2.1 + 2.2 + 2.3

1/53

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

What is economic growth

an increase in the long term productive potential of a country

What is GDP

Measures the total value of all goods and services produced within an economy over a year

What is the formula for GDP per capita

GDP/population

Distinction between real and nominal GDP

Real GDP is adjusted for inflation

What are other measures of national income

gross national income - income earned domestically in addition to income earned overseas

Gross national product - value of total goods produced domestically in addition to goods produced abroad

What are PPPs

Purchasing Power Parities - compares the value of currencies by measuring how much of one currency can buy a basket of goods in comparison to another country

for example the Big Mac index

Why are PPPs beneficial

Useful to compare living standards by measuring the cost of living

What are the problems of using GDP to compare standard of living

Inaccuracy of data

inequalities

quality of goods and services

types of spending - for example GDP in the UK was a lot higher in WW2 due to defence spending

Why can the inaccuracy of data be a problem of using GDP to compare standards of living

black market

the subsistence economy

What is national happiness and how is it measured

Societal and personal wellbeing, looking beyond GDP to areas such as health, life expectancy

measuring national wellbeing report - updated quarterly and asks 4 questions about life satisfaction, anxiety, happiness and worthwhileness

What is an example of national happiness in the UK

In 2012-2016 life satisfaction, happiness and worthwhile have continued to rise whilst anxiety levels fell but began to rise slightly

this could be due to falling unemployment but concerns over global security could be causing anxiety

What is the Easterlin Paradox

Happiness and income are positively related at low incomes, but higher levels of income aren’t associated with increases in happiness

once basic needs are met an increase in consumption won’t increase long term happiness

What are the different directions of inflation

inflation - a sustained increase in the GPL

deflation - sustained fall in the GPL

disinflation - GPL is still increasing but not as significantly

How to work out index numbers

New figure/base year figure x 100

What is the CPI and how is it calculated

Consumer price index

ONS survey

Create a consumer basket of most popular goods and services with prices

Prices of these goods and services are weighed as a % of income

Weighted prices are added to give total weighted price of the basket

What are the limitations of using CPI

not completely representative

does not include the price of housing

difficult to make comparisons with historical data as it’s only been used since 1996

What is RPI

retail price index

includes housing costs such as mortgage and interest payments

takes into account that when prices rise people switch to the product which has gone up by less

excludes the top 4% of earners and low income pensioners as they aren’t average households

What are the different types of inflation and what are the diagrams

demand pull - AD increasing and AD shifting outwards

cost push - increase in costs of production causing firms to push their prices up and SRAS shifting inwards

growth of money supply - more money but not enough goods and services to supply increase in demand

What is the impact of inflation on consumers

fall in living standards (if wages don’t rise with inflation)

those in debt (either benefit or loose)

consumers saved will suffer

What is the impact of inflation/deflation on firms

If expected, deflation causes people to postpone their purchases and are likely to save - fall in demand and business confidence

What is the impact of inflation on workers

if wages don’t rise they are worse off

deflation could cause staff to loose their jobs due to lack of demand

What is the impact of inflation on governments

If the government fails to excise taxes in line with inflation then real gov revenue will fall

however if they fail to change personal income tax allowances real gov revenue will rise and taxpayers will have less money

How can negative impacts on inflation be reduced

If it’s anticipated negative impacts can be reduced through indexation

wages and taxes increase in line with inflation eg: workers can negotiate with employers for wage rises in line with the predicted CPI

What is the definition of unemployment

The number of people above working age who are not currently working but seeking a job

What are the ways of measuring unemployment

the claimant count - the number of people receiving benefits for being unemployed

ILO survey sent to 60,000 people every quarter of a year, respondents self determine whether they are unemployed

Comparisons between the claimant count and LFS

some people may not be included in ILO survey but would be included in the claimant count eg: those who fraudulently claim benefits

some people would be in the ILO survey but not the claimant count as they are eligible for benefits

What is under employment

Those who work below their skill set qualifications or who are working less hours

tends to increase during recessions because firms will reduce staff hours - can reduce AD as they have lower incomes

What is frictional unemployment

Short term - moving between jobs

What is structural unemployment

Long term decline in a demand for an industry leading to unemployment

What is seasonal unemployment

Only prominent during certain times in a year

What is cyclical unemployment

Due to a lack of demand of goods and services - caused by a recession

What is real wage inflexibility

When wages are above their market clearing level

What are the impacts on unemployment on workers

loss of income

long term unemployed have difficulties gaining jobs as they lose skills

Impact of unemployment on firms

decrease in demand for their goods

long term unemployment can lead to a loss of skills - smaller amount of people to employ

Impacts of unemployment on the government

reduced income due to a fall in tax revenue and higher welfare spending (opportunity cost)

can result in a budget deficit

What is the impact of an increase in migration

Increased jobs and lower wages

What components make up the balance of payments

current account

capital account

financial account

What components make up the current account

balance of trade - goods and services

primary income - earnings from ownership of FOP

secondary income - one way payment

What are the macro economic objectives

T - trade

I - inflation

G - growth

E - employment

R - redistribution of income

S - sustainability

B - balanced budget

What are the 4 causes of globalisation

increased individual trading

more assets owned internationally

higher migration

more technology being shared

What is the definition of aggregate demand and what are its components

The total planned expenditure of a countries goods and services at a given price level in a given time

Formula : C+I+G+(X-M)

Consumption - 60%

Investment - 15-20%

Government spending - 18-20%

Net trade - 5%

What is MPC and MPS

marginal propensity to consume - how much a consumer changes spending following a change in income

marginal propensity to save - the proportion of each additional pound of household income that is used for saving

Added together they equal 1

What are influences on consumer spending

Interest rates - impacts saving, mortgage payments and taking out loans

consumer confidence/animal spirits - job security/unemployment

wealth effects - negative and positive

How does the wealth effect impact consumer spending

If houses prices increase consumers experience a rise in equity so they might be paying less on their mortgage than the house is worth on the market, making them feel wealthier so more willing to spend + take out more loans

What is an evaluation point for the wealth effect

Ricardo Sousa found that the wealth effect is not significant in the UK because 50% of people rent, this means that as house prices increase people will pay more rent and therefore consume less

What is the distinction between gross and net investment

gross - total amount of investment

net - gross investment - capital depreciation

What are influences on investment

spare capacity

buisness expectations and confidence

interest rates - cost of borrowing/rate of return (higher opportunity cost of interest rates are high for not saving money)

access to credit - either more expensive or not possible

government regulations- corporation tax or subsidies

Influences of net trade

real income - during economic growth consumers can afford to import goods

exchange rates - WIDEC and SPICED

protectionism - tariffs, quotas… (uk may increase protectionism to decrease imports but this may cause retaliation)

Evaluation for impact of exchange rates on net exports

Depends what currency the pound depreciates against - if it’s not one of UKs major trading partners it won’t be as significant

What is the distinction between SRAS and LRAS

SRAS - short run (when atleast one factor of production if fixed)

LRAS - long run (when all factors of production are variable, and maximum output when all factors of production are fully employed)

What factors influence SRAS

cost of production

exchange rates

productivity

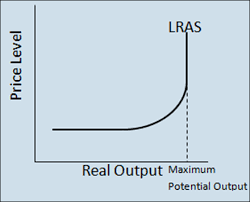

What is the Keynesian LRAS

Suggests the price level is fixed until all factors are fully employed, horizontal section shows the output and price when there is spare capacity in the economy (here output can be increased without impacting the price level)

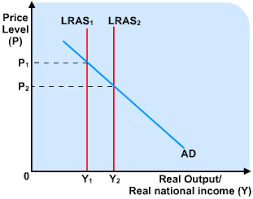

What is the classical LRAS

Suggests output is fixed at each level - in the long run all factors of production are fully employed

Factors influencing LRAS

Quantity or quality of factors of production

technological advancements

relative productivity

education and skills

government regulation

migration