed to produce a good or service

What are variable costs?

Costs that vary with output (materials, packaging, delivery, piece-rate wages, commission)

What is variable cost per unit?

The variable cost of making 1 product

What is total variable cost?

The sum of all variable costs for the entire output (variable cost x output)

What are fixed costs?

Costs that don’t vary with output (insurance, rent and mortgage payment, machines, and salaries and wages that aren’t dependent on output)

What are semi-variable costs?

Costs with a fixed and variable element (utility bills, staff who are paid a basic salary and a bonus)

What are direct costs?

Costs that can be tracked back to an individual project, product, or department (staffing costs of a particular department, utilities of a store, material costs of a product line)

What are indirect costs?

Costs that can’t be tracked to the production or sale of any single product (nationwide campaigns, expenses of a central HR department)

What is revenue?

Income earned from selling goods and services

How do you calculate total revenue?

Selling price x quantity sold

What are revenue streams?

Methods through which a business will get revenue

What is the effect of having more revenue streams?

Makes the business more resilient to external changes

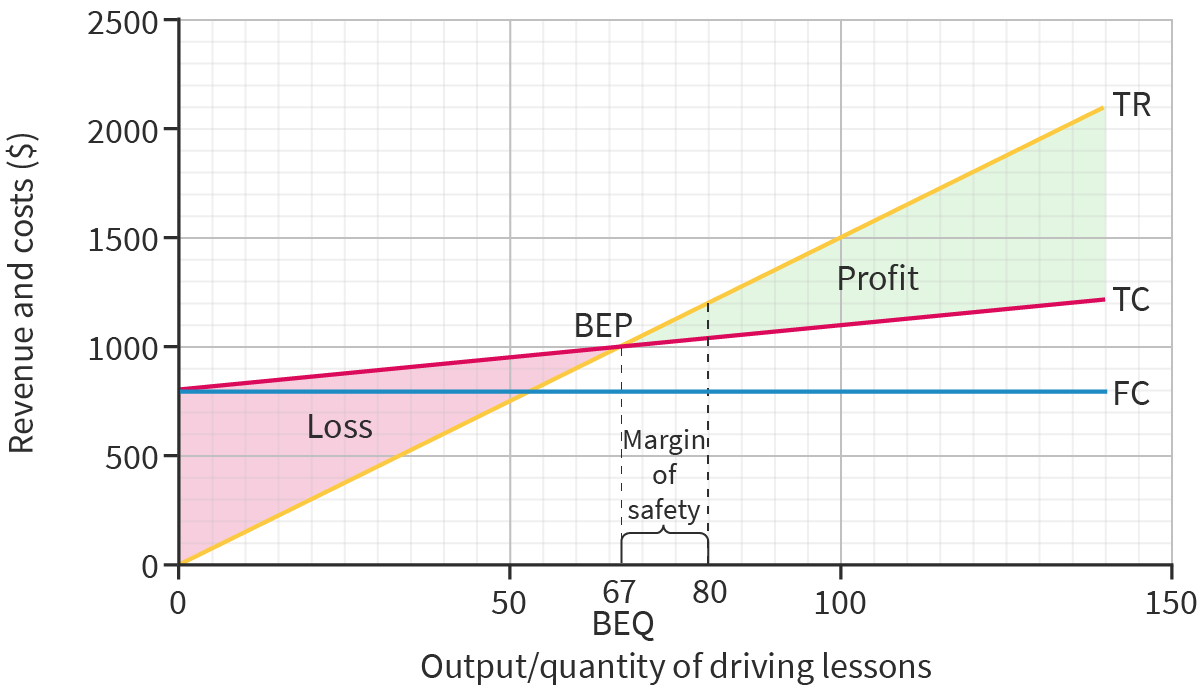

What is the break-even point?

The quantity or output where total revenue equals total costs

How is contribution per unit calculated?

Selling price - variable costs per unit

How is total contribution calculated?

Contribution per unit x output

How is BEP (units) calculated?

Fixed costs ÷ contribution per unit

How is the margin of safety (units) calculated?

Current output - BEP

How is profit at a certain level of output calculated?

(Output x contribution per unit) - fixed costs

How is a break-even chart made?

Calculate BEP

Draw fixed cost line

Draw total cost line (starting at FC line and increases with output)

Draw total revenue line (starting at 0 and increases with output)

Mark BEP, where TC and TR intersect

Mark current or planned output and indicate margine of safety

Shade area of profit and loss

What is a break-even chart used for?

Help understand what output is needed to earn a profit

Used by banks and investors to judge a risk of a loan or investment

Examine cost and revenue scenarios when considering change

What are the limitations of break-even?

Costs and revenue change regularly, need to update often

Assumes costs and revenue are linear

Time-consuming to analyze for each product

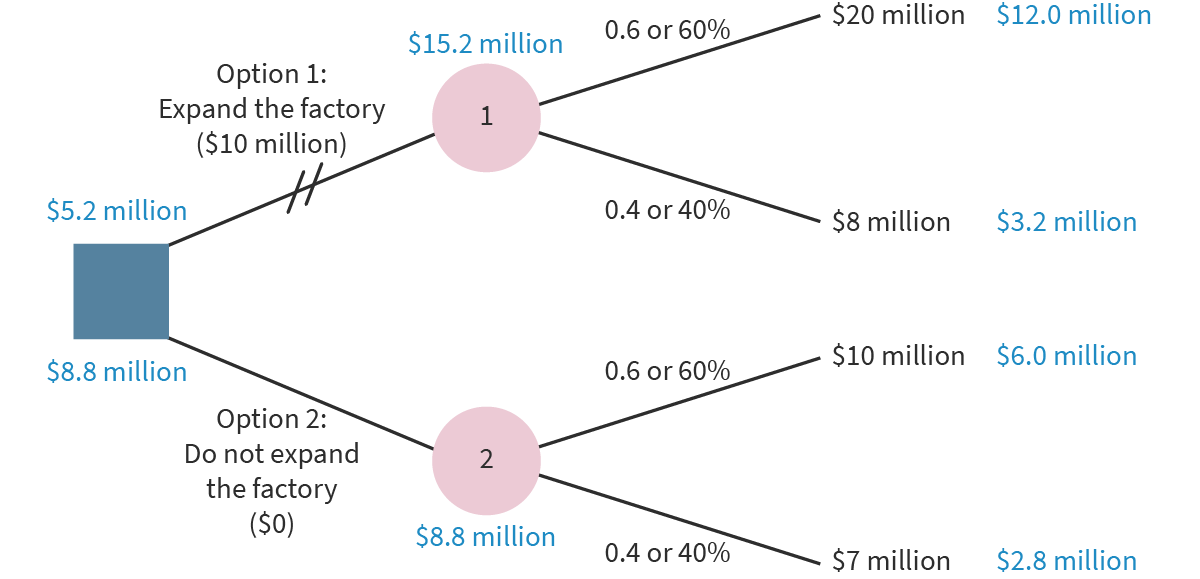

What are decisions trees?

Tool that helps businesses make decisions by putting an estimated value on various options, often used to choose between investment decisions

What are elements of a decision tree?

Decision node (square)

Probability node (circle)

Crossed-out lines to indicate an option is rejected

How is a decision tree made?

Calculate the expected revenue of each outcome (probability x revenue)

Calculate the total expected value of each outcome for each option (successful + unsuccessful expected revenue)

Calculate the net expected value of each option by subtracting initial costs, written next to the decision node

Cross out rejected option

What are advantages of decision trees?

Clear and easy visual representation of complex problems

Integrates uncertainty (risks) into analysis

Considers all options

What are disadvantages of decision trees?

Don’t take qualitative factors into account

Probabilities and revenues are estimated, can lead to false results

Estimated figures are prone to bias

How does management use final accounts?

See changes in the business and develop new strategies, identify how easily short and medium-term debts are covered, how profits are earned, values of assets, and amount of money invested by shareholders

How do owners and shareholders use final accounts?

Identify how effectively their money is invested and how much they will receive in dividends

How do employees use final accounts?

Know financial stability of a business and how secure their jobs are, negotiate wages based on profits

How does the government use final accounts?

Assess taxes, health of a business, identify when a business needs financial support

How do competitors use final accounts?

Assess overall financial strength, compare profits

How do banks use final accounts?

Check ability to pay loans

How do suppliers use final accounts?

Check how effectively a business can pay for goods on credit

How does the local community use final accounts?

Check how financially stable a company is and if the business can continue to provide jobs and goods/services

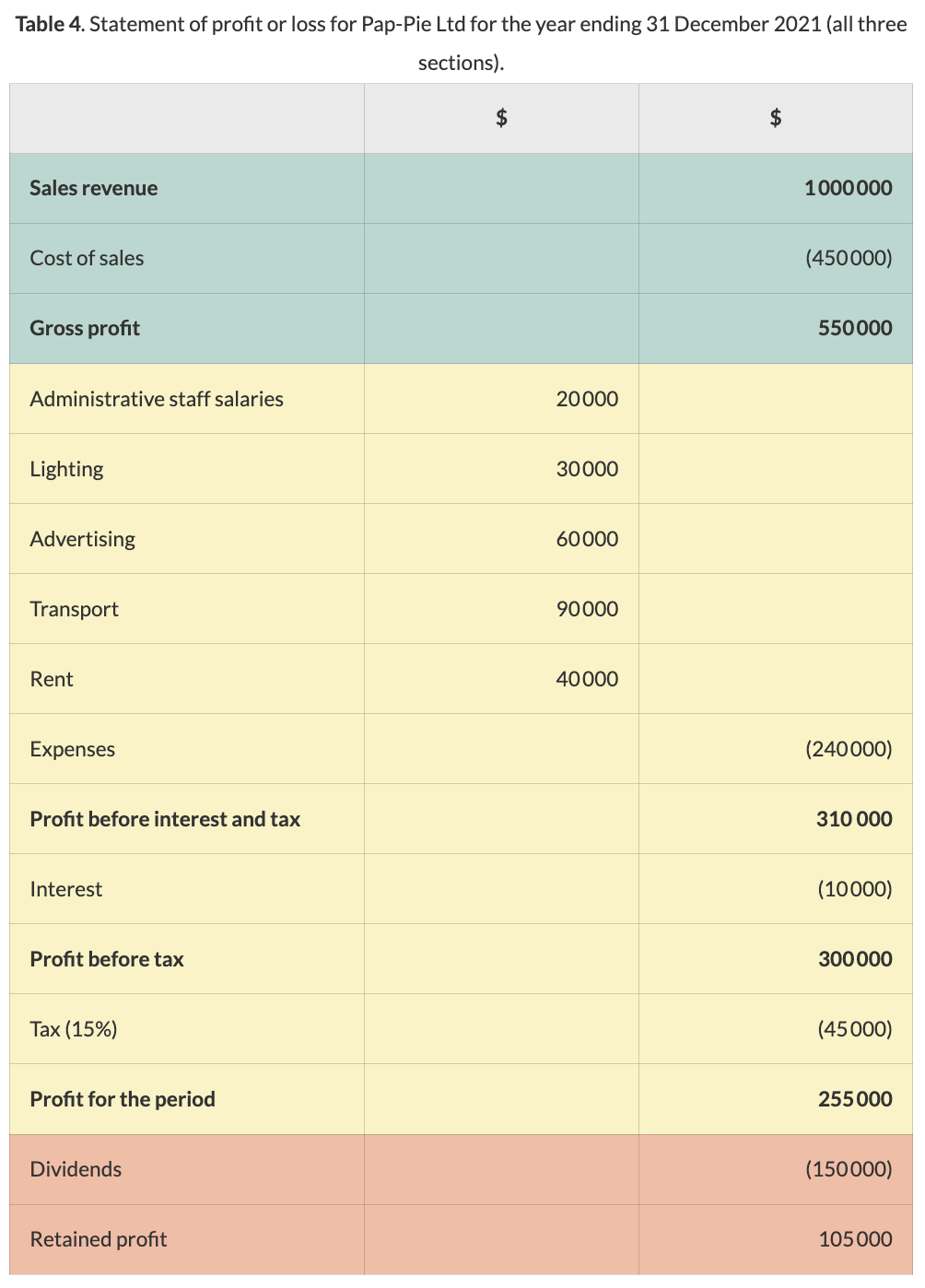

How is a statement of profit and loss/income statement for a for-profit enterprise made?

Calculate gross profit (sales revenue - cost of sales)

Cost of sales = opening stock + purchases - closing stock

Calculate profit or loss

Profit before interest and tax = gross profit - expenses

Calculate profit before tax (profit before interest and tax - interest)

Calculate profit for period (profit before tax - tax)

List how profits are distributed (dividends and retained profits)

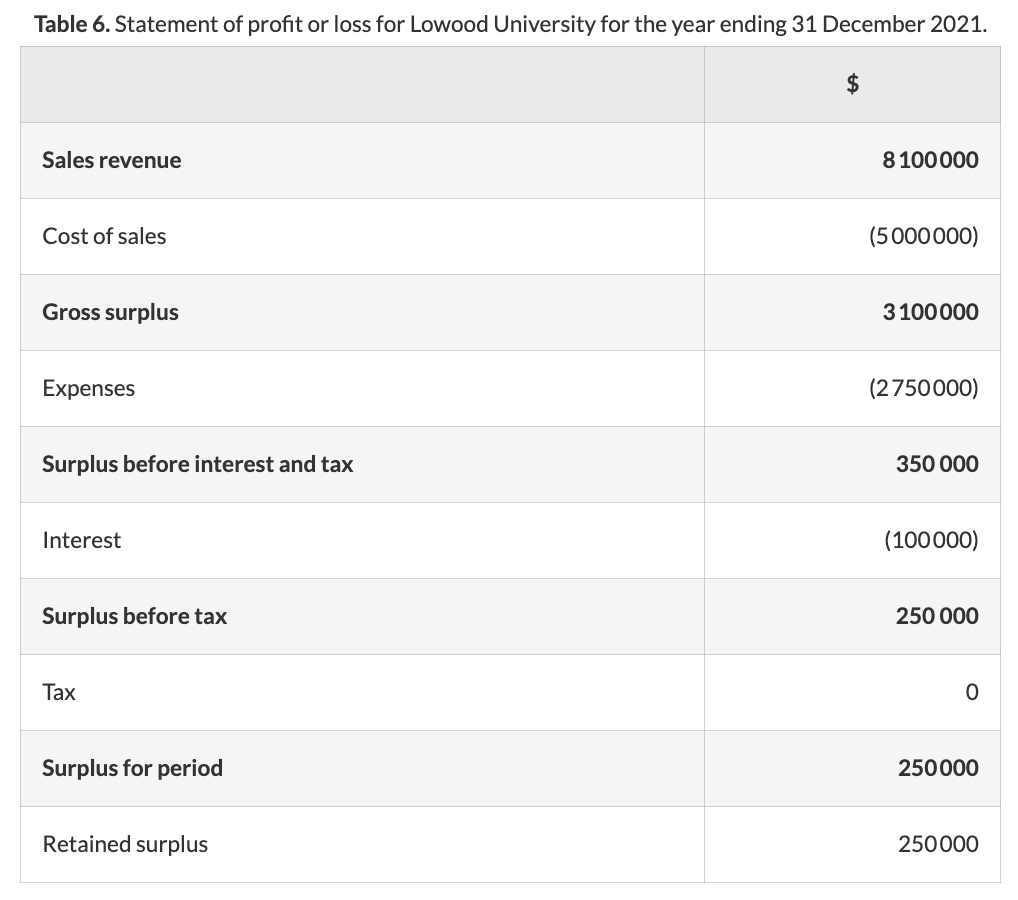

What is the difference between a profit and loss statement for a profit and non-profit enterprise?

Surplus instead of profit, no taxes, no dividends

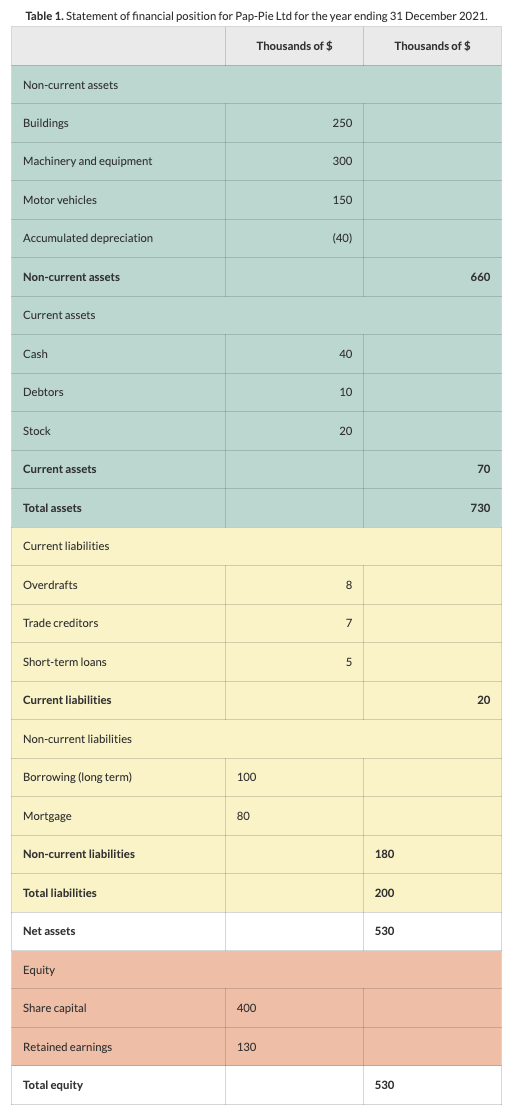

What is a statement of financial position/balance sheet?

States the company’s assets and liabilities and shareholder’s investment or equity in the business

What is the structure of a balance sheet for a for-profit enterprise

Current assets

Cash

Debtors

Stock

Non-current assets

Total assets

Non-current liabilities

Current liabilities

Total liabilities

Net assets

Equity

Share capital

Retained earnings

Total equity

Net assets = total equity

What is the difference between a balance sheet for a profit and non-profit enterprise?

No shareholders so no share capital

What are intangible assets?

Non-physical items of value owned by a company that has a lifespan of more than a year

What are patents?

Legal protection given to inventors of products to prevent copying for a certain number of years

Why are patents beneficial for businesses?

They grant temporary monopoly or production, businesses can earn large revenue

Incentive to develop or innovate even with high costs

What is copyright?

A form of legal protection given to producers of literary or artistic works to protect their exclusive right to publish, reproduce, perform, distribute, and sell

How long does copyright last?

50-70 years after the creator’s death, once expired work enters the public domain

What is a registered trademark?

A distinctive mark, sign, or symbol a company or individual uses to identify or brand itself

What is goodwill?

The intangible value of a company derived from its ‘good nature’ in business, public’s perception of a business