Chapter 8: variable costing: a tool for management

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

8 Terms

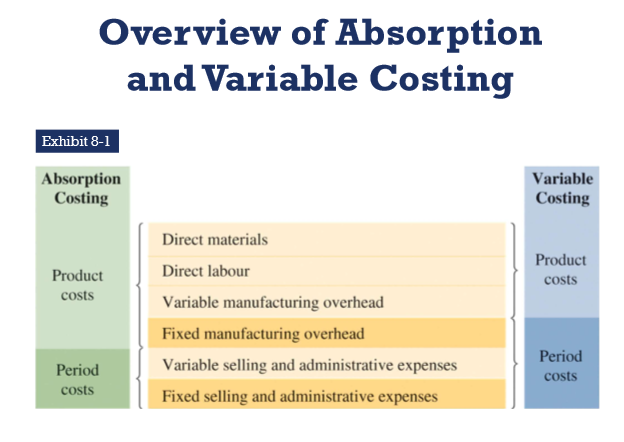

What is the difference between absorption & variable costing systems?

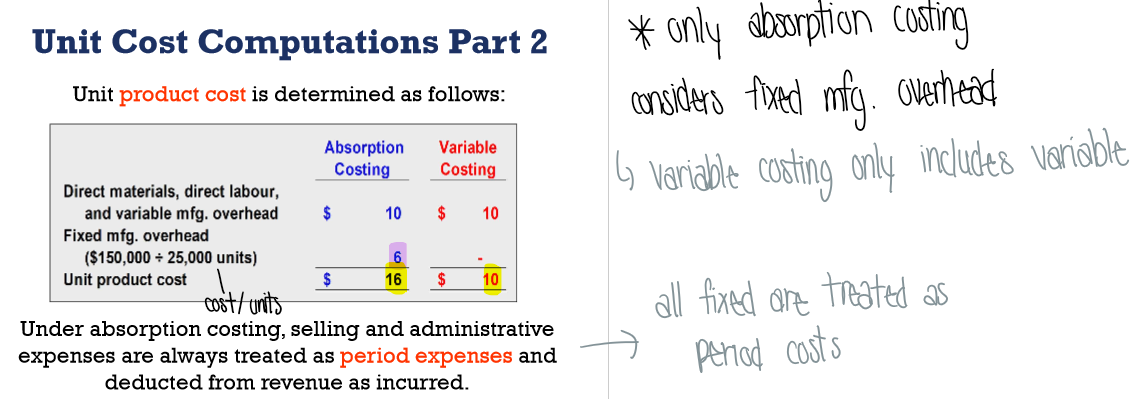

How do absorption & variable differ in unit computations?

Absorption:

considers direct materials, direct labour, variable mfg. overhead, AND fixed manufacturing overhead for its unit product cost

Variable:

only considers direct materials, direct labour, and variable mfg. overhead

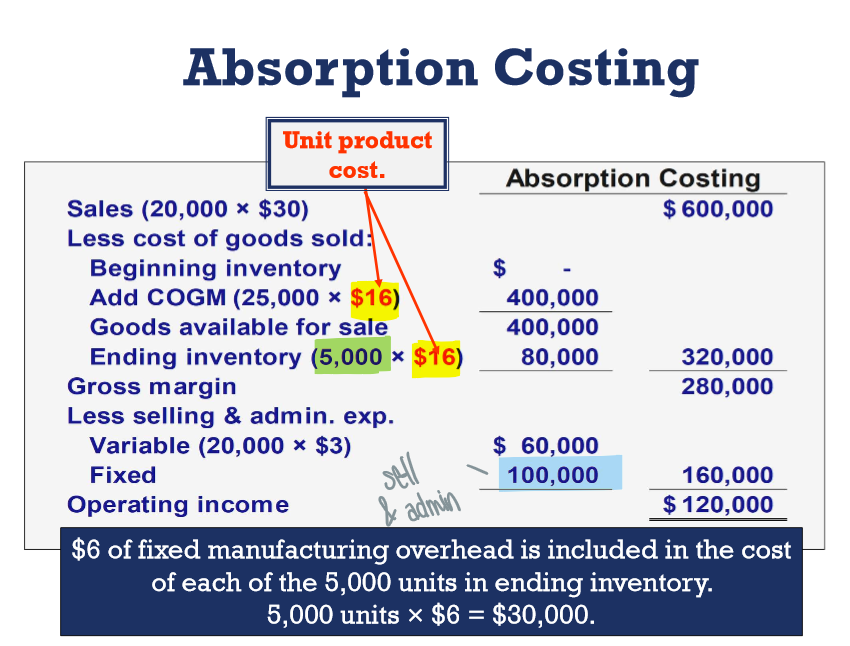

What does absorption costing look like?

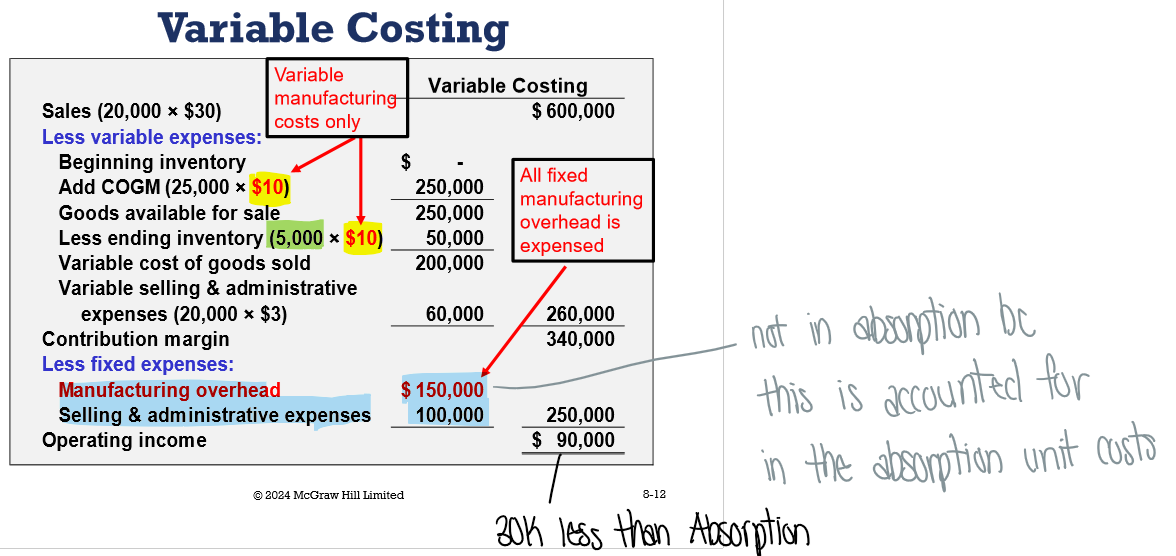

What does variable costing look like?

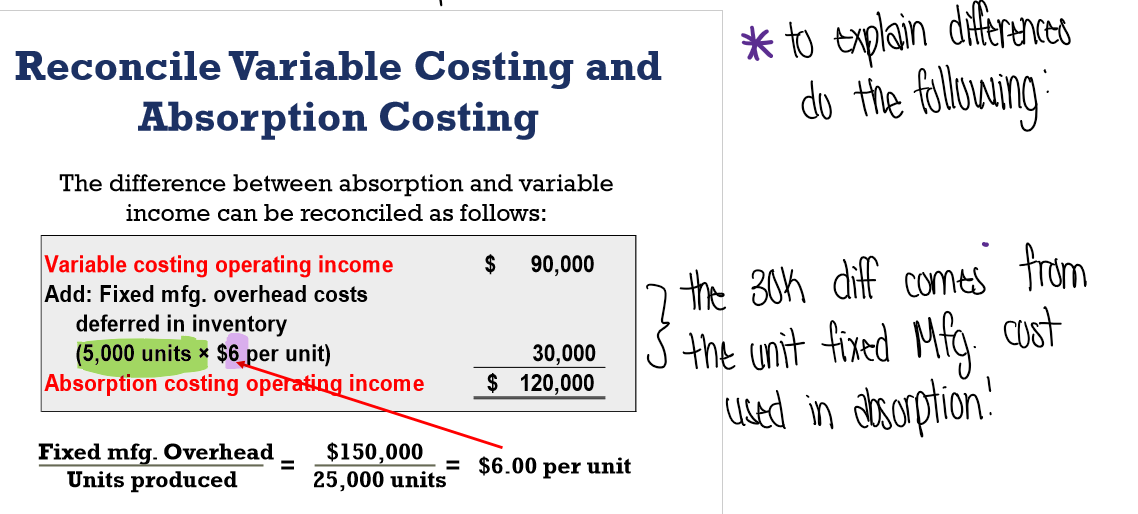

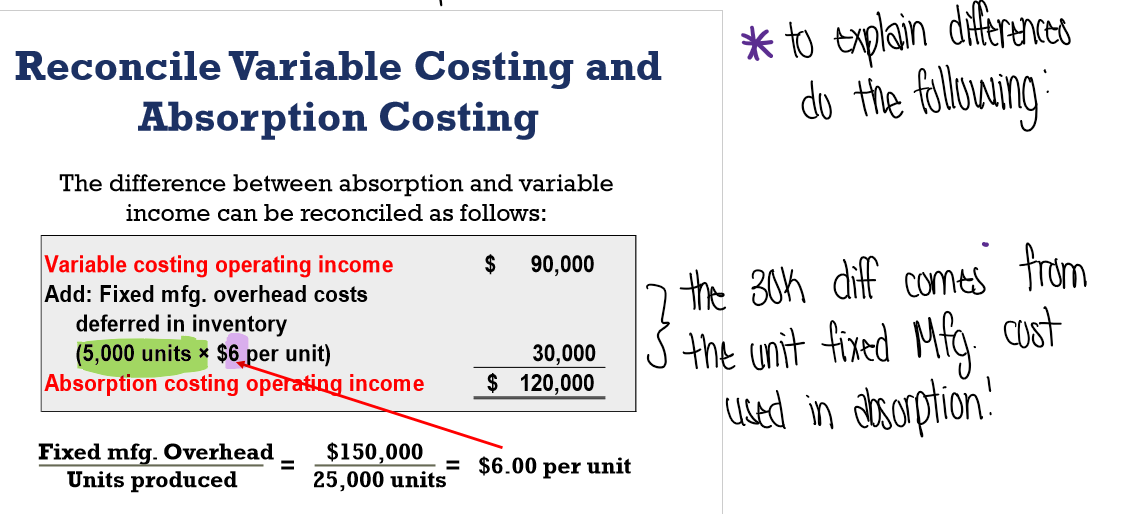

How do you explain the differences in operating income between variable & absorption?

Take the leftover inventory for the period (not sold) & multiply by the additional fixed mfg. overhead per unit under absorption

25,000 - 20,000 = 5000 x $6 = 30,000

Or just find the difference if given 2 numbers

How do you find only the variable unit cost that’s used in absorption?

Fixed manufacturing overhead costs / units produced

= variable cost per unit

How are changes in operating income explained in variable & absorption costing?

Variable: income only affected by change in unit sales → not by number of units produced

Absorption: income influenced by changes in unit sales AND number of units produced → increase OI simply by producing more

What is an issue of absorption costing?

Under absorption, break-even-point is higher → which can be misleading

show income when really it’s a loss

can show OI if you produce more → costs more spread out