Secure Transactions Part 1

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

51 Terms

What collateral does a debtor have?

Ownerships that is subject to the security interest

What collateral does a creditor/secured party have?

A security interest

What does the debtor give the creditor/secured party and what does the creditor give to the debtor

Debtor promises to pay and security interest → Creditors gives credit to debtor

If you were a creditor you would want a collateral to be worth what?

To be worth equal or higher of the debt

If a collateral is worth more than a debt what can’t the creditor do?

They cannot keep the excess funds, they have to return the difference.

Upon any default, the secured party’s rights in collateral are what?

They are greater than the debtor

How are secured partys rights regulated?

They are determined by state law/ the uniform Commercial Code.

Goods Collateral?

Property that is movable or tangible and intended for sale. (Example: Consumer goods, Equipment, Inventory, and Farm Products)

Accounts collateral

Property that represents a right to receive money or payment, such as accounts receivable or promissory notes.

Documents of Title Collateral

Legal documents that grant ownership rights to goods, enabling their transfer and storage. Examples include warehouse receipts and bills of lading.

Investment Property Collateral

Property that consists of stocks, bonds, and other financial assets that can be used as collateral for secure transactions.

General Intangibles Collateral

Assets that cannot be physically possessed, such as intellectual property, patents, trademarks, and goodwill, which can serve as collateral for transactions.

Which category of collateral is a piano?

It is a good collateral because it is tangible and moveable.

Consumer good collateral

Used it for personal use

Equipment collateral?

Used for business operations or production. (Piano is used in a business context, such as performances or teaching.)

Inventory Collateral

Used in the course of business operations as stock for sale or production. (You sell and manufacture pianos)

What type of collateral are shares of Stock?

Investment Property

Suppose Marriott owes you 100,00 and you use that receivable as collateral to get a loan from TP. In this case, the category of collateral depends on whether your receivable is what?

Notes Receivable (Instruments collateral) or an Accounts Receivable (Accounts collateral)

Attachment?

Fixes the rights between Debtor and Creditor and affects the rights of some third parties.

First requirement to attach?

Debtor must have rights in the collateral

Second requirement to attach?

There must be a debt (i.e, Creditor must give VALUE), It need not be relative value; collateral can be given to secure an old debt.

Third requirement to attach?

Security Agreement → For proof, Creditor must have either

A. Physical Possession of the collateral or

B. A writing signed by debtor.

If all 3 requirements to attach are in place what happens?

Attachements happens

Bank lends Debtor money to buy a car, and Debtor signed a security agreement identifying that car as collateral. If Debtor gets the money and flies out of town without buying the car, can Bank repossess the car from Dealer?

No, the bank has no right on the car because the debtor didn’t have rights in the collateral.

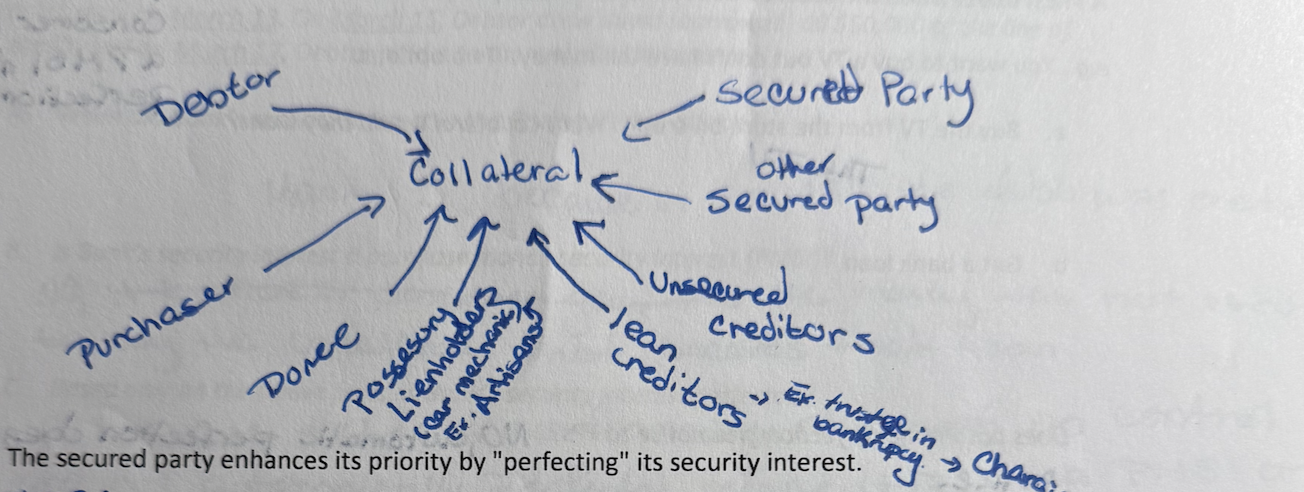

Attachment fixes the rights of the Secured Party and Debtor in the event of default, but who else might be interested in the collateral?

Other creditors or lienholders.

How does a secure party enhances its priority?

By “Perfecting” its security Interest through filing a financing statement or taking possession of the collateral.

Perfection?

Steps to take for security interest party so that they can be in a better position. Makes the secured party go in a higher position than other creditors.

First way to perfect

Files a Financing Statement

Financing Statement

Filed publicly, gives constructive notice to the whole world of the secured party.

Why should filing a financing statement improve a secured party’s position?

Because anybody that comes after takes a collateral knowing that the secured party’s is already there, subject to their rights.

Second way to perfect?

By either having Physical Possession (A PLEDGE) or Control of the Collateral.

Suppose you give your creditor a security interest in a Charles Schwab brokerage account you own. Could the creditor perfect by physical possession?

No, because the brokerage account is intangible and cannot be physically possessed.

Control?

When the secured party has the power to sell the property without any further action from the owner.

Instruction

for the secured party to have access and manage the collateral directly, often applicable to financial assets.

Third way to Perfect?

By having automatic perfection - for a purchase money security interest (PMSI) in Consumer Goods.

When does automatic perfection happen

Only exists when it is a PMSI and collateral is a consumer good. → Its not eligible for automatic perfection If it is a security on consumer good or a PMSI

When does a PMSI exist?

It exists when a creditor provides the goods or funds to buy the collateral and takes a security interest in that same collateral (typically goods)

You want to buy a tv but don’t have the money. You have two options → Buy the TV from the store on credit. What collateral would they want? Get a bank loan

For the money to buy the TV. In both cases, the collateral is the TV itself.

Does automatic perfection give notice to third parties (TP)?

No, automatic perfection does not give notice.

Automatic perfection does not apply to cars, boats, trucks, motorcycles, planes, and motor homes. What do these all have in common?

You need a title document

How to perfect a security interest in cars, boats, trucks, motorcycles, planes, and motor homes.

You must file a financing statement or obtain a certificate of title.

How are secured transactions flexible?

The specific collateral securing a debt often changes → inventory and accounts collateral.

Proceeds from collateral?

If debtor sells collateral the proceeds are included to the security interest.

After- Acquired Property (need a clause in the security agreement)?

Means that in the future if the debtor acquired new property the security agreement also attaches to it

How can the debt often change in size?

The debt shrinks as it is paid → If the security Agreement says so, it also can grow as Future Advances are made.

Line of Credit

You can borrow up to a certain amount, multiple times (Example: Credit Cards)

The Case of Debtor's Line of Credit

On March 1, Debtor applied to Bank for a line of credit, intending to use the proceeds to set up a website. On March 8, Bank gave Debtor a line of credit, and Debtor signed a security agreement giving Bank a security interest in 2,000 shares of Boeing, which share certificates Debtor purchased on March 13. On March 15, Debtor drew down (borrowed) all $50,000 of the line of credit, and on March 17, Debtor paid it to the website developers.

A. When did Bank's security interest in the Boeing shares attach?

March 15, because in the 15th the debt was created.

The Case of Debtor's Line of Credit

On March 1, Debtor applied to Bank for a line of credit, intending to use the proceeds to set up a website. On March 8, Bank gave Debtor a line of credit, and Debtor signed a security agreement giving Bank a security interest in 2,000 shares of Boeing, which share certificates Debtor purchased on March 13. On March 15, Debtor drew down (borrowed) all $50,000 of the line of credit.

Is Bank's security interest a purchase money security interest (PMSI)?

No, the money was not used to buy the collateral that secures that loan.

The Case of Debtor's Line of Credit

On March 1, Debtor applied to Bank for a line of credit, intending to use the proceeds to set up a website. On March 8, Bank gave Debtor a line of credit, and Debtor signed a security agreement giving Bank a security interest in 2,000 shares of Boeing, which share certificates Debtor purchased on March 13. On March 15, Debtor drew down (borrowed) all $50,000 of the line of credit.

Based only on the above facts, is Bank's security interest perfected?

No, because the security interest wasn't perfected—there's no financing statement, no control or possession of the certificated securities, and no automatic perfection since it's not a PMSI or consumer good.

The Case of Debtor's Line of Credit

On March 1, Debtor applied to Bank for a line of credit, intending to use the proceeds to set up a website. On March 8, Bank gave Debtor a line of credit, and Debtor signed a security agreement giving Bank a security interest in 2,000 shares of Boeing, which share certificates Debtor purchased on March 13. On March 15, Debtor drew down (borrowed) all $50,000 of the line of credit.

If Debtor defaults, can Bank repossess the Boeing shares?

yes, you don't need to be perfect to reposes → you only need attachment

The Case of Debtor's Line of Credit

On March 1, Debtor applied to Bank for a line of credit, intending to use the proceeds to set up a website. On March 8, Bank gave Debtor a line of credit, and Debtor signed a security agreement giving Bank a security interest in 2,000 shares of Boeing, which share certificates Debtor purchased on March 13. On March 15, Debtor drew down (borrowed) all $50,000 of the line of credit.

Assume Bank had taken possession of Debtor's Boeing shares on March 13. Why are they still unperfected at that point?

Because they are not attached, there is still no debt created. They became attached and perfected on March 15.