MOS - Chp 11 (Dividends, Stock, Repurchases and Payout Policy)

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

Types of Dividends

Regular Cash Dividend

cash dividend paid on a quarterly basis

Extra Dividend

often paid at the same time as regular cash dividiends

ensures that a minimum portion of earnings is distributed to shareholders each year

Special Dividend

one-time payment to shareholder in large amounts of cash

Liquidating Dividend

Paid to stockholders when a firm is liquidated (last priority)

money from the sale of asset to creditors, stockholders etc.

Dividend Payment Process

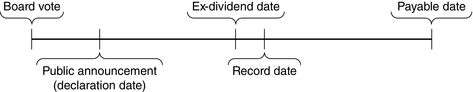

Board Vote — The firm’s board votes to issue a dividend, specifying the amount and key dates of the issue.

Public Announcement Date — The firm releases the information regarding the dividend payment. Often the stock price will move on the dividend announcement date because investors use this dividend information as a signal regarding the future prospects of the firm.

Declaration Date - announces the value that stockholders received per share (subject to change), dividend payment dates

Ex-Dividend Date - set by stock exchange, shares traded without the right to receive the dividend

Record Date - an investor must be a stockholder or record to receive dividend, typically 2 days after ex-dividend date

Stock Repurchases

when a company repurchases shares (which reduces the number of shares held by investors)

taxed on the profit of the total value

added to liability side of balance sheet

How are Stock Repurchases Purchased?

Open Market Repurchases

limited purchasing power due to government limited number of shares purchased daily

Tender Offer

Open offer by a company to purchase shares

Fixed-Price: the company offers a fixed price to

investors who agree to sell their sharesDutch Auction: the company seeks bids for the number of shares investors would sell at a series of prices. The company may then choose the price in the series that will result in the desired number of shares being

repurchased.

Targeted Stock Repurchases

used to buy blocks of shares from large stockholders

Dividends Benefits and Costs

Benefits of Dividends | Costs of Dividends |

|

|

Dividend vs Stock Repurchase

| Dividend | Stock Repurchase |

Who is impacted? | All shareholders receive a dividend when declared | Shareholders if they want to sell shares |

Shares Outstanding | No change in the number of shares outstanding | Number of shares that exist decreases when a company repurchases shares |

Tax Treatment | Treated as dividend income

| Treated as a capital gain

|

Balance Sheet |

|

|

*stock repurchase a slightly unethical given managers have inside knowledge and can be used to their advantage

Stock Dividends vs Stock Splits

Stock Dividends | Stock Split |

Shareholders receive shares | Division of each share into more shares

|

Usually indicated as a % | Does not provide cash |

Factors that managers consider WHEN setting dividend payouts

Excess Value in the form of…

expected profitability

future investment requirements

financial reserves and flexibility

firm’s ability to raise capital quickly