AP Econ I Chapter 4 and 5 (comparative and absolute advantage & price elasticity) 12.03.25.

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

31 Terms

why do people trade?

because you can’t make everything yourself

everyone should specialize in the production of g/s and trades for everything else.

more trade = better standard of living

two ways to measure production

input: what goes into making it (time)

output: how MANY can you make (the good itself)

absolute advantage

who can produce more of something with the same resources

productivity, efficiency

Adam Smith’s concept

specialize and trade things you can make quicker and more of (absolute advantage).

example of absolute advantage

I can make 10 cookies in an hour.

Lahari can make 5 cookies in an hour.

I have absolute advantage in making cookies because I can make the most.

comparative advantage

lower opportunity cost of making something

the thing you’re giving up is not valuable so who gives up LESS

example of comparative advantage

you can make cookies or cupcakes.

I can make 1 cookie but I give up 3 cupcakes.

Lahari can make 1 cookie but she gives up 1 cupcake.

Lahari has comparative advantage of making cookies because she gives up less.

overall differences between absolute and comparative advantage

absolute advantage: who can make the most

comparative advantage: who gives up the least to make it

input vs. output

input: how long does it take to produce

output: how much can they produce

math application for absolute advantage

input: who makes it quicker → absolute advantage

output: who makes more → absolute advantage

math application for comparative advantage

input: IOU → Input: Other goes Under

output: OOO → Output: Other goes Over

based on the data, who should do which chore and why? base your answer only on the information above and on comparative advantage considerations

based on the combinations, this will produce most at lower opportunity cost and take the least time.

price elasticity of demand

determines how sensitive buyers are to a change in price

if price changes, how much does quantity demanded change?

do people still buy it if the price increases/decreases?

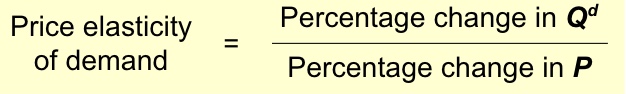

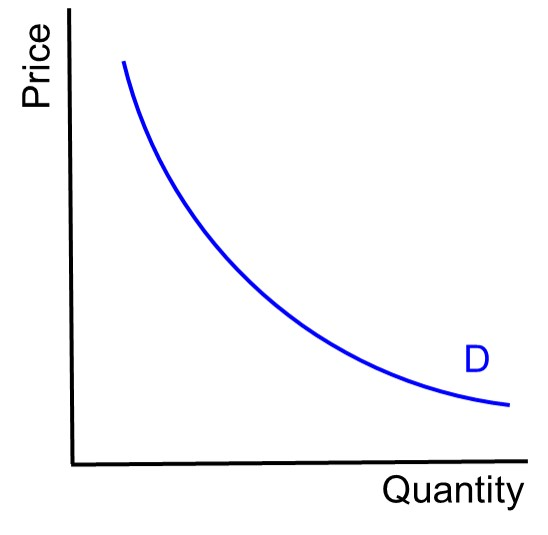

formula for elasticity of demand

what is quantity demanded?

the amount of a good/service that consumers are willing and able to buy at a specific price

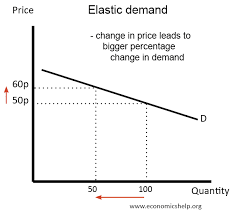

elastic demand

Qd changes a lot when prices change

fancy restaurant meals, luxury items, etc

elastic goods have substitutes so people switch easily

inelastic demand

Qd doesn’t change much when prices change

gasoline, insulin, basic necessities

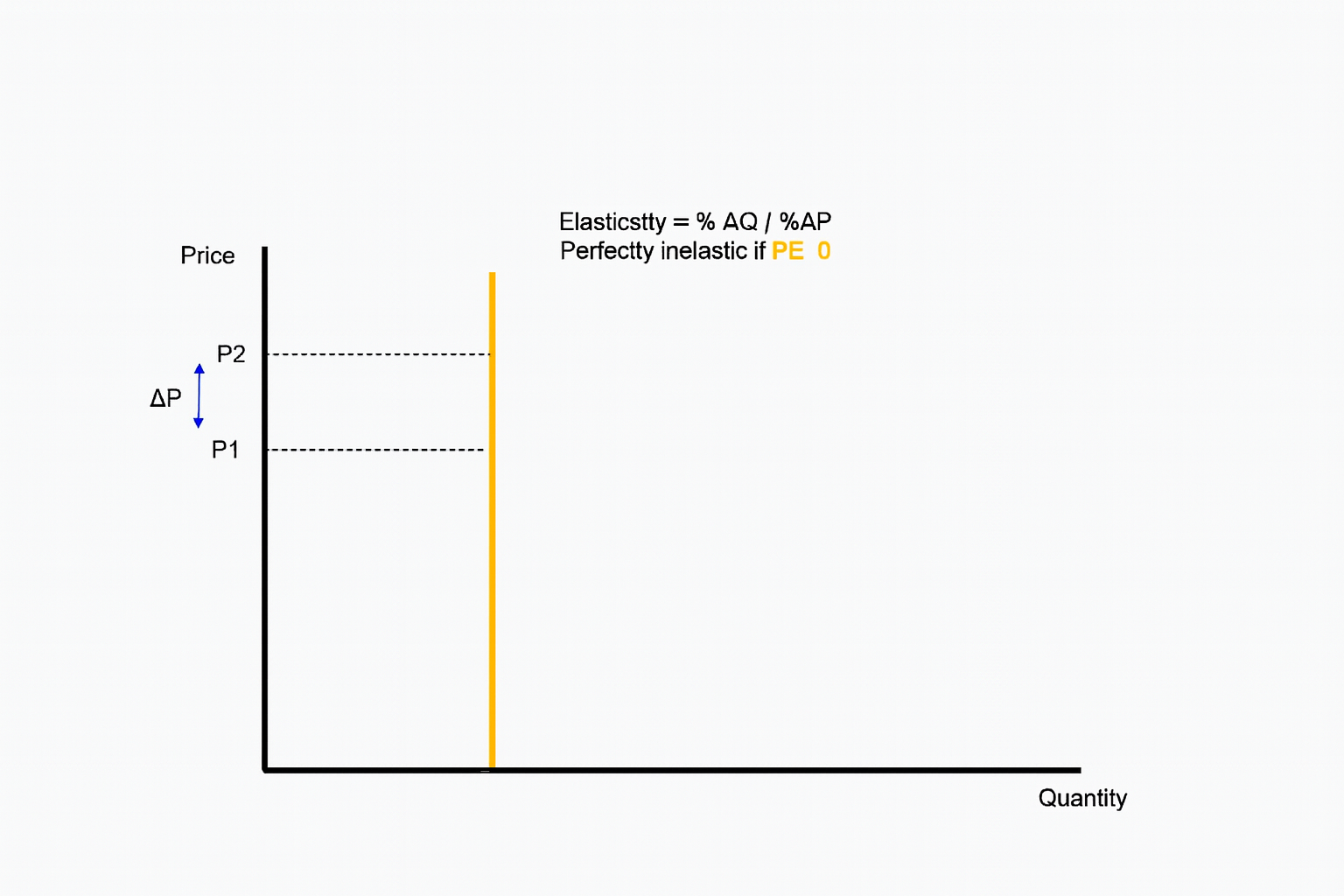

what type of relationship do price and Qd have?

negative relationship

As price decreases, Qd increases

As price increases, Qd decreases

when is demand inelastic and elastic?

demand is more elastic at lower quantities (higher $)

demand is more inelastic at higher quantities (lower $)

percent change formula

end - start/ start x 100

midpoint method

use this when start and endpoints aren’t given

end value - start value/ midpoint value x 100

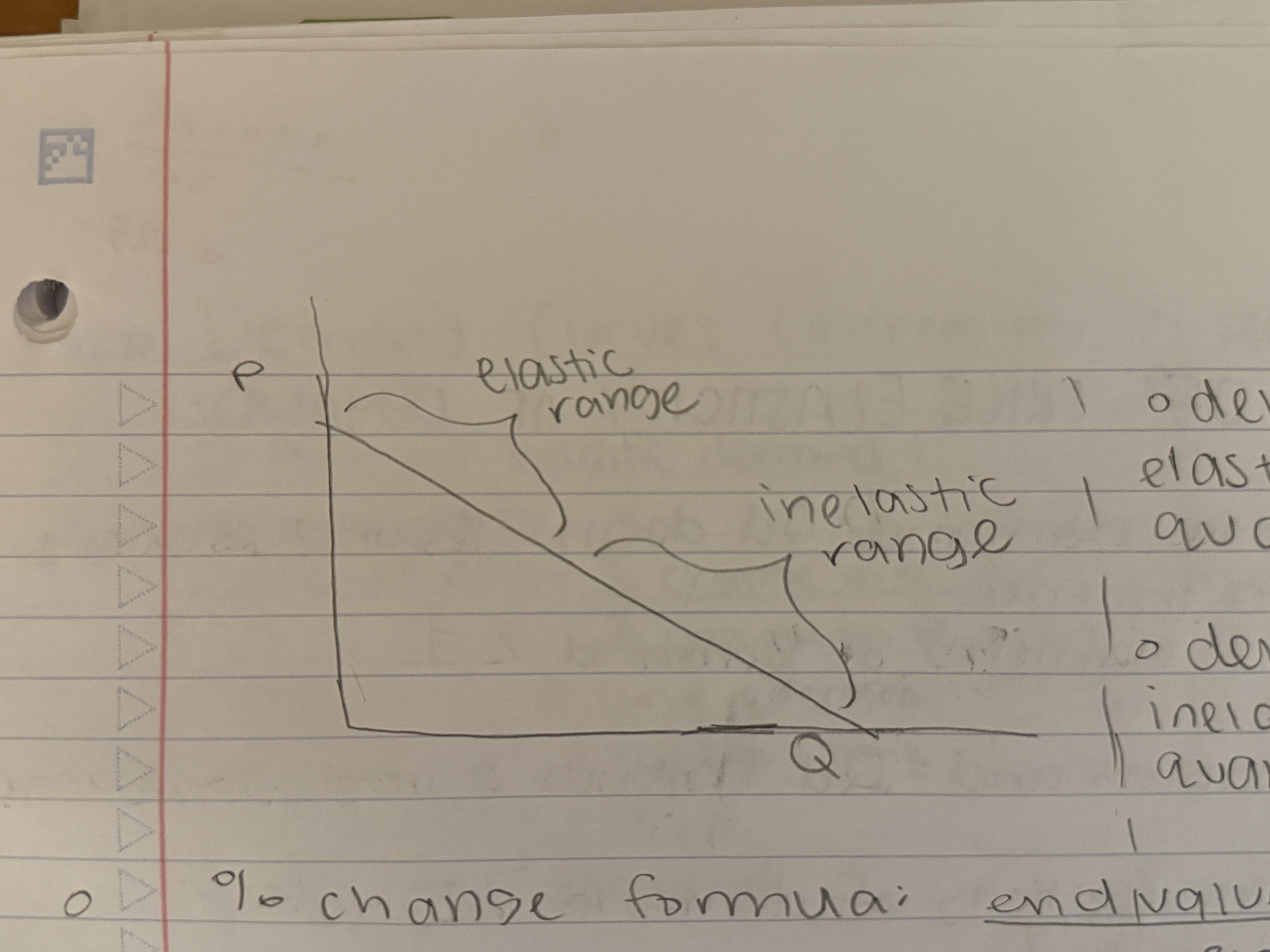

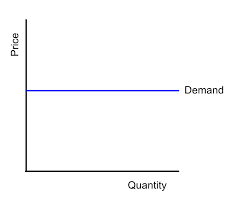

1) perfectly inelastic demand

Qd does not change when price changes

price elasticity of demand (PED) =0

2) inelastic demand

Qd doesn’t respond strongly to changes in price

price elasticity of demand < 1

3) unit elastic

Qd changes by the same % as price changes

price elasticity of demand = 1

4) elastic demand

Qd responds strongly to changes in price

price elasticity of demand > 1

5) perfectly elastic demand

Qd changes infinitely with any change in price

price elasticity of demand = infinity

determinants price elasticity of demand

(SNITT)

S - substitutes ( a lot or a few?)

N - necessity vs. luxury

I - income share (portion of income) - ( don’t need to know?)

T - type of market (broad or narrow?)

T - time horizon - elasticity is higher in the long run than in the short run

supply determinants

(FAC)

F - flexibility of production

A - availability of inputs

C - capacity

why does price elasticity of demand matter?

helps firms predict how consumers will react to price changes → affects revenue

why does price elasticity of supply matter?

helps firms know how quickly they can increase production when prices rise

total revenue

price x quantity demanded