Analysing the strategic position of a business 3.7

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

Non-financial measures of performance

Environment - how ethical + sustainable

Compliance regulation - how lawful

Health and safety - employee safety

Social media reach - numbers on socials

Net present value

Calculates the monetary value of the projects future cash flows.

Mission statement

Overriding goal and provides a strategic perspective.

Internal influences on corporate objectives

Business ownership

Attitude to profit

Ethical stance

Culture

Leadership

Strategic position

Stakeholder influence

External influences on corporate objectives

Short-termism

Economic environment

Political/ legal environment

Competition

Social/ tech change

Strategy

Long term, made by seniors

Tactics

Short term, supports achievements of targets and is usually delegated to juniors.

SWOT

Internal: Strengths/Weaknesses

External: Opportunities/Threats

Return on capital employed (ROCE)

The return the business has made on its resources being used.

Current ratio

Assess whether a business has enough cash or equivalent current assets to be able to pay its debts as they fall due.

Gearing

Measures the amount of borrowing that is done.

Payable days

Average time it takes a business to pay its debts

Receivable days

Average time it takes a business to receive its debts.

Inventory turnover

How often inventory is replaced during the year

Core competencies

Unique that a business has or can do strategically well that other business cannot copy.

Examples of Core Competencies

Collective learning

Ability to integrate skills and tech

Ability to deliver superior products/services

Ways a business is differentiated

Short and long term performance examples

Share price

Revenue growth

Gross and operating profit

Unit cost/ productivity

ROCE

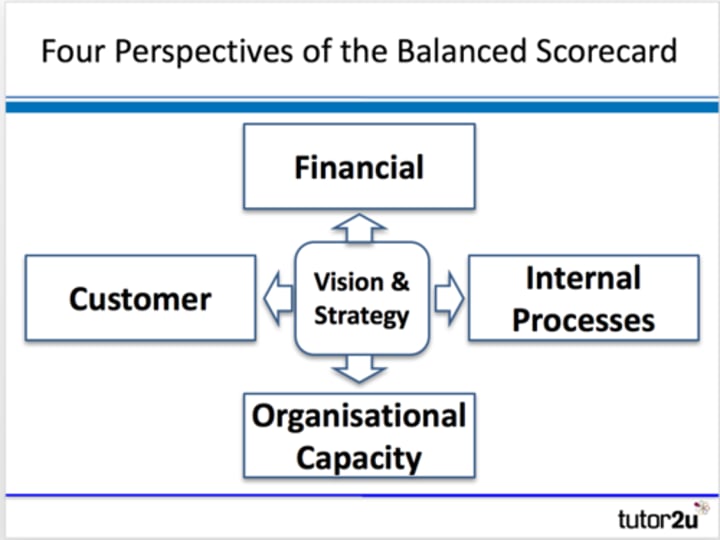

Kaplan and Norton's balanced scorecard

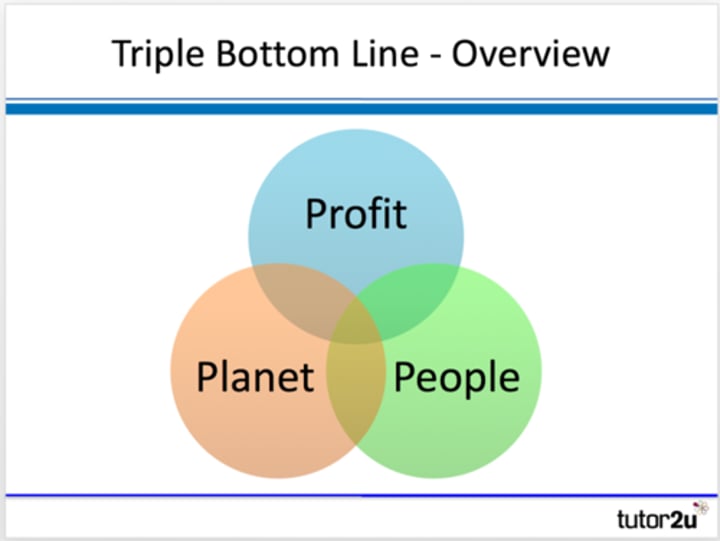

Elkington's triple bottom line

Regulators

Agencies that oversee enforcement of rules.

International trade

The exchange of goods and services between countries

GDP

Total market value of all goods and services produced annually in an economy

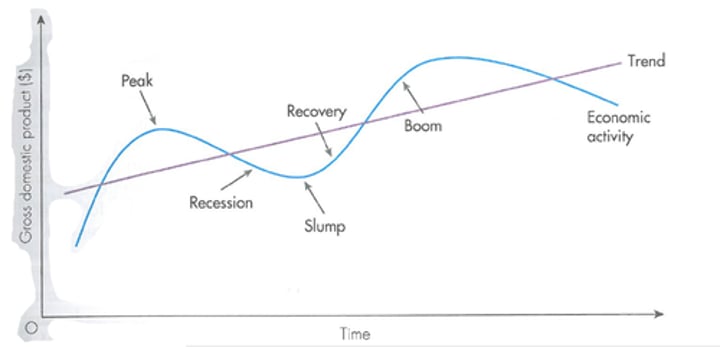

Business cycle

Exchange rate

How much one currency is worth in relation to another.

Inflation

Progressive increase in prices

Fiscal policy

Use of tax and spending to manage level of economic activity.

Monetry policy

Controlling money/interest rates within economy in order to achieve desired level of activity.

Open trade

Countries freely able to trade between each other with no tariffs or quotas.

Protectionism

Economic policy of shielding an economy from imports.

Economic factors

GDP

taxation

exchange rates

inflation

fiscal and monetary policy

more open trade v protectionism

Globalisation

The trend for many markets to become worldwide in scope

Emerging markets

Countries in the process of rapid growth and industrialization. Examples are BRIC(S) and MINT.

Reasons for greater globalisation of a business

Support of governments and major businesses.

Falling cost of international transport and communications.

Growth of global trading blocs and reduction of barriers to trade.

Growth of multinational companies.

Increasing global incomes and growing demand for goods and services.

Importance of globalisation for a business

Increased sales, revenue and profits

Cheaper resources

Economies of scale

Developing different products for different markets

Importance of emerging economies

Provide labour sources

Offer large markets

Rapid growth

Exclusive natural resources

Urbanisation

Increase in the proportion of the countries population living in towns and cities

CSR (Corporate Social Responsibility)

A business's concern for the welfare of society.

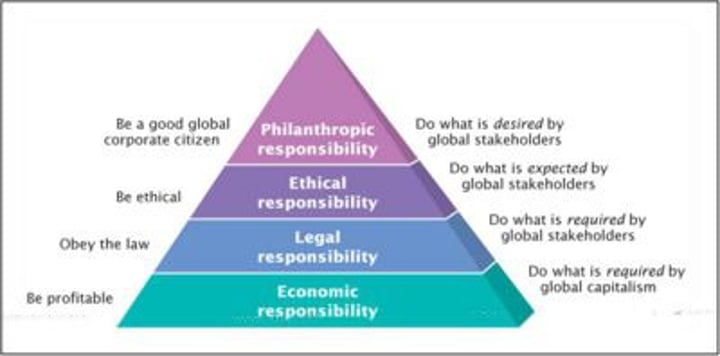

Carroll's CSR Pyramid

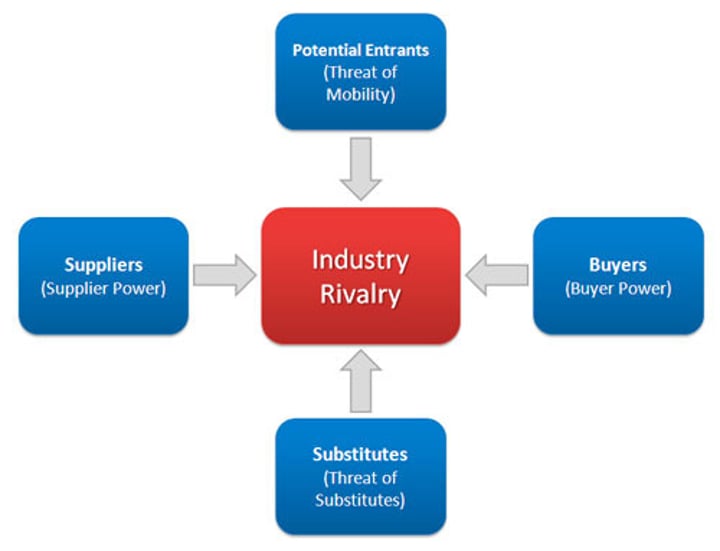

Porters five forces

Payback period

Time it takes for a project to repay its initial investment

Average rate of return

Looks at the total accounting return for a project to see if it meets the target return.