Macro Topic E - Expectation

1/28

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

C and expectations

Previously assumed C depends on disposable income (c0) and MPC (c1)

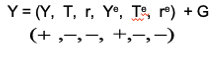

Now C depends on total wealth → Ct = C

what makes up total wealth

Total wealth = human wealth + non-human wealth

Human wealth

expected present value of after-tax current and future labour income

Wealth depends on current taxes / income and how you expect taxes / income to be in the future

Non - human wealth

financial wealth + housing wealth

financial wealth

the value of stocks and bonds + the value of savings

Housing wealth

Value of house - mortgage left

Total wealth theory of C

Individuals smooth shocks to income across their lifetimes

if they can correctly anticipate the future

C in reality

C reacts to current changes in income

Individuals incorrectly judge expectations about the future

Individuals are financially constrained

How do expectations affect C

Directly - Human wealth & Indirectly - Non-human wealth

If the consumer decides the decrease in income is permanent / transitory, they are likely to decrease consumption one-for-one / less than 1-1

Consumption may move even if current income does not change due to changes in consumer confidence

How expectations directly affect C

expectations of future labour income, real interest rates and taxes change

How expectations indirectly affect C

Financial markets & i play a role

I & expectations

I depends on Y + r & Ye + re → Investing in K depends on expected profits and current costs

I depends positively on Ye & negatively on re

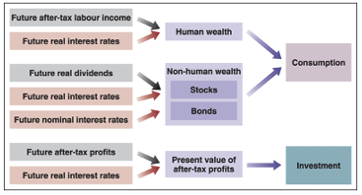

AD and expectations

i now affects C

re affects Human + non-human wealth + I

Increase in Current and expected future post tax real labour income

increase HW → C increases

Increase in current and expected future real dividends

stock prices UP → increase NHW → C increases

decrease in r & re

increase HW → C increases

&

stock prices UP → increase NHW → C increases

&

Present values of real after tax profits UP → I increases

Decrease in i & ie

Bond prices UP → NHW increase → C increases

Increase in current and expected future real after tax profits

Present values of real after tax profits UP → I increases

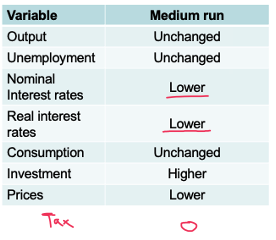

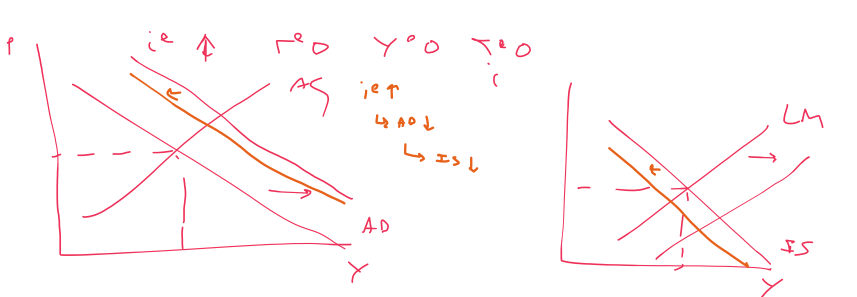

IS and expectations

Downwards sloping

Steeper - changes in current r not only determinant of I

Increase in G or Ye → Shift right

Increase in T, Te or ie → shift left

Multiplier under expectations

changes in current r have smaller impact in present

IF they dont change expectations

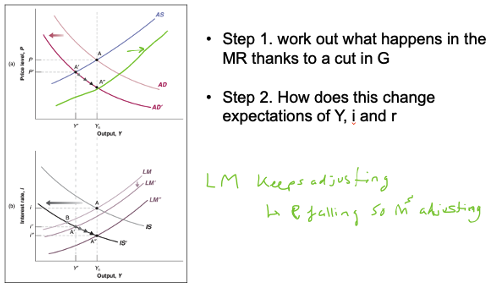

Expectations and AD-AS

Expectations only affect SR

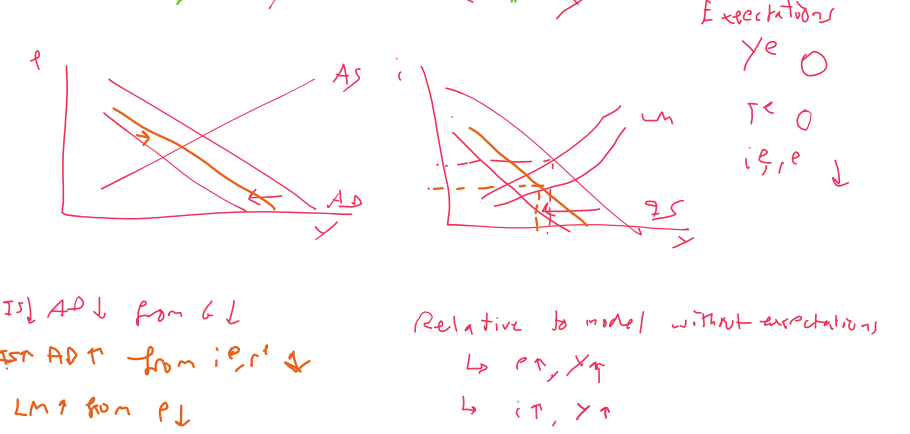

FP - G decrease - NO EXPECTATIONS

FP - G decrease - EXPECTATIONS

Y = Ye & T = Te r & i are different to re & ie

i & r fall → HW + NHW +I rise

AD shifts after initial AD fall

Austerity plans and current effects

Back loading - Expected cuts in G will increase Y in current

works unless cuts aren’t credible if deficit reduction programme doesn’t look good

Govt must play balancing act - enough cuts in current to show commitment to deficit reduction + enough cuts left to future to reduce adverse effects on economy in SR.

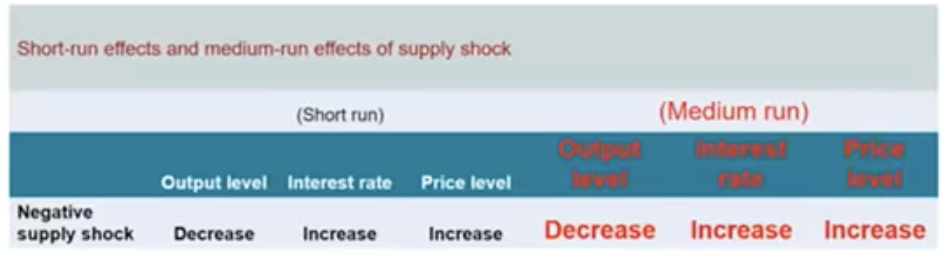

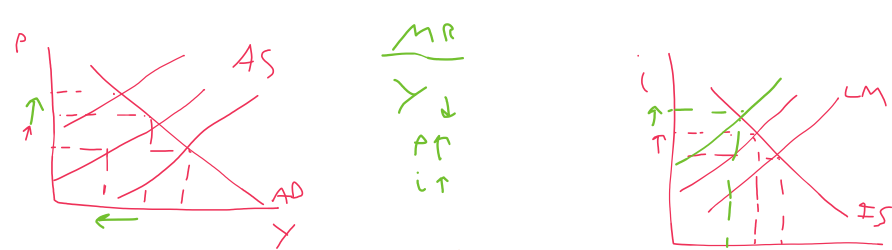

Negative AS shock - NO EXPECTATIONS

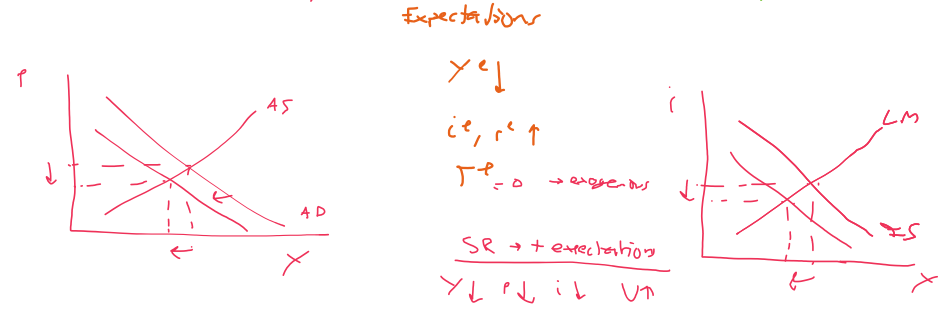

Negative AS shock - EXPECTATIONS

Ye falls ie & re rise Te unchanged - exogenous

Y + p + i fall & u rises

Expectations & static vs dynamic model

in MR:

Static → Y i r T unchanged

Dynamic → i affected so ie changes ∆ gm = ∆π = ∆i

Expansionary MP + expectation in DYNAMIC MODEL

Expansionary MP →∆gm increase → i increase → ie increase → AD shifts inwards

Back loading

Expected cuts in G will increase Y in current