10 circular flow

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

circular flow

model illustrating how money, goods, and services move through an economy

represents the interactions between households and businesses in the production and consumption of goods and services

injection

additions to the circular flow

income

exports

government spending

withdrawal (leadkage)

factors that leas to income not being passed on within the circular flow

savings

tax

imports

saving

the portion of income not spent on consumption and instead set aside for future use

investment

money spent on capital goods to generate future income flows

what causes businesses to invest

low interest rates

high confidence

higher income

lower corporation tax

technology to replace obsolete assets

what causes households to save

high interest rates

threat of recession

higher national income

age of population

what causes households to save less

low interest rates

high consumer confidence

economic growth

disposable income

Income available to households after taxes and necessary expenses are deducted, which can be used for saving or consumption

saving ratio

The proportion of disposable income that households save rather than spend on consumption

positive multiplier effect

a situation where an increase in injections (such as investment, government spending, or exports) leads to a larger final increase in GDP

an initial increase in spending creates income for someone, who then spends part of that income, which becomes income for someone else, and the cycle continues

negative multiplier effect

a situation where a decrease in injections or an increase in leakages (like savings, taxes, or imports) leads to a larger fall in GDP

a cut in spending reduces income, leading to less consumption and further declines in income/output throughout the economy

reasons for an higher multiplier

Marginal propensity to consume (MPC) is high

When people receive extra income, they spend a large portion of it, fuelling further rounds of spending

Low savings rate

Less income is saved, meaning more money continues to circulate in the economy.

Strong consumer and business confidence

People are more likely to spend and invest, amplifying the impact of initial injections.

Low taxes

More disposable income is available to be spent rather than taken out of the circular flow.

Spare capacity in the economy

If there's unemployment or unused resources, increased demand leads to more output rather than just higher prices.

Reasons for the Negative Multiplier Effect

High marginal propensity to save (MPS)

People save most of their income instead of spending it, weakening the cycle of income generation.

High taxes

A larger portion of income is withdrawn by the government, reducing consumers' spending power.

High import spending (high marginal propensity to import)

Increased income leads to more spending on foreign goods, so the money leaves the domestic economy.

Falling confidence

If consumers and firms are pessimistic, they cut back on spending and investment, deepening downturns.

Austerity measures

Cuts in government spending or tax hikes reduce demand and can trigger a downward spiral in output and employment.

additional income equation

MPC + MPS + MPM(import) + MPT(tax)

multiplier formula

1 / (1 - MPC)

importance of the MPC

confidence

if consumers are confident they will consume more

household income level

with lower incomes, households will spend a greater proportion of income on essential goods and services, increasing their MPC

interest rate

higher interest rates makes borrowing more expensive and saving more attractive so the MPC falls

real income

the actual income of an individual or group, adjusted for inflation, reflecting the purchasing power of money

nominal income

the income of an individual or group without adjusting for inflation

marginal propensity to consumer

the fraction of additional income that a household consumes rather than saves, influencing overall spending in the economy

marginal propensity to save

the fraction of additional income that a household saves rather than consumes, impacting savings rates and investment in the economy

marginal propensity to tax

the fraction of additional income that a household pays in taxes rather than consumes or saves, influencing government revenue and economic behaviour

marginal propensity to import

the fraction of additional income that a household spends on imported goods rather than domestic products, worsening the current account balance and affecting domestic production

marginal propensity to withdraw

the fraction of additional income that is not spent in the domestic economy, affecting overall demand and economic growth

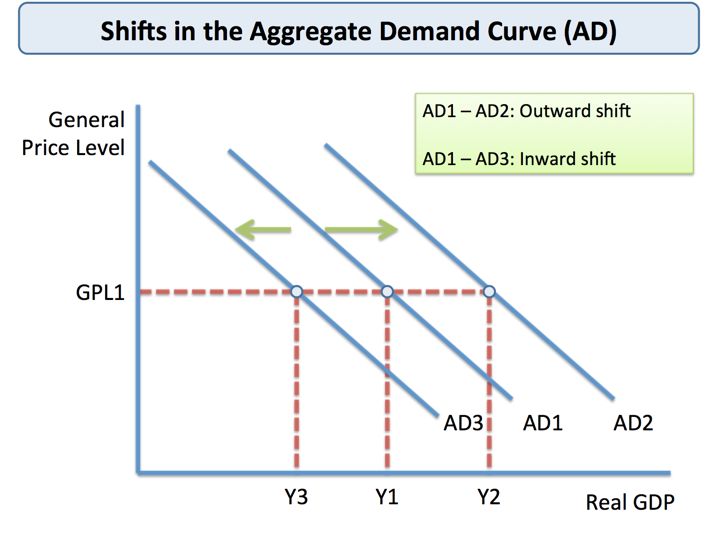

aggregate demand

the total demand for all goods and services in an economy at a given price level and in a given time period

AD =

C + I + G + (X - M)

why does the AD curve slope downwards

income effect

as price level falls the real value of income rises, money goes further

substitution effect

as the price level falls, UK products become cheaper to international buyers and so the demand for UK goods and services rises

interest rate effect

low inflation results in lower interest rates, which encourage borrowing and spending, increasing aggregate demand

what causes AD to shift

change in any C + I + G + (X - M)

consumption

consumer expenditure on goods and services, included durable and non durable goods

goods - visibles

services - invisibles

credit - money flowing in

debt - money flowing out

factors effecting investment

business confidence

interest rates

depreciation

technological advancements

income

substitutes

profit retained

price of capital

factors affecting consumption

taxation

interest rates

confidence

wealth

distribution of income

MPC

wealth effect - when prices of assets fall, consumers feel poorer and reduce spending

age, size of population

government spending

expenditure by the government to influence economic activity, including public services, infrastructure or welfare payments

factors effecting government spending

economic growth

unemployment rates

inflation rates

tax income

shocks

state of economy

accelerator effect

a rise in national income results in a proportionately larger rise in investment

businesses invest lots now so then they can produce extra units when demand increases, leading to higher production and investment

capital output ration

ratio of capital required to produce a given level of output, indicating how efficiently capital is used in the production process

invest 400, get an every 100 every year after the investment = capital out ration 4:1

multiplier and accelerator together

increase in spending

multiplier effect

rise in national income

accelerator effect

increase in investment

back to top

net exports

X - M, trade balance

when exports are positive there is a trade surplus

when exports are negative there is a trade deficit which reduces AD

factors effecting net exports

strength of pound

if UK goods are competitive

tariffs

substitutes

inflation

consumer income

non-price factors

reputation

quality

demand shocks

when AD fall unexpectedly

examples

credit crunch 2008

price bubbles

recession

aggregate supply

total quantity of output that producers in the economy are willing and able to supply at a given price level over a time period

factors affecting total production

price level rises there is a profit incentive to supply more

as output increases production costs increase as resources become more scarce so firms raise prices to maintain profit margins

price of raw materials

cost of labour

level of tax

better production techniques

improve quality / quantity of capital

increased productivity

availability of FOP

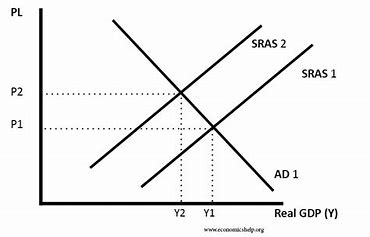

SRAS

Short-Run Aggregate Supply, representing the total production output available in the economy at varying price levels over a short time period

factors affecting SRAS

if costs change at each price level/output

average costs = total costs / output

wage rates

raw material and component prices

taxation/subsidy

interest rates affecting cost of loans

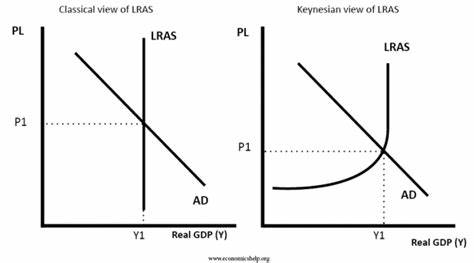

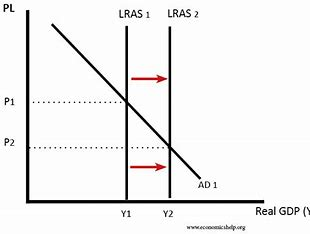

LRAS

Long-Run Aggregate Supply, representing the total output of an economy when all input prices can adjust, indicating full employment and production capacity

reflects an economies productive capacity

the maximum output that can be produced with UK FOP

factors affecting LRAS

only way to move LRAS is through an increase in the quality or quantity of FOP

land

labour

education, birth rate

capital

technological advancements

enterprise

training, tax incentives

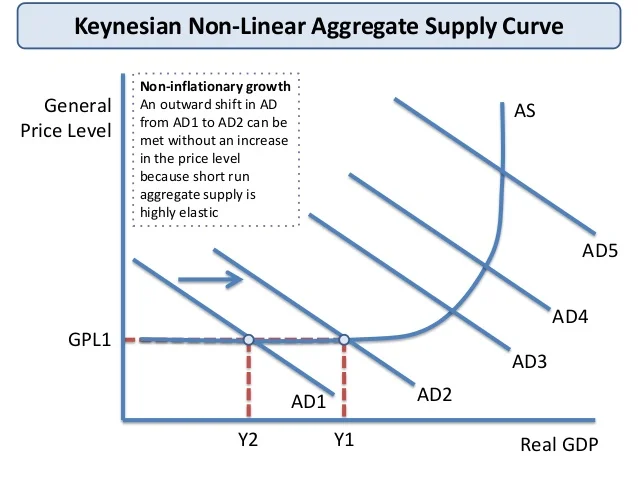

Keynesian AS

AS is highly price elastic as producers have spare capacity and can increase output without higher costs

output can only be increased at the expense of an increase in PL as resources become more scarce and firms get close to full capacity

full employment, no extra resources available so AS becomes inelastic. FOP very expensive

supply side shocks

rise in oil/gas prices

strikes

natural disaster

breakthrough in technology

change in ER

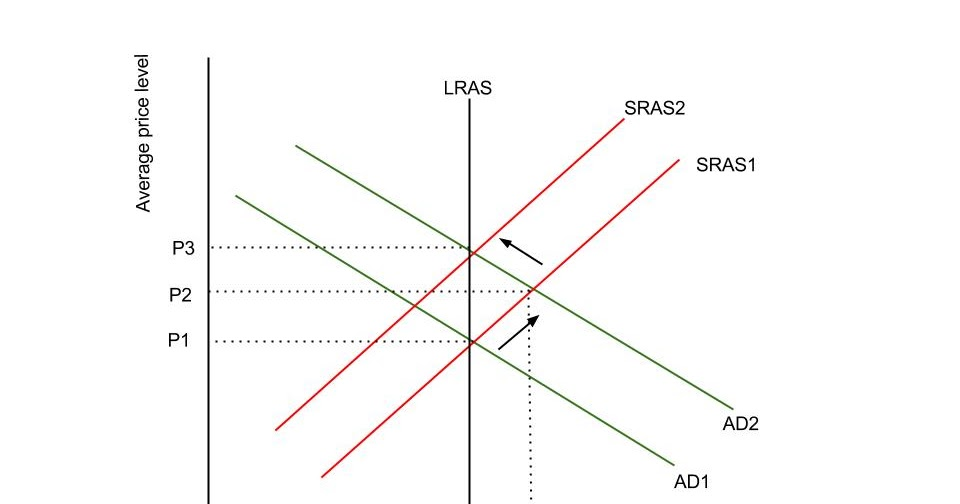

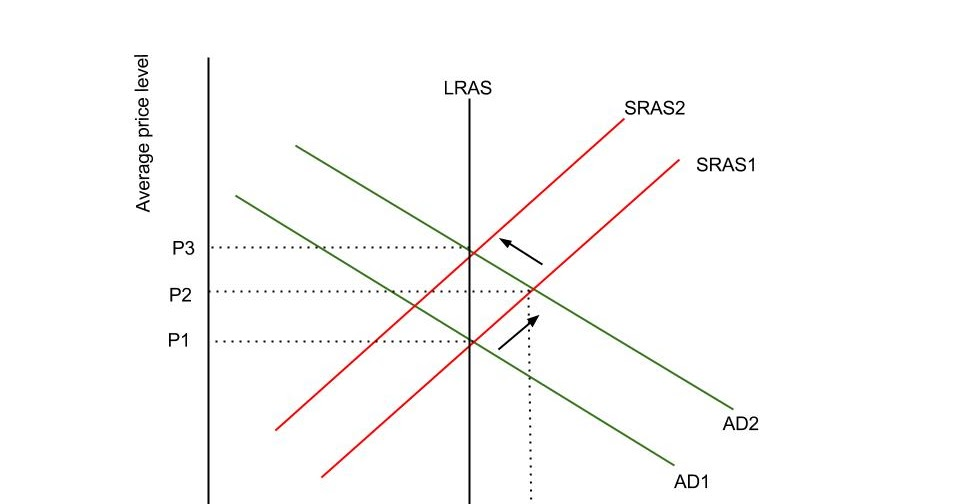

classical AD, AS diagram

AD increases above capacity

firms want to increase out put as there is a profit incentive (excess demand)

firms can only do this by working employees overtime

firms only willing to extend supply if PL increases to compensate

contraction down AD2

however in the long run costs increase at every price level

SRAS shifts left, resulting in a new equilibrium at a higher price level