economics : theme 4 - laffer curve

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

what did liz truss attempt to cut

income tax 20% to 19%

corporation tax

what is income tax

part of fiscal policy

can also be a supply side policy when used to encourage entrepreneurs to create and expand businesses effectively allowing entrepreneurs higher abnormal profits for successful innovations

impact on tax revenue would be positive (higher taxable incomes)

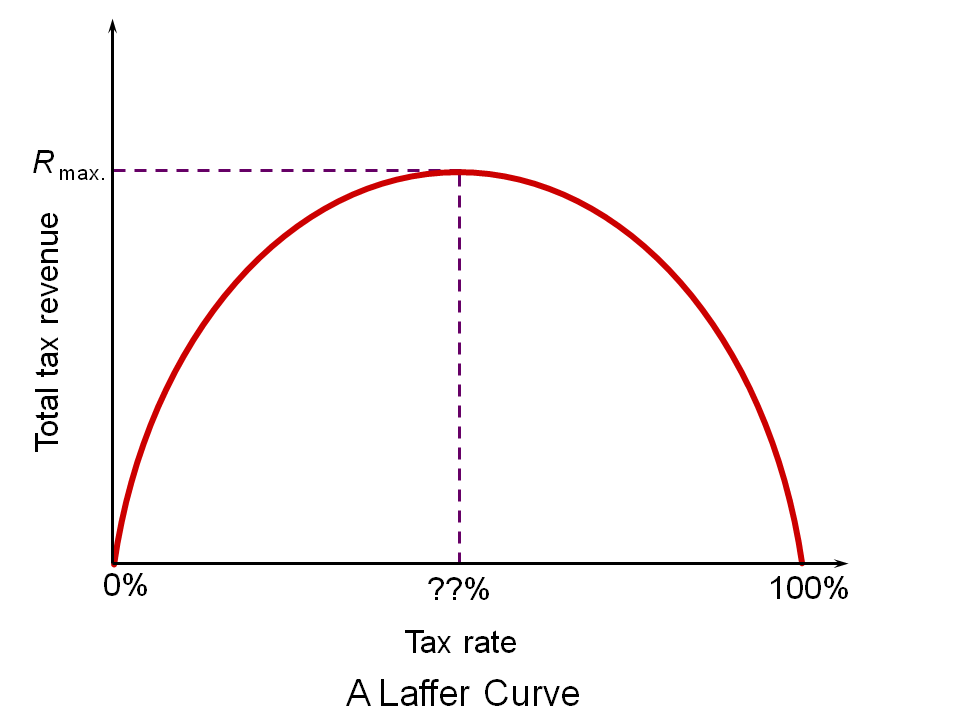

laffer curve

tax revenue on y axis

tax rate % on x axis

what does the laffer curve assume

nobody would work at a tax rate of 100% and more obviously when the rate is 0% then no tax revenue is generated

laffer curve explained

optimal tax rate is when the curve peaks (followed down)

any rate above a disincentive to increase individual earnings begins

advocates assume that the current rate is higher than the optimum

income or corporation tax rates can be reduced and the government will actually receive higher tax receipts because it is argued that lower rates of tax create a greater incentive to work, thus higher employment outweighs the lower tax yield per person

what is the laffer curve often used as an argument for

tax cuts

3 problems with the laffer curve

evidence

complementary taxes / costs

social benefits

evidence explanation

based off of the american system , not the uk

corporation tax went from 26% down to 20% in the uk from 2011 to 2015 but there was still no overall change in investment

complementary taxes / costs explanation

still other taxes you have to pay e.g. NI so full effect of tax change might not be felt

changing one tax still might not give incentive to invest

social benefits explanation

income / wealth inequality

if you lower the tax for the rich, then the gap between the rich and poor will widen