EXAM 5 SECTION C

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

80 Terms

risk classification

grouping risks w/ similar risk characteristics (expected costs) for purpose of setting prices

adverse selection

Insurer not using risk characteristic used by competitors

Competitors will attract lower risk insureds

While insurer left w/ higher than proportional share of higher risks

High risks undercharged → unprofitable

favorable selection

when you recognize risk char not recognized by competitor

Strategy: raise rates for low risks to be just below competition’s

so they’ll still move over to your company AND maximize profit!

proxy underwrite accept market

What if a rating variable is prohibited?

Find correlated _____ variables and rate based on those

Can still _____ based on the risk char to only _____ lower risk insureds

_____ to lower risk insureds & avoid marketing to higher risk

skimming the cream uw marketing

_____: insurer uses a risk characteristic in _____ or _____ to attract lower cost risks WITHOUT lowering prem!

Protects insight from competitors

Rates have to be made publicly available

UW guidelines don’t

significance homogeneity credibility objective expense verifiable affordability causality controllability privacy

Criteria for Rating Variables:

Statistical Criteria

Statistical _____

_____

_____

Operational Criteria

_____

_____

_____

Social Criteria

_____

_____

_____

_____

Legal Criteria

statistical significance expected costs homogeneity individ class subclasses loss potential credibility large

Statistical Criteria for Rating Var

_____ _____: _____ _____ should vary by class w/ acceptable lvl of stat confidence

_____: expected costs for _____ risks within _____ should be similar

No clearly identifiable _____ w/ significantly diff _____ _____

_____: classes _____ enough to allow cred statistical predictions

But a class doesn’t need to be fully credible on its own

operational objective measurable defined expense obtaining verifiable manipulate

_____ Criteria for Rating Var

_____: classes are _____ & clearly _____; exhaustive & mutually exclusive

_____: cost of _____/maintaining data not too high

_____: easily verifiable, hard to _____

social affordability negative causality intuitive acceptance controllability chance privacy

_____ Criteria for Rating Var

_____: esp a problem when there’s _____ correlation between income & rates

_____: _____ relationship between rating var & cost

Increases public _____

_____: encourages insureds to reduce _____ of loss for lower rate

Increases public acceptance

_____: not too intrusive

legal

_____ Criteria for Rating Var

in compliance w/ local laws & regulations

exposure

Overall Rate Indications → overall avg rate for book

Class Relativities → relative costs between classes

Univariate Analysis

Multivariate Analysis

Preferred bc correctly adjusts for _____ correlation

simple correlation OL levels rels

Univariate Pricing Approaches:

PP Approach

Pro: _____

Con: least accurate when there’s exposure _____

LR Approach

Pro: partially corrects for exp corr

Con: requires _____ prem by _____ of var

Adjusted PP Approach

Pro: partially corrects for exp corr

Con: cumbersome to calculate wtd-avg _____ for many variables

***Identical results as LR Approach!

exposure correlation

exposures of levels of X1 are correlated w/ exposures of levels of X2

“double counts” experience of correlated variables

exposures at base adj exposures rebase

Univariate Pricing Approaches w/ Credibility

Need ind rel & complement to be on same basis!

Ind Rel to Total

Normalized Complement

Make them relative to a WEIGHTED total

PP → weigh by earned _____

LR → weigh by prem _____

Adj PP → weigh by _____

Don’t forget to _____!

pp

Univariate Pricing approach → _____

Ind Rel = PPclass / PPbase

lr prem at base olep curr rel

Univariate Pricing approach → _____

Ind Rel Chg Factor = LR / Total LR

Ind Rel = Curr Rel x Chg Factor

SHORTCUT: Cred Complement is Current Rates

Weigh Chg Factor with 1!

Other complements → weigh rels by _____

calculate relativities first then weigh

Prem at Base = _____ / _____

adj pp

Univariate Pricing approach → _____

For each level of a variable:

Adj Exp = EE wtd by Curr Rel of Other Var

sequential analysis

sequence of using Adj PP Approach

Pro: partially corrects for exp correlation

Con: order matters

Steps

Perform univariate analysis to get ind rel for Var1

Use Var1 ind rels to adjust exp for Var2

Apply Adj PP approach

Use Var2 ind rels to adjust exp for Var3

Apply Adj PP Approach

…

class rel

Ind Class 1 Rel = Ind RateClass 1 / Ind RateBase

Assuming same VE & profit:

Ind Class 1 Rel = (PPClass 1 + FE per ExpClass 1) / (PPBase + FE per ExpBase)

If no FE:

Ind Class 1 Rel = PPClass 1 / PPBase

cats lr

Adjustments in Class Ratemaking

Cat & Large Loss → replaced w/ loads

Consider whether some classes are more prone to _____

One-Time Changes → need to on-level

esp for _____ Approach

Credibility → important bc individual classes have less data

Ignored:

Trends → assume all class trending at same rate

Development → assume all class developing at same rate

Expense & Profit → assume same variable loads for all classes

univariate

_____ Class Ratemaking

Pros: simpler to explain, intuitive

Cons: don’t properly account for exposure correlation

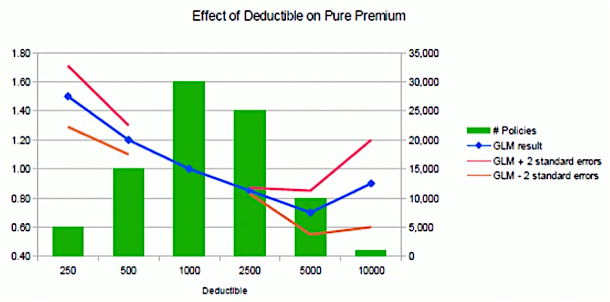

systematic noise diagnostics interactions response

Multivariate Classification (ex: GLMs)

Accounts for exposure corr

Attempts to focus on _____ effects in data & ignore _____

Provides statistical _____ (ex: CIs)

Considers _____ between rating vars → _____ correlation

minimum bias procedure

a Multivariate classification

Pro: corrects for exposure corr

Cons:

Computationally inefficient (iterative)

Doesn’t test vars for statistical significance

link random software lr prem granular theoretical rates

Generalized Linear Models (GLMs)

Corrects for exposure corr

Select a dependent variable to run on → PP, Freq, Sev

Select _____ function & underlying _____ process

Use _____ to solve GLM and estimate relativities

NOT typically run on _____ bc:

_____ needs to be on-levelled at _____ level

no common _____ distr for modeling LR

LR models become obsolete when _____ change

exponential normal constant

GLM vs Classical Linear Model

Response Variable

GLM → member of _____ family of distributions

Classical Lin Model → _____

Variance

GLM → doesn’t have to be constant

Classical Lin Model → _____

data anomalies ratemaking

Actuary’s Role in GLMs

Obtaining reliable _____

Exploring _____ w/ additional analysis

Consider model results from statistical & business perspective

Develop appropriate methods to communicate model results based on company’s _____ objectives

geo demographic weather property insured

External Data to use in GLMs

_____-_____ info → pop density

_____ → avg rainfall

_____ characteristics → sq footage, quality of local fire dept

Info ab _____ → credit scores

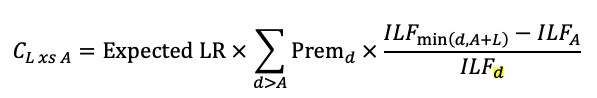

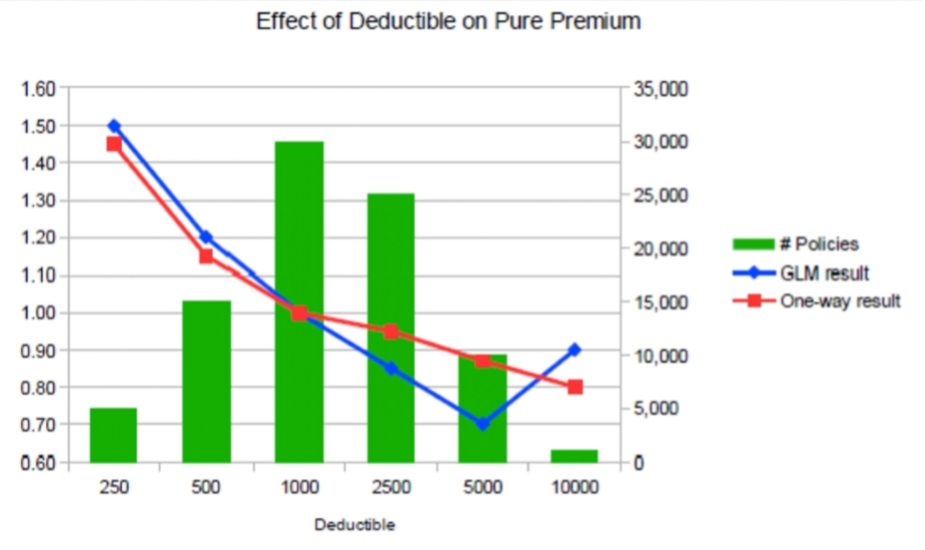

ded

GLM Outputs

**Check output makes sense

Higher rates for higher _____ → doesn’t make sense

May be due to limited data at higher ded

wide 1 same rel

GLM Confidence Intervals

Low volume of data → _____ CI

Shows if each level & var as a whole is statistically significant

If CI includes _____ → no stat sig diff between that class & base

Overlapping CIs → reasonable from statistical significance perspective to charge _____ _____

deviance tests

compares GLM models

Chi-Squared Test, F-statistic, AIC/BIC

time consistency

tests whether GLM estimated parameters are consistent over time

if diff years have similar patterns → model performing consistently

model validation overfitting underfitting

_____: measures model performance on unseen data

compares prediction vs actual results

Reasons for not performing well:

_____

_____

factor cluster groups cart

Data Mining Techniques

_____ Analysis: reduce # of vars needed in GLMs

Ex: using a single symbol var to capture multiple risk chars

_____ Analysis: combine similar risks into _____, resulting in fewer vars

Ex: combining ZIPs into Territory variable

_____: build set of if-then rules to identify most important vars

Detect interactions

Classification & Regression Trees

territorial ratemaking

Challenges: highly correlated w/ other var → can use GLMs

small geographic areas have low cred

Steps:

Establish territorial boundaries

Determine ind rates for each territory (using GLM)

spatial smoothing distance weather urban rural physical boundaries adjacency socio demographic

_____ _____: cred-weighting ind rates of neighbouring territories so no large discrepancies

_____-based → better for _____

Assumes distance has same impact for _____ & _____ risks

Doesn’t consider _____ _____

_____-based → better for _____ _____ perils (ex: theft)

Better reflects urban & rural differences

Considers physical boundaries

Over-smoothing: using geo units too far away, not relevant

Under-smoothing: giving local results too much cred → results too volatile

unit systematic residual spatial smoothing territories non contiguous

Establishing Territorial Boundaries:

Define geographic _____ (ex: ZIP code, counties)

Est geographic _____ risk for each unit → using GLMs

Unexplained geographic var incorporated into a _____ variable

Apply _____ _____ on residual var

Smooth results across neighboring areas

Cluster units into _____

Add constraints to avoid _____ _____ territories

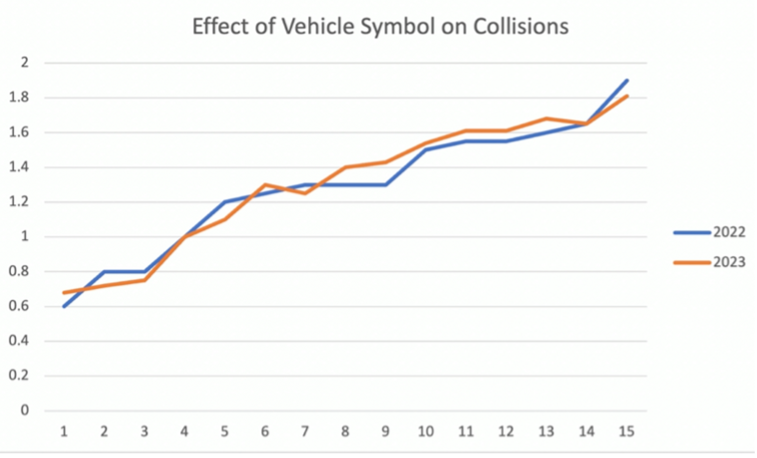

ILFs less data impractical

Increased Limits Ratemaking

Rated using _____ (Increased Limit Factors)

ILF = 1 → Basic Limit

Can’t use standard ratemaking to price

______ _____ for higher amts → volatile

_____ results → ex: higher price for higher limit

Importance:

Ppl need more covg as wealth grows

Trends have more impact on increased lim than basic lim

More lawsuits, higher jury awards

ILF trend develop layer variable same freq indep

Standard _____ Approach

_____ & _____ data first!

bc they may vary by _____

Assumptions:

All UW expenses & profit are _____ and _____ for all lims

_____ same for all lims

Freq & sev _____

expense profits freq

ILF(H) = RateH / RateB

= (PP incl LAEH / 1-VH-QH) / (PP incl LAEB / 1-VB-QB)

= PP incl LAEH / PP incl LAEB → same UW _____ & _____

= (FreqH x SevH) / (FreqB x SevB)

= SevH / SevB → same _____

=LAS(H) / LAS(B)

full losses claims

Limited Avg Severity (LAS):

For loss < H → _____ loss amt

For loss > H → # of claims x H

LAS(H) = _____ capped at H / # of _____

x-h k

LAS for layer K xs H:

Below H → don’t contribute

Between [H, H+K] → contribute only what’s above H, i.e. _____

Above H+K → contribute full _____

Denominator → Only include losses that contributed to num

i.e. exclude claims below H

LAS(K xs H) = Losses in layer / # Claims contributing to layer

lower

LAS for Censored Data

Lowest limit → same as uncensored

Higher limit → calculate incrementally

LAS(H2) = LAS(H1) + LAS(layer between H1, H2) x Pr(X > H1)

Can’t use data from _____ limits bc don’t know uncapped loss!

Pr(X > H1) → Only based on policies that could have claim above H1

exclude claims capped at lower lims

deductible pricing

2 Types of Deductibles:

Flat dollar

Percentage

**Trend & develop data first!

expenses profits variable xs ratio ler

Ded Pricing: Loss Elimination Ratio (LER) Approach

Assumes all UW _____ & _____ are _____

Base = no ded → Ind Rel = 1

Ind Rel(D) = _____ _____(D)

= Loss&LAE above D / Ground-up Loss&LAE

= 1 - Loss&LAE below D / Ground-up Loss&LAE

= 1 - ____(D)

**Denom is ALL ground-up loss (not basic loss!)

ler behaviour incentive

_____ Approach to ded pricing assumes claimant ______ will NOT vary by ded

GLM & Univariate Analysis → can vary!

Ex: financial _____ in filing a $501 claim w/ $100 ded vs $500 ded

1 - ler(d w/ base b)

LER for censored data

Don’t know claims below ded

Can only use claims where amt at BOTH ded are known!

LER(D w/ base B) = Diff in Loss assuming diff deds / Loss assuming B ded

Ind Rel(D) = ______

dollar caps coverage percentage

Deductible impact on Premium

Higher ded = lower prem

Problem if increasing ded lowers prem more than ded difference

Limit prem impact by:

_____ _____ on prem credit for ded

Vary ded factors by _____ amount

_____ ded

lower censored

Problems w/ Deductible or Limit data to price ded:

Policies w/ ded may only have data for loss xs of ded

Sol’n:

GLM

LER approach using only data from ded _____ than ded you’re pricing

Policies w/ lim may only have data for loss _____ by historical lim

Sol’n: GLM

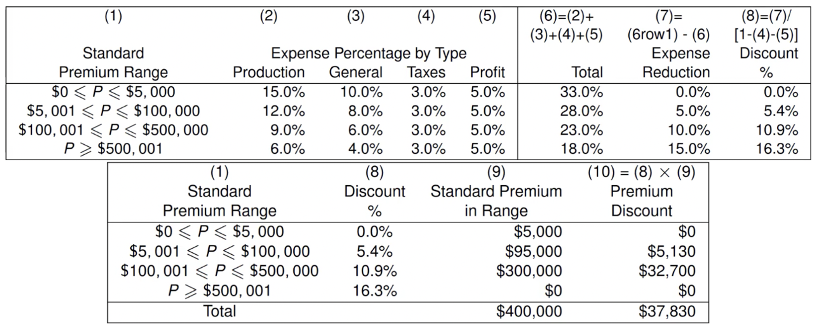

dec undercharged overcharged expense constant fe size writing prem discount larger

Work Comp Size of Risk

FE as % of prem should _____ as prem inc

So small risks are not _____, large risks not _____

_____: accounts for ____ that don’t vary by _____ of risk

so small risks not undercharged

prem might not be enough to cover FE of _____ the policy

_____: % discount for _____ policies

so large risks not overcharged

to recognize that expenses are a lower % of prem than small risks

lowest expense reduction portion

Premium Discount

Sum expenses for each range of loss

Expense Reduction = diff w/ expense of _____ range

Discount % = _____ _____ / (1 - VE)

VE % are same for all claim sizes → Taxes, Profit

Std Prem in Range = _____ of std prem in each range

Start w/ smallest range until it adds up to full amt of std prem

Prem Discount = Std Prem in Range x Discount %

safety return injured experience rating prevent loss constants

Small Work Comp insureds have worse loss experience bc

Have less sophisticated _____ programs

Don’t have _____ to work programs for _____ workers

Not as impacted / don’t qualify for _____ _____

Less incentive to _____ injuries

Price for this diff using GLMs or _____ _____

expected loss experience equalizes

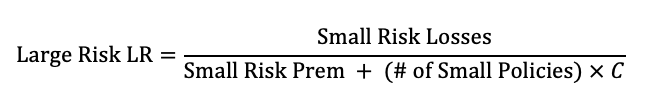

Loss Constants: accounts for fact that small risks have worse _____ _____ _____ than large risks

_____ LR between small & large risks

Added to prem of either 1) small risks only; or 2) both risks

Steps:

Equate LR of small & large risk

Add C x # of policies to prem in Denom

Solve for C

covg amt replacement cost

Insurance to Value (ITV)

For Homeowners or Commercial Property insurance

Coverage Amt = Face Amt

ITV = _____ / _____

underinsured inc dec

_____: when ITV < 100% → i.e. covg < replacement

Ind Rate per $1k covg _____ as ITV _____ (if partial loss possible)

fully covered rates inadequate vary coinsurance

Issues when Underinsured:

Insured not _____ _____ in event of total or near-total loss

If insurer assumes 100% ITV in _____, prem will be _____

Sol’ns:

_____ rates by ITV

_____

covg amt

ITV:

Ind Rate = PP = Freq x Sev

Ind Rate per $100k covg = PP / (_____ _____/100)

higher undercharged

Underinsured will pay _____ rate per $1k covg

So if charging all at same rate, underinsured will be _____

adequate equitable

_____: prem ≥ expected policy costs (loss + expenses)

_____: prem relatively fair across insureds

Equal LR for all risks

should not be subsidizing

*Compare prem to expected costs

sev dec constant inc

ITV → _____ Distribution

As ITV dec, ind rate per $1k covg inc

As ITV inc, ind rate per $1k covg dec!

Rate depends on sev distr!

As covg inc, ind rate per $1k covg will DECREASE at…

Right-skewed (small loss likely) → _____ rate

Uniform → _____

Left-skewed (large loss likely) → _____ rate

tools home characteristics inspections

Guaranteed Replacement Cost (GRC)

If home insured at 100% ITV, total loss guaranteed will be covered regardless of actual cost

Past: hard to est Replacement Cost

NOW:

Better _____ to estimate RC based on _____ _____

Property _____ → get more accurate info for est

coinsurance underinsurance penalty

_____: insured also responsible for a portion of loss

Another sol’n to _____

Instead of inc rates, insurer reduce loss!

Implemented by coinsurance clause

Coinsurance requirement = X% ITV

If ITV < X% → coinsurance _____ apply

proportional underinsurance penalty PP underinsured

Coinsurance & EQUITABLE rates:

Adjust amt insurers pay on claims _____ to amt of _____

After coinsurance _____ applied, all risks will have equal _____ per $1k covg

Makes single rate per $1k covg for all ITV levels is equitable

Coinsurance & ADEQUACY:

Reduce paid loss on _____ risks s.t. the same rate as risks insured to coinsurance requirement will be adequate

replacement covg loss

COINSURANCE

Coinsurance Apportionment Ratio:

a = min(1, Covg / (Coins Req% x _____ Cost))

Indemnity before ded: I = min( a x Loss , _____)

Indemnity after ded: I - ded

Coinsurance Penalty = min(_____, Covg) - I

less loss

Coinsurance Penalty will be positive if 2 conditions:

Insured for _____ than coinsurance req

_____ occurs that’s less than coinsurance req

covg coinsurance requirement

Coinsurance Penalty Graph

Max penalty @ loss = _____

Dec to 0 @ loss = _____ _____

credibility

when historical data is volatile or small in volume → may not be fully reliable

give some weight to other related experience to improve ests

decreasing

3 Criteria for Credibility:

0 ≤ Z ≤ 1

As n inc, Z inc → dZ/dn ≥ 0

As n inc, Z inc at _____ rate → d/dn (Z/n) < 0

evpv/vhm

Buhlmannn (Least Squares) Credibility

k = _____

Z = n / (n+k)

accurate unbiased indep available compute logical

5 Desirable Qualities for a Cred Complement

_____

Stable, low var, large volume

_____

Adjust for diff between states / another company’s book of business

Statistically _____ from base stat

Subject isn’t large portion of complement

_____

Easy to _____

Ex: use same methods used to produce small insurer ind on large insurer data

______ relationship to base stat

Ex: both insurers write personal auto in same state

larger group related rate change present harwayne trended competitor

Complements in First Dollar Ratemaking

LC of _____ _____ that includes group being rated

LC of larger _____ group

_____ _____ from larger group applied to _____ rates

_____’s Method

_____ Present Rates

_____’s Rates

accurate available compute logical biased

Complement: LC of Larger Group that includes group being rated

Pro: _____, _____, easy to _____, _____

Indep if subject experience excluded

Con: _____ bc there’s reason why subject is separated from larger group

indep available compute biased

Complement: LC of Larger Related Group

Pro: _____, _____, easy to _____

Possibly accurate, logical relationship

Con: _____

biased

Complement: Rate Chg from Larger Group applied to Present Rates

Adj ver of LC of Larger Grp → less _____

Pro: easy to compute

C = Current LCSubject x (Ind LCLarger / Current Avg LCLarger)

accurate unbiased available logical compute exposures adj factor

Complement: Harwayne’s Method

Adjusts for overall LC diff between states, exposure distr differences

Pro: _____, _____, mostly indep, _____, _____ relationship

Con: hard to _____

EX: Want complement for State A Class 1 LC

Calculated Wtd-Avg PP for State A

Calculate Wtd-Avg PP for other states using State A’s _____

_____ _____ = Wtd-Avg PPState A / Wtd-Avg PPother state

For each other state: Adj Class 1 LC = Class 1 LC x Adj Factor

C = wtd avg of all Adj Class 1 LC using Class 1 exposures

residual unbiased available compute logical inaccurate ind implemented

Complement: Trended Present Rates

Adjust current rates for trends & _____ indication

Pro: _____, _____, easy to _____, _____ relationship

Con: may be _____ if ind volatile, may or may not be indep

Trend Period:

From OG target effective date of last review (NOT actual implementation date)

To: target effective date of next rate chg

PP Method:

C = Trended Curr Rate x (Prior _____ LC / Prior _____ LC)

LR Method:

Note: LR Trend = Loss Trend / Prem Trend

C = LR Trend Factor x (Prior Ind Rate Chg Factor/Prior Imp Rate Chg Factor) - 1

k p

Classical Cred:

Observed is within _____ of its expected mean w/ prob = _____

# claims for full cred = (z(p+1)/2 / k)2

indep loss distr accurate biased expected lr compute

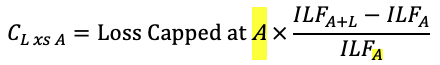

Complements in XS Ratemaking

Complement for layer L xs of A → (A, A+L)

Inc Limits Analysis

Use ground-up loss up to attachment pt A

Pro: _____

Con: biased if ILFs based on a diff _____ _____, inaccurate due to low volume of data

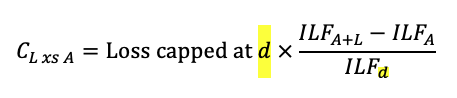

Lower Limits Analysis

Use data capped at lower lim d

Pro: more _____ than inc lim

Con: more _____

Limits Analysis

Use data capped at all limits greater than A

Pro: for reinsurers that don’t have ground-up data

Con: biased, inaccurate, assumes same _____ _____ for all limits

Fitted Curves

Pro: accurate, less biased, logical relationship

Con: less indep, hard to _____, data may not be available

inc lim analysis

lower lim analysis

limits analysis

For all limits d > A