ACYAFAR5: Cost Accounting (Job Order, Process, Joint and By product, JIT and Backflash)

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

Which of the following is least likely to be an objective of a cost accounting system?

a. Product costing

b. Department efficiency

c. Inventory valuation

d. Sales commission determination

D

When shall the job order costing be used instead of process costing?

a. When the production process performs standardized or uniform procedures

b. When the company performs a very long production runs

c. When the company produces high-value and heterogeneous products

d. When the company produces low-value and homogeneous products

C

In a job cost system, the application of factory overhead is usually reflected in the general ledger as an increase in

a. Factory overhead control

b. Finished goods

c. Work in process

d. Cost of goods sold

C

When the amount of overapplied factory overhead is significant, the entry to close overapplied factory overhead will most likely require

a. A debit to cost of goods sold

b. Debits to cost of goods sold, finished goods inventory, and work in process inventory

c. A credit to cost of goods sold

d. Credits to cost of goods sold, finished goods inventory and work in process inventory

D

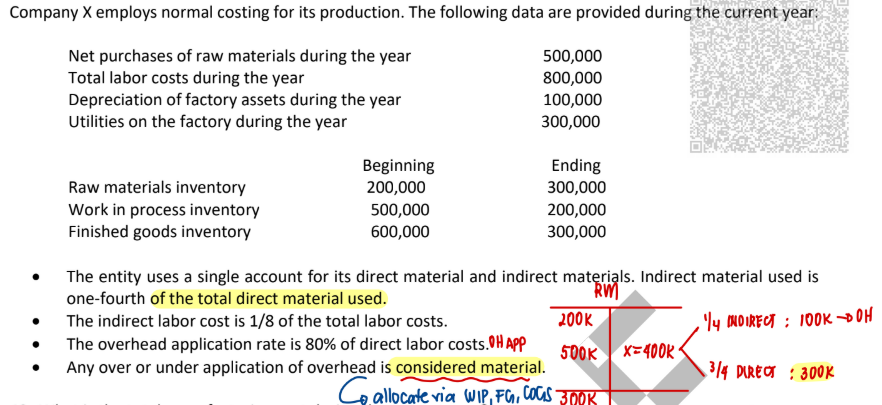

What is the total manufacturing cost during the current year?

a. 1,560,000

b. 1,500,000

c. 1,640,000

d. 1,740,000

A

What is the cost of goods manufactured during the current year?

a. 2,040,000

b. 1,860,000

c. 1,940,000

d. 1,800,000

B

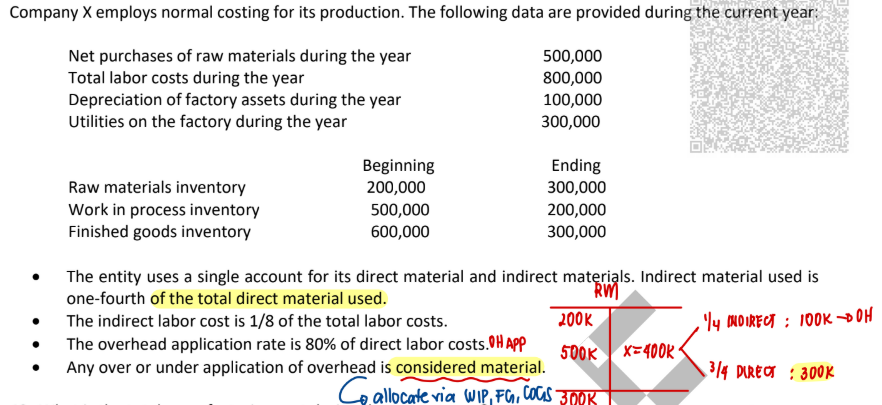

What is the over or under application of overhead

a. 60,000 over application

b. 140,000 under application

c. 40,000 under application

d. 160,000 over application

C

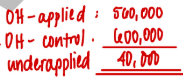

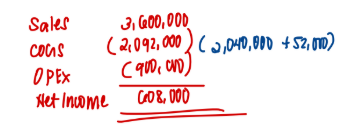

Company X has no work in process or finished goods inventories at the close of business on December 31.

The balances of Company X’s account as of December 31 are as follows:

Company X’s pretax income for the year is

a. 608,000

b. 660,000

c. 712,000

d. 52,000

A

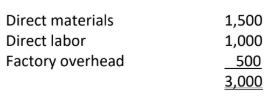

53. Company X’s Job No. 15 for the manufacture of 6,600 coats was completed during August at the following unit costs:

Final inspection of Job No. 15 disclosed 600 spoiled coats, which were sold for P600,000. Assuming that spoilage loss is charged to all production, what would be the unit cost of the good coats produced on Job

No. 15?

a. 2,900

b. 2,950

c. 3,000

d. 3,050

C

When shall the process costing be used instead of job order costing?

a. When the production process performs standardized or uniform procedures

b. When the company performs a very short production runs that is based on customer specifications

c. When the company intends to use it for billing customers

d. When the company produces high-value and heterogeneous products

A

Equivalent units of production are equal to the

a. Units completed by a production department in the period

b. Number of units worked on during the period by a production department

c. Number of whole units that could have been completed it all work of the period had been used to produce whole units

d. Identifiable units existing at the end of the period in a production department

C

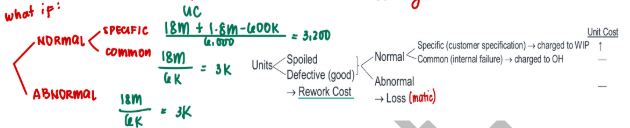

If the spoilage in process costing is considered discrete because there is inspection point, which of the following statements is correct?

a. The cost assigned to abnormal loss shall be treated as period cost or expense

b. The cost assigned to normal loss shall be allocated to either (1) units completed only or (2) prorated to units completed and word-in-process ending inventory based on equivalent units of production, depending on where those normal losses were discovered

c. The normal or abnormal loss shall be given or not given equivalent unit of production depending on the stage of inspection point and stage of adding the cost component

d. All of the above

D

In a process costing system using the weighted average method, cost per equivalent unit for a given component is found by dividing which of the following by EUP?

a. Only current period cost

b. Current period cost plus the cost of the beginning inventory

c. Current period cost less the cost of the beginning inventory

d. Current period cost plus the cost of ending inventory

B

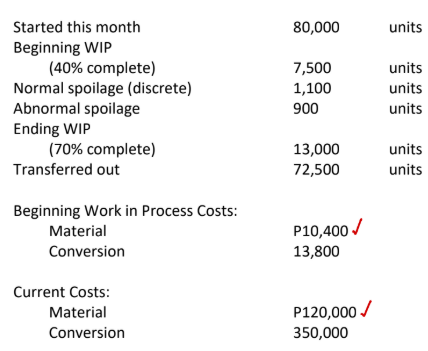

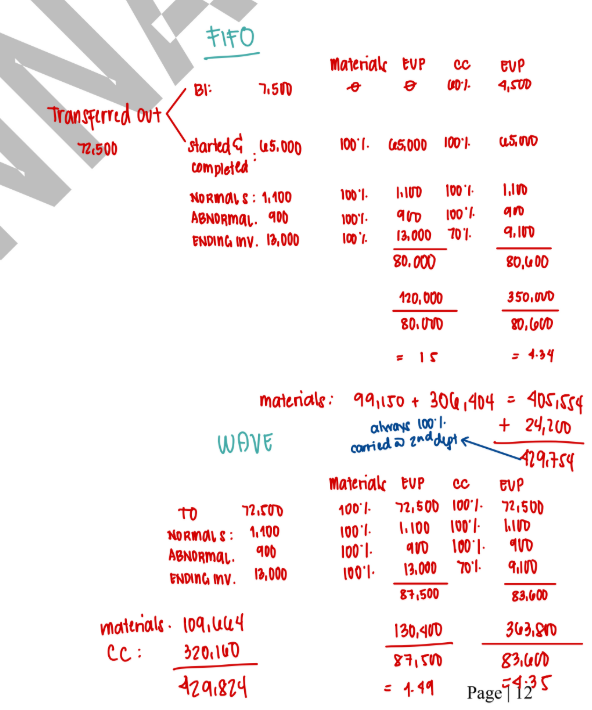

The following information is available for ABC Company for the month:

All materials are added at the start of production and the inspection point is at the end of the process.

What is the total cost assigned to goods transferred out using Weighted Average (WAVE) and FIFO?

a. P429,824; P429,754

b. P435,080; P428,656

c. P429,824; P423,400

d. P423,400; P429,824

A

The allocation of joint costs to individual products is useful primarily for purposes of

a. Determining whether to product one of the joint products

b. Inventory costing

c. Determining the best market price

d. Evaluating whether an output is a main product or a by-product

B

This method of allocating joint manufacturing costs to main/joint products allocates joint costs on the basis of estimated sales value at split off of a given joint product relative to the sales value at split off of total joint production.

a. Market value at split-off approach

b. Hypothetical market value or approximated net realizable value approach

c. Average unit or production output method

d. Weighted average method

A

In a joint production process, a by-product is also described as

a. A simultaneously produced product of relatively low value

b. A form of main product with controllable proportions

c. Products of low value recovered at the end of a production process

d. A product with no value contribution to help offset production costs

A

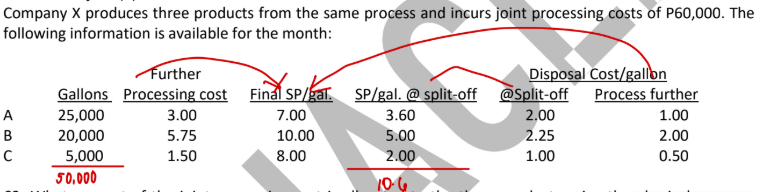

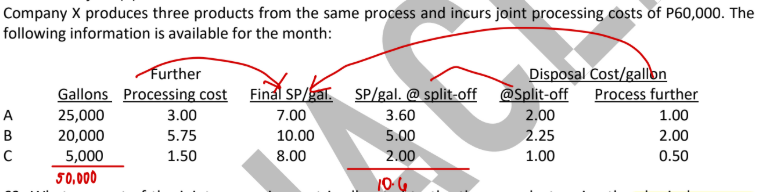

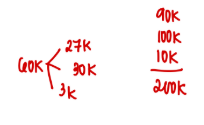

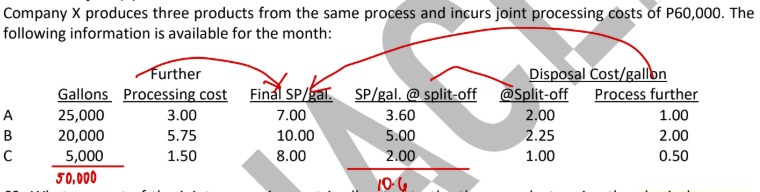

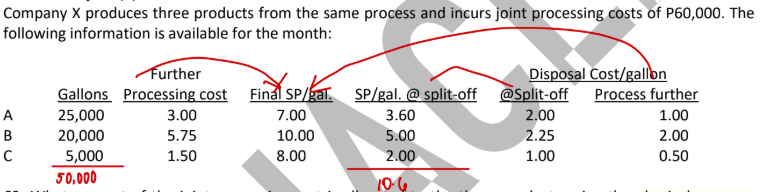

What amount of the joint processing cost is allocated to the three products using the physical measure allocation?

A B C

a. 25,000 20,000 15,000

b. 30,000 15,000 15,000

c. 30,000 24,000 6,000

d. 20,000 20,000 20,000

C

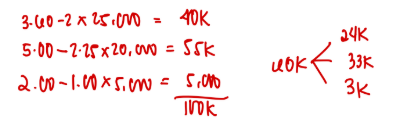

What amount of the joint processing cost is allocated to the three products using the sales value at split- off?

A B C

a. 24,000 33,000 3,000

b. 27,000 30,000 3,000

c. 30,000 18,000 12,000

d. 20,000 20,000 20,000

B

What amount of the joint processing cost is allocated to the three products using the net realizable value at split-off?

A B C

a. 24,000 33,000 3,000

b. 27,000 30,000 3,000

c. 30,000 18,000 12,000

d. 20,000 20,000 20,000

A

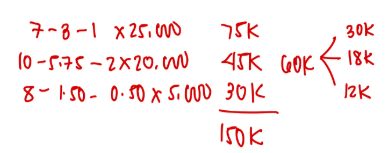

What amount of the joint processing cost is allocated to the three products using the approximated net realizable value?

A B C

a. 24,000 33,000 3,000

b. 27,000 30,000 3,000

c. 30,000 18,000 12,000

d. 20,000 20,000 20,000

C

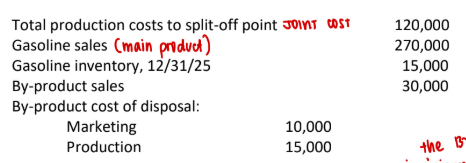

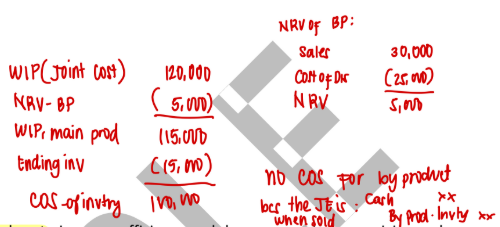

66. Company X which began operations in 2025, produces gasoline and a gasoline by-product. The following information is available pertaining in 2025 sales and production:

The company accounts for the by-product at the time of production. What are the company’s 2025 cost of sales for gasoline and the by-product?

Gasoline By-product

a. 105,000 25,000

b. 115,000 0

c. 108,000 37,000

d. 100,000 0

D

It is an inventory strategy a company employs to increase efficiency and decrease waste by receiving and producing goods as they are needed in the production process, thereby reducing inventory costs.

a. Just in time inventory system

b. Min-max inventory system

c. Pareto/80-20 inventory rule

d. ABC inventory system

A

Under Just-in-Time Inventory System and Backflush Costing, what costing method is ideally employed?

a. Normal costing

b. Actual costing

c. Standard costing

d. Budgeted costing

C

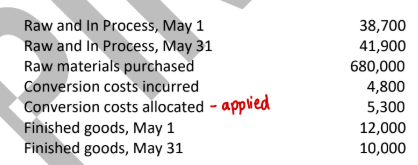

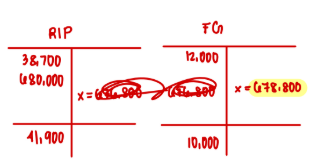

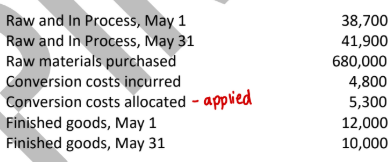

Company X uses a Raw and In Process (RIP) inventory account and expensed all conversion costs to the cost of goods sold account. At the end of each month, all inventories are counted, their conversion cost components are estimated, and inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to finished goods. The following information is for May:

What is the calculated material cost to be backflushed from RIP to cost of goods sold?

a. 718,700

b. 688,800

c. 678,800

d. 676,800

C

Company X uses a Raw and In Process (RIP) inventory account and expensed all conversion costs to the cost of goods sold account. At the end of each month, all inventories are counted, their conversion cost components are estimated, and inventory account balances are adjusted accordingly. Raw material cost is backflushed from RIP to finished goods. The following information is for May:

What is the amount of conversion costs to be backflushed to cost of goods sold?

a. 10,100

b. 5,300

c. 4,800

d. 500

B