Unit 1: Introduction to BM

1/154

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

155 Terms

1.1 What is a business?

Business

The organization of human, physical and financial resources to produce goods or services that meet customer needs while adding value

The aim of a business

To satisfy the needs and desires of their customers by selling a good or providing a service

Factors of Production

Resources used in the production process

Land

The natural resources used in the production of a product

E x : Good, water, physical land, fish, metal ores, minerals

Capital

The money and equipment used to produce the product, including non-natural resources

E x : Tools, equipment, machinery, vehicles, buildings

Labour

Physical human effort and psychological intellect used in the production process, hence the employees themselves.

Enterprise

An individual with the necessary skills and ability to take risks in organizing the previous three to generate profitable output

Transformation (adding value)

The process of creating a product that is worth more than the costs of the inputs used

Value added is measured as the difference between the costs of the inputs and the price of the final output

Outputs

Goods

Tangible physical items capable of being stored

Services

Intangible items that cannot be stored and are given to customers when needed

By-products

Combined (Good + Service)

Primary Sector

Businesses in the first stage of production involved in extraction, harvesting, and conversion of natural resources

Relatively low value added in this sector

E x : Fishing, forestry, mining

Secondary Sector

Businesses involved in the processing of raw materials into finished and usable products or inputs for other businesses

E x : Car making, construction, breweries, aerospace, engineering

Tertiary sector

Businesses that focus on providing a service to consumers and other businesses

– High value is added in this section

EX: Banking, insurance, security, catering, education, healthcare, retail, transportation, news media, law, leisure, tourism, entertainment

Quaternary sector

Businesses involved in the creation or sharing of knowledge or information

High value is added

Entrepreneur

Someone who takes the financial risk of starting and managing a new business in return for a profit. They are usually self-employed.

Challenges for starting up a business AO2

Lack of experience in all the different areas of a business:

Poor marketing

Poor hiring

Lack of cash flow

Poor pricing

Difficulties raising money to set up and expand

Businesses are at a high risk in their early stages

Entrepreneurs may have to use their own funds, which can be limited

Can restrict the options when developing and launching the product

Difficulties in building brand awareness

New products must compete with well-established brands

Difficult to attract the attention of intermediaries (e.g. retailers) and customers

New products may not get shelf space as they are risky

Lack of market power

Customers may feel they have the power to delay payments

Suppliers may be worried about getting paid, may insist on early or advance payments

Legal problems, e.g. copyright and patent problems

External influences

Opportunities for starting up a business

Social change

EX: An ageing population brings forth the opportunity to start up businesses taking care of the elderly

Technological change

EX: An increased demand for EVs may inspire startups in the automotive industry

Economic change

EX: Growth in an economy can lead to more consumer spending

Creates new markets & opportunities for new businesses

Environmental change

EX: Growing concern regarding the environment can inspire startups linked to sustainability

Political change

Ex: A decision to join a trading union with another country

Start-ups in tourism or export

Legal change

Ex: Fewer regulations → reduced costs of selling up a business

Ethical change

Ex: Growing interest in the values of a brand

Opportunities to start up businesses with a strong ethical stance

1.2 Types of business entities

Nationalization

Occurs when a government takes ownership of a business from the private sector into the public sector.

Privatization

Occurs when a government transfers ownership of a business from the public sector to the private sector.

Public sector business

A business organization which is owned and controlled by the government.

These organizations may have strategic importance to the country (e.g. defence).

They may provide essential services which the government wants to ensure everyone has access to (e.g. energy).

They may provide merit goods, which are goods or services that private individuals undertake and thus do not consume enough of.

Private sector businesses

Organizations that are owned and controlled by individuals rather than the government.

These businesses are either run to make a profit or have profit and social objectives as dual purposes.

Types of private sector businesses

Profit-based businesses

For-profit social enterprise

Non-profit social enterprise

Types of profit-based businesses

Unincorporated

Sole trader

Partnership

Incorporated

Privately-held companies

Publicly-held companies

Shareholder

Persons or organizations that own a part of a company. Each share represents a part ownership of the business

Limited liability

Investors can only lose the money they have invested in a business in case of bankruptcy the investors’ personal possessions are safe, limiting their risk.

Unlimited liability

Occurs when an individual or group of individuals is personally responsible for all the actions of their business. If the business has financial problems, investors could lose their personal assets

Dividend

Money that is paid out of profits to shareholders. They are a reward to the owners of a business

Social enterprises

Businesses that set out to solve a social or environmental problem

Types of social enterprises

For profit social enterprise

Non-profit social enterprise

For-profit social enterprise/private sector social enterprise

Business that makes revenue and profits but also has a social and/or environmental objectives as part of its business model

A private sector social enterprise is a type of for-profit social enterprise.

Features of a for-profit social enterprise

Private sector business - Independent of state or government control

More than half its income earned through trading (business activities)

At least half of its profits are reinvested/donated towards their mission

Are transparent in the way they operate and the impact they have

Types of for-profit social enterprises

Private sector social enterprise

Cooperative

Advantages of Social Enterprises

Can generate profit while also contributing to society

Self-sustaining

Don’t need to depend on donations or taxpayer money

Employees may be more motivated as they feel they are working towards a greater purpose

Differentiation from competitors (?)

Since the business’s operations have a unique aspect of social goals which sets the business apart from competitors in the eyes of consumers

Disadvantages of Social Enterprises

Funding (??)

Mainly contribute to the social cause through earning profits from trading

If the business is not profitable enough, it may not be able to contribute enough to the social cause.

Investors may receive lower returns

Due to the social aspect within distributing profit.

Greenwashing

There may be a risk that the business may not be genuinely contributing to social/environmental goals.

Challenges with staying true to the business’s social aims as it grows.

Cooperative

type of for-profit social enterprise that is owned and run by and for its members, who each have the power of one vote.

Types of cooperatives:

Employee cooperative

Owned by employees

Producer cooperative

Community cooperative

Owned by members of the community

Non-profit social enterprise

Private sector businesses that are not for the purpose of making profit but to benefit society

Types of non-profit social enterprises

NGOs

Charities

Non-governmental organizations (NGOs)

Non-profit social enterprises that promote a particular cause. They generally operate in the private sector.

Funded by:

Donations

Sale of goods services

Government grants

Sole Traders

An individual who owns and controls their business.

They take all the risk

They keep all the profit

They may hire employees

They are unincorporated

They have unlimited liability

E.g., Hairdressers, Restaurants, Plumbers

Advantages of Sole Traders

Can set up the business easily and quickly

Can keep all the profit

Independence – owners can manage themselves

Direct contact with the market demand and can respond quickly

No report of financial statements to the public

More privacy

Quicker decision making

No time taken to sort out disagreements

Disadvantages of Sole Traders

Unlimited liability

losses will have to be paid out of pocket

Limited sources of finance

Banks are unlikely to lend money to sole traders

when they do it will be with high levels of interest

High risk of failure

Due to inability to cover unexpected costs, lack of specialization or expertise in all required areas

All aspects of the business must be handled by the owner

No economies of scale

Not enough room for significant changes in production

Lack of continuity

If sick, no income

Partnership

Two or more people combine to form a business. They may combine their finances, run the business together, as well as share the profit.

Deed of partnership includes

How much start-up capital each partner puts in

How the profit is distributed

How much each partner will be paid

How a partner may leave

Advantages of Partnership

Easy to set up, only a deed of partnership is required

Better financial strength than a sole trader

Start-up capital combined

Two people would share the loss

Division of Labour

Each owner specializes in what they are good at

No report of financial statements to the public

More privacy

Disadvantages of Partnership

Unlimited liability

Prolonged decision making process frequent disagreements or conflicts

Due to joint legal and financial accountability

Lade of continuity

Incorporation

The process of the company and its owner(s) becoming separate legal identities — the company itself can own assets, incur debts, enter into contracts, be sued, or sue others independent of its owner(s)

The company has limited liability

If the company goes bankrupt, owners can only lose their initial investment in the company

The company is owned by shareholders

Shareholders are entitled to dividends and voting at the Annual General Meeting

A board of directors (elected by the shareholders) will run the company

Continuity ownership is passed on through the transferring of shares

Privately-Held Company

Limited-liability companies whose shares cannot be sold on the open market

Shares can only be sold with the agreement of other shareholders

Mostly small to medium-sized company

Common legal forms:

Ltd.(UK)

inc.(US)

GmbH(Germany)

Advantages of Private Held Companies

Easier to raise finance

Banks are more likely to lend money to a company than an unincorporated business

Limited liability

Continuity

Economies of scale possible as the rate of production can be higher—move room for change in production method

Division of labour

As the company is not only managed by owners—higher productivity

Tax benefit

Corporate tax is lower than tax on an unincorporated business

Disclosure of information

Disadvantages of Private Held Companies

Bureaucracy

Lots of paperwork

Compliance costs

Must hire accountants, lawyers and auditors

Loss of control

Shareholders have a say in how the entrepreneur runs their business

Limited Funding

Shares cannot be sold to the general public

Disclosure of information

Registered companies have to submit audited financial statements

Publicly-Held Companies

A publicly-held company sells a percentage of its shares to the public.

ITis incorporated

Limited liability

Owned by shareholders

Shares can be bought freely on the stock market

Shares are quoted on the stock exchange

Anyone can buy or sell shares easily

Ownership is often split across many people who are often not linked to the company

Common legal forms

Ltd or PLC (UK)

Inc. or Corp (US)

AG (Germany)

Advantages of Publicly-Held Companies

Limited Liability

Can raise large amount of capital

The company issues new shares when they do the IPO

New shareholders, BUT

Easy for shareholders to trade shares

Makes shares more attractive

Specialization

Company can hire specialist managers in each department

Disadvantages of Publicly-Held Companies

Lacks privacy

The business must provide financial statements to the public.

Costly legal requirements

Short-termism of shareholders

Since shareholders are less personally acquainted with the company, their main objectives will most likely be to earn profits and dividends

1.3 Business Objectives

Mission statement

A statement that outlines the overall purpose of a business and what it is trying to accomplish. It is usually specific and realistic.

It is normally unchanged over time

Includes

Core purpose (why it exists)

identity (who they are)

Focus (what they do)

Often includes a reference to

who its customers are

the way it does business

Vision statement

A statement that outlines the goals and dreams of the business in the future. It is usually an inspiring, broad and aspirational declaration.

Not necessarily realistic

Advantages of Vision and Mission Statements

Gives direction and guides

Long-term planning

Decision-making

Behaviour

Brand image is

Solidified

Consistent

... For the customers of the business

Because these statements can be used in promotional materials

Motivates employees

Satisfies the need for self-actualization in Maslow's hierarchy of needs.

A motivating factor (responsibility/work itself) in Herzberg’s motivation theory

Allows external stakeholders to know more about the business and what it aims to be.

Possibly easier to convince stakeholders of decisions if they are more aligned with the businesses' aims to begin with.

Disadvantages of Vision and Mission Statements

Can be too vague and general

Either statement can be this

Can lead to the business losing a sense of direction.

Strategic and tactical objectives [AO3]

Objective

Clearly defined and measurable targets of an organization used to achieve its overall goals. They are given a specific timescale.

Types of business objectives in the private sector

Growth

Revenue

Profit

Market share

Assets

Profit

Involves maximizing the difference between revenue and costs

Protecting shareholders' value

Shareholders generally want higher share prices and dividend payments

Survival

To continue trade over a defined period of time

Key objective during:

Start-up period

Recession or intense competition

Times of crisis

Cash flow

Essential to be able to pay debts on time

Important for businesses which have a long cash cycle

Cash cycle is time that elapses between cash outflow and cash inflow

Diversification

A business aims to produce an increased range of unrelated goods and/or services.

This objective may be set in order to spread risk across different markets & products.

Business objectives in the public sector

Ethical objectives

E.g. helping the community or environment

Development of relatively poor regions

Help raise standards of living in less affluent areas

Financial objectives

To cover operating costs

So they do not drain government funds

Providing a service to the community

Serve all of the country’s population

E.g. Operating bus services in places where few people live

Strategy

A long-term plan that involves a considerable commitment of resources.

Tactics

Short-term plans that implement a strategy

Strategic Objectives

Refers to aims and goals of a business that are long-term. These are a result of short-term tactics

E.g.

Become a market leader

Buy a competitor

Achieve a stock market valuation of $1Bn

Tactical objectives

Aims and goals of a business that are short-to medium-term

and often only include parts of the business. These are put in place to implement strategic objectives.

Corporate Social Responsibility (CSR) [AO3]

Corporate social responsibility

An approach under which businesses consider the interests of all groups in society and multiple stakeholders groups as a central part of their decision-making

This approach is used by traditional businesses to include social responsibilities into their business objectives

Advantages of CSR

Enhanced brand image

Recognition as socially responsible builds trust in consumers.

Differentiation from competitors

Being a socially responsible company distinguishes a company from a normal shareholder-focused business in the market

Employee retention & motivation

Maslow: Self-Actualization needs

Herzberg: Motivating factors - Responsibility, work itself

Attracts more investors

Investors may be interested in not only financial returns but also positive societal or environmental impact

Disadvantages of CSR

Increased costs overall

There are compliance costs involved with social responsibility and implementing ethical objectives

Increased publicity for unethical behaviour

Since the company has been established as socially responsible, consumers may see through it

As a strategy to get more revenue

Lower profit in the short-term (?)

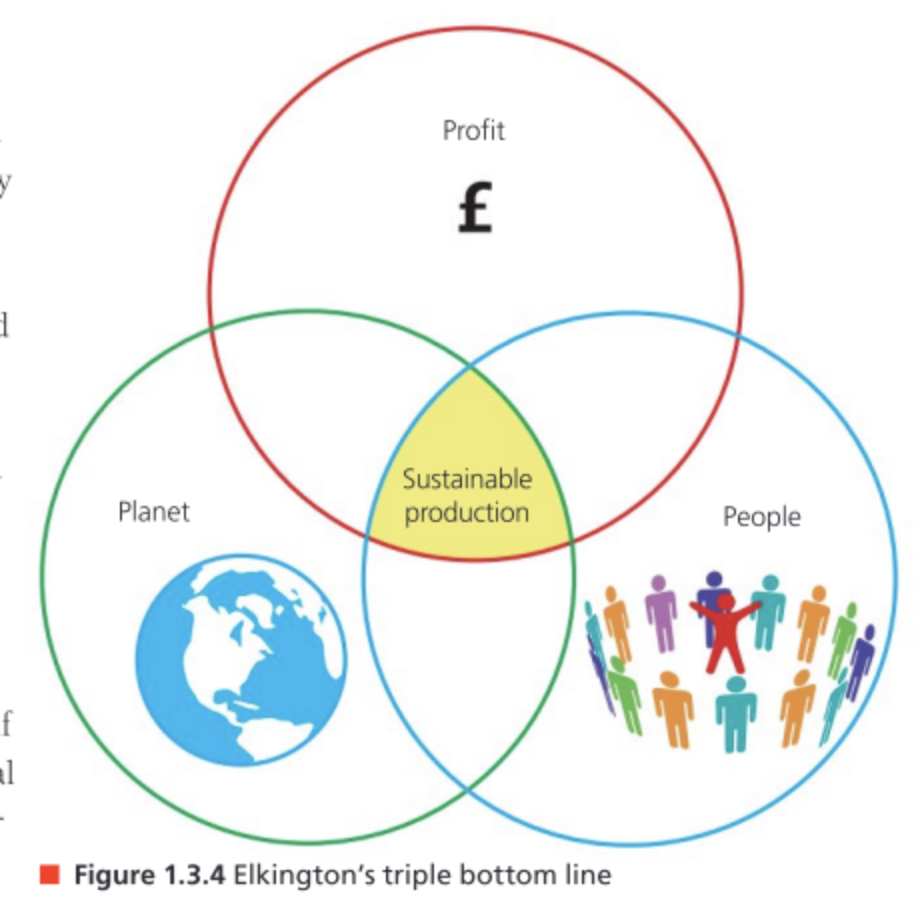

Triple Bottom Line

Refers to when businesses have social and environmental objectives alongside profit.

Implementation of Triple-Bottom Line

Marketing-focused

The business claims sustainable practices though often with limited measurable evidence

In order to create a positive brand image

Could be potentially greenwashing

Impact report and societal impact

A business produces an impact report to show evidence of social-and-environment-friendly practices

Becoming a private sector social enterprise

A business with social, environmental, or community goals as its main objective

E.g. B-corps, which certifies companies committed to social impact

1.4: Stakeholders

Stakeholders

An individual or group that is interested in or affected by the decisions made in a business organisation

Internal Stakeholders (list)

Shareholders/owners

Managers

Employees

Rights / wants of Shareholders

Rights

To receive a share of profits

To be kept informed by the management

Wants

Maximize share price

Maximize dividend

Responsibilities of Shareholders

To treat management fairly

Employees

The workers within an organization

Rights/wants of employees

Rights

To be treated fairly (good working conditions

Job security

To be paid fairly

To be kept informed

Wants

High pay

Promotion opportunities

Competitive remuneration packages

Responsibilities of employees

To work effectively

To show up for work on time

Rights/Interests of managers

Rights

To be appropriately rewarded for responsibilities

Duties correspond to level of authority

Interests

Maximize salary

Satisfy shareholders

Maximize profits

Make the business grow/be more efficient

They may want to reinvest profits to grow the business but the shareholders want higher dividends —> Conflict

Responsibilities of managers

To carry out duties to the best of their abilities

To be discreet when handling sensitive business data

External stakeholders (definition)

Refers to individuals or groups outside of the business organization who are interested in or affected by a business

External stakeholders (list)

Customers

Competitors

Suppliers

Government

Pressure groups

Banks

Customers

Refer to a firm’s clients, individuals or organizations who puchase a business’s goods and services

Rights/Interests of customers

Rights

To be able to purchase goods/services at a reasonable price

Receive good quality service/goods in exchange for the price paid

To have a range of choices

No business having an unreasonably high market share so customers don’t have any option but to buy from them

To be supplied on time

Responsibilities of customers

To pay suppliers on time

Competitors

Competitors are businesses which operate in the same industry as a business and contest for the same customers

Wants of competitors

We dont care

Pressure groups

Individuals who come together or organizations which are set up for a common concern. They aim to influence government and public opinion to create social change.

Rights/Interests of pressure groups

Interests

Businesses follow the pressure group’s vision

E.g. Sustainable operations

To live in an area that is free from excessive noise or pollution

To benefit from employment

Responsibilities of pressure groups

To cooperate with the business in its daily activities

Suppliers

Refers to organizations that provide the goods and services for other businesses

Rights/Interests of suppliers

Rights

To be paid on time

To be kept informed about any changes in future orders

Interests

Shorter trade credit durations

Responsibilities of suppliers

To provide products which

Are good quality

Meet specifications requested

Are sent on time

Government

Refers to the ruling authority within a state or nation

Rights/Interests of the government

Rights

The business pays its taxes

The business obeys the law

Interests

The business provides employment to the local community

(Ties in with MNCs and their impact on the host country —> if they don’t provide employment, stakeholder conflict with government)

Responsibilities of the government

To protect business, customers, employees, and the environment

Banks/other lenders

A source of finance for the business who may provide loan capital

Rights/interests of banks/other lenders

Rights

That the business is able to pay back the loan

Interests

To have a good/long-lasting with the business

Responsibilities of banks/other lenders

To not charge excessive interest rates

To not withdraw loans without a reasonable period of notice

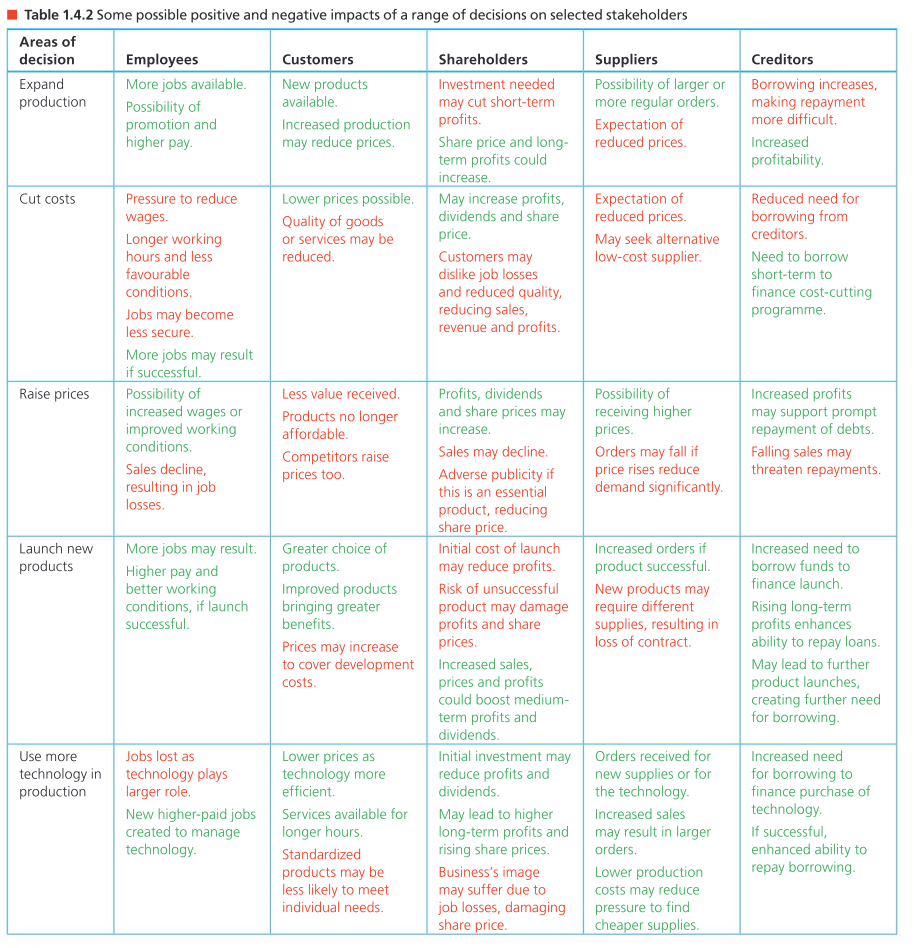

Common types of stakeholder conflicts

Managers vs. consumers

Managers want to raise price of product to gain more profit

Consumers want a reasonable price

Managers vs. Shareholders

Shareholders want high dividend payouts

Managers may want a higher bonus instead

Shareholders vs. pressure groups

Shareholders may not be worried about environmental harm as long as they can maximize their share price and dividends

Pressure groups are concerned about the environment

1.5 Growth and Evolution

How is the size of a business measured

Sales Revenue

Market share → Revenue/market revenue

Value

Profit

No. of employees