Joint Cost Allocation (Learning Distinguishing Characteristics.)

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

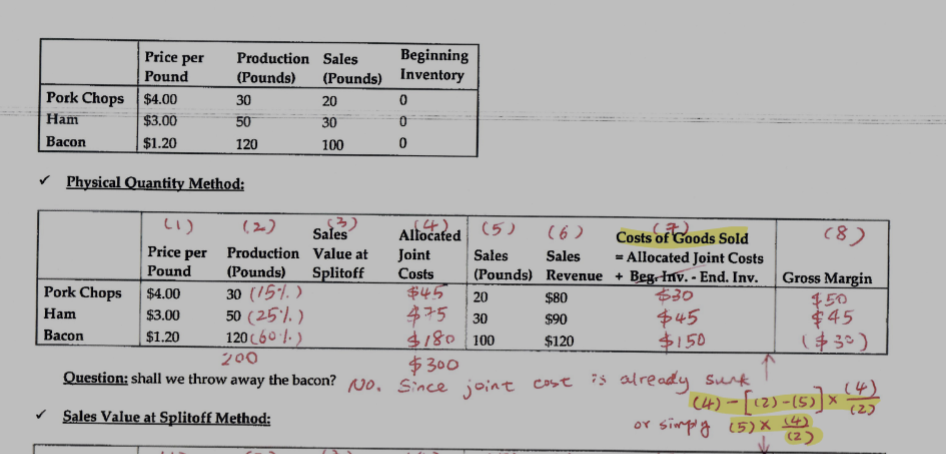

Physical Quantity Method

A cost allocation method that uses physical measures such as weight, volume, or quantity of output to divide joint costs among multiple products produced together.

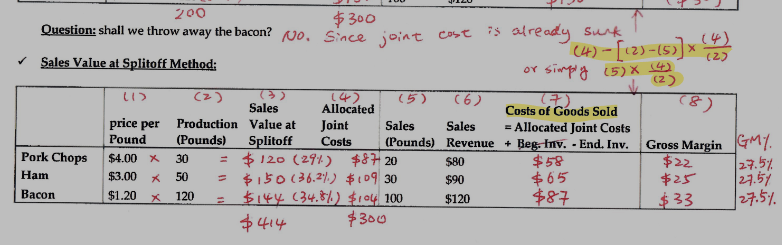

Sales Value at Splitoff Method

This method allocates joint costs based on the relative sales value of each product at the split-off point. It emphasizes the economic value of products to determine cost distribution.

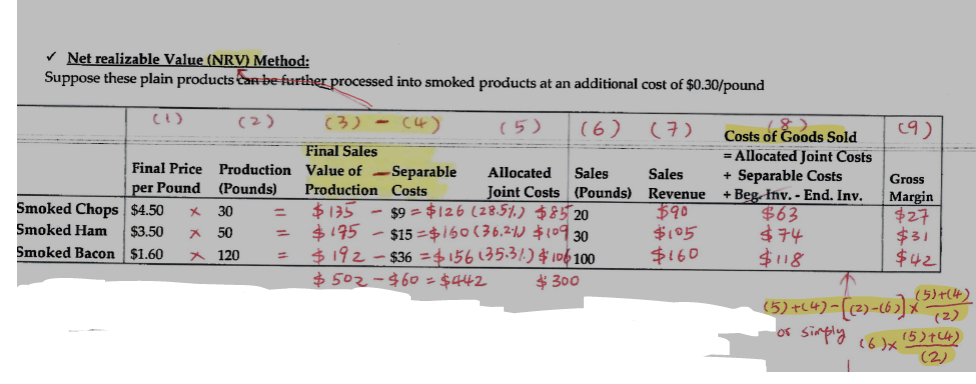

Net realizable Value (NRV) Method

A method for allocating joint costs based on the estimated net realizable value of each product after the split-off point. This value is calculated by taking the final sales value of the product and subtracting any additional costs required to make the product saleable.

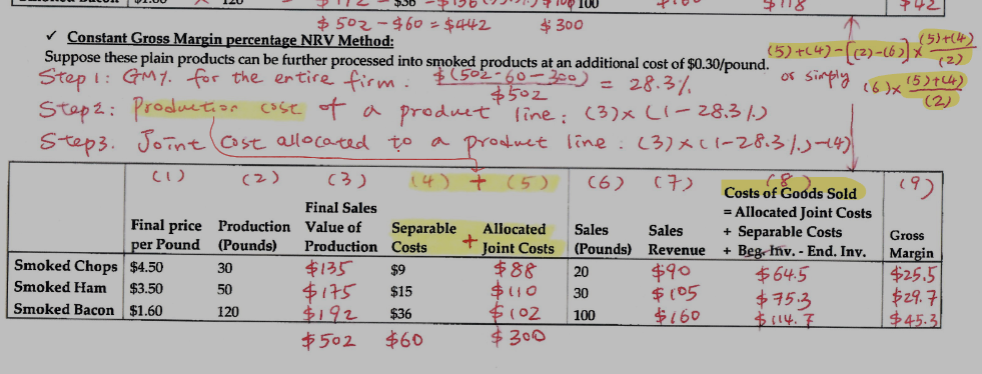

Constant Gross Margin percentage NRV Method:

A joint cost allocation method that ensures each product retains a consistent gross margin percentage based on its net realizable value. This method adjusts the allocated costs to maintain a predetermined gross margin across all products derived from joint production.

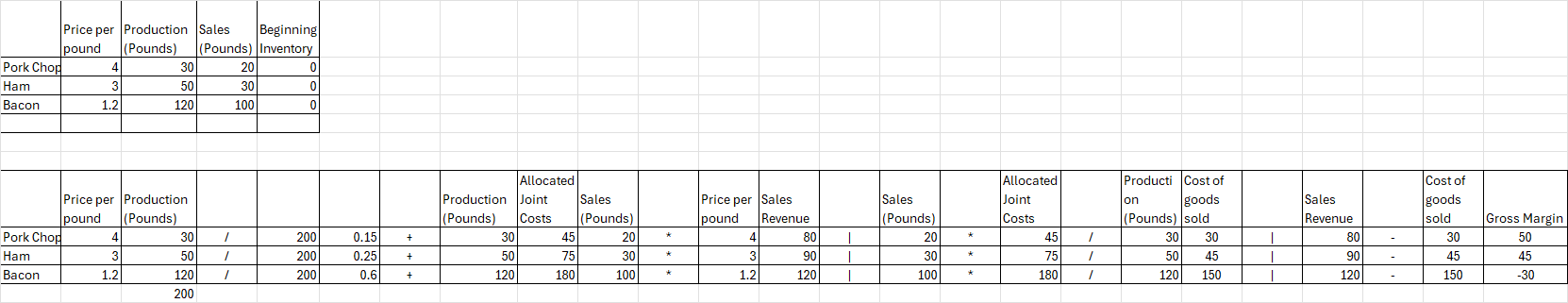

Physical Quantity Method

| Price per pound | Production (Pounds) | Sales (Pounds) | Beginning Inventory | ||||||||||||||||||||

Pork Chops | 4 | 30 | 20 | 0 | ||||||||||||||||||||

Ham | 3 | 50 | 30 | 0 | ||||||||||||||||||||

Bacon | 1.2 | 120 | 100 | 0 | ||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||

| Price per pound | Production (Pounds) |

|

|

|

| Production (Pounds) | Allocated Joint Costs | Sales (Pounds) |

| Price per pound | Sales Revenue |

| Sales (Pounds) |

| Allocated Joint Costs |

| Production (Pounds) | Cost of goods sold |

| Sales Revenue |

| Cost of goods sold | Gross Margin |

Pork Chops | 4 | 30 | / | 200 | 0.15 | + | 30 | 45 | 20 | * | 4 | 80 | | | 20 | * | 45 | / | 30 | 30 | | | 80 | - | 30 | 50 |

Ham | 3 | 50 | / | 200 | 0.25 | + | 50 | 75 | 30 | * | 3 | 90 | | | 30 | * | 75 | / | 50 | 45 | | | 90 | - | 45 | 45 |

Bacon | 1.2 | 120 | / | 200 | 0.6 | + | 120 | 180 | 100 | * | 1.2 | 120 | | | 100 | * | 180 | / | 120 | 150 | | | 120 | - | 150 | -30 |

200 |  |

What cost allocation method is this?

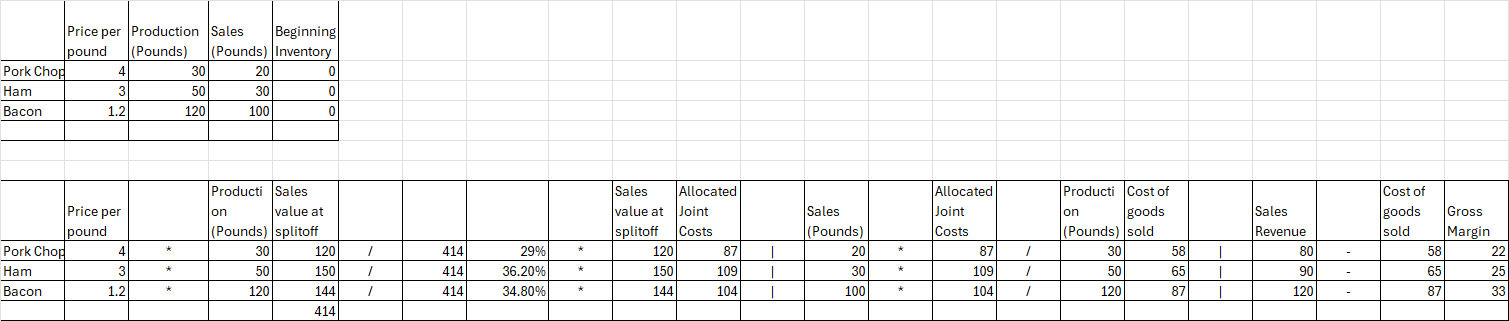

Sales Value at Splitoff Method

| Price per pound | Production (Pounds) | Sales (Pounds) | Beginning Inventory | ||||||||||||||||||

Pork Chops | 4 | 30 | 20 | 0 | ||||||||||||||||||

Ham | 3 | 50 | 30 | 0 | ||||||||||||||||||

Bacon | 1.2 | 120 | 100 | 0 | ||||||||||||||||||

|

|

|

|

| ||||||||||||||||||

| Price per pound |

| Production (Pounds) | Sales value at splitoff |

|

|

|

|

| Allocated Joint Costs |

| Sales (Pounds) |

| Allocated Joint Costs |

| Production (Pounds) | Cost of goods sold |

| Sales Revenue |

| Cost of goods sold | Gross Margin |

Pork Chops | 4 | * | 30 | 120 | / | 414 | 29% | * | 414 | 87 | | | 20 | * | 87 | / | 30 | 58 | | | 80 | - | 58 | 22 |

Ham | 3 | * | 50 | 150 | / | 414 | 36.20% | * | 414 | 109 | | | 30 | * | 109 | / | 50 | 65 | | | 90 | - | 65 | 25 |

Bacon | 1.2 | * | 120 | 144 | / | 414 | 34.80% | * | 414 | 104 | | | 100 | * | 104 | / | 120 | 87 | | | 120 | - | 87 | 33 |

|

|

|

| 414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What Cost Allocation Method is this?

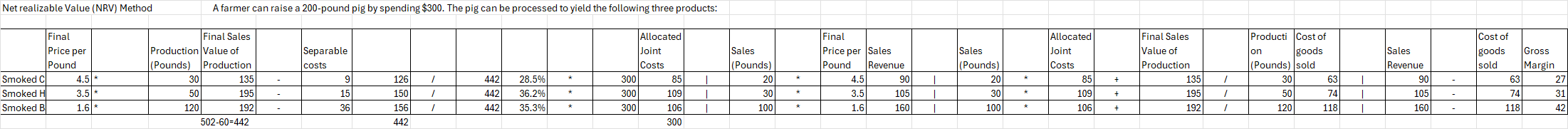

Net realizable Value (NRV) Method

| Final Price per Pound |

| Production (Pounds) | Final Sales Value of Production |

| Separable costs |

|

|

|

|

|

| Allocated Joint Costs |

| Sales (Pounds) |

| Final Price per Pound | Sales Revenue |

| Sales (Pounds) |

| Allocated Joint Costs |

| Final Sales Value of Production |

| Production (Pounds) | Cost of goods sold |

| Sales Revenue |

| Cost of goods sold | Gross Margin |

Smoked Chops | 4.5 | * | 30 | 135 | - | 9 | 126 | / | 442 | 28.5% | * | 300 | 85 | | | 20 | * | 4.5 | 90 | | | 20 | * | 85 | + | 135 | / | 30 | 63 | | | 90 | - | 63 | 27 |

Smoked Ham | 3.5 | * | 50 | 195 | - | 15 | 150 | / | 442 | 36.2% | * | 300 | 109 | | | 30 | * | 3.5 | 105 | | | 30 | * | 109 | + | 195 | / | 50 | 74 | | | 105 | - | 74 | 31 |

Smoked Bacon | 1.6 | * | 120 | 192 | - | 36 | 156 | / | 442 | 35.3% | * | 300 | 106 | | | 100 | * | 1.6 | 160 | | | 100 | * | 106 | + | 192 | / | 120 | 118 | | | 160 | - | 118 | 42 |

502- | 60 | 442 | 300 |  | ||||||||||||||||||||||||||||

What Cost Allocation method is this?

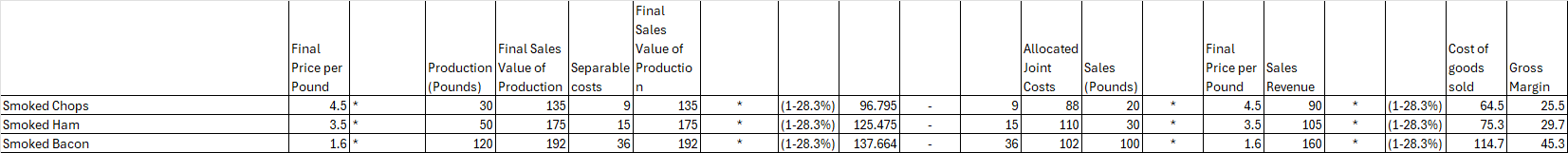

Constant Gross Margin percentage NRV Method

| Final Price per Pound |

| Production (Pounds) | Final Sales Value of Production | Separable costs | Final Sales Value of Production |

|

|

|

|

| Allocated Joint Costs | Sales (Pounds) |

| Final Price per Pound | Sales Revenue |

|

| Cost of goods sold | Gross Margin |

Smoked Chops | 4.5 | * | 30 | 135 | 9 | 135 | * | (1-28.3%) | 96.795 | - | 9 | 88 | 20 | * | 4.5 | 90 | * | (1-28.3%) | 64.5 | 25.5 |

Smoked Ham | 3.5 | * | 50 | 175 | 15 | 175 | * | (1-28.3%) | 125.475 | - | 15 | 110 | 30 | * | 3.5 | 105 | * | (1-28.3%) | 75.3 | 29.7 |

Smoked Bacon | 1.6 | * | 120 | 192 | 36 | 192 | * | (1-28.3%) | 137.664 | - | 36 | 102 | 100 | * | 1.6 | 160 | * | (1-28.3%) | 114.7 | 45.3  |

What Cost Allocation method is this?

Physical Quantity Method

Production+(Production/Total Production)= Allocated Joint Costs

Which Cost Allocation Method is this?

Sales Value at Splitoff

Price per Pound*Production=Sales Value

Sales value/Total Sales values= Sales%

Sales%*Total Joint Cost= Allocated Joint Costs

Which Cost Allocation Method is this?

Net realizable Value (NRV) Method

((Final sales value of production-Separable costs)/Total of all sales value of production)-separable costs= Percentage.

Percentage*Total Allocated Joint costs= Allocated Joint Costs

Which Cost Allocation Method is this?

Constant Gross Margin percentage NRV Method

Total Final Sales value of production-Total separable costs-Total production=Gross Margin Percentage.

Final Sales value of production*(1-Gross Margin Percentage)-Separable costs= Allocated Joint costs

Which Cost Allocation Method is this?