3.5 profitability and liquidity ratio analysis

1/13

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

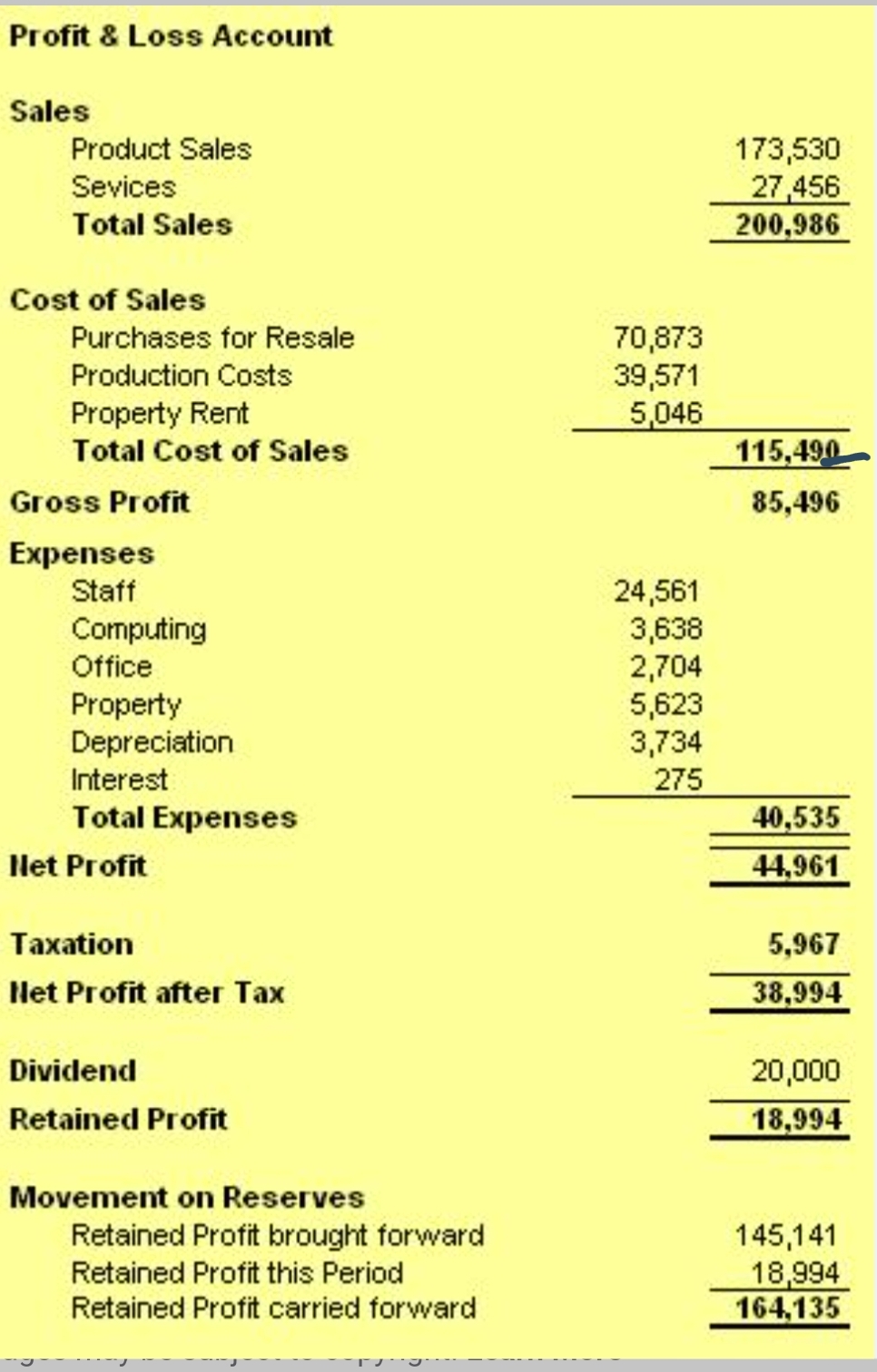

Profit and Loss account

Keep track of all the money in the business and its earnings and losses.

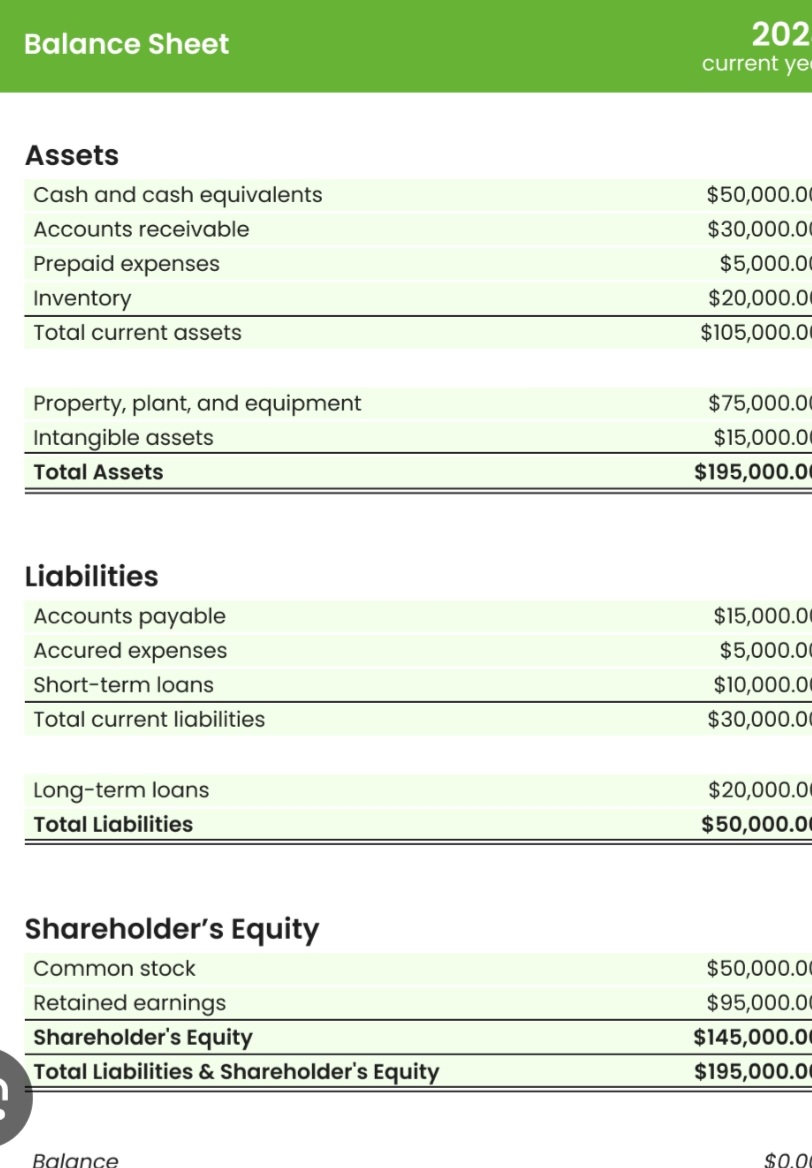

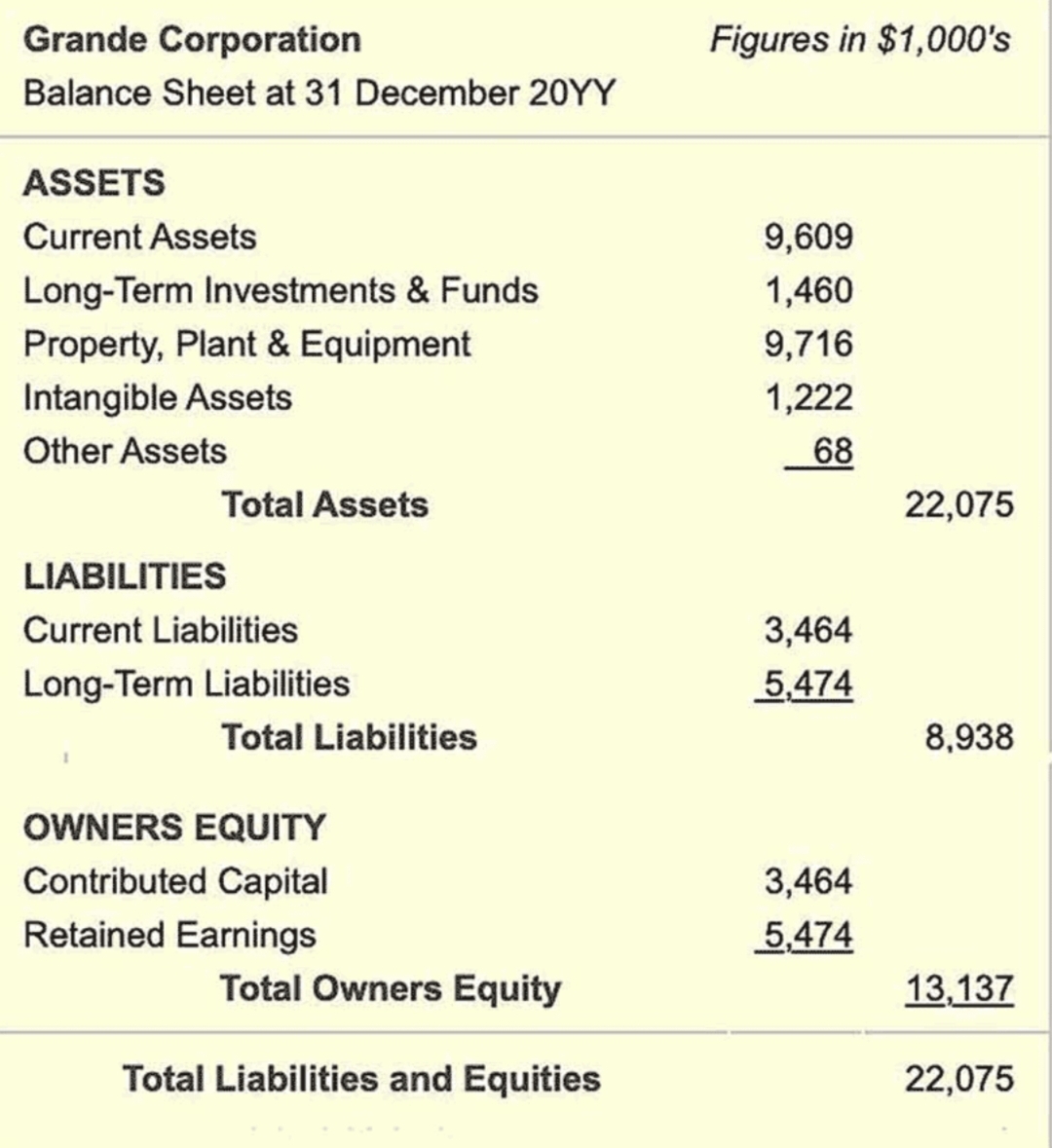

Balance sheet

Shows businesse's financial I at a specific period of time.

Assets

Stack, cash, debtors

Liabilities

Overdraft, trade creditors, borrowings, loans

Current ratio

Asset / liability

Acid test ratio

Asset-stock / liabilites

Gross profit margin

Gross profit / sales revenue. X 100

Net profit margin

Net profit before - (interest + tax) / sales revenue x 100

Net profit - money after covering all the costs

Gross profit - (expenses + taxes)

Gross profit - money after some costs

Sales revenue - cost of sales

Revenue

Q x P

Percentage Change

New value - old value /old value ×100

Net profit

profit (not money) business retains after paying all expenses.