Chap. 10 - Adverse Selection in Real Markets

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Positive Correlation between Risk and Coverage

As level of risk increases, so does the amount of coverage (riskier people will seek coverage more)

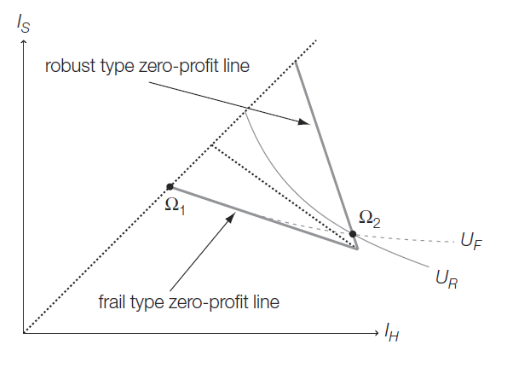

Rothschild-Stiglitz

Separating equilibrium —> high-risk types have full insurance (Ω1), low risk types have incomplete insurance (Ω2

Bulk discounts

a lower per-unit price for a large purchase of commodity

Bulk markups

a higher per-unit price for large purchases of a commodity

Insurance companies

__________ use bulk markups to protect themselves from risky customers who want a lot of insurance (what Rothschild model predicts!)

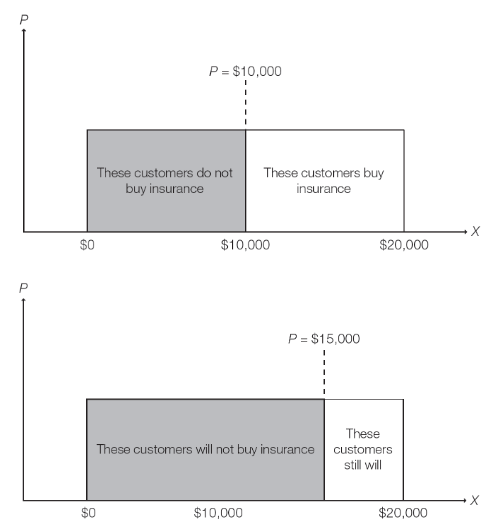

Adverse selection death spiral

both frail and robust individuals are pooled together, frail types are indirectly subsidized by robust individuals but robust types leave the pool (they are paying more due to the frail ppl even though they are healthy!) cycle repeats

predict health care costs

since people can do this more accurately than insurance companies, families with high predicted costs were more likely to was supplemental insurance (RAND HIE)

negative correlation

US workers with employer-sponsored insurance, medicare beneficiaries

life insurance

negative risk-coverage correlation: people with life insurance live longer! (some studies show that it is positively correlated but some don’t)

Viatical settlements

a firm purchases a life insurance contract from a sick person and collects the payout when he dies

why would adverse selection not occur

customers mispercieve their own risk

customers do not act on their private information

insurers can accurately observe customer risks

“advantageous selection”

customers misperceive their own risk

→ US novice drivers demand less insurance bc they believe they are safer than average driver

→ men aged 85-89, 31% think they will live to 100 but only about 3% will

customers do not act on their private information

→ Real customers have more important things to think about than small bargains on insurance

→ fail to realize their advantage

insurers accurately observing risk

→ Long-term care insurers, with access to historical data and a team of analysts, are better at predicting whether middle-aged customers will eventually need nursing home care than the customers themselves

→ all models rest on an assumption of information asymmetry

Advantageous selection

→ healthier, less risky people are sometimes more likely to buy insurance

→ more risk averse, higher income, better understanding of insurance benefits

cognitive ability

→positively correlated with medigap insurance purchase

→ negatively correlated with health expenditures

adverse selection

a situation in markets where one party, typically the buyer or seller, has more information about their risk or value than the other party

Ex post risk

risk that remains after an event has occured or after insurance contract is purchased.

Ex ante risk

reflects the uncertainty before the event, before insurance is purchased