FAR - Chapter 11 - EPS & Distributable profits

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

What is EPS & what is it an indicator of?

Earnings per share

a company’s performance

What 2 things is it important that users can do regarding EPS?

They can compare EPS of different entities

They can compare EPS of the same entity in different accounting periods

What is the PE ratio and how is it calculated?

Price Earnings ratio

PE Ratio = Market value of share / EPS

What does the PE Ratio give an indicator of when compared with other companies in a similar sector?

Market confidence

Why must EPS be calculated in a standard way?

As the PE ratio is an important stock market ratio

How does EPS achieve comparability?

defining earnings

prescribing methods for determining the number of shares to be included in the calculation of EPS

requiring standard presentation and disclosures. The basic EPS is required to be shown on the face of the statement of profit or loss. Compliance with IAS 33 Earnings per share is only mandatory for:

– the separate financial statements of entities whose ordinary shares are publicly traded or in the process of being issued in public markets

– the consolidated financial statements for groups whose parent has shares similarly traded/being issued

What is the basic EPS formula?

Earnings/ Share

What is the IAS 33 definition of earnings?

net ‘profit or loss for the period attributable to ordinary equity holders of the parent entity

What is the IAS33 definition of shares?

the ‘weighted average number of ordinary shares outstanding […] during the period

What are the 3 type of preference shares & how do we treat them?

Redeemable

Treated as debt (liability). Finance costs will already be included in the SPL

Irredeemable (without cumulative/ mandatory dividends)

Treated as equity Dividend must be deducted from the net profit in the SPL to arrive at earnings

Irredeemable Cumulative

Always treat dividends as having been paid in the correct period

When a company issues new share capital, what will it increase?

it will increase earnings and share capital, although not necessarily proportionally

What should be done to earnings to calculate the correct EPS figure?

earnings should be apportioned over the weighted average number of equity shares (i.e. taking account of when shares are issued during the year).

What 2 facts do we assume about the calculation of EPS to allow comparability year on year?

the bonus shares are deemed to have been issued at the start of the year

comparative figures are restated to allow for the proportional increase in share capital caused by the bonus issue i.e. treat the bonus issue as always having been in place.

What are the steps for calculating EPS after a bonus issue?

Step 1: Calculate bonus fraction = Shares after the issue/Shares before the issue

E.g. if there is a 1 for 5 bonus issue, the bonus fraction = 6/5. The number on the top should be higher

Step 2: In the calculation of the weighted average number of shares, adjust all shares in existence BEFORE the bonus issue by multiplying by the bonus fraction

Step 3: Calculate EPS

Step 4: restate prior year comparative by multiplying by the INVERSE of the bonus fraction.

What is the main problem with rights issues?

they contribute additional resources but they are normally priced BELOW full market price.

What are the steps for calculating EPS after a rights issue?

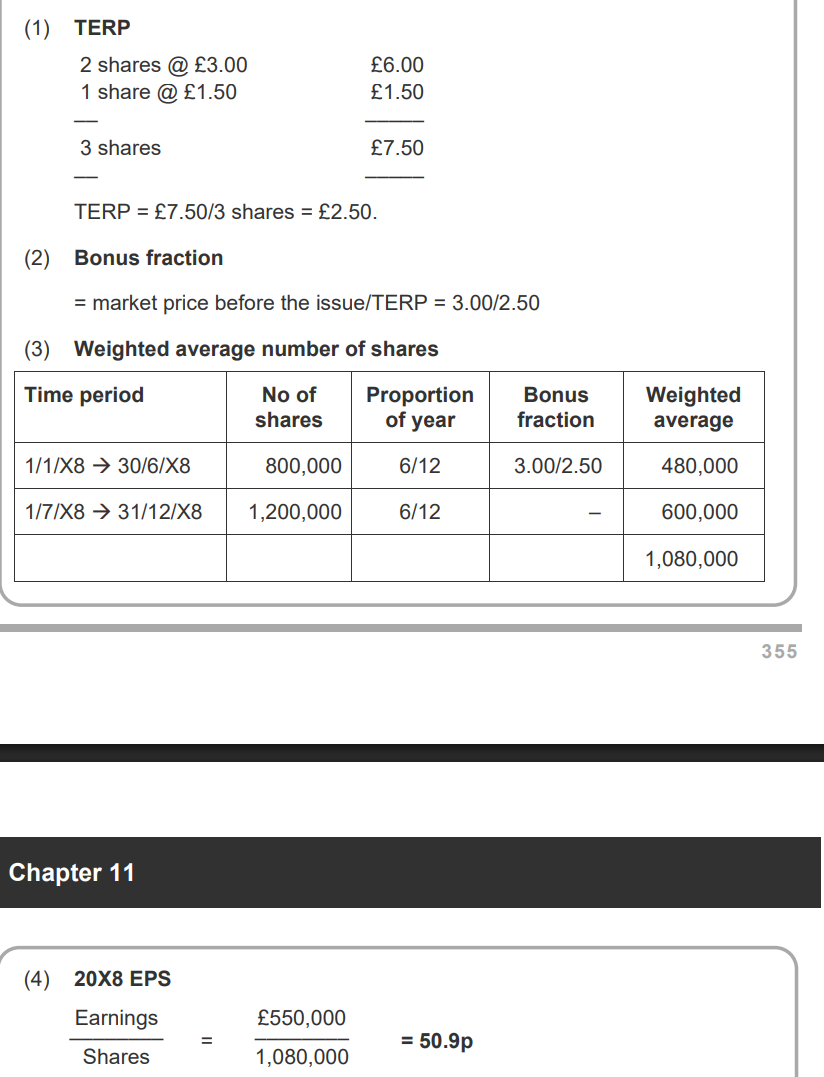

Step 1: Calculate theoretical ex-rights price (TERP)

Step 2: Calculate bonus fraction on the rights issue = Market price before the rights issue/TERP

Market price before rights issue price aka cum rights price

Step 3: Calculate weighted average number of shares by adjusting all shares in existence BEFORE the rights issue by multiplying by the bonus fraction

Step 4: Calculate EPS and restate prior year comparative, by multiplying the original EPS by the INVERSE of the bonus fraction.

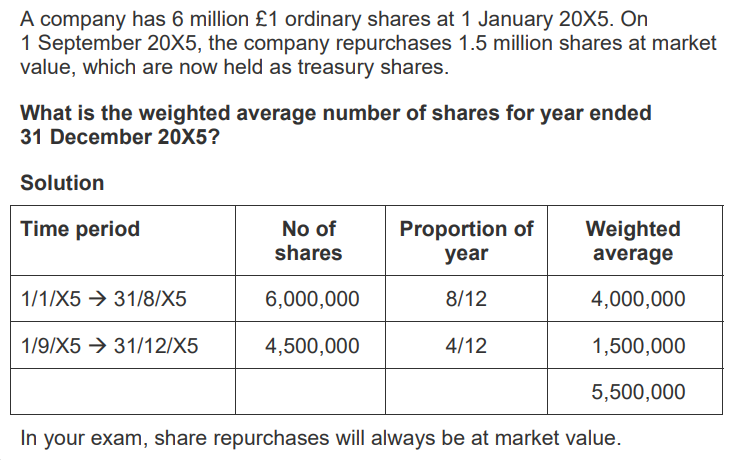

What do treasury shares reduce and do they affect share capital? What is required?

Treasury shares reduce the number of shares in issue.

However, share capital remains the same as treasury shares are a separate part of equity.

An adjustment is required to the weighted average number of shares, similar to a 'reverse' of a full market value issue.

What is the formula for profits available for dividend?

=Accumulated, realised profits - accumulated, realised losses

What do distributable profits usually equate to?

retained earnings balance but some adjustment may be required

What is the distributable profit figure calculation based on?

individual company financial statements rather than consolidated financial statements

What are the 4 rules regarding distributable profits from Companies Act 2006?

a provision made in the accounts is a realised loss

a revaluation surplus is an unrealised profit

if noncurrent assets are revalued and, as a result, depreciation increases, the additional depreciation may be treated as part of the realised profit for dividend purposes

on the disposal of a revalued asset any unrealised surplus or loss on valuation immediately becomes realised.

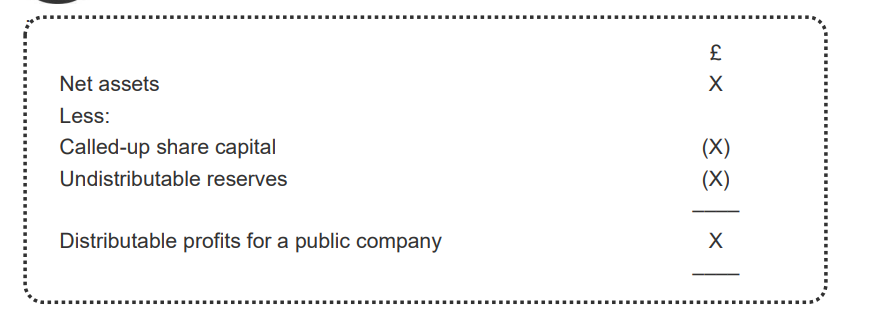

What is the first formula for distributable profits for a public company? (regarding net assets)?

Net assets X

Less:

Called-up share capital (X)

Undistributable reserves (X)

Distributable profits for a public company X

What are undistributable reserves?

the share premium account

excess unrealised profits over unrealised losses

any other reserve which the company is prohibited from distributing by any statute or by its memorandum or articles of association.

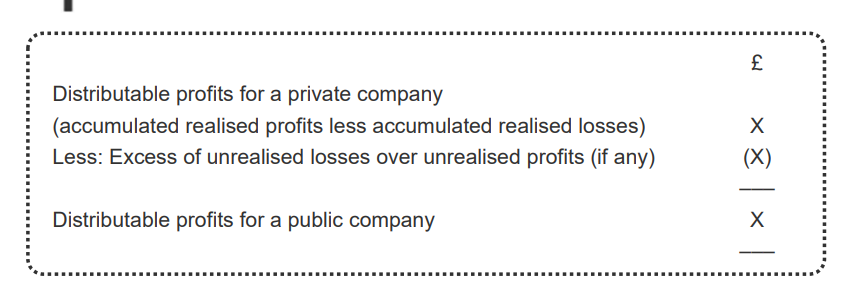

What is the second formula for distributable profits for a public company?

Distributable profits for a private company (accumulated realised profits less accumulated realised losses) X

Less: Excess of unrealised losses over unrealised profits (if any) (X)

Distributable profits for a public company X

What are the gains and losses when a revaluation of noncurrent assets takes place:

gains are unrealised unless they reverse a loss previously treated as realised

losses are realised except where the loss:

– offsets a surplus on that asset

– arises from a reassessment of the value of all noncurrent assets

– arises from a reassessment of some noncurrent assets where the assets not revalued are worth at least their carrying amounts.