International Finance - Foreign exchange markets

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

what is the interbank market

large companies

major financial institutions

institutional investors

big amounts

what is the retail market

small companies

individual traders

online brokers

small amounts

what is the bid for bank and customer

bank → buy

customer → sell

what is the ask for bank and customer

bank → sell

customer → buy

what are direct trades

trades not intermediated by a third party

what are indirect trades

trades intermediated by a third party

what is a spot transaction

= (St) is a trade where the buyer and seller agree to settle the transaction immediately, usually within one or two business days.

what is a forward transaction

(Ft,T) is a contract between two parties to exchange a specific asset (like currency, commodity, or security) at a predetermined future date and price.

what are foreign exchange options

They give the right to buy or sell a currency with another

currency at a specified exchange rate during a specified period

what are foreign exchange swaps

is an agreement between two parties to exchange one currency for another at a specified rate agreed at the

conclusion of the contract (the short leg), with a reverse exchange at a future date and rate (the long leg).

what are currency swaps

They commit two counterparties to exchange streams of interest

payments in different currencies for an agreed period of time.

what is a direct quote

It is domestic currency price of one unit of foreign currency (e.g. value of USD in EUR)

HC/FC

what is an indirect quote

It is foreign currency price of one unit of domestic currency. (e.g. value of EUR in USD)

FC/HC

what is the formula of the quoting convention if there is no bid-ask spread

Direct = 1/indirect

what is the formula of the percentage spread

percentage spread = (ask-bid)/midpoint

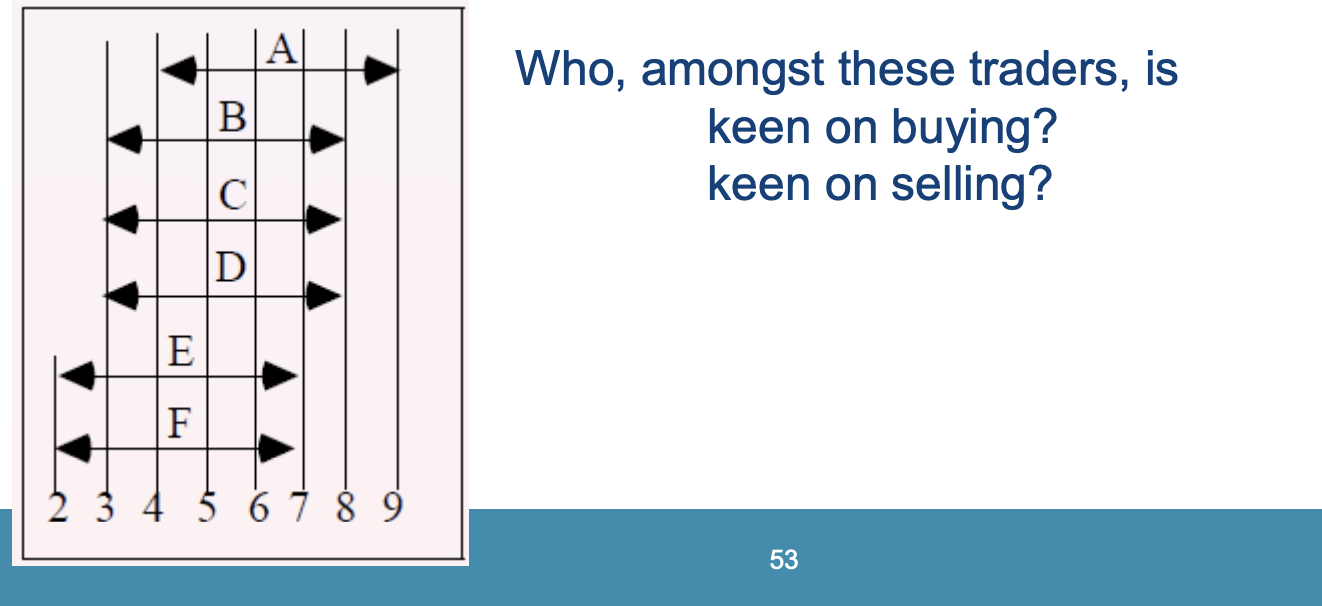

how to read this image

dimension is USD/EUR

left bid

right ask

what is the formula of a change in the spot rate and how can we interpret it

s = new rate - old rate/ old rate

= St+1 - St / St

if s > 0 → the foreign currency has appreciated

if s < 0 → the foreign currency has depreciated

what is a vehicle currency and why it is used

a currency that is actively used in many international financial transactions around the world

Used due to transaction costs of making markets in many currencies being too high

ex.: USD

how to read this table

column → direct quote from the perspective of the country whose currency is at the top of the column

row → indirect quote from the perspective of the country whose currency begins the row

what is arbitrage opportunity

Buy low, immediately re-sell high without risk

In efficient markets arbitrage opportunities vanish immediately as soon as they are used

what is shopping around

looking for best quotes on different brokers

keen on buying? A

keen on selling? E, F

what is a settlement risk

he risk that a counterparty fails to deliver on a trade or transaction at the agreed-upon time, potentially causing financial loss.

can transform into systemic risk

bilateral and multilateral netting diminish the settlement risk

what is the Payment-versus-payment system

you get paid only if you pay

how to calculate the total transaction cost

= amount x (ask - midpoint)