Chapter 7 - Fiscal Policy

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Fiscal Policy Definition

Governments approach towards its own spending and taxation

Minister of finance presents an annual budget to Parliament each spring that contains estimates of governments revenue and expenditures

Net Tax Revenue (NTR) less

Total tax revenue received by government less transfer payments

Budget Balance

The difference between net tax revenues and government spending

Budget Surplus

Net tax revenue in excess of government spending on goods and services

Budget Deficit

Government spending on goods and services in excess of net tax revenues

National Debt

The sum of the federal governments annual budget deficits less its surpluses

Balances Budget

The equality of net tax revenues and government spending on goods and services within a given time period/year

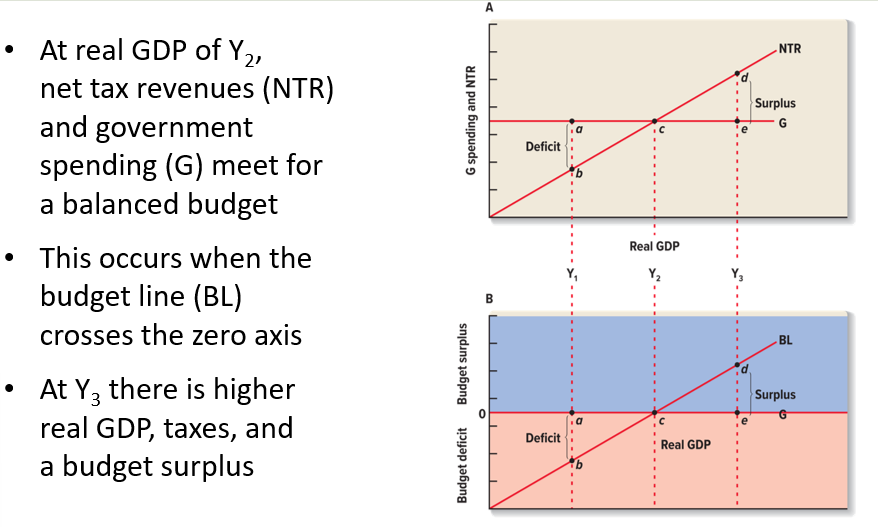

Understand what’s happening in this graph

What’s Happening in the Graphs?

Top Graph (A)

The red line going up (NTR) shows how much money the government collects in taxes.

The straight red line (G) is how much the government spends.

If the government spends more than it collects (left side), it has a deficit (losing money).

If it collects more than it spends (right side), it has a surplus (extra money).

At Y₂, the two lines meet, meaning the government collects exactly as much as it spends (balanced budget).

Bottom Graph (B)

This graph shows the difference between money collected and money spent.

Below zero (red area) = deficit (government needs more money).

Above zero (blue area) = surplus (government has extra money).

Y₂ is where the balance happens (neither losing nor gaining money).

Y₃ means the economy is doing well, more people are working, paying taxes, and the government has a surplus.

Why Does This Matter?

If there’s a deficit, the government might borrow money or increase taxes.

If there’s a surplus, the government can save money, invest in new projects, or lower taxes.

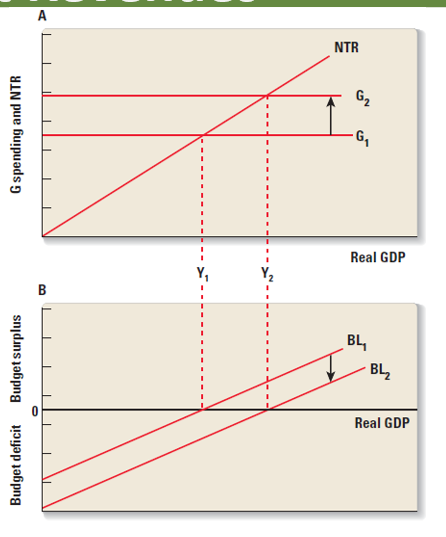

The government budget is affected by (3):

A change in level of GDP, change in tax rates, and a change in the amount of government spending

An increase in government spending shifts the 'G spending' line up and the BL line down

An increase in taxes graphically shifts both the NTR and BL line up

What is happening in the first and second graph

An increase in G spending shifts the line up and the BL line down

An increase in taxes graphically shifts both the NTR and BL line up

Three Distinct and opposing philosophies on Fiscal Policy: (name and definition)

Countercyclical fiscal policy

When in a recession the government should be overspending and when dealing with inflation the government should underspend – doing this will help the economy achieve the goals of full employment and stable prices

Balenced Budget fiscal policy

Balancing the budget annually is the best way to deal with fiscal policy

Cyclically balanced budget policy

Combination of countercyclical and balance budget

Countercyclical Fiscal Policy was created by ___

J.M. Keynes

Keynes believed and argued…?

Keynes believed that: the depression was caused by decrease in aggregate expenditures and that an increase in spending/AD would pull economics out of depression

Keynes argued that: for increased government expenditures (G) to also increase employment and incomes since increase in other types of spending. Increased spending was financed through borrowing

Countercyclical fiscal policy recessionary gap means:

The economy isn’t producing enough (Real GDP is at Y₁, below full employment Y_FE).

Businesses are not selling enough, so they hire fewer workers, and unemployment rises.

The government can spend more (G ↑) or lower taxes (T ↓) to encourage people to buy more.

This shifts the AD (Aggregate Demand) curve to the right, from AD₁ to AD₂.

Now the economy reaches full employment at Y_FE, and things are balanced again

Countercyclical fiscal policy inflationary gap means:

The economy is producing more than it should (Real GDP is above Y_FE).

Too much spending leads to inflation (prices going up).

The government spends less (G ↓) or raises taxes (T ↑) to slow things down.

This shifts the AD curve to the left, reducing demand and bringing the economy back to Y_FE.

So, the government adjusts spending and taxes to speed up or slow down the economy as needed.

Y_fe stands for

Full Employment Output (or Full Employment GDP).

It’s the level of Real GDP where the economy is producing at its full potential without causing inflation.

In a countercyclical what happens in R and I?

When there is a recessionary gap, governments should spend and tax to increase aggregate demand

When there is an inflationary gap, governments should spend and tax to decrease/reduce aggregate demand

In the following cases, indicate the direction in which the AD curve will shift:

Government spending decreased

Countercyclical fiscal policy is used to close a recessionary gap

Countercyclical fiscal policy is used to close an inflationary gap

Taxes Increase

Left, Right, Left, Left

Countercyclical fiscal policy can cause Shortcomings, this means:

It can be subject to serious lag times and has an inflationary bias. It results in crowing out effect and can cause serious budget deficits

National debt will ___ due to ___ fiscal policy aimed to close a gap. Done through by __ decreasing

fall, countercyclical, inflationary, aggregate demand

Balanced budget fiscal policy advantages (3)

Avoids problems associated with counter-cyclical policy

Relies on automatic stabilizer (tax laws and spending programs that automatically cut back on spending during a boom and increase spending in a slowdown)

The economy will eventually return to full employment through self-adjustment process

Balanced budget fiscal policy recessionary gap effects

Eventually wages will be forced down due to job lose, AS increases, returning economy to Yfe, also decrease in price level

Balanced budget fiscal policy shortcomings

In a recession, government spending is cut back, increasing unemployment more

In a boom, the government increased spending, to increase demand and inflation more

This is procyclical: meaning that it tends to push the economy in the same direction as it is leaning

Cyclically Balenced Buget Fiscal Policy Definition

Balance the budget over the length of the business cycle instead of each year

Running a budget deficit to reduce unemployment during recessionary gaps and running a budget surplus to reduce inflation during inflationary gaps

Cyclical vs. Structural Deficits

Structural deficit – exists at full employment GDP

Cyclical deficit – results from a recession – Cyclical deficit = actual deficit – structural deficit

Cyclically Balenced Budget Fiscal Policy Shortcomings (3)

No guarantee that the size and length of the recessionary gap will exactly offset the size and length of the inflationary gap

Increasing government spending in bad times is politically easy; decreasing government spending in goods times is politically hard. Meaning that cyclical deficits turn into structural deficits

Business cycles rarely matches political cycles, so governments blame earlier governments for the deficits

Government borrows by issuing bonds as a way to raise funds

These bonds (debt) are held by individuals, corporations, and financial institutions

Bond interest payments redistribute wealth from all taxpayers to wealthy bondholders.

Problems with High Deficits/Debt (4)

Interest payments must be paid

Income redistribution effect on large interest payments

Reduced ability of government to meet the need on citizens

Possible increase power grabbing and wastefulness of government

Invalid criticism of the size of national debt: (4)

Unlike a private company, a country cannot go bankrupt

Not only will future generation inherit the debt, they will also inherit bonds represents by that debt

Concentration of debt can be misleading, the assets of an intuition/government should also be considered

The size of debt should only be considered as a percentage of income (GDP), Canadas percentage is low at 45%

Crowding out effect

The crowding-out effect in economics describes how increased government spending or borrowing can reduce or "crowd out" private sector spending, typically through increased interest rates and reduced investment

The Arithmetic of a Balanced Budget

Decreasing both G and T by the same amount is not self-cancelling, the effect of G change is bigger than impact on taxes because of the multiplier. Each decreasing by $40, will affect government spending impacts more