ECON 2020 Exam 2

1/49

Earn XP

Description and Tags

Linan Peng

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

Which of the following observations would be consistent with the imposition of a price ceiling that is higher than the equilibrium price? After the price ceiling is established.

there will be no effect on the market price or quantity sold.

Under rent control, landlords can cease to be responsive to tenants’ concerns about the quality of the housing because

with storages and waiting lists, they have no incentive to maintain and improve their property.

Consider the U.S. market for coffee, a market n which the government has imposed a nonbinding price ceiling. Which of the following events could convert the price ceiling from a nonbinding to a binding price ceiling?

Brazilian coffee bean producers refuse to ship to coffee producers in the Unites States.

If the government removes a tax on a good, then the price paid by buyers will

decrease, and the price received by sellers will increase.

Mobile homes are housing units installed on a permanent foundation owned by a landlord. Although a resident owns the home, they rent the foundation from the landlord. In theory, owners of mobile homes can transfer their home to a different foundation if the rent becomes too steep, but uninstalling, transporting, and reinstalling the mobile homes usually prohibitively expensive. This “lock-in” effect encourages state legislatures to create rent control for mobile home foundations. Which statement describes a plausible, unintended consequence of these laws?

There are few new mobile home foundations constructed.

Because of government price controls, a business must now sell soft-serve ice cream at half its original price. This business might respond by:

All of the answers are correct.

Which would be the LEAST likely result of a price ceiling imposed in the market for gasoline?

Buyers will bribe station attendants to fill up their tanks.

The U.S. government establishes a price floor of $1,000 on personal computers. The market price for netbooks (personal computers that specialize in Internet and other basic computer functions) is about $500. How would this price control affect the netbooks market?

Consumers would have a harder time finding conventional netbooks since most would be too powerful.

Suppose that New York sets a price ceiling on electricity but New Jersey does not. Also suppose that swimming pools in New Jersey are heated but swimming pools in New York are not. This is an example of a(n):

misallocation of resources caused by price controls.

During the energy crisis of the 1970s, President Nixon ordered gas stations to close between 9:00 PM Saturday and 12:01 AM Monday in an attempt to prevent wasteful and unnecessary Sunday driving. This policy:

gave people the incentive to fill up their tanks earlier in the week.

Uber uses information about the supply and demand for rides when setting prices. This means that rates following a concert at Madison Square Garden will:

increase to reflect higher demand and encourage more drivers to drive and satisfy the increase in demand.

Uber introduced surge pricing, by which an increase in demand causes an increase in price,:

encourage more drivers to drive and satisfy the increase in demand.

Vietnam’s foreign minister said, “The Americans couldn’t destroy Hanoi, but we have destroyed our city by very low rents.” He was referring to the fact that:

very low rents turned portions of city housing into a state of disrepair and slum-like conditions.

Under rent control, bribery is used to:

make the total price of a rental property, including the bribe, closer to the market price that would prevail without rent controls.

Housing vouchers are a better option than rent controls when a government is attempting to make housing affordable for the poor. The reason is that the housing voucher entitles the tenants

a certain dollar amount off the rent of any apartment they choose.

Ancient Athens had strict controls on the price of wheat, and punishment for violation of the price control was death. The speech by a politician imploring a jury to convict an alleged violator of the law survives to this day: "And consider that in consequence of this vocation, very many have already stood trial for their lives; and so great the [earnings] which they are able to derive from it that they prefer to risk their life every day, rather than cease to draw from you, the public, their improper profits." Which is the MOST likely reason merchants were willing to risk their lives to charge more than the legal price?

Merchants could not stay in business if they didn't raise prices.

After a hurricane the prices of many items rise. How BEST might the government help poor people afford to buy goods and services?

give poor people debit cards for use in purchasing essential items, but leave prices unregulated

If the government levies a $1700 tax per automobile on sellers of automobiles, then the price paid by buyers of automobiles would

increase by less than $1700.

Suppose there is currently a tax of $80 per ticket on airline tickets. Sellers of airline tickets are required to pay the tax to the government. If the tax is reduced from $80 per ticket to S64 per ticket, then the

supply curve will shift downward by $16, and the effective price received by sellers will increase by less than $16.

Suppose the government imposes a 20-cent tax on the sellers of artificially-sweetened beverages. The tax would shift

supply, raising the equilibrium price and lowering the equilibrum quantity in the market for artificially sweetened beverages.

Suppose the government imposes a 50-cent tax on the sellers of packets of chewing gum. The tax would

discourage market activity.

You receive a paycheck from your employer, and your pay stub indicates that $300 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

The $300 that you paid is not necessarily the true burden of the tax that falls on you, the employee.

Suppose that the demand for picture frames is highly inelastic, and the supply of picture frames is highly elastic. A tax of $1 per frame levied on picture frames will increase the price paid by buyers of picture frames by

between $0.50 and $1.

The burden of a luxury tax usually falls

more on the middle-class workers than on the rich customers.

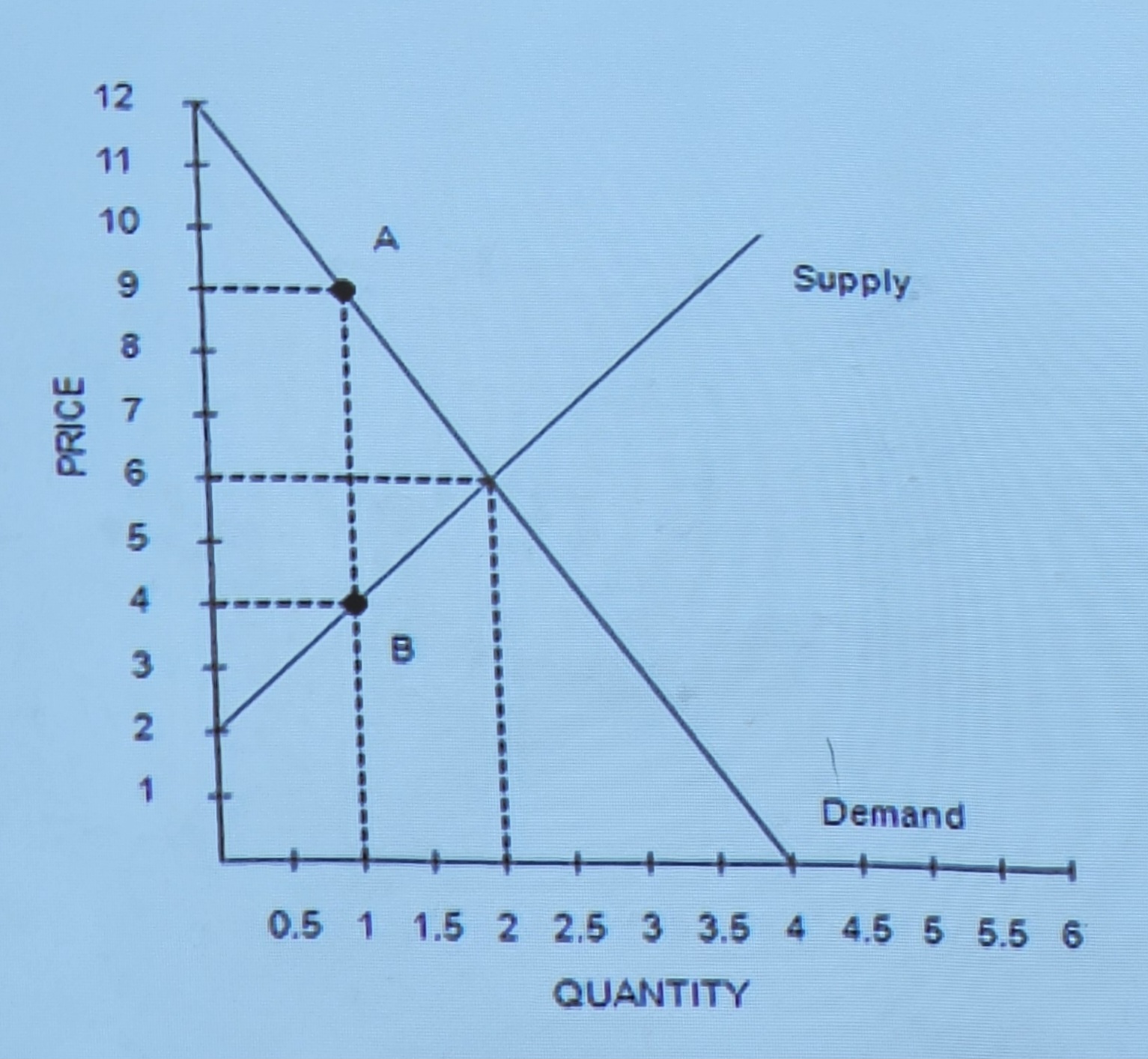

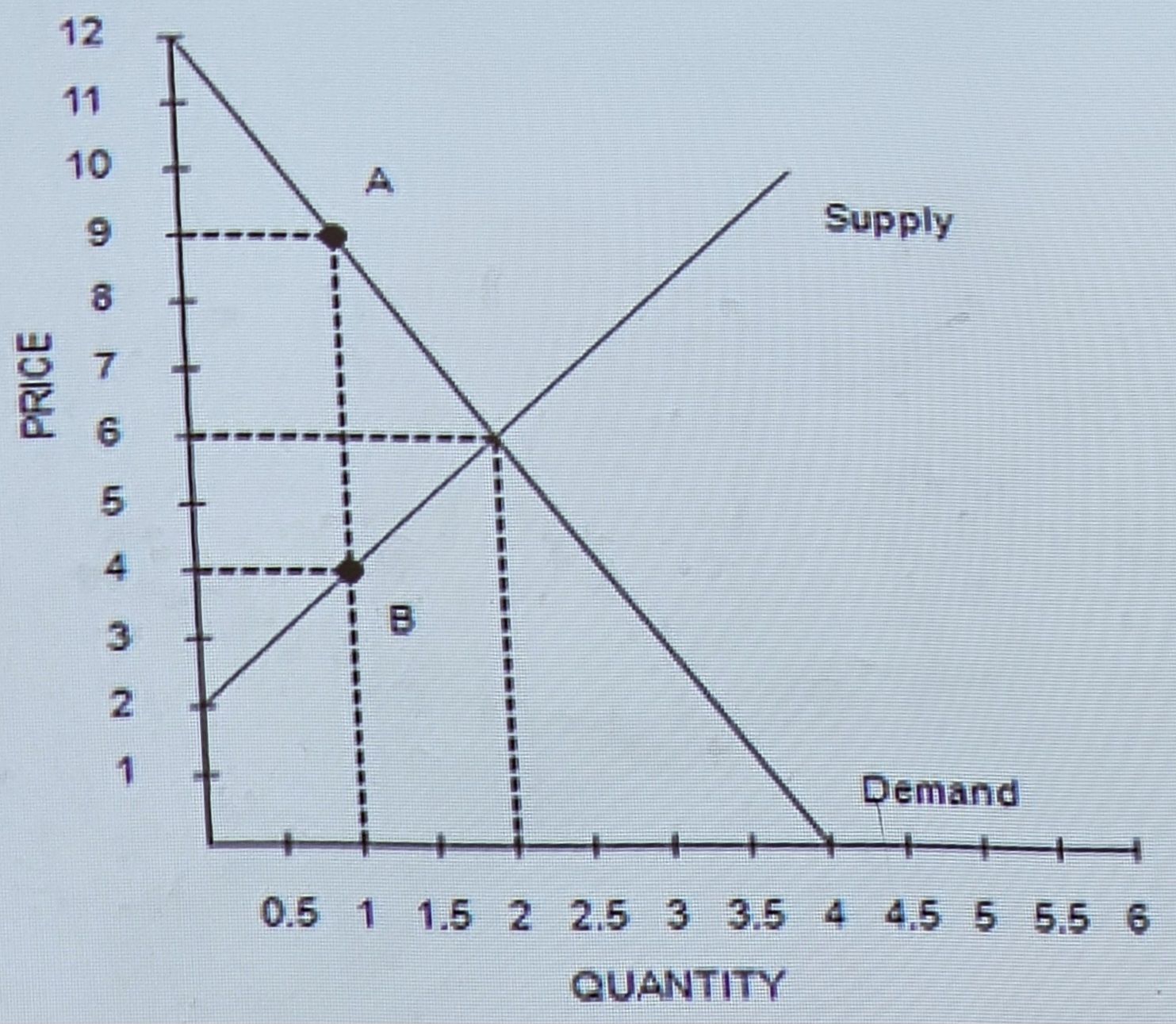

The vertical distance between points A and B represents a tax in the market. The imposition of the tax causes the quantity sold to

decrease by 1 unit.

The vertical distance between points A and B represents a tax in the market. The amount of the tax on each unit of the good is

$5

Roland mows Karla's lawn for $25. Roland's opportunity cost of mowing Karla's lawn is $20, and Karla's willingness to pay Roland to mow her lawn is $28. Assume Roland is required to pay a tax of $3 each time he mows a lawn Which of the following results is most likely?

Roland and Karla still can engage in a mutually-agreeable trade.

Kate is a personal trainer whose client William pays $80 per hour-long session. William values this service at $100 per hour, while the opportunity cost of Kate's time is $75 per hour. The government places a tax of $ 10 per hour on personal trainers. After the tax, what is likely to happen in the market for personal training?

Kate and William will agree to a new price somewhere between $85 and $100.

Suppose Yolanda needs a dog sitter so that she can travel to her sister's wedding. Yolanda values dog sitting for the weekend at $200. Rebecca is willing to dog sit for Yolanda so long as she receives at least $ 175. Yolanda and Rebecca agree on a price of $185. Suppose the government imposes a tax of $30 on dog sitting. What is the deadweight loss of the tax?

The lost benefit to Yolanda and Rebecca because after the tax, Rebecca will not dog sit for Yolanda

The deadweight loss from a tax per unit of good will be smallest in a market with

inelastic supply and inelastic demand.

Suppose the government imposes a tax on cheese. The deadweight loss from this tax will likely be greater in the

eighth year after it is imposed than in the first year after it is imposed because demand and supply will be less elastic in the first year than in the eighth year.

When a country is on the downward-sloping side of the Laffer curves, a cut in the tax rate will

increase tax revenue and decrease the deadweight loss.

If the size of a tax increases, tax revenue

may increase, decrease, or remain the same.

Suppose China exports televisions to France and imports sugar from Brazil., This situation suggests

China has a comparative advantage relative to France in producing televisions, and Brazil has a comparative advantage relative to China in producing sugar.

When the nation of Duxembourg allows trade and becomes an importer of software,

residents of Duxembourg who produce software become worse off; residents of Duxembourg who buy software become better off; and the economic well-being of Duxembourg rises.

When a country allows trade and becomes an exporter of cheese, which of the following is not a consequence?

The price received by domestic producers of cheese decreases.

Import quotas and tariffs produce some common results. Which of the following is not one of those common results?

Producer surplus of domestic producers decreases.

Representative Vazquez cites the "jobs argument" when he argues before Congress in favor of restrictions on trade; he argues that everything can be produced at lower cost in other countries. The likely flaw in Representative Vazquez's reasoning is that he ignores the fact that

the gains from trade are based on comparative advantage.

The "unfair-competition" argument might be cited by an American who believes that

the French government's subsidies to French farmers justify restrictions on American imports of French agricultural products.

If the Korean steel industry subsidizes the steel that it sells to the United States, the

harm done to U.S. steel producers is less than the benefit that accrues to U.S. consumers of steel.

If the United States threatens to impose a tariff on Colombian coffee if Colombia does not remove agricultural subsidies, the United States will be

worse off if Colombia doesn't remove the subsidies in response to the threat.

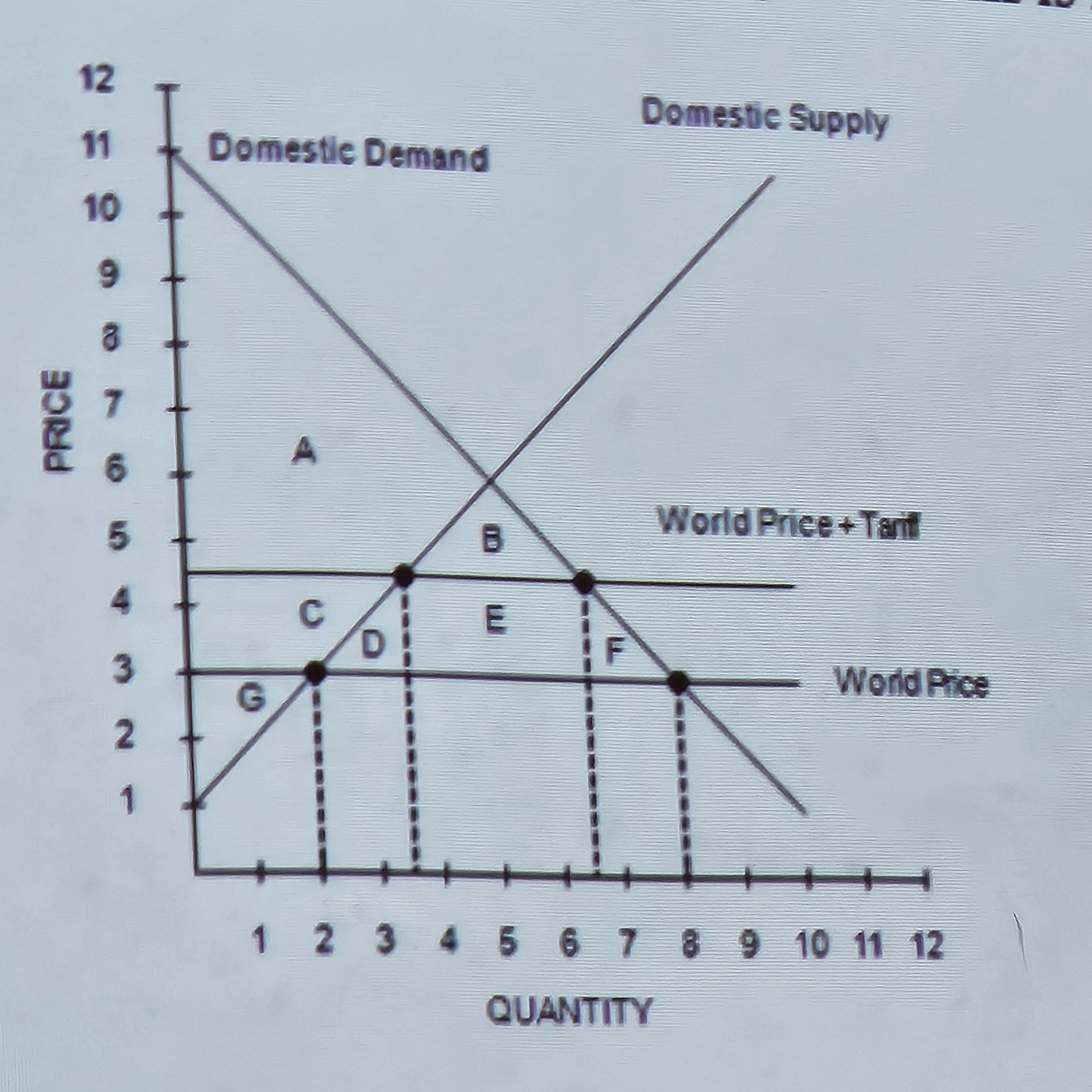

Government revenue raised by the tariff is represented by the area

E.

Denmark is an importer of computer chips, taking the world price of $10 per chip as given. Suppose Denmark imposes a $4 tariff on chips. Which of the following outcomes is possible?

The price of chips in Denmark Increases to $14 the quantity of Danish-produced chips increases; and the quantity of chips imported by Denmark decreases.

When Monique drives to work every morning, she drives on a congested highway. What Monique does not realize is that when she enters the highway each morning she increases the travel time of all other drivers on the highway. In this case, the external cost of Monique's highway trip

increases the social cost above the private cost.

Which of the following statements is not correct?

Corrective taxes set the maximum quantity of pollution, whereas tradable pollution permits fix the price of pollution.

In which of the following cases is the Coase theorem most likely to solve the externality?

Ed is allergic to his roommate’s cat.

Zaria and Hannah are roommates. Zaria assigns a $30 value to smoking cigarettes. Hannah values smoke-free air at $15. Which of the following scenarios is a successful example of the Coase theorem?

Zaria pays Hannah $16 so that Zaria can smoke.

Employing a lawyer to draft and enforce a private contract between parties wishing to solve an externality problem is an example of

a transaction cost.

Suppose that Company A's railroad cars pass through Farmer B's corn fields. The railroad causes an externality to the farmer because the railroad cars emit sparks that cause $1,500 in damage to the farmer's crops. There is a Special soy-based grease that the railroad could purchase that would eliminate the damaging sparks. The grease costs $1,200. Suppose that the farmer has the right to compensation for any damage that his crops suffer. Assume that there are no transaction costs. Which of the following characterizes the efficient outcome?

The railroad will purchase the grease for $1,200 and pay the farmer nothing because no crop damage will occur.

Which of the following is not a characteristic of pollution permits?

Allowing firms to trade their permits reduces the total quantity of pollution beyond the initial allocation.