CAIE AS Microeconomics

1/28

Earn XP

Description and Tags

Praying for that A*

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

What is a market?

Any structure which allows buyers and sellers to exchange any goods, services and information.

What is the law of demand?

The law of demand states that an inverse relationship exists between the price of a good and the quantity demanded of a good, ceteris paribus.

What is the law of supply?

The law of supply states that a direct relationship exists between the price of a good and the quantity supplied of good, ceteris paribus.

Why is the demand curve downwards sloping?

One reason why the demand curve is downwards sloping is because of the income effect. When price of a good falls, people will find that their ability to buy goes up. That is, the purchasing power of their income or real income has gone up. This leads them to buy more of the good.

Another reason why the demand curve is downwards sloping is because of the substitution effect. When the price of a good falls then all other goods automatically become relatively expensive so consumers will tend to substitute other goods for the cheaper good.

Why is the supply curve upwards sloping?

One reason why the supply curve is upwards sloping is because of the profit motive. As the price of a good rises, firms see the opportunity to earn higher profits. This incentivises them to increase production and supply more to the market.

Another reason why the supply curve is upwards sloping is because of the cost motive. Expanding output raises marginal cost as less efficient resources are used; e.g. workers are paid overtime. To stay profitable, firms require higher prices to cover these rising costs, so supply increases only when price rises.

What are the five main non-price determinants of demand?

Changes in Income either yield an outward or inward shift in demand, ceteris paribus, depending upon whether the product is normal or inferior in nature.

Changes in the price of related goods would shift the demand for a product. If two goods are substitutes, the fall in price of one good would shift demand inwards for the other; since they provide similar utility to the consumer. Conversely, if two goods are complements, a fall in the price of one good would shift demand outwards for the other; as they are typically used in tandem.

Changes in consumer fashion/taste would shift demand for a product, as it affects the perceived utility of the good for consumers. Tastes are mainly affected by advertising and observing other consumers.

Changes in the distribution of income would shift demand for different products, as different income groups have different spending habits. A redistribution towards lower-income households may increase demand for inferior goods, while a redistribution towards higher-income households is likely to increase demand for normal and luxury goods

Changes in expectations of future prices would shift demand for a product, because consumers adjust their purchasing decisions based on anticipated changes. If consumers expect prices to rise in the future, their willingness to pay now increases, leading to an outward (rightward) shift of the demand curve. Conversely, if they expect prices to fall, consumers delay purchases, reducing current demand and shifting the demand curve inward (leftward)

What are the eight non-price related determinants of supply?

Changes in the cost of production influences firms’ profitability and their ability to supply goods at given prices. If costs rise, firms reduce supply, causing an inward shift of the supply curve. If costs fall, firms expand supply, shifting the curve outward.

Changes in technology affects firms’ efficiency in production. Advances in technology reduce costs and increase output capacity, leading to an outward shift of the supply curve. A decline in available technology would instead shift supply inward.

Changes in productivity determines the amount of output produced per unit of input. Productivity is defined as output per unit of input; for example labour productivity would be output per worker. Higher productivity lowers costs and allows more supply at each price, shifting the supply curve outward. Lower productivity raises costs and shifts supply inward.

Changes in the prices of related goods can affect the supply of a goods. In joint supply, producing more of one increases supply of the other, shifting both curves outward. In competitive supply, producing more of one reduces supply of the alternative, shifting its curve inward.

Government interventions alter production costs and incentives. Taxes or strict regulations raise costs, shifting supply inward. Subsidies or deregulation lower costs, shifting supply outward.

The number of firms in a market determines total supply available. An increase in the number of firms shifts the supply curve outward. A fall in firm numbers shifts the curve inward.

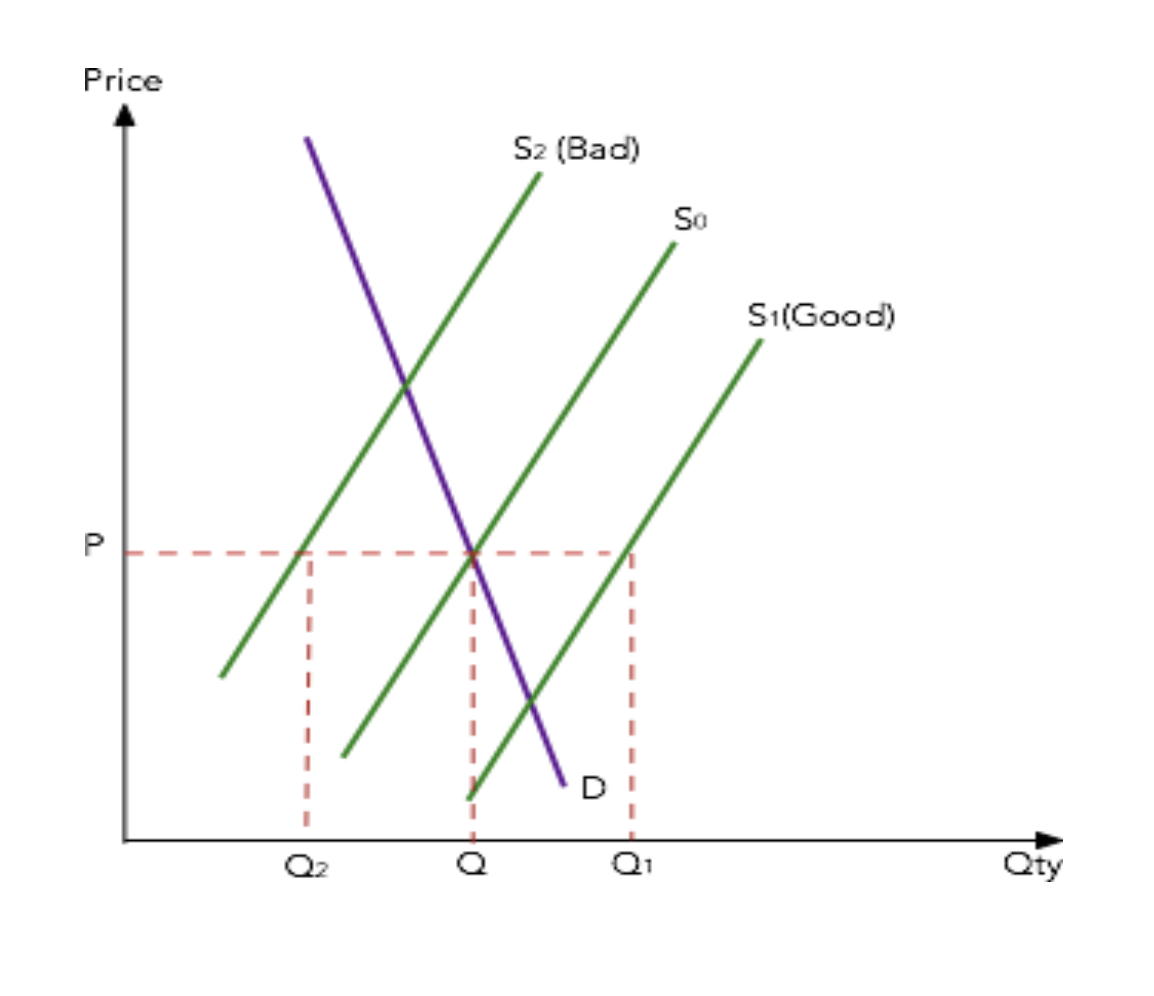

Exogenous factors act as shocks to the such as weather, natural disasters, or conflicts affect production conditions. Positive shocks, like favourable weather, increase supply and shift the curve outward. Negative shocks reduce supply, shifting the curve inward.

Expectations of future prices influence firms’ decisions on when to supply. If firms expect higher prices in the future, they withhold output now, shifting current supply inward. If they expect lower prices, they release more output now, shifting supply outward.

What is consumer surplus?

Consumer surplus is the economic benefit consumers receive by paying a market price lower than the maximum they were willing to pay for a good or service.

What is producer surplus?

Producer surplus is the economic benefit producers receive by selling a good or service at a market price higher than the minimum they were willing to accept.

What is PED and what are some ways it is relevant?

PED measures the responsiveness of a good’s demand relative to a change in its price. PED is relevant for economic analysis as it enables comparison between quantity changes and price changes.

PED is relevant to firms aiming to maximise their revenue, as it allows them to predict changes in revenue before implementing price changes. For elastic goods, decreases in price will increase total revenue; conversely for inelastic goods, increases in price will increase total revenue.

Another reason why PED is relevant to firms’ marketing strategies as they aim to make their products more inelastic through promoting brand loyalty; primarily through the use of advertising.

PED is relevant to governments, as it allows them to estimate the size of the necessary tax to reduce consumption of a demerit good. Examples would include reducing consumption of goods such as tobacco products or alcoholic beverages.

PED is also important because it determines the incidence of taxation.

What is PES and what are some ways it is relevant?

PES measures the responsiveness of a good’s supply relative to a change in its price.

What are the five determinants of PED?

The number and closeness of available substitutes would affect PED. This is because if alternative substitutes are readily available, consumers can easily switch to them if the price of a product increases.

The proportion of income spent on the product affects PED, as it influences the extent of the income effect on demand. Goods which constitute a high percentage of a consumer’s income tend to have more elastic demand, as a price rise significantly reduces purchasing power. Conversely, goods which constitute a small percentage of income have inelastic demand, since price changes have little impact on purchasing power.

The time period considered would affect PED; demand is more elastic over longer time periods, are consumers need time to adjust their consumption habits.

The nature of the product would affect PED, as goods which are considered necessities or habit-inducing in nature would be harder or even impossible to forgo for consumers; hence they would be more willing to purchase them at higher prices.

How does PED affect the incidence of taxation?

The incidence of tax will be higher on the consumer the more inelastic the demand for a product is; e.g. a cigarette manufacturer selling an inelastic good would pass on the burden of tax onto the consumer.

The incidence of tax will be higher on the producer the more elastic the demand for a product is; e.g. a luxury goods manufacturer selling an elastic good would bear the burden of a tax.

What are three determinants of PES?

PES is largely determined by the degree of spare capacity. When producers are close to full capacity, increasing output requires higher costs, making supply inelastic. According to the marginal decision rule, firms will only expand output if the additional revenue from higher prices outweighs the rising marginal costs. Certain factors which would affect

PES is also determined by whether a product is perishable or non-perishable. The supply of perishable goods tends to be more inelastic in nature, as they have to be sold within a short time frame; or else they lose their value.

PES varies depending on the time period considered. In the short one, at least one factor of production will be fixed making supply relatively inelastic. In the long run, all factors of production will be variable, making supply relatively elastic.

What are the three roles of prices in the market?

Prices signal to firms what to prioritise in production; if prices are rising due to increased demand, firms are signalled to expand out; if prices are falling due to decreased demand, firms are signalled to cut back production.

Prices ration scarce goods when demand exceed supply based on willingness and ability to pay.

Prices provide incentives that influence both firm and consumer behaviour. Higher prices incentivise firms to increase production for greater profit, while lower prices discourage production but encourage greater consumption.

Why is government intervention in the market necessary?

Governments intervene in the market in order to correct “market failures” which result in a non-optimal allocation of resources from a society’s point of view. This can occur as merit and public goods are under-provided, whereas demerit goods are over-provided.

Governments intervene in the market in order to promote equity; reduce the opportunity gap between the rich and poor. This would include laws to protect workers and laws to prevent monopolies from forming as they can result in unreasonably high prices.

Governments intervene in markets to support poorer households. Policies such as progressive tax structures and welfare payments could be used to redistribute wealth towards these households or support them in sustaining themselves/

What is the purpose of imposing a maximum price (price floor)?

Maximum prices are imposed when the price of a good is deemed too high. This is often done to improve equity; to improve affordability of essential and merit goods.

What is the purpose and effect of imposing a minimum price?

Minimum prices are imposed when the market price of a good is deemed too low. This is often done to protect producers from price volatility; namely producers of agricultural goods and primary commodities. Governments hope that implementing a price floor will guarantee producers a minimum level of income. Minimum prices can also be imposed to correct market failure; by discouraging the consumption of demerit goods.

What are some issues with imposing a maximum price?

A maximum price set below equilibrium creates a shortage, as it causes an extension in demand while simultaneously leading to a contraction in supply. This results in a large decrease in producer revenue, and also means that prices no longer serve their rationing function; even if consumers are willing and able to purchase the good, it is not guaranteed they will end up with the product.

What are some issues with imposing a minimum price?

A minimum price set above equilibrium creates a surplus, as the higher price incentivises greater supply while reducing demand. The unsold surplus represents wasted resources and reduces firms’ profitability. To deal with this surplus, governments may result to intervention buying; purchasing the excess supply.

What impacts do maximum prices have on consumers, producers and the government?

Maximum prices can benefit consumers, given they are able to purchase the good; however the remainder of consumers will suffer. They may choose to source alternative supply, notably through the black market where they are susceptible to exploitation by illegal firms. Alternatively, consumers may spend additional time queueing up to purchase the good; creating opportunity costs from lost work or leisure time.

Maximum prices will disadvantage producers, as imposing a price ceiling will contract supply and decrease total revenue; goods subject to maximum prices are generally price inelastic. This also results in decreased producer surplus; reducing producer welfare and profitability. This may cause producers to shift production towards alternative goods.

To an extent, a government may be successful in making a good more accessible to lower income consumers through the imposition of a maximum price. However, the shortage will creates allocative problems, as many consumers will be unable to access the good, and firms may be incentivised to produce other goods; shifting supply inwards. Black markets may emerge as an alternative source of supply, often at inflated prices, making the maximum price counterproductive. In addition, governments lose tax revenue, and consumers face undermined consumer protection.

Governments may address the shortage by subsidising firms or directly supplying goods and services. However, these measures carry significant opportunity costs, such as reduced spending on healthcare, education, or infrastructure. If financed through increased direct taxation, households face lower disposable income, reducing consumption and savings. Firms experience lower after-tax profits, constraining investment and shifting long-run aggregate supply inwards.

What impacts do minimum prices have on consumers, producers and the government?

Consumers will not benefit, as the imposed minimum price will result in higher prices and thus lower purchasing power; this results in a fall in consumer surplus. For low-income households, this is regressive, as the imposed minimum price takes a larger share of their income.

In the long run, consumers also bear the cost of intervention buying through higher taxes, cuts in government spending, or borrowing.

If there is intervention buying, producers benefit from higher revenues, greater producer surplus and protection from volatility.

If there is no intervention buying, producers may not benefit, as producers can only sell Qd units; thus limiting revenue.

The government may achieve some goals; protecting producers, supporting industries, or in the case of correcting market failure, reducing harmful consumption.

However, they face problems with handling the surplus; if they choose to intervene by buying up the surplus, there is a large fiscal opportunity cost, as funds are diverted from alternative forms of spending, such as healthcare or infrastructure. Alternatively, storing the surplus would prove costly; destroying the surplus would prove a waste of resources; higher prices could result in black markets developing.

Why are black markets economically harmful?

Loss of tax revenue – Transactions are hidden from authorities, so the government cannot collect tax to fund public services.

Undermines policy effectiveness – Black markets bypass government interventions like minimum or maximum prices, making official policies ineffective.

Unfair competition – Illegal sellers avoid taxes and regulations, letting them undercut legitimate businesses that comply with the law.

Resource misallocation – Labour and capital are diverted into unlawful trade instead of productive, legal industries, reducing overall economic efficiency.

What are three advantages of indirect taxation?

Indirect taxes use the mark forces of demand and supply to alter production.

Indirect taxes are easy to administer. Since the tax is included in the price of a product, tax evasion is difficult.

Indirect taxes help generate a fiscal dividend.

What are four disadvantages of indirect taxation?

Indirect taxes are less effective when demand for a good is price inelastic. This means that a large tax will be needed to initiate a small proportionate reduction in quantity demanded.

They are regressive in nature as the amount of tax levied solely depends on expenditure of the product, and does not account for a consumer’s income.

Indirect taxes are inflationary, as they increase the cost of production artificially. Firms face higher costs, which are often passed on to consumers in the form of higher prices, reducing purchasing power.

Indirect taxes prevent markets from reaching their natural equilibrium. By raising production costs, they push up prices and cause firms to supply less. As a result, consumers buy fewer goods than they otherwise would, even when they value them above the original market price. This gap between what could have been bought and sold in a free market and what actually happens under the tax creates a welfare loss, as some mutually beneficial exchanges no longer take place.

What are the aims of a buffer stock scheme?

A buffer stock scheme is when the government purchases surplus output during periods of oversupply and releases stocks back into the market during shortages. The aim is to stabilise prices and protect farmers’ incomes.

What are some problems with a buffer stock scheme?

The cost of purchasing, administering, and storing the surplus creates an opportunity cost for the government, since funds used for buffer stocks could otherwise have been spent on areas such as healthcare or infrastructure.

What is a subsidy, and what does it aim to achieve?

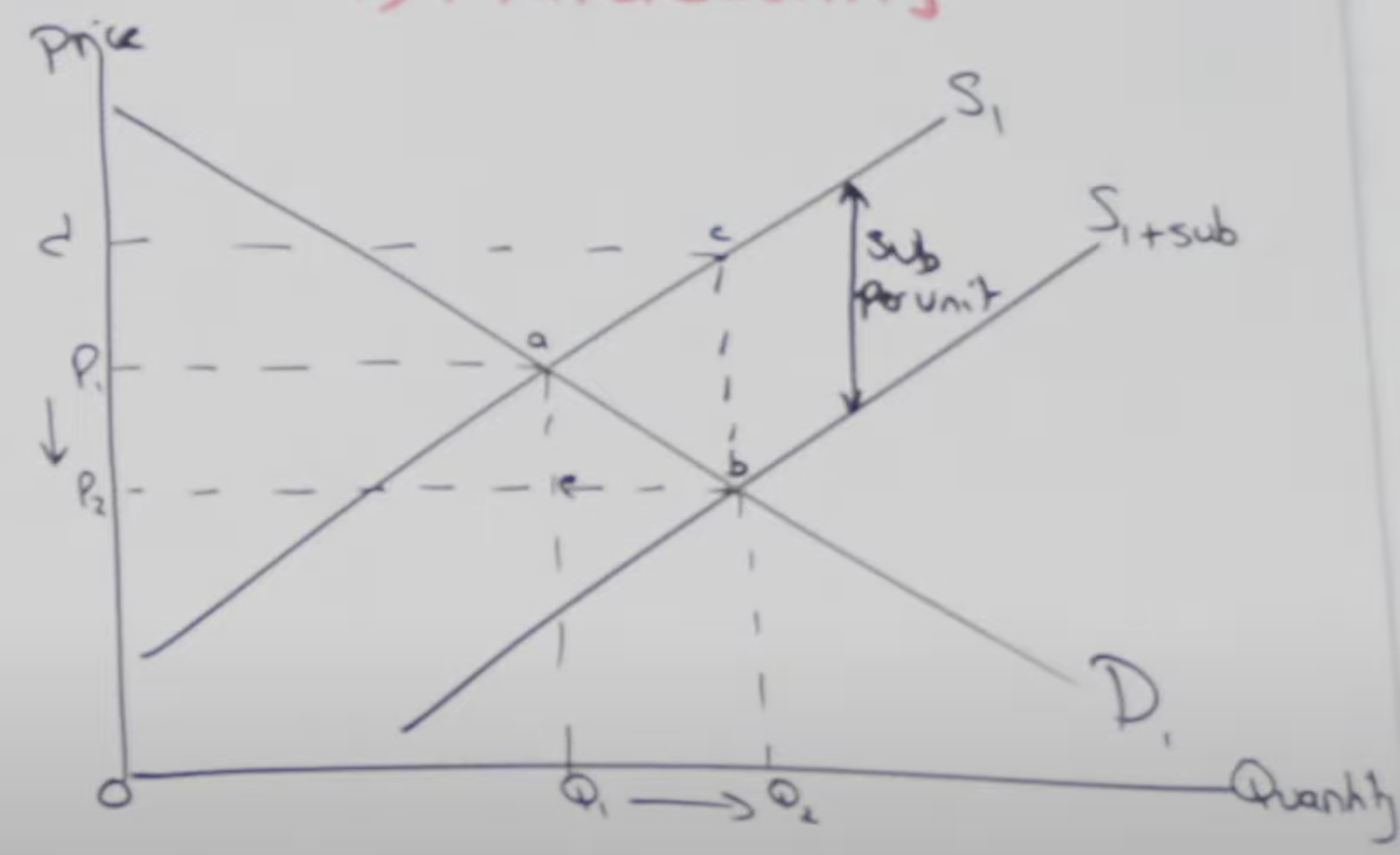

A subsidy is a per-unit payment from the government to firms on each unit produced. It lowers production costs, encouraging firms to supply more, which can increase output, lower prices, boost consumption, and raise firms’ revenues.

Governments grant subsidies for a variety of reasons:

Subsidies are often used to lower the price of essential or merit goods such as food, healthcare or education. By reducing costs for consumers, governments aim to increase consumption and make these goods accessible to low-income households.

Subsidies are also granted to provide financial assistance to protect nascent or infant industries, allowing them to compete internationally in the long run.

Subsidies can also be targeted at priority sectors to encourage investment in research and development (R&D), innovation, and adoption of new technologies. This is often done for strategic reasons, such as advancing technology or supporting firms in producing more environmentally friendly products.

How does a subsidy affect the three main economic stakeholders?

Consumers benefit from subsidies to an extent, as the decrease in prices increases purchasing power and increased consumer surplus.

However, the funding of a subsidy results in opportunity costs for consumers, as taxation is often increased or redirected from other areas of government expenditure, which may reduce overall social welfare, as resources are reallocated away from alternative public goods and services.

Producers benefit from subsidies as they result in a large increase in total revenue and subsequently an increase in producer surplus. Labourers will also benefit from subsidies as increased firm revenue can lead to more job opportunities and thus higher employment.

Governments benefit from subsidies if they achieve their aims of either solving market failure, improving affordability or protecting or growing strategic industries.

However, subsidies represent a opportunity cost of funds due to their high fiscal cost, which could otherwise be used for public services such as healthcare, education, or infrastructure.

Firms may rely on continued subsidies instead of improving efficiency or competitiveness, leading to long-term inefficiency in the industry. Subsidies may be diverted to purposes unrelated to production, such as paying bonuses or dividends, reducing their effectiveness in achieving policy aims.