3.8 - taxes as policies to reduce income and wealth inequalities, direct and indirect, recessive progressive and proportional

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

effect of taxation

income redistribution

types of taxes

direct taxes

indirect taxes

direct taxes

paid directly to the government tax authorities

types of direct taxes

personal income taxes

corporate income tax

wealth tax

social insurance contributions/ pay roll taxes

personal income taxes

PROGRESSIVE

taxes paid by households/ individuals on their income (what earned → tax → disposable income)

most important source of government tax revenues

paid on income

wages

rent

interest

profit

corporate income tax

PROGRESSIVE

taxes on the profits of the corporations, assessed on their net income after expenses and allowable deductions.

wealth taxes

PROGRESSIVE

taxes on the net wealth of individuals or households, targeting accumulated assets and property

property tax

inheritance tax

social insurance contributions/ pay roll taxes

PROPORTIONAL

taxes paid by employees and employers to fund social insurance programs such as Social Security and Medicare

tax revenues are not paid into government’s budget

indirect taxes

ALL REGRESSIVE

taxes that are not directly paid by individuals but are instead included in the price of goods and services

sales taxes

excise taxes

tariffs/ customs duties

sales taxes/ general expenditure taxes (VAT → value added tax)

taxes on spending/ selling on goods and services

fixed % of retail price of goods and service

may exclude/ offer different rate for some goods and services on ground of equity

excise tax

tax paid on specific goods or services (usually demerit)

eg. on cigarettes, alcohol etc

tariffs/ customs duties

taxes imposed on imported or exported goods

aimed at regulating trade and generating revenue for the government.

why are all indirect taxes regressive

! indirect taxes account for a bigger proportion of income of low-income households compared to high-income households

example:

car price = 10 000

sales tax = 10%

income A = 20 000

income B = 100 000

*both pay 1 000 $ od tax

but

A = 1 000/ 20 000 = 5%

B = 1 000/ 100 000 = 1%

tax rate

tax as % of income

the 3 natures of taxes

proportional taxation

progressive taxation

regressive taxation

proportional taxation

tax rate remains constant regardless of income level

progressive taxation

tax rate increases as income increases,

reduces income inequality

the more progressive taxation the more equal after-tax distribution of income

regressive taxation

tax rate decreases as income increases

places higher burden on low-income households

calculation of taxes

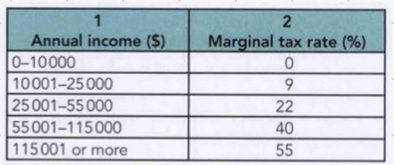

marginal tax rate

the amount of tax paid on an additional dollar of income

average tax rate

the total tax paid divided by total income

marginal tax rate and average tax

tax brackets

applying a different marginal tax rate to each bracket

example calculation based on the photo:

calculate the amount of income tax paid on an annual income of $59 000

(0 × 10 000) + (0.09 × 15 000) + (0.22 × 30 000) + (0.40 × 4 000) = 0 + 1350 + 6600 + 1600 = 9550$

average tax: 9550$/ 59000$ = 16.2% or 0.162

calculating indirect taxes

a = value after indirect tax (disposable income)

x = indirect tax

in = income after income tax

s = amount of spending on indirect tax/ value of indirect tax

a+ax = in

eg.

60 000 = total income

15 000 = value of income tax

60 000 - 15 000 = 45 000 = income after income tax

12.5% = indirect tax

so:

a + 0.125a = 45 000

0.125a = 45 000

a = 40 000

s = 45 000 - 40 000 = 5 000

average rate of indirect tax

arit = indirect tax value/ total income

total average indirect tax rate

tatr = (vale of income tax + value of indirect tax)/ total income

percentage of redistribution that occurs through tax system

25%

downsides of progressive taxes

(in theory more progressive taxes = more equal distribution of income)

disincentive effects

income tax reduces after-tax income, acting as a disincentive to work

lower quality of labour offered in the market

lower quantity of savings

lower investment

lower production of new capital goods

lower economic growth rate

lower income taxes may not lead to more work

lower corporate taxes may not to lead to greater investment