ap macroeconomics unit 4

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

money

anything that can be used to purchase goods and services

wealth

accumulation of savings through the purchase of assets (with money) that occurs over time

financial assets

written claims where buyers have the right to future income from sellers

examples of financial assets

loans

bonds

stocks

physical assets

demand deposits

liquidity

how easily assets turn into cash

comparison of liquidity

how easily demand deposits, savings accounts, and bonds can be turned into cash

assets

valuable because they allow holder to accumulate wealth over time - interest makes assets grow over time - leads to growth in the aggregate economy

types of assets investors are attracted to

financial assets that have higher rates of return

speculation

when consumers hold money rather than bonds because they expect the interest rate to increase in the future

bond

number of years a holder can earn interests

after a bond comes to maturity, the bondholder gets the total face value of bond _ interest it earned overtime

relationship between bond prices and interest rates

inverse relationship between bond prices and the interest rates

nominal interest rate

rates you see when doing business with a financial institution

rates paid on loan that are not adjusted for inflation levels

real interest rates

real rate of return earned on financial assets or paid back on loans

rates that ARE ADJUSTED for inflation

fisher effect

NIR = RIR + Inflation

calculates the real rate of return

effects of when unexpected inflation occurs

real value of return on financial assets falls and the real value of financial assets falls

fiat money

a currency issued by a government that is not tied to any physical commodity like gold or silver but rather to the government's authority

example: US Dollar

real value of money isn’t set by government

set by number of goods and services it can purchase

store of value

money has purchasing power over time

other assets can also hold value

inflation decreases money’s ability to store value

result: we need to print more money

medium of exchange

money used to exchange goods and services to help economies grow faster

unit of account

a function of money that provides a standard monetary unit to measure and compare the value of different goods, services, and assets

M0 = monetary base

currency and bank reserves

M1

currency in circulation, demand deposits, and savings accounts

M2

M1 + small denomination time deposits + retail money market $

M3

M1 + M2 + larger time deposits + larger liquid assets

banking system

made of many different banks (commercial and investment)

properties of commercial banks

store your money and pay you interest

customers store money in checkings accounts - become bank’s liability

loan money and earn interest

banks use portion of customer demand deposits to make loans to individuals and businesses - bank assets

fractional reserve banking

central bank sets the percentage of customer demand deposits that a bank must hold in reserves (not loan out) - known as the reserve requirement

essentially how banks make money

bank balance sheets

show amounts of bank assets and bank liabilities each individual bank has and both sides are equal to each other

examples of assets

reserves and loans

example of liability

demand deposits

effects of changes in demand deposits

size of the bank’s required and excess reserves

required reserves

percentage of demand deposits that the banks must hold in reserves

excess reserves

percentage of demand deposits that banks choose to hold onto. these can be loaned out to individuals and businesses

commercial banks with non-zero reserve requirement can create money through

lending excess reserves to customers

individual banks can make new loans or fewer loans based on

behavior of their customers

when customer deposits $1000, there’s a change in the

demand deposits, required reserves, and amount of new loans

money multiplier

determines maximum changes to the banking system when deposits or withdrawals from demand deposits occur

formula for money multiplier

1 / (reserve requirement)

effects of customers’ withdrawing money

withdrawn from bank’s reserve (bank’s assets) and subtracted from bank’s demand deposits (bank’s liabilities)

demand deposits = liabilities

represent money owed to the depositor that can be withdrawn on demand

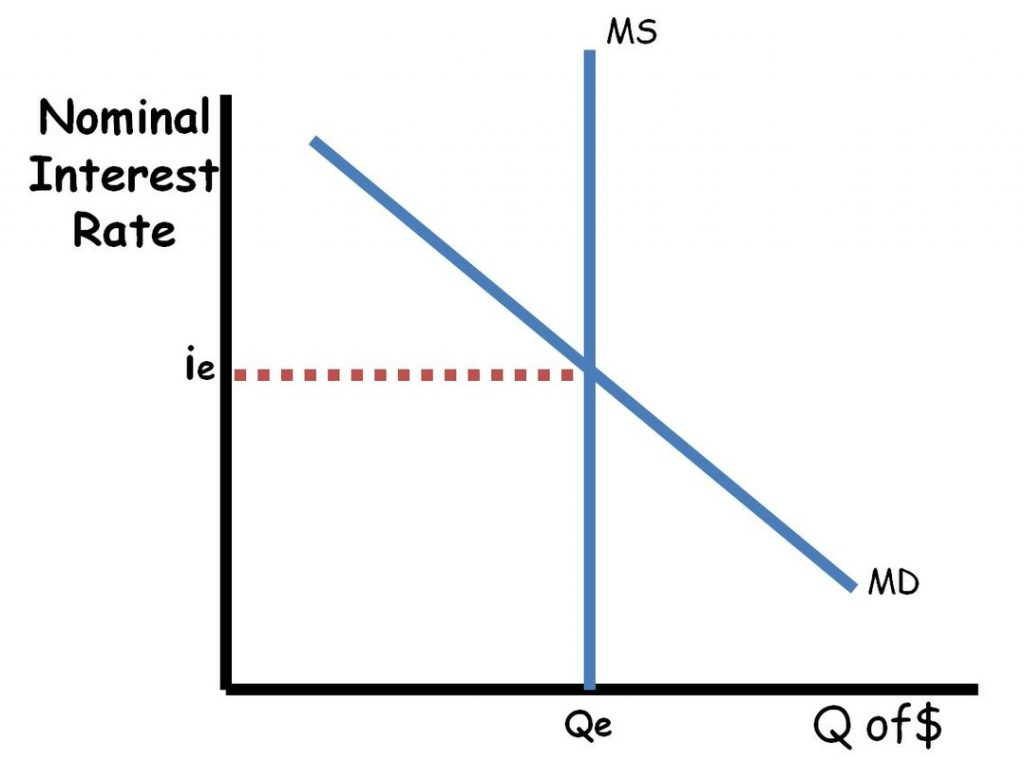

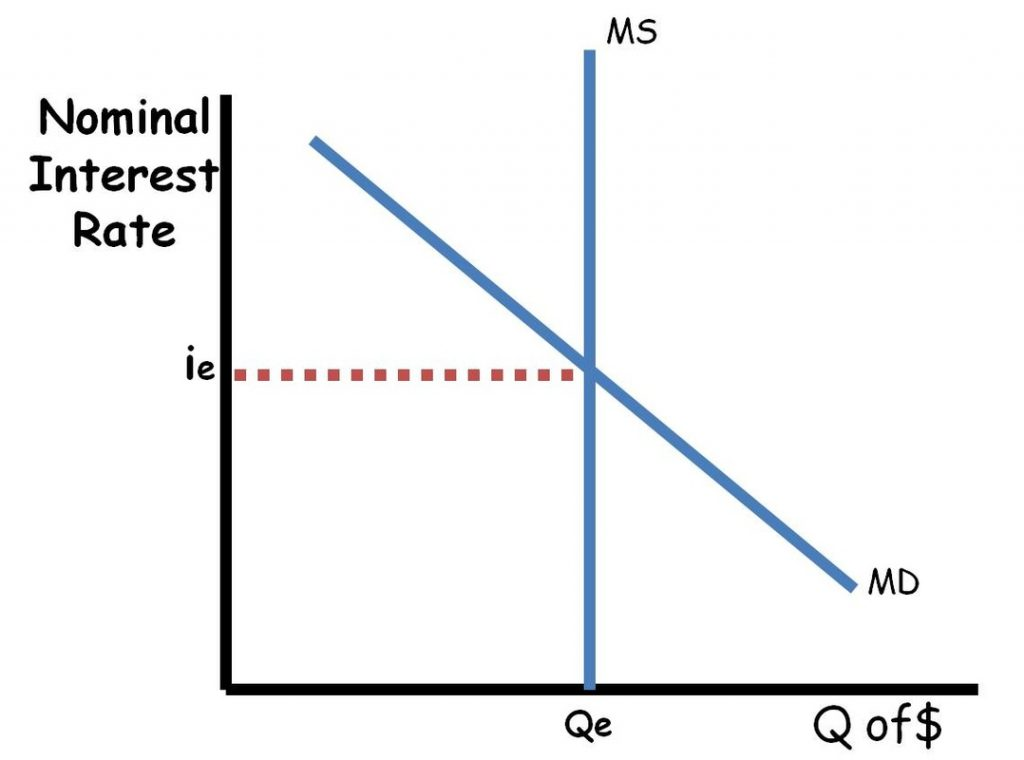

money market

competitive market where the good being supplied and demanded is money (M1)

also known as the liquidity preference model because of the interest rate

price in the money market =

nominal interest rates because NIR is opportunity cost of holding money

demand in the money market

represents relationship between nominal interest rate and the quantity of money demanded

3 types of demand in money market

transactions of demand

speculative/asset demand

precautionary demand

type of relationship between nominal interest rate and the quantity of money demanded

an inverse relationship

when nominal interest rate is high

the quantity of money demanded is low

when nominal interest rate is low

the quantity of money demanded is high

graph for the demand of money

downward sloping line

supply in the money market

amount of money that people have access to

controlled by a country’s central bank

independent of nominal interest rate

supply of money graph

look at the graph here

market equilibrium on money market graph

occurs when the nominal interest rate is set where the current supply of money intersects the current demand for money

in terms of supply, at higher interest rates

the surplus will drive down the interest

in terms of supply, at lower interest rates

the shortage will drive up the interest

shifters of the money demand

aggregate price level, real GDP (national income), and technology

aggregate price level

higher prices require more money to make purchases

real GDP

when national income increases, spending increases, so more money is needed

technology

the easier it is to convert less liquid assets into money, the less money is needed/demanded

availability/cost of using money substitutes (such as credit cards) affect the money demand too

factors that shift money supply

related to monetary policy as conducted by the central bank

monetary policy

central bank’s policies of influencing the nominal interest rates to help achieve macroeconomic objectives

price stability (low/stable rate of inflation)

full employment levels

interest rate changes impact

price level, real output, and unemployment through shifts in the AD

monetary policy’s target interest rate BG

when banks are unable to meet the reserve requirement they can call in loans, sell assets, borrow from central bank, and borrow from commercial banks (policy rate)

policy rate

overnight interbank lending rate

called federal funds rate in the USA

central banks often set a target range from the policy rate as a way to

guide monetary policy

expansionary monetary policy

when the central bank decreases nominal interest rates in the short run to help an economy out of a recessionary gap

lower interest rates - less expensive to borrow - more interest sensitive spending (I & C) - increase in aggregate demand

contractionary monetary policy

when central bank increases nominal interest rates in the short run to get the economy out of an inflationary gap

higher interest rates - more expensive to borrow - less interest sensitive spending - decrease in the AD

recognition lag

takes central bank time to collect and analyze the data needed to recognize problems in the economy

impact lag

takes time for economy to adjust after the policy action is taken

limited reserves framework

banking system in which reserves are not overly abundant

qualities of limited reserves framework

non-zero reserve requirement

commercial banks hold required reserves and possibly also some excess reserves

monetary policy works by changing supply of excess money/reserves - ultimately the supply of money

changing money supply results in changes to the nominal interest rate

lower NIR - expansionary because there will be no more interest sensitive spending - AD will decrease

higher NIR - contractionary because there will be less interest sensitive spending so AD decreases

central banks use their monetary policy tools

required reserve ratio - percentage of demand deposits banks MUST hold in their reserves

discount rate - interest rate commercial banks must pay to borrow from the central bank

open market operations - central bank buying and selling of government bonds (securities)

required reserve ratio

percentage of demand deposits banks must hold in their reserves

if RRR decreases, banks have more in excess reserves to lend so the MS increases (NIR falls)

if RRR increases, banks have less in excess reserves to lend to the MS decreases (NIR rises)

discount rate

interest rate commercial banks must pay to borrow from the central bank

if DR increases, banks are encouraged to lend less so MS decreases

if DR decreases, banks are encourages to lend more so MS increases

open market operations

central bank buying and selling of govt bonds known as securities

when central bank buys goods (OM purchase), banks’ excess reserves increase so MS increases

when central bank sells bonds (OM sale) banks’ reserves decrease so MS decreases

money multiplier and OMO

OMO causes changes in reserves so monetary base is also going to change

in limited reserves environment, effect of an OMO on the MS is greater than the effect on monetary base because of the MM

increases and decreases in excess reserves

increase - leads to banks making more loans - more deposits - more excess reserves - more loans

decrease - leads to banks making less loans - less deposits - less excess reserves - less loans

maximum possible value of money = 1 / RRR based on the assumptions that

banks hold no excess reserves

borrowers spend entire loans

customers hold no form of cash with them

equation for maximum change as a result of OMO

OMO amount (money multiplier)

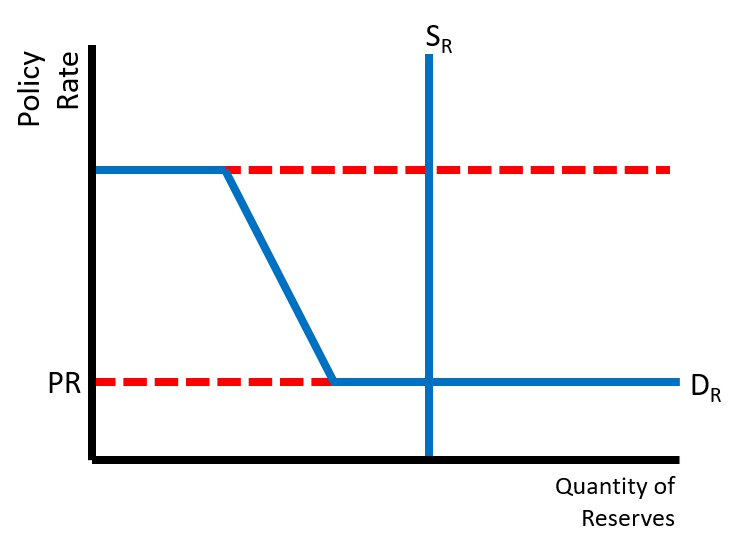

in ample reserves framework

interest rate changes are brought about through changes to administered interest rates

ample reserves framework quality

banking system in which reserves are abundant

required reserves ratio is 0

diff monetary policy tools needed - central banks often set target ranges for their policy rates

changing MS doesn’t lead to changes in the NIR

reserve market model graph

policy rate set at the intersection of SR and DR - overnight interbank lending rate

intersection in ample reserves

SR intersects lower horizontal portion of DR

maintaining ample reserves

maintained through buying bonds

monetary base increases, but there’s no real impact on the interest rates

monetary policy tools - ample reserves

interest on reserves

interest rate commercial banks earn on the funds in their reserve balance accounts with the Fed

serves a the Fed’s primary monetary policy tool

increases/decreases to IOR move up/down the lower bound on RMM graph

discount rate

interest rate commerical banks must pay to borrow from the fed

adjusted in the same manner as interest on reserves

increases/decreases to the discount rate move up/down the upper bound on reserve model graph

when will the DR move down

decrease in administered interest rates - decrease in policy rate - decrease in nominal interest rates

expansionary policy because int spending and AD will increase now

when will the DR move up

increase in administered interest rates - increase in the policy rate - increase in other nominal interest rates

contractionary policy because int spending and AD will decrease now

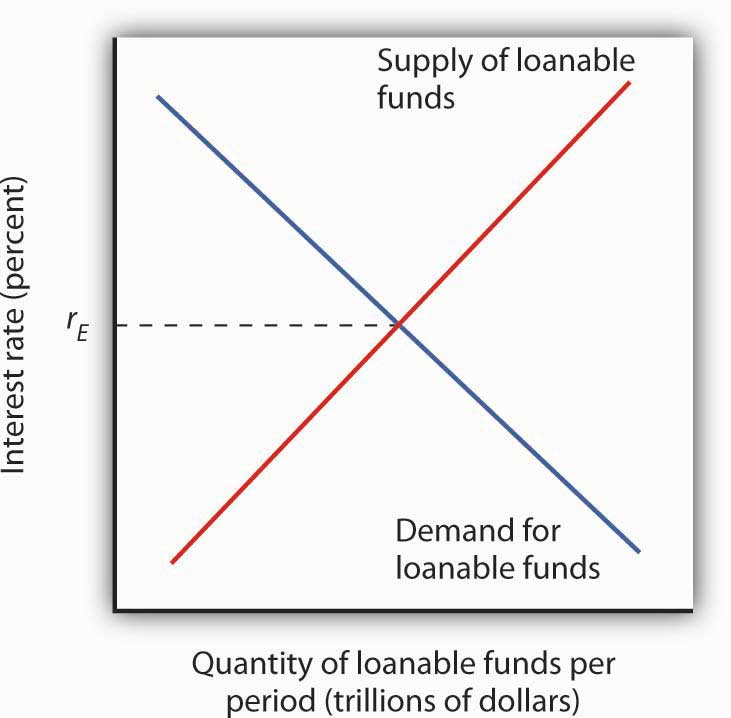

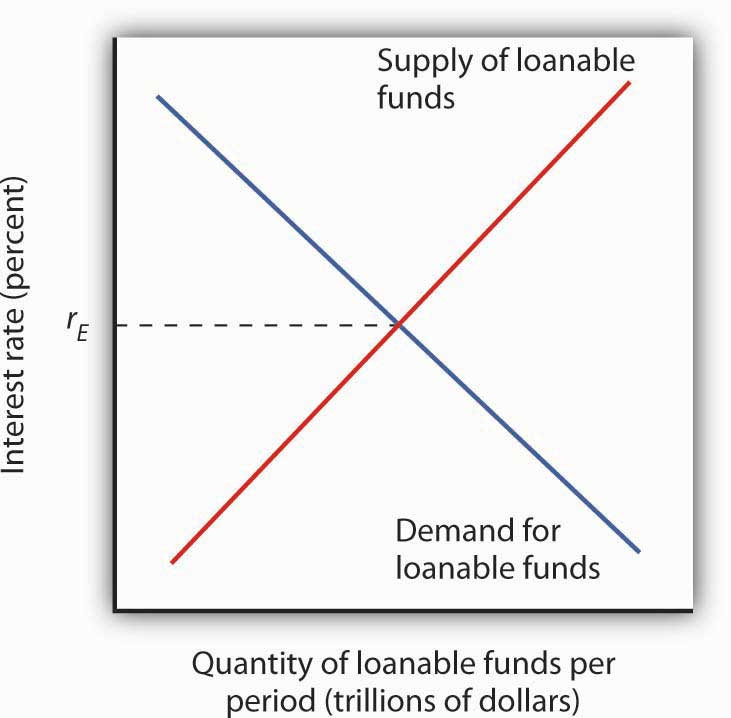

loanable funds market

how much money in the form of a loan consumers, businesses, and the government are requiring

determined by expectation of return on investment

real interest rate equals price of borrowing money

how much consumers pay for borrowing money

real interest rate = nominal interest rate - inflation

graph for demand for loans

follows law of demand

represents amount of loans demanded by consumers (mortgages), producers (business loans), government (bonds)

graph for supply of loans

follows law of supply

closed economy = supply equal to national savings (public + private)

open economy = supply equal to national savings + net capital flow

when economy is in a negative (recessionary) or positive (inflationary) output gap

combo of expansionary/contractionary fiscal or monetary policy will be used to restore full employment

combo of fiscal/monetary policy influences

aggregate demand, real output, price level, and interest rates

fiscal policy

manipulate AD by changing spending + taxes

monetary policy

manipulate AD by changing interest rates

recessionary gap

fiscal policy - increase spending, lower taxes - shift AD right - unemployment down

monetary policy - decrease interest rates - shift AD right - unemployment down

inflationary gap

fiscal policy - decrease spending, increase taxes - shift AD left - price level down

monetary policy - increase interest rates - shift AD left - price level down

when economy is at full employment

changes in the money supply have no effect on real output in the long run

causes of inflation/deflation

increasing/decreasing money supply at too rapid for a rate for a sustained period of time

quantity theory of money

in long run, growth rate of the money supply determines the growth rate of price level (inflation rate)