F4 - Measuring liquidity

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

6 Terms

What is liquidity?

A measure of a business’s ability to survive in the short term i.e. its ability to meet short term dets and day to day expenses.

If a business cannot meet current liabilities from current assets then it is at risk of failure if creditors demand immediate payment of debts.

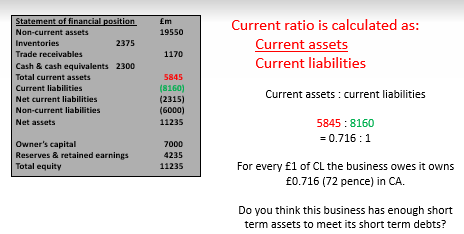

How is Current ratio calculated?

Current assets / current liabilities

CA / CL

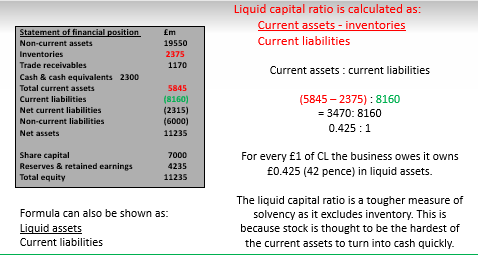

How is the Liquid capital ratio calculated?

Current assets - inventories / current liabilities

CA - INV / CL

Why is the Liquid capital ratio a tougher measure of solvency?

The liquid capital ratio is a tougher measure of solvency as it excludes inventory.

This is because stock is thought to be the hardest of the current assets to turn into cash quickly.

How can a business with low liquidity be in danger?

A business with low liquidity is in danger if short term creditors demand payment quickly e.g. the bank recalls an overdraft.

How can businesses improve liquidity?

Sell assets that are no longer being used e.g. turn them from a non-current asset to a current asset (cash).

Move cash balances from current accounts to high interest bearing accounts so its value increases more rapidly - ISA.

Switch to long term sources of finance.

Monitor debtors to avoid bad debts.