Acct I - Fall Final

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

80 Terms

accounting

Planning, recording, analyzing, and interpreting financial information

asset

anything of value that is owned

debit

-ex: supplies, cash

expense

money spent

debit

ex: utilities expense, advertising expense

replenishing petty cash

add an amount to the petty cash fund to brig it back to its original balance

sales journal

selling merch on account

purchases journal

buying merch on account

general journal

journal with two amount columns in which all kinds of entries can be recorded

-declare dividends

-supplies on account

-purchases returns

-sales returns

cash receipts journal

received cash

cash payments journal

paid cash

temporary journal

journal that will be closed in the post closing trial balance

account titles

name given to an account

closing entries

journal entries used to prepare temporary accounts for a new fiscal period

accounting cycle

journal

posting

worksheet

income statement

post closing trial balance

liability

an amount owed by a business

-credit

permanent accounts

accounts used to accumulate information from one fiscal period to the next; are not closed in post closing trial balance

adjustments

changes recorded on a work sheet to update general ledger accounts at the end of a fiscal period

accounting equation

owner's equity

the amount remaining after the value of all liabilities is subtracted from the value of all assets

withdrawals

assets taken out of a business for the owner's personal use

-debit

post reference column

journal account number or ledger journal page used as a reference to where you got the information and where you left off

revenue

an increase in owner's equity resulting from the operation of a business

petty cash

an amount of cash kept on hand and used for making small payments

blank endorsement

name only

special endorsement

gives money to someone else

restricted endorsement

check can be put into one place only

controlling accounts

an account in a general ledger that summarizes all accounts in a subsidiary ledger

fiscal period

the length of time for which a business summarizes and reports financial information

business entity

business information is kept separate from the owner's information

adequate disclosure

all necessary info is given to understand a business's financial situation

-accurate and up-to-date

matching expenses with revenue

revenue from operations and expenses associated with earning that revenue are recorded in the same accounting period

-if not done correctly would create incorrect financial statements

-gives true pictures of how business is doing

going concern

expectation that the business will remain in operation indefinitely

balance sheet

financial statement that reports assets, liabilities, and owner's equity on a specific date

-prove accounting equation equals

schedule of accounts payable

listing of vendor accounts, account balances, and total amount due all vendors

worksheet

summarizes general ledger

-includes all accounts

-helps prepare for financial statement

schedule of account receivable

a listing of customer accounts, account balances, and total amount due from all customers

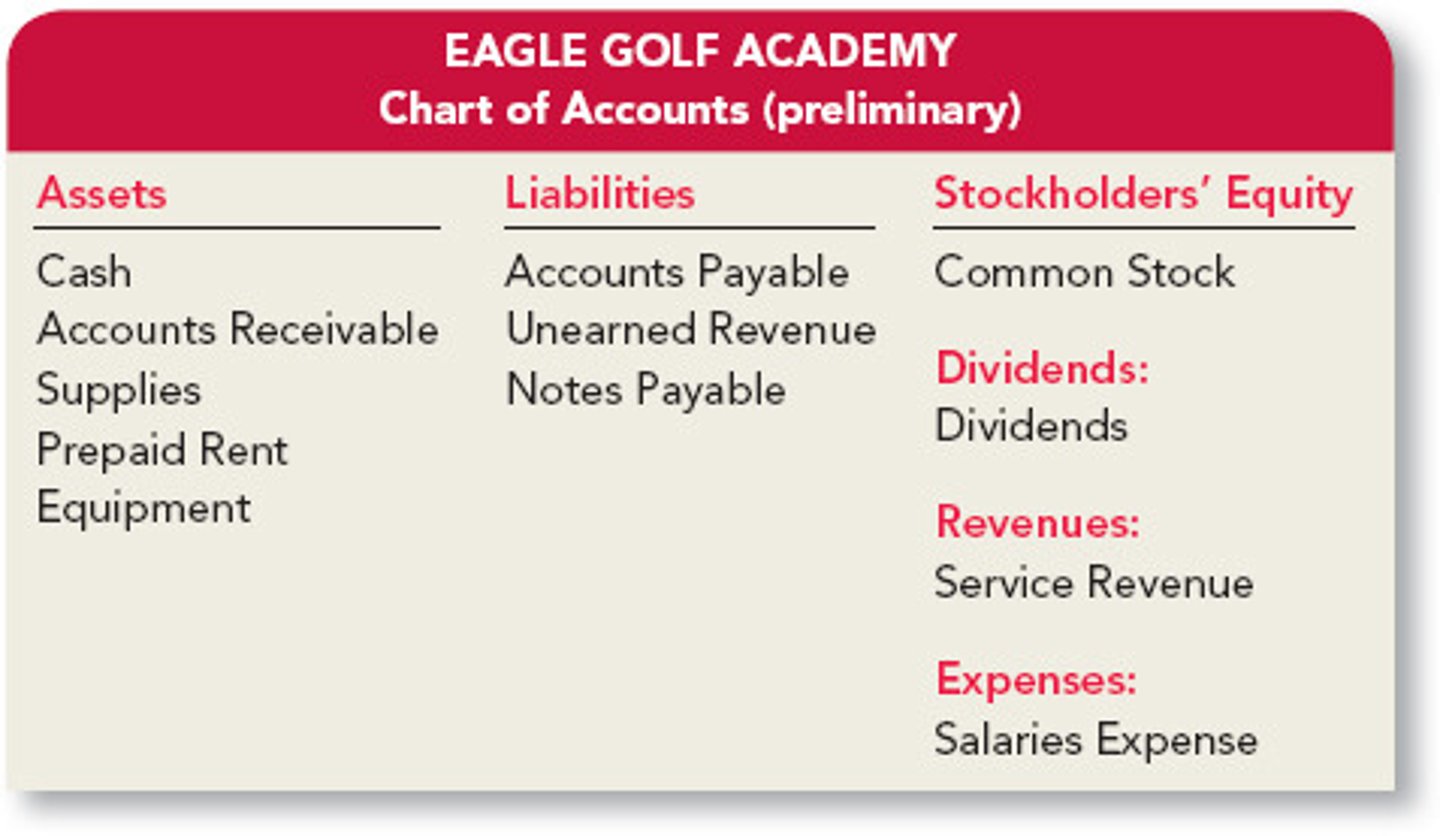

chart of accounts

a list of accounts used by a business

-organized by account classification

difference between ordering of assets, liabilities, owner's equity, revenue, and expenses

assets is in order by liquidity

everything else is in order alphabetically

journal

recording transactions by date

contra account

an account that reduces a related account on a financial statement

contra account of sales

sales returns and allowances

-debit

contra account of purchases

purchases returns and allowances

-credit

ledger

a book for keeping financial records

posting

transferring information from a journal entry to a ledger account

post reference

when info is transferred from journal to ledger a posting reference is added; allows to trace data from ledger to journal

post closing trial balance

all debits equal credits and all temporary accounts have been closed

-last step in accounting cycle

income statement

financial statement showing the revenue and expenses for a fiscal period

-shows net income or net loss

-get info from income summary from worksheet

customer v vendor

customer = accounts receivable

vendor = accounts payable

what does 2/10 n/30 mean

have 10 days to pay and you will receive a 2% discount, or pay in 30 days and pay in full

income summary classification and normal balance

owner's equity

no normal balance

capital classification and normal balance

owner's equity

credit

prepaid insurance classification and normal balance

asset

debit

accts. rec. classification and normal balance

asset

debit

sales classification and normal balance

revenue

credit

supplies classification and normal balance

asset

debit

purchases classification and normal balance

cost account

debit

any amount owed classification and normal balance

liability

credit

owner's drawing account classification and normal balance

owner's equity

debit

anything owned classification and normal balance

asset

debit

purchases returns and allowances classification and normal balance

contra account

credit

sales discount classification and normal balance

revenue

debit

order of posting

S P G CR CP

sales purchases general cash receipts cash payable

some people get crazy constantly

what two documents are the only two that include "for month ended" with the date

worksheet and income statement

order of closing

REID

-revenue to income summary

-expense to income summary

-income summary to capital

-drawing to capital

what is shown on an income statement

revenue - expenses

order of heading in financial statement

company

statement

date

what kind of accounts does the general ledger contain

all accounts

after adjusting entries are posted, prepaid insurance account will be equal to what

insurance left at end of month

what does a post closing trial balance show

debits = credits

report of deposits, withdrawals, and bank balance sent to depositor by bank is called what

bank statement

info needed for journalizing adjusting entries is from where

worksheet adjustments column

after adjusting entries are posted, supplies account is equal to what

supplies on hand at end of fiscal period

accounts listed on a post closing trial balance have what

balances after closing entries are posted

(permanent accounts)

what are the major sections of a balance sheet

assets, liabilities, owner's equity

if pair of worksheet columns do not balance and difference between totals can be divided by 9 error is probably what

transposed number or "slide"

-ex: supposed to be 18, but wrote it as 81

what should the heading of a financial statement include

name of company

name of financial statement

date

what is the purchase account classified as

cost account

where can you find information needed to journalize a closing entry for revenue from a worksheet

income statement credit column

what do you debit and credit when purchasing merchandise for cash

debit purchases

credit cash

on an income summary, what is the net loss and net income

net loss = expenses greater = debit

net income = revenue greater = credit

how do you know if net income calculated on income statement is correct

if it is the same as net income on the worksheet