10.2 Trade Balances in Historical and International Context and Flows of Financial Capital

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

6 Terms

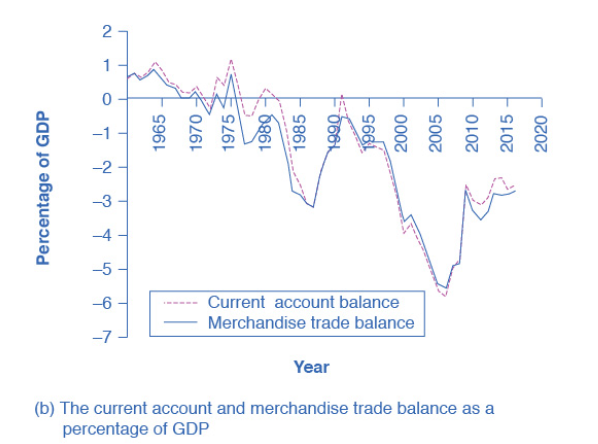

For about two decades prior to 1980s, the U.S. economy experienced modest trade surpluses.

True

False

True

According to historical data, the U.S. economy had small trade surpluses in the 1960s into the 1970s, as indicated by the graph below. Because the numbers are positive during those years, it indicates a trade surplus.

Which of the following best describes a nation experiencing a current account surplus?

Select all that apply:

The nation has an inflow of financial investment capital from abroad.

The nation is considered a net borrower from the rest of the world.

The nation is considered a net lender to the rest of the world.

The nation has domestic investors who are sending their funds abroad.

The nation is considered a net lender to the rest of the world.

The nation has domestic investors who are sending their funds abroad.

A current account surplus implies that the value of an economy's exports is greater than the value of its imports. A current account surplus means that, after taking all the flows of payments from goods, services, and income together, investors will be sending their funds abroad and the nation is a net lender to the rest of the world.

When a country’s purchases of foreign assets is greater than foreign purchases of domestic assets, the country is ______________________.

Select the correct answer below:

a net lender

a net borrower

is experiencing a trade deficit

none of the above

a net lender

If a country’s purchases of foreign assets is greater than foreign purchases of domestic assets it means that the country is experiencing a trade surplus i.e. it is a net lender to the rest of the world.

All of the following statements are true, except:

One way to measure globalization is to look at a country's export of goods and services as a percentage of their GDP.

If two countries import and export almost the same dollar value of goods and services to each, they will have the same export ratio.

Most countries have trade surpluses or deficits that are less than 5% of GDP.

Dividing the trade deficit in each year by GDP in that year, inflation and growth in the real economy can be factored out.

If two countries import and export almost the same dollar value of goods and services to each, they will have the same export ratio.

GDP differences between two countries as well as the value of their exports and imports with other countries will easily ensure that their individual export ratios are different.

Which of the following best represents a nation experiencing a trade deficit?

Select the correct answer below:

A nation with an economy that is experiencing a net outflow of financial capital.

A nation with an economy that is experiencing a net inflow of financial capital.

A nation with domestic investors receiving extra capital that they invest abroad.

A nation with foreign investors choosing to hold their funds in their home countries.

A nation with an economy that is experiencing a net inflow of financial capital.

A trade deficit represents an inflow of financial capital coming into the domestic economy and being invested. Therefore, a nation with a trade deficit has an economy that is experiencing a net inflow of financial capital.

Which of the following statements is true?

Select the correct answer below:

Domestic investors will have more financial investment capital when the economy is in a trade surplus.

A country is likely not a net borrower from abroad if it has a current account deficit.

A negative current account balance means a country is likely a net lender to the rest of the world.

Domestic investors will have less financial investment capital when the economy is in a trade surplus.

Domestic investors will have more financial investment capital when the economy is in a trade surplus.

Trade surplus means an overall outflow of financial investment capital, as domestic investors put their funds abroad. A current account deficit means that, the country is a net borrower from abroad. Conversely, a positive current account balance means a country is a net lender to the rest of the world.