Intro Financial Accounting 1-4

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

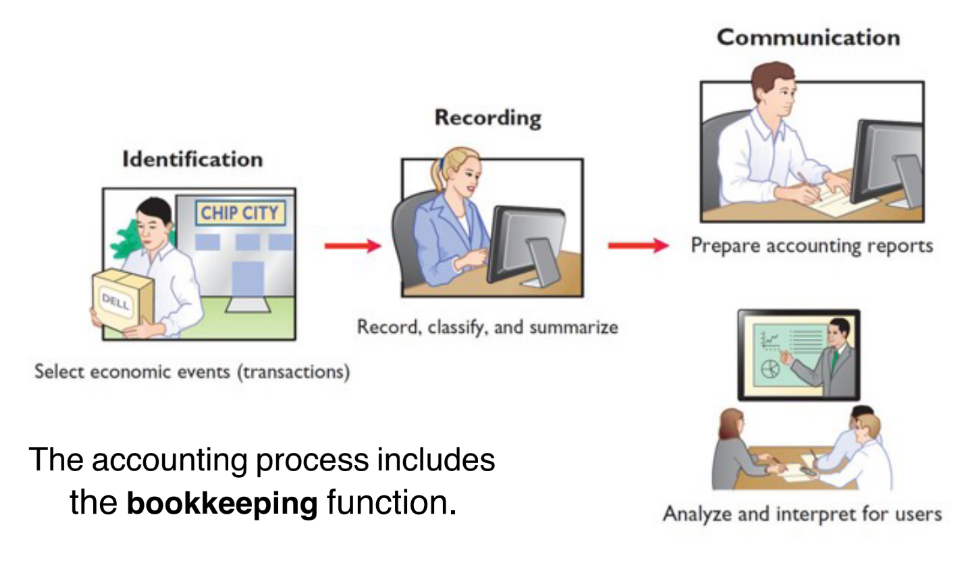

Accounting consists of what three basic activities?

identifies,

• records, and

• communicates

the economic events of an organization to interested users.

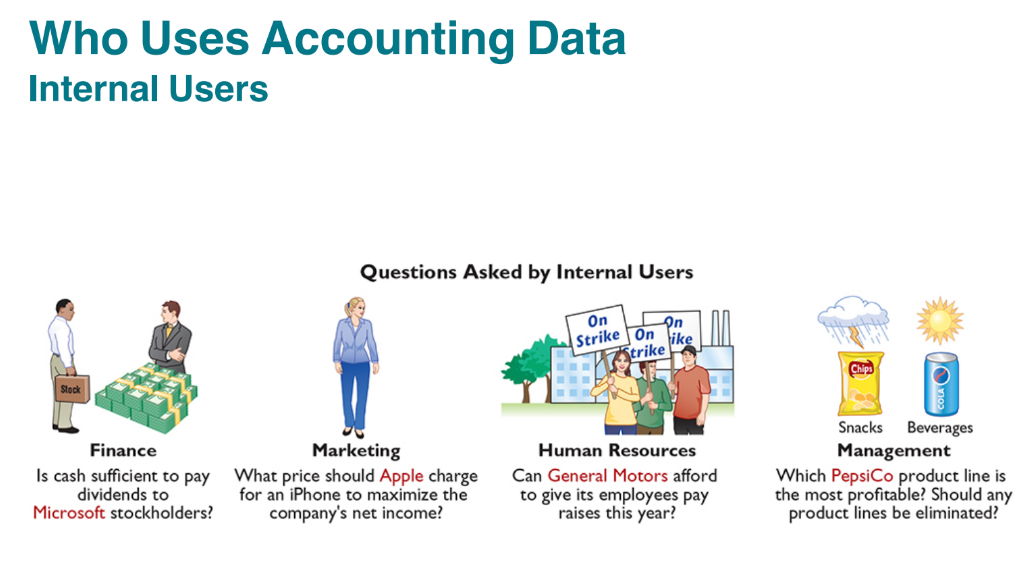

internal users

finance, marketing, HR, management

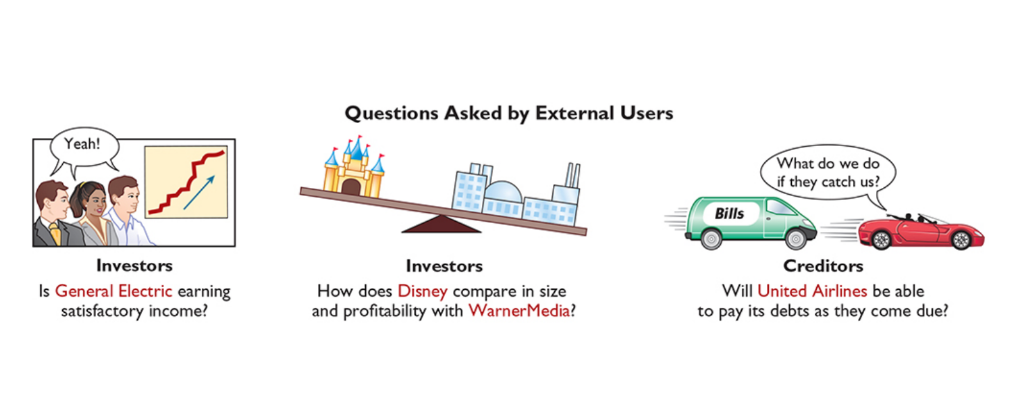

external users

investors, creditors

Sarbanes Oxley act

Recent financial scandals include Enron, WorldCom,

HealthSouth, AIG, and other companies.

• Regulators and lawmakers were concerned that the

economy would suffer if investors lost confidence in

corporate accounting. In response, Congress passed

Sarbanes-Oxley Act (SOX).

• Effective financial reporting depends on sound ethical

behavior – Sarbanes-Oxley was passed in an effort to

reduce unethical corporate behavior and decrease the

likelihood of future corporate scandals.

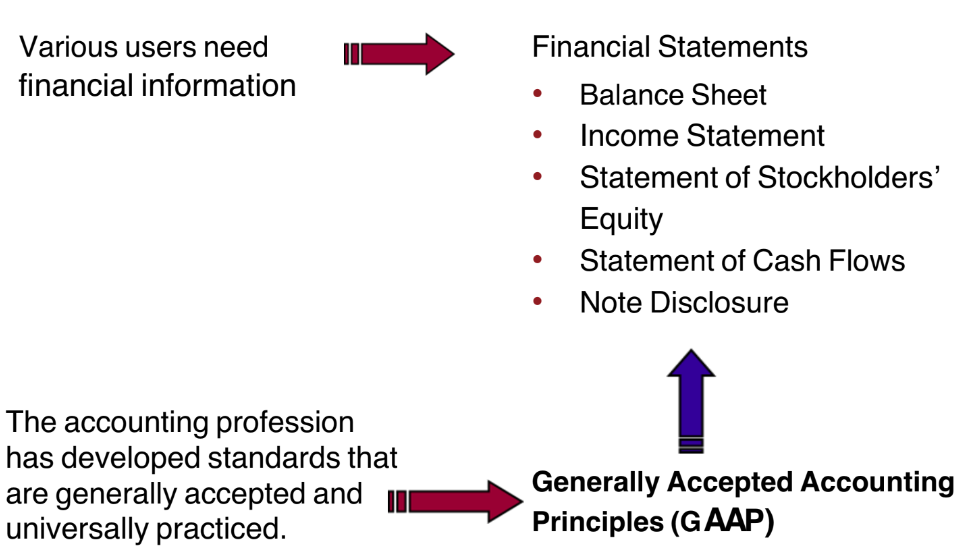

GAAP

Standards that are

generally accepted and universally practiced. These standards indicate

how to report economic events.

Standard-setting bodies:

• Financial Accounting Standards Board (FASB)

• Securities and Exchange Commission (SEC)

• International Accounting Standards Board (IASB)

If a business is liquidated, ___

must be paid before ___

claims of creditors (liabilities), ownership claims (stockholders’

equity).

assets

• Resources a business owns.

• Provide future services or benefits.

• Cash, Supplies, Equipment, etc.

liabilities

Claims against assets (debts and obligations).

• Creditors (party to whom money is owed).

• Accounts payable, notes payable, salaries and wages

payable, sales and real estate taxes payable, etc.

stockholders’ equity

Ownership claim on total assets.

• Referred to as residual equity.

• Common stock and retained earnings.

stockholders’ equity formula

common stock + retained earnings (revenues - expenses - dividends)

Companies prepare what 4 financial statements?

Income Statement

• Retained Earnings Statement

• Balance Sheet

• Statement of Cash Flows

income statement

Reports the profitability of the company’s operations over

a specific period of time.

• Lists revenues first, followed by expenses.

• Shows net income (or net loss).

• Does not include investment and dividend transactions

between the stockholders and the business.

retained earnings statement

Reports the changes in retained earnings for a specific

period of time.

• The time period is the same as that covered by the income

statement.

• Information provided by this statement indicates the

reasons why retained earnings increased or decreased

during the period.

(net income - dividends)

balance sheet

Reports the assets, liabilities, and stockholders’ equity at a

specific date.

• Lists assets at the top, followed by liabilities and

stockholders’ equity.

• Total assets must equal total liabilities and stockholders’

equity.

• Is a snapshot of the company’s financial condition at a

specific moment in time (usually the month-end or year-

end).

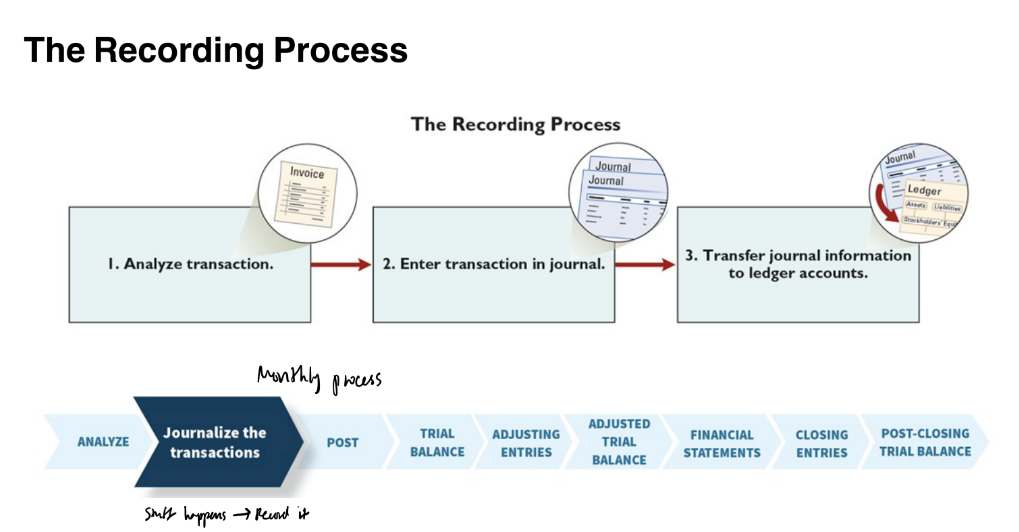

recording process

-analyze transaction

-enter transaction in journal

-transfer journal info. to ledger accounts

journal

Book of original entry.

• Transactions recorded in chronological order.

• Contributions to the recording process:

1. Discloses in one place the complete effects of a

transaction.

2. Provides a chronological record of transactions.

3. Helps to prevent or locate errors because the debit

and credit amounts can be easily compared.

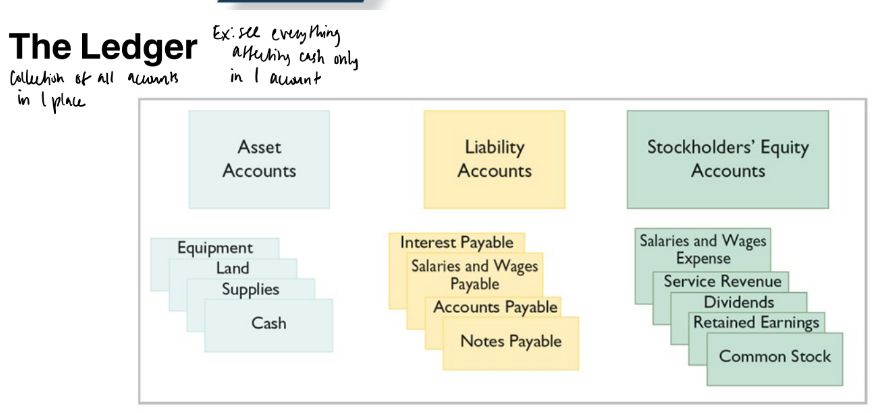

ledger

the entire group of accounts maintained by

a company.

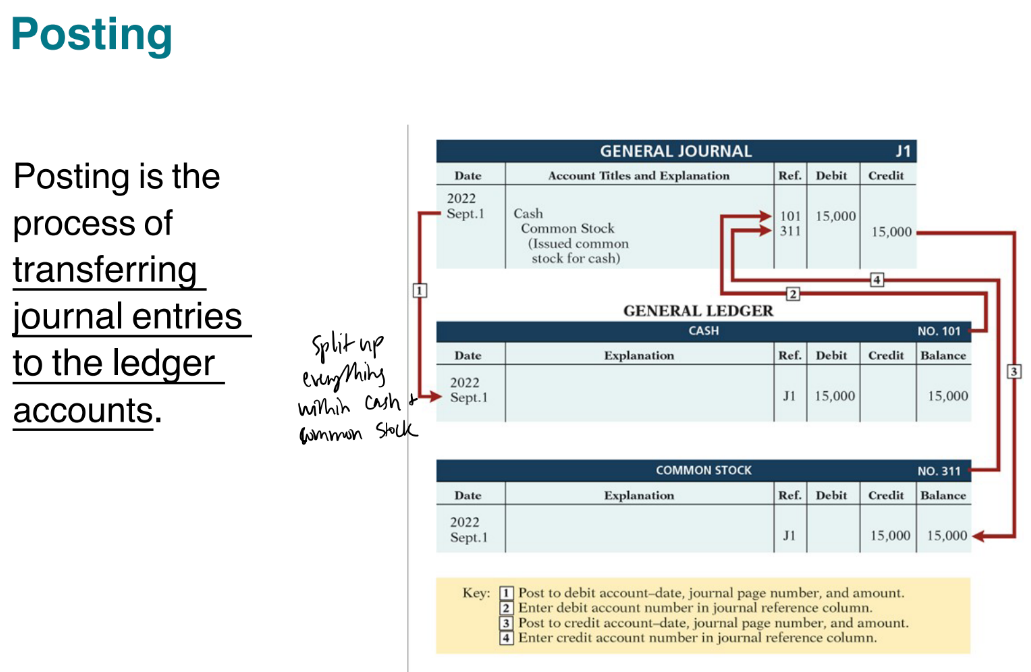

posting

process of

transferring

journal entries

to the ledger

accounts.

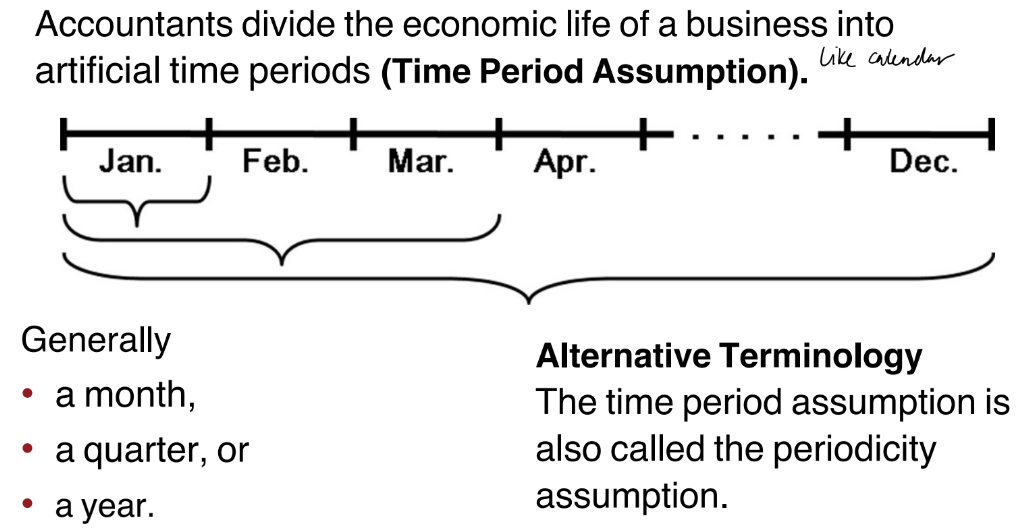

time period assumption

Accountants divide the economic life of a business into

artificial time periods

cash-basis accounting

Revenues are recorded when cash is received.

• Expenses are recorded when cash is paid.

• Cash-basis accounting is not in accordance with generally

accepted accounting principles (GAAP).

accrual-basis accounting

Transactions are recorded in the periods in which the

events occur.

• Companies recognize revenues when they perform

services (rather than when they receive cash).

• Expenses are recognized when incurred (rather than when

paid).

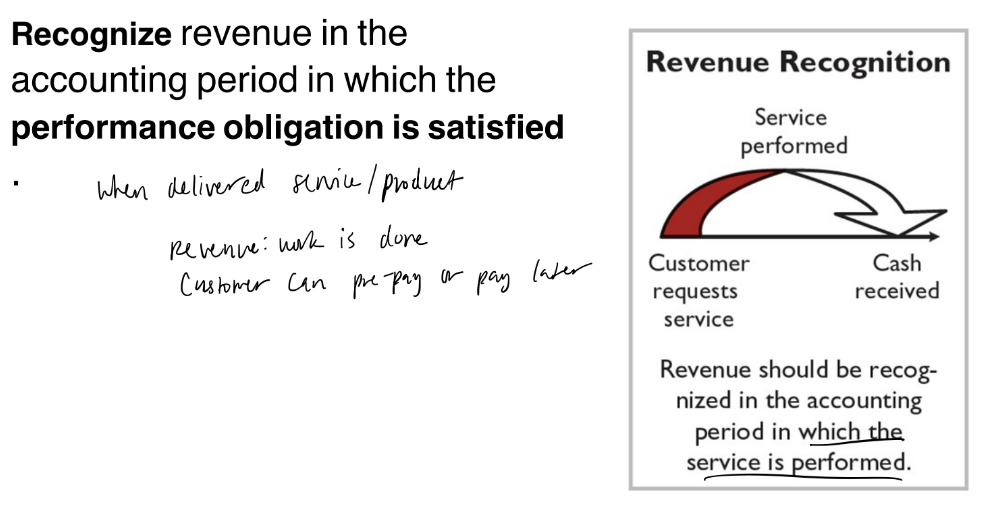

revenue recognition principle

Recognize revenue in the

accounting period in which the

performance obligation is satisfied

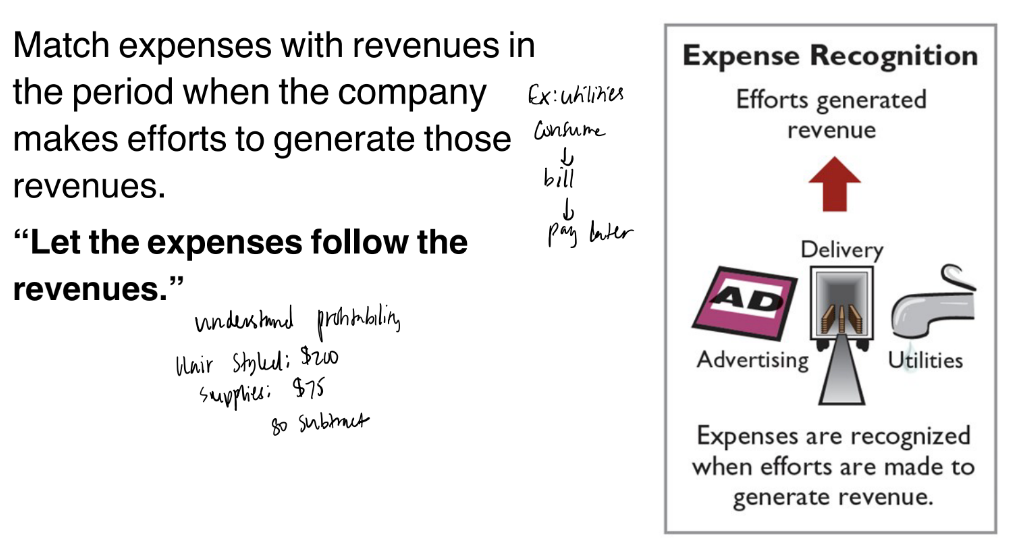

expense recognition principle

Match expenses with revenues in

the period when the company

makes efforts to generate those

revenues.

adjusting entries

Ensure that the revenue recognition and expense

recognition principles are followed.

• Necessary because the trial balance may not contain up-to-

date and complete data.

• Required every time a company prepares financial

statements.

• Will include one income statement account and one

balance sheet account.

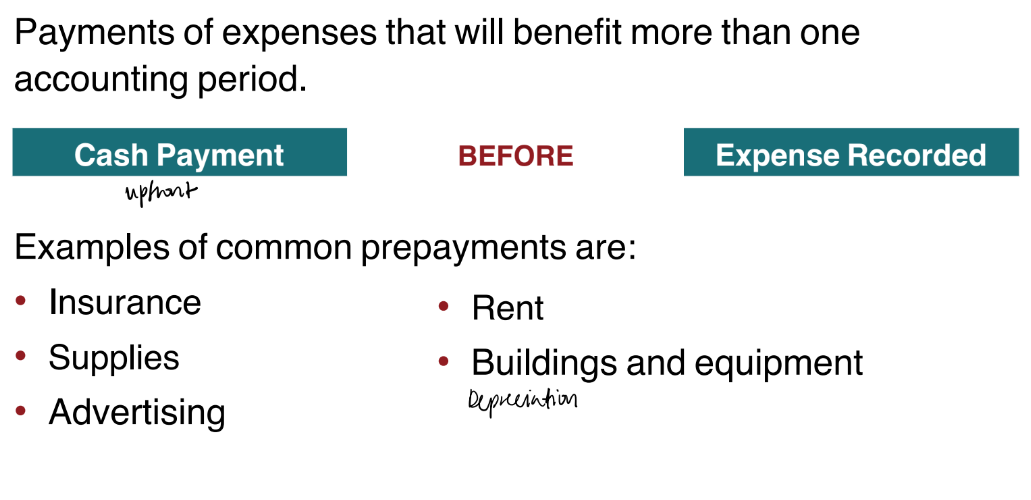

prepaid expenses

Expenses paid in cash

before they are used or

consumed.

Payments of expenses that will benefit more than one

accounting period.

• Insurance

• Supplies

• Advertising

• Rent

• Buildings and equipment

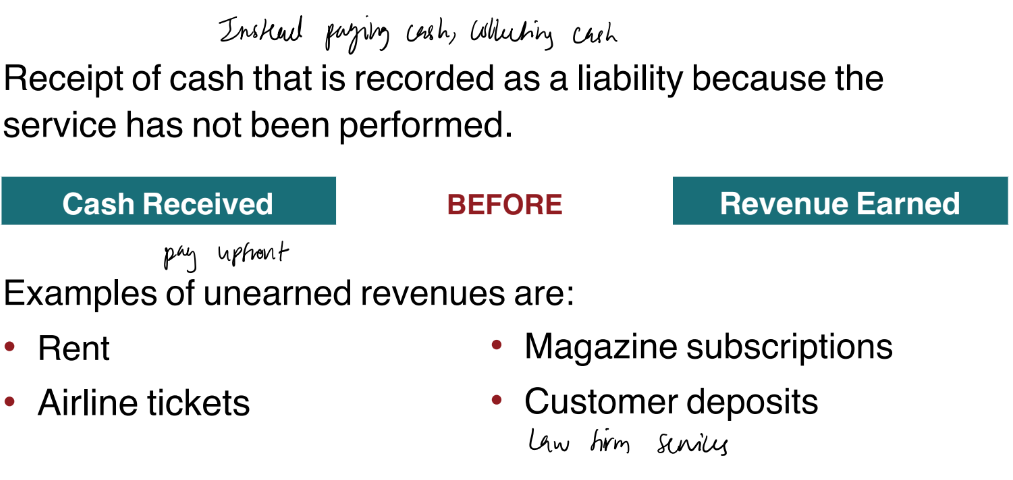

unearned revenue

Cash received before

services are performed.

Receipt of cash that is recorded as a liability because the

service has not been performed.

• Rent

• Airline tickets

• Magazine subscriptions

• Customer deposits

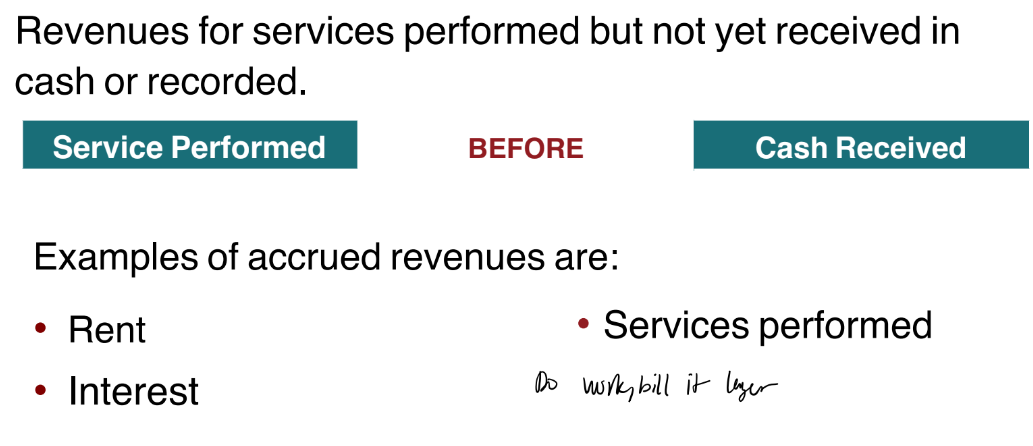

accrued revenue

Revenues for services

performed but not yet

received in cash or

recorded.

Revenues for services performed but not yet received in

cash or recorded.

• Rent

• Interest

• Services performed

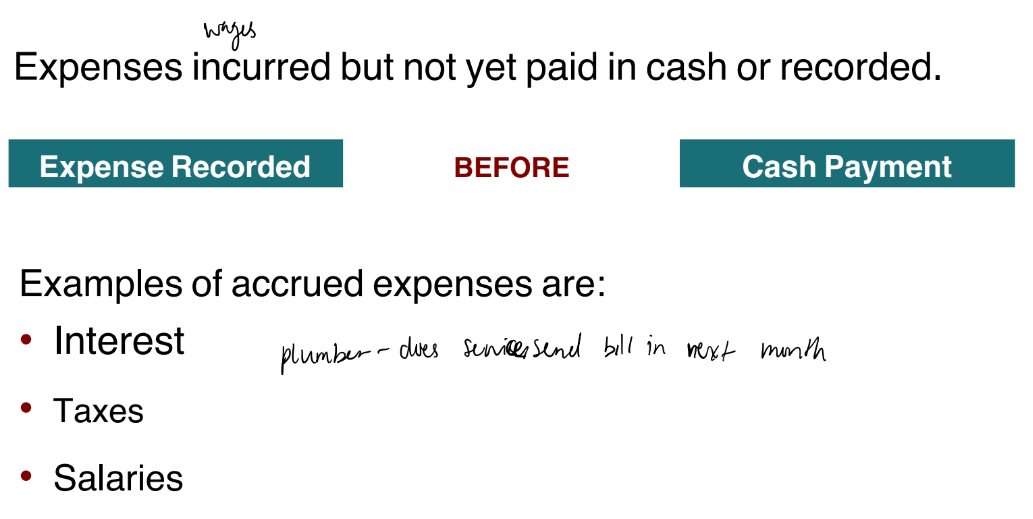

accrued expense

Expenses incurred but

not yet paid in cash or

recorded.

Expenses incurred but not yet paid in cash or recorded.

• Interest

• Taxes

• Salaries

relevance

Make a difference in a business decision.

• Provides information that has predictive value and confirmatory

value.

materiality

is a company-specific aspect of relevance.

o An item is material when its size makes it likely to influence the

decision of an investor or creditor.

faithful representation

Information accurately depicts what really happened.

• Information must be

o complete (nothing important has been omitted),

o neutral (is not biased toward one position or another), and

o free from error.

comparability

Comparability results when different companies use the same

accounting principles.

going concern

The business will remain in

operation for the foreseeable

future.

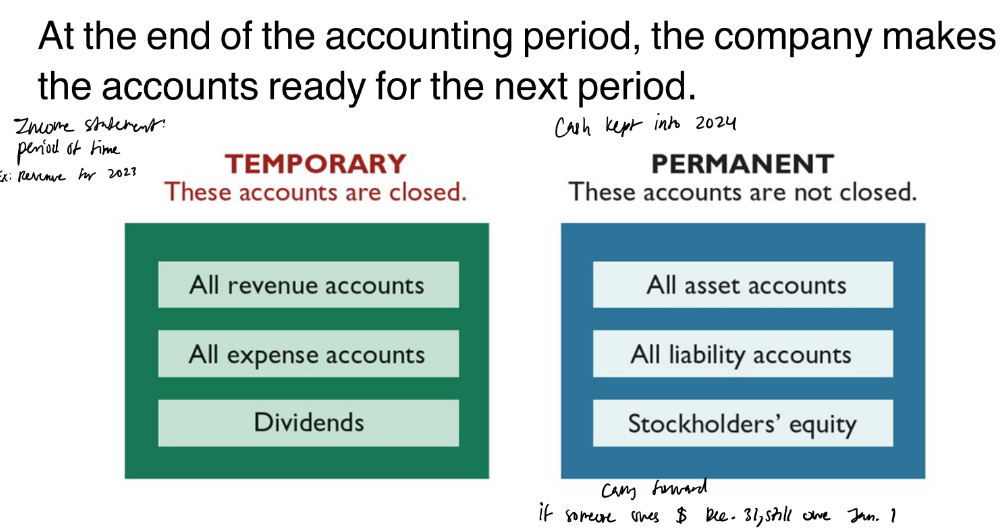

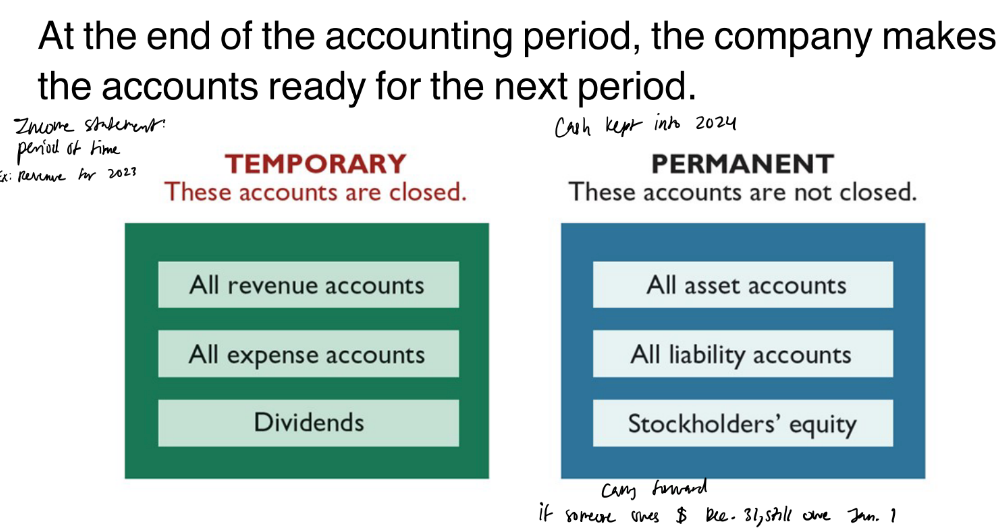

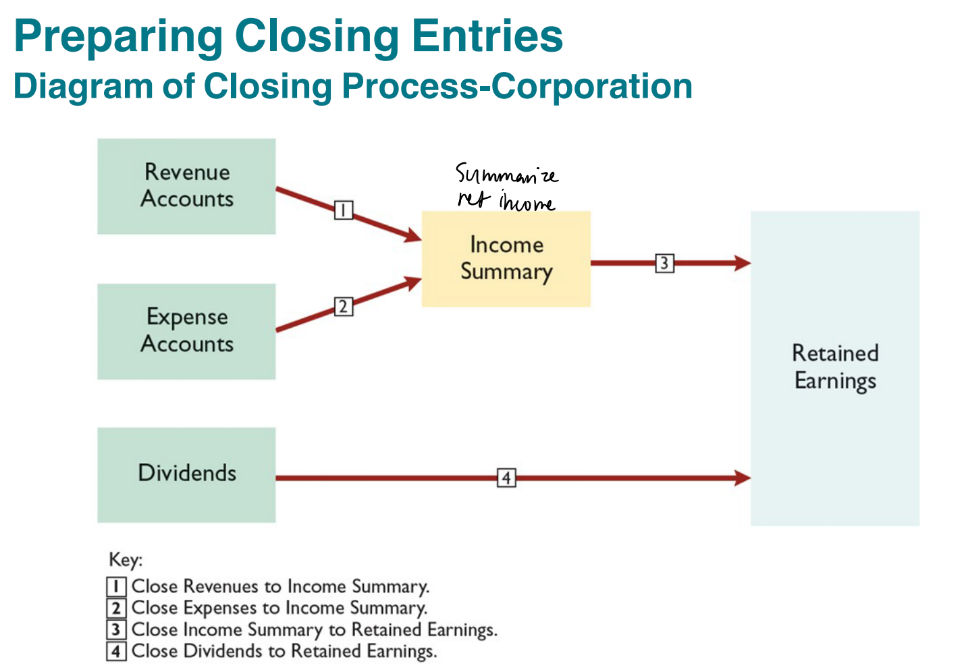

temporary accounts

-all revenue accounts

-all expense accounts

-dividends

permanent accounts

-all asset accounts

-all liability accounts

-stockholder’s equity

closing entries

formally recognize in the ledger the

transfer of

• net income (or net loss) and

• Dividends

to Retained Earnings.

Companies generally journalize and post closing entries

only at the end of the annual accounting period.

Closing entries

income summary account

First, a company closes revenues and expenses to an

account called Income Summary. Think of this account,

Income Summary, as a temporary holding account for

these amounts. Once all the revenues and expenses are

closed to Income Summary, the account balance equals

net income. This balance is then closed to Retained

Earnings.

-won’t show up on financial statement

steps in accounting cycle

Analyze Business Transactions

2. Journalize the Transactions

3. Post to the Ledger Accounts

4. Prepare a Trial Balance

5. Journalize and Post Adjusting Entries: Deferrals/Accruals

6. Prepare an Adjusted Trial Balance

7. Prepare Financial Statements

8. Journalize and Post Closing Entries

9. Prepare a Post-Closing Trial Balance

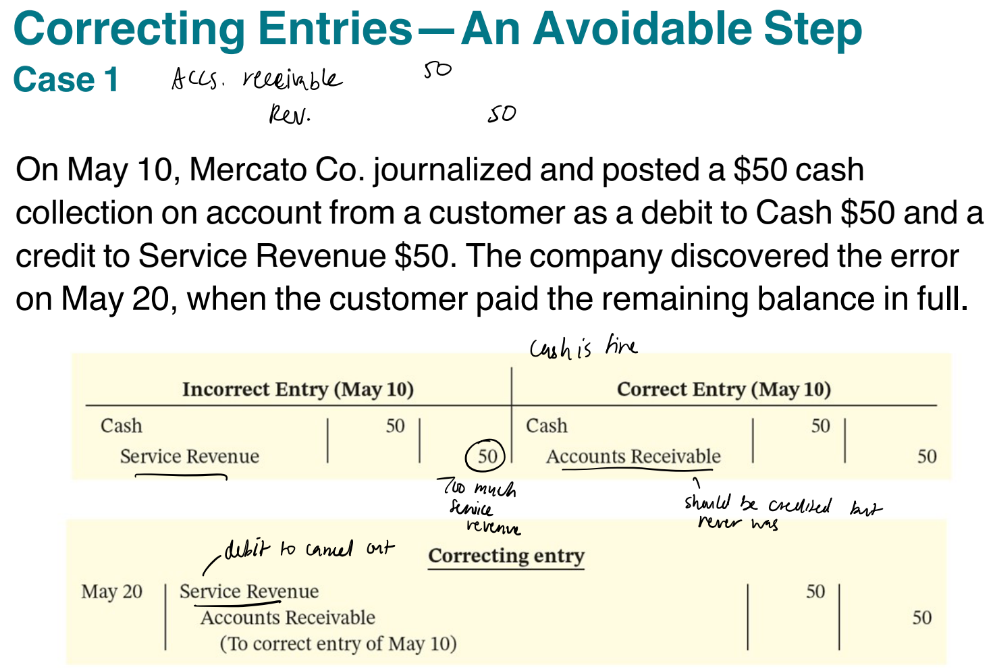

correcting entry

• Unnecessary if accounting records are free of errors.

• Made whenever an error is discovered.

• Must be posted before closing entries.

Instead of preparing a correcting entry, it is possible to reverse

the incorrect entry and then prepare the correct entry.

On May 10, Mercato Co. journalized and posted a $50 cash

collection on account from a customer as a debit to Cash $50 and a

credit to Service Revenue $50. The company discovered the error

on May 20, when the customer paid the remaining balance in full. correcting entry?

-debit service revenue 50

-credit AR 50

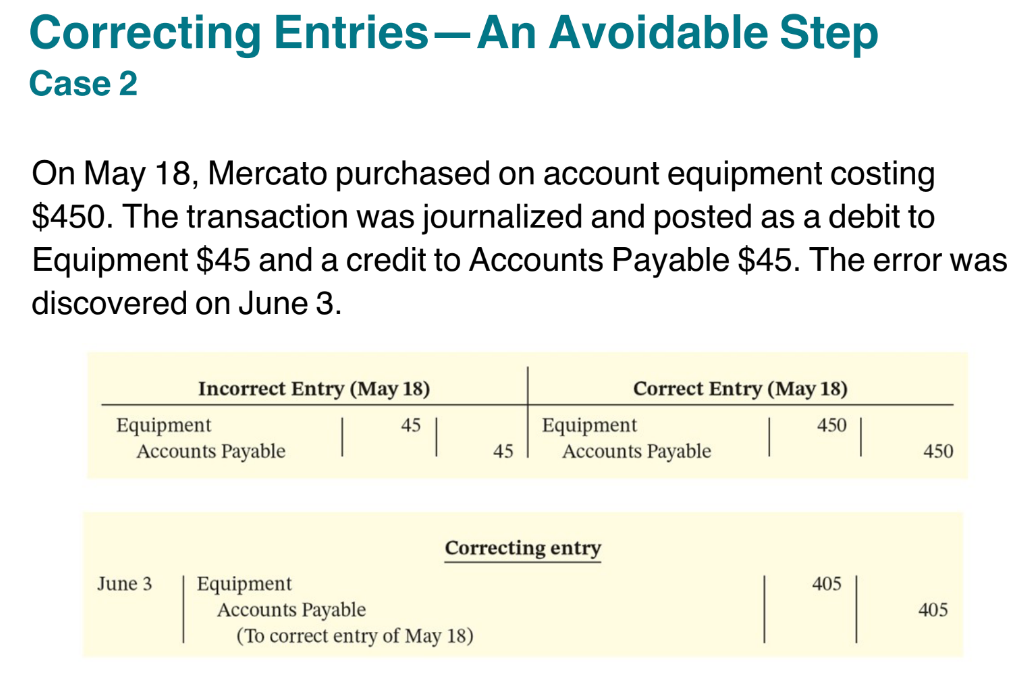

On May 18, Mercato purchased on account equipment costing

$450. The transaction was journalized and posted as a debit to

Equipment $45 and a credit to Accounts Payable $45. The error was

discovered on June 3. Correcting entry?

-D equipment 405

-C AP 405

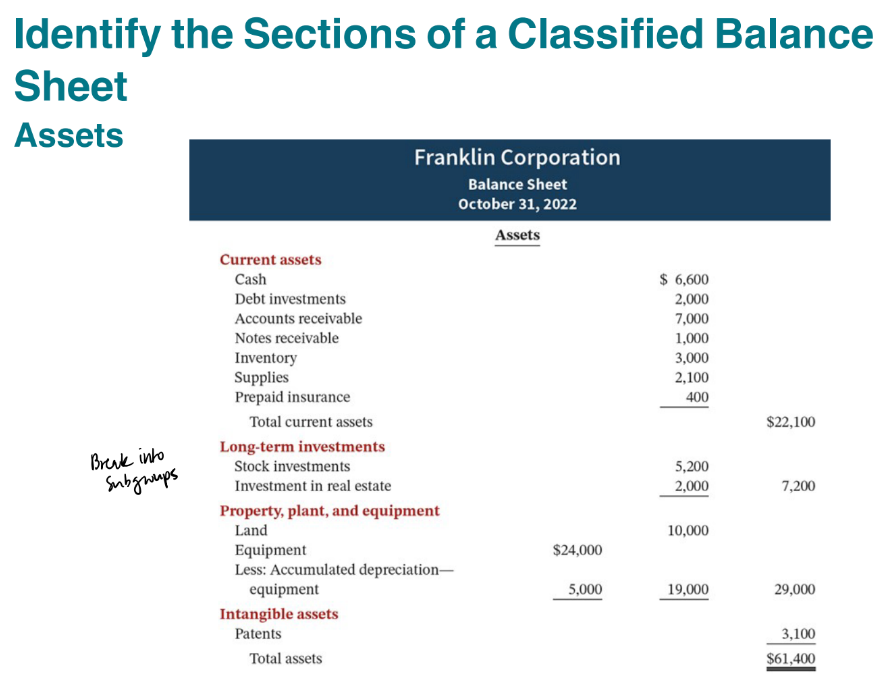

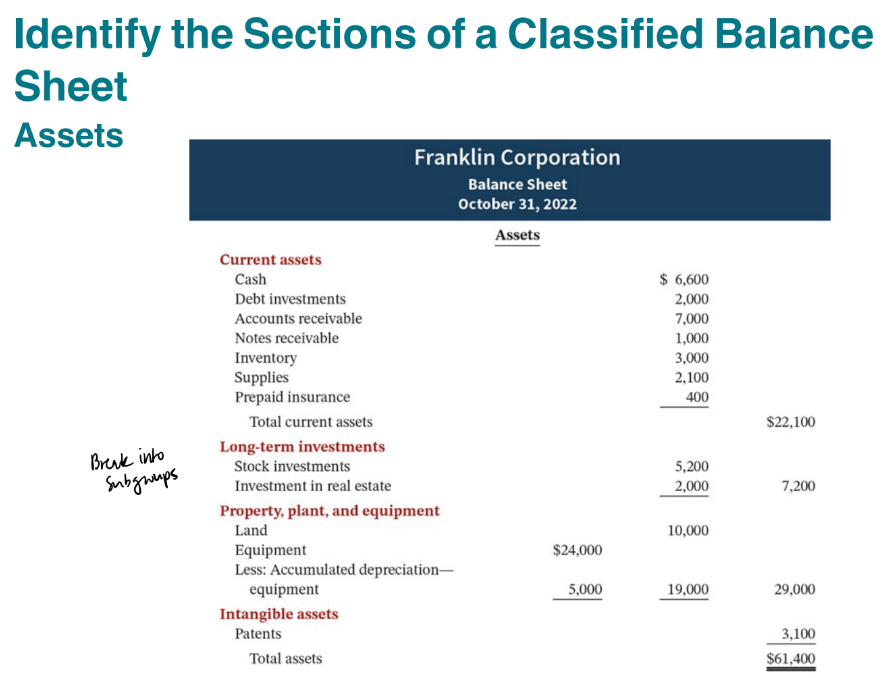

classified balance sheet: assets

current assets, long-term liabilities, property/plant/equipment, intangible assets

classified balance sheet: liabilities and stockholder’s equity

current liabilities, long-term liabilities, stockholder’s equity

classified balance sheet: current assets examples

cash, debt investment, accounts receivable, notes receivable, inventory, supplies, prepaid insurance

classified balance sheet: property/plant/equipment examples

land, equipment

-less accumulated depreciation

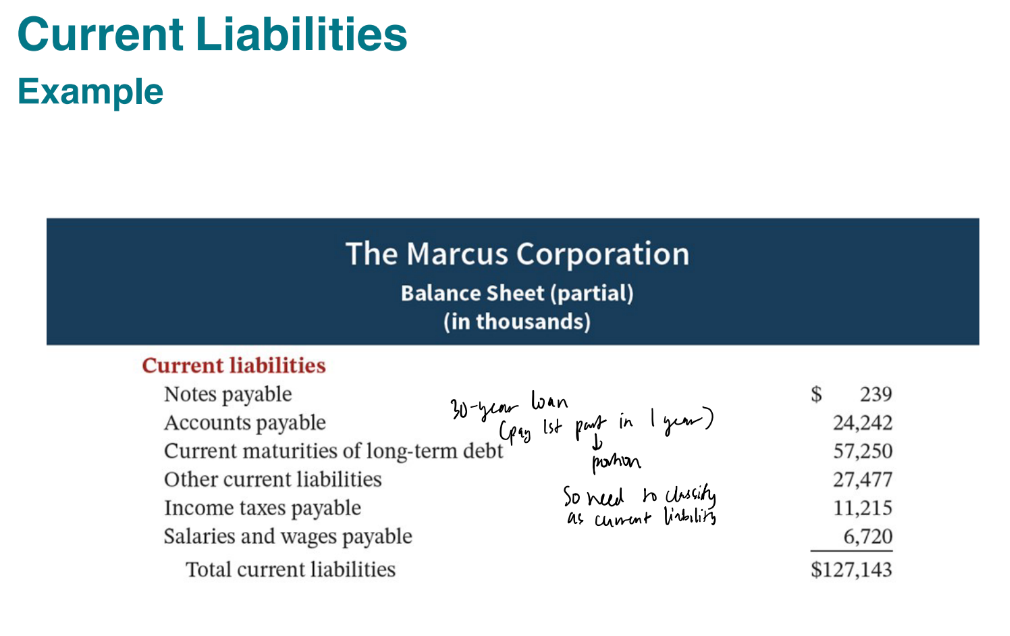

classified balance sheet: current liabilities examples

notes payable, accounts payable, unearned service revenue, salaries and wages payable, interest payable

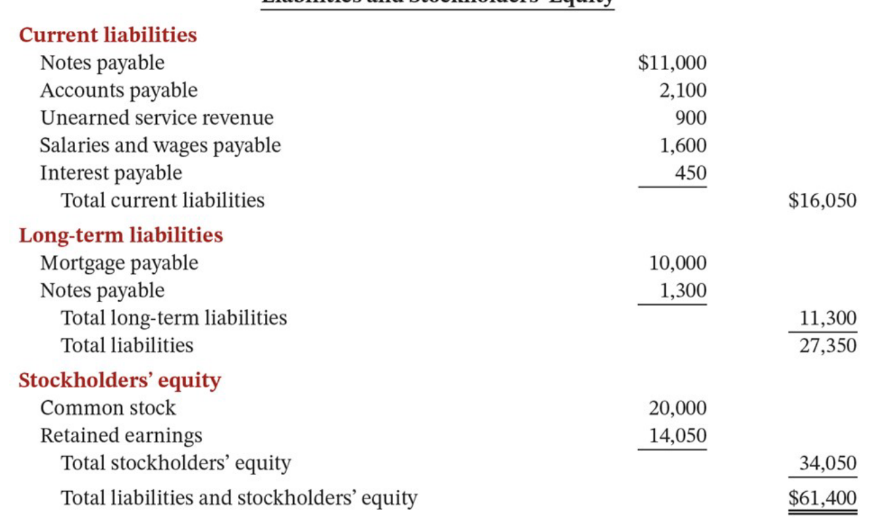

current assets

Assets that a company expects to convert to cash or

use up within one year or its operating cycle,

whichever is longer.

• Operating cycle is the average time that it takes to

purchase inventory, sell it on account, and then collect

cash from customers.

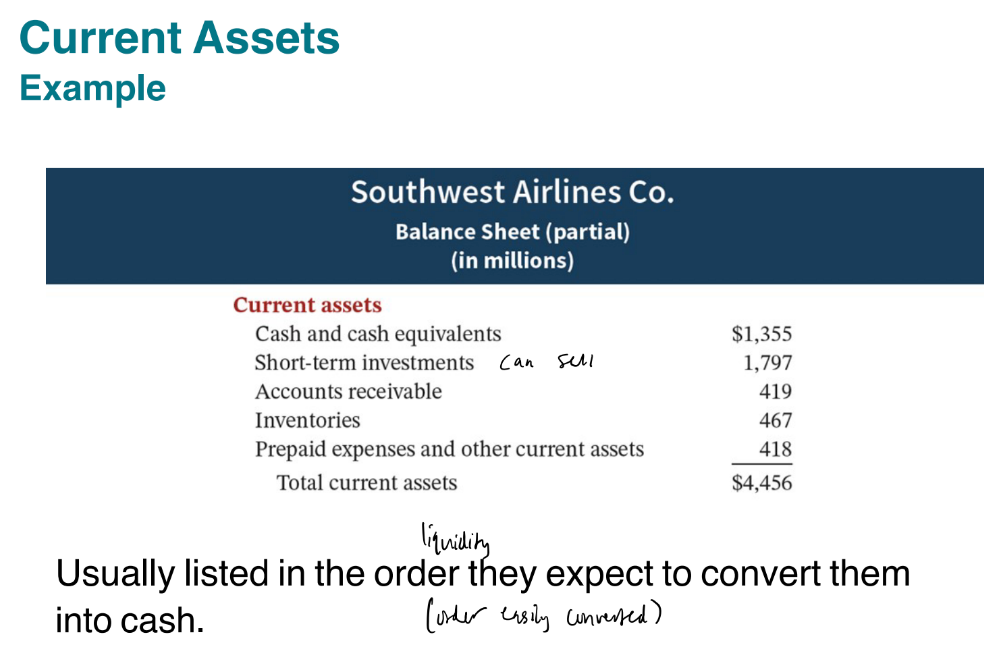

property, plant, and equipment

Long useful lives.

• Currently used in operations.

• Depreciation - allocating the cost of assets to a number of

years.

• Accumulated depreciation - total amount of depreciation

expensed thus far in the asset’s life.

current liabilities

Obligations the company is to pay within the coming year

or its operating cycle, whichever is longer.

• Usually list notes payable first, followed by accounts

payable. Other items follow in order of magnitude.

• Common examples are accounts payable, salaries and

wages payable, notes payable, interest payable, income

taxes payable, and current maturities of long-term

obligations.

• Liquidity - ability to pay obligations expected to be due

within the next year.

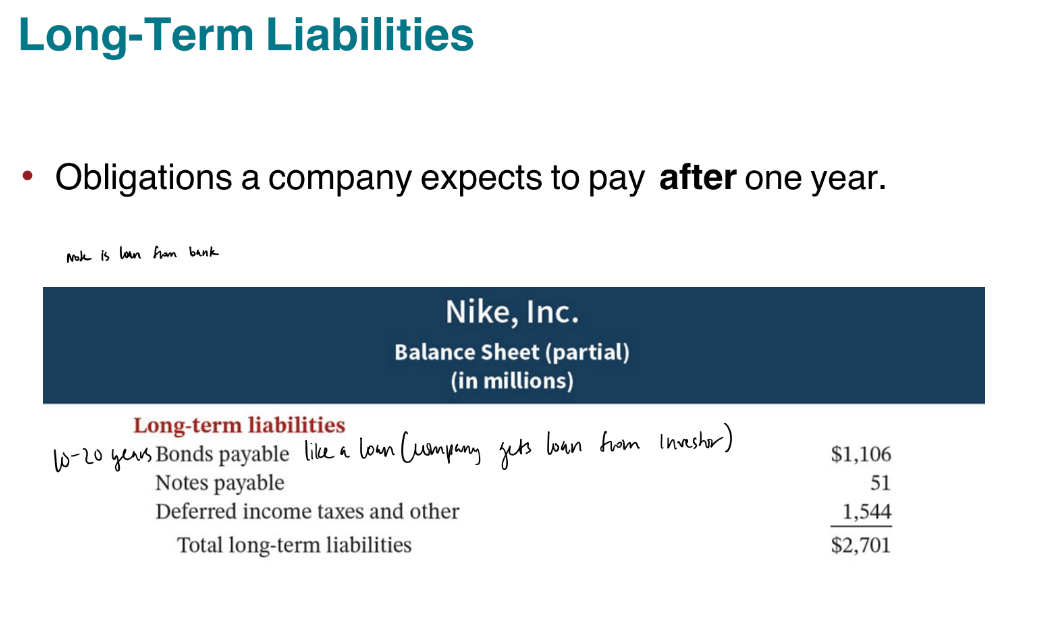

long-term liabilities

Obligations a company expects to pay after one year.

reversing entry

It is often helpful to reverse some of the adjusting entries

before recording the regular transactions of the next

period.

• Companies make a reversing entry at the beginning of the

next accounting period.

• Each reversing entry is the exact opposite of the adjusting

entry made in the previous period.

• The use of reversing entries does not change the amounts

reported in the financial statements.