Ch 10

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

what is corporate governance

Rules that influence manager decision making

what is the stick method

threat of removal

what is carrot method

compensation

what are the three pillers of coporate goverance

transparency

accontability

security

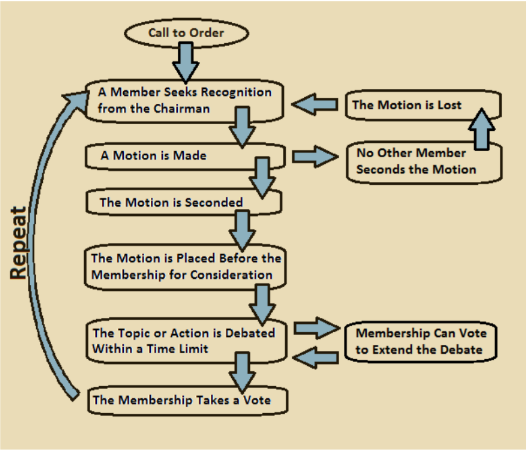

Robert’s Rules of Order

when is a agency relationship created? (2)

hiring someone to perform a service

give them decision making authority

If you are the only employee, and only your money is invested

in the business, would any agency problems exist?

NO

does a agency problem exist in these situations?

when the manager own less than 100 pf the firm’s stock

firms borrows

yes

yes

Would hiring additional people

create agency problems?

yes

who bears the costs?

manager/owner owns all the stock

outside stockholder

mangager/owner

partly the stockholder

what is agency cost or minority discount?

minority shareholder may pay less for stock

does minority shareholders have more or less say in corporate goverance

less

can borrowers make decision that affect lender? how

yes

invest in risky projects

what do if creditors anticipate possible harmful actions by stockholders (3)

higher interest rate

cost of capital goes up

value of company go down

What Actions Reduce Agency Cost of Debt? (2)

secure loan with company assets

restrictive convenants in debt agreement

examples of restrictive covenants in debt agreement (4)

maintain profitability ratios and RE

maintain debt ratios

not issuing more debt

personal guarantee

Six Potential Problems with Managerial Behavior

Expend too little time and effort or focus on the wrong things

Consume too many nonpecuniary (non-monetary) benefits

Conflict of Interest

Reject risky positive NPV projects to aviod looking bad if project falls; take a risky negative NPV projects trying to hit a homr run

Avoid returning capital to investors by making excess investments in marketable securities or by paying too much for acquisitions

Massafe information or manage earnings to avoid revaling bad news

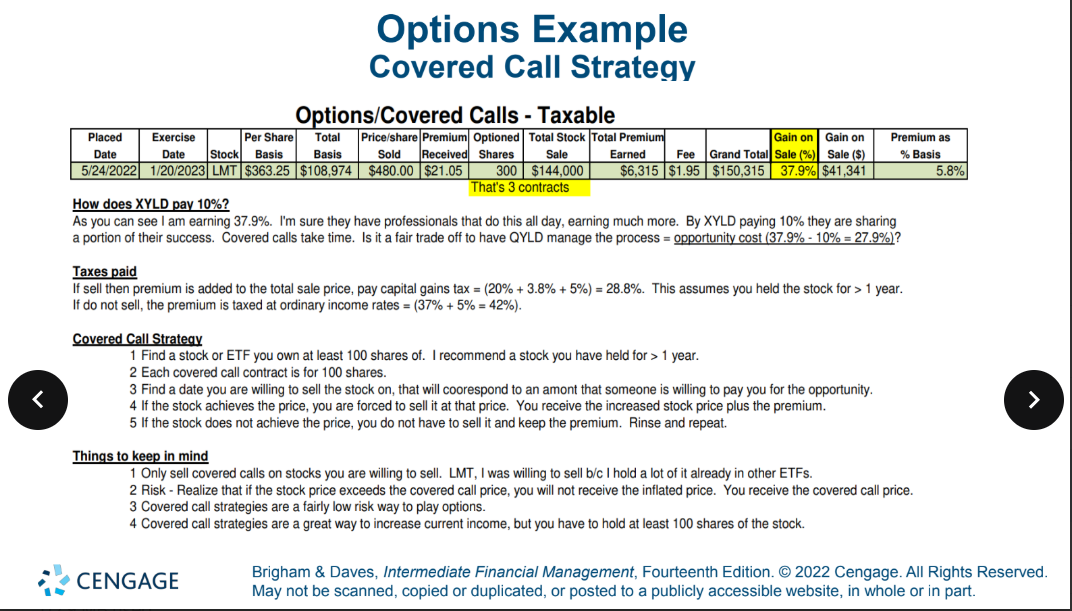

what is strike price

buy a share at a specificed price

Options that have value are called “_________”.

above or below the current stock price

would options be exericed

in the money (below current price)

below

yes

Options that have no value are called “_______”.

is price higher or lower than current stock price

will options be exercised

are the options worthless

underwater

higher

no

yes

what is a warrant?

right to buy at a certain price before a expiration date

what is the problem with manager stock options

Manager can underperform and still get rewarded from options as long as the stock price increases to above the exercise price

why is a classified board/staggered board good?

maintain institutional memory

why do you want a odd number of boardmembers?

to avoid deadlock votes

Are these effective or uneffective?

CEO is not chairman of the board (not always) and does not have undue influence over the nominating committee.

Board has a majority of outside directors (i.e., those who do not have another position in the company) with business expertise.

An inside director is a board member who also holds a managerial position in the company.

large boards

effective

effective

effective

uneffective

why do you need to aviod a interlocking board? (the ceo of one board sitting on the board of another company)

conflict of interest

what does it mean for a boardmember to be unduly busy?

too many board or too many business activities

different ways boardmembers are compsitated (4)

fixed salary

linked to firm performance or stock performance

attendance

not paid

anti-takeover provisions (3)

targeted share repurchases

shareholder rights provisions

restricted voting rights plans

what is greenmail

Target share repurchases that occur when a company buys back stock from a potential acquirer at a higher than fair market price. In return, the potential acquirer agrees not to attempt to take over the company.

what is poision pill

Shareholder rights provision allowing existing shareholders to purchase company shares at below market prices if a potential acquirer purchases a controlling interest in the firm.

what is an example of restricted voting rights plans?

own a certain amount of stock? voting rights canceled!

what is block ownership

Outside investor owns large amount/block of stock of company’s shares