Week 9(Aggregate Demand and Purchasing Power Parity)

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

39 Terms

Aggregate disposable income

GDP - Taxes + Transfers

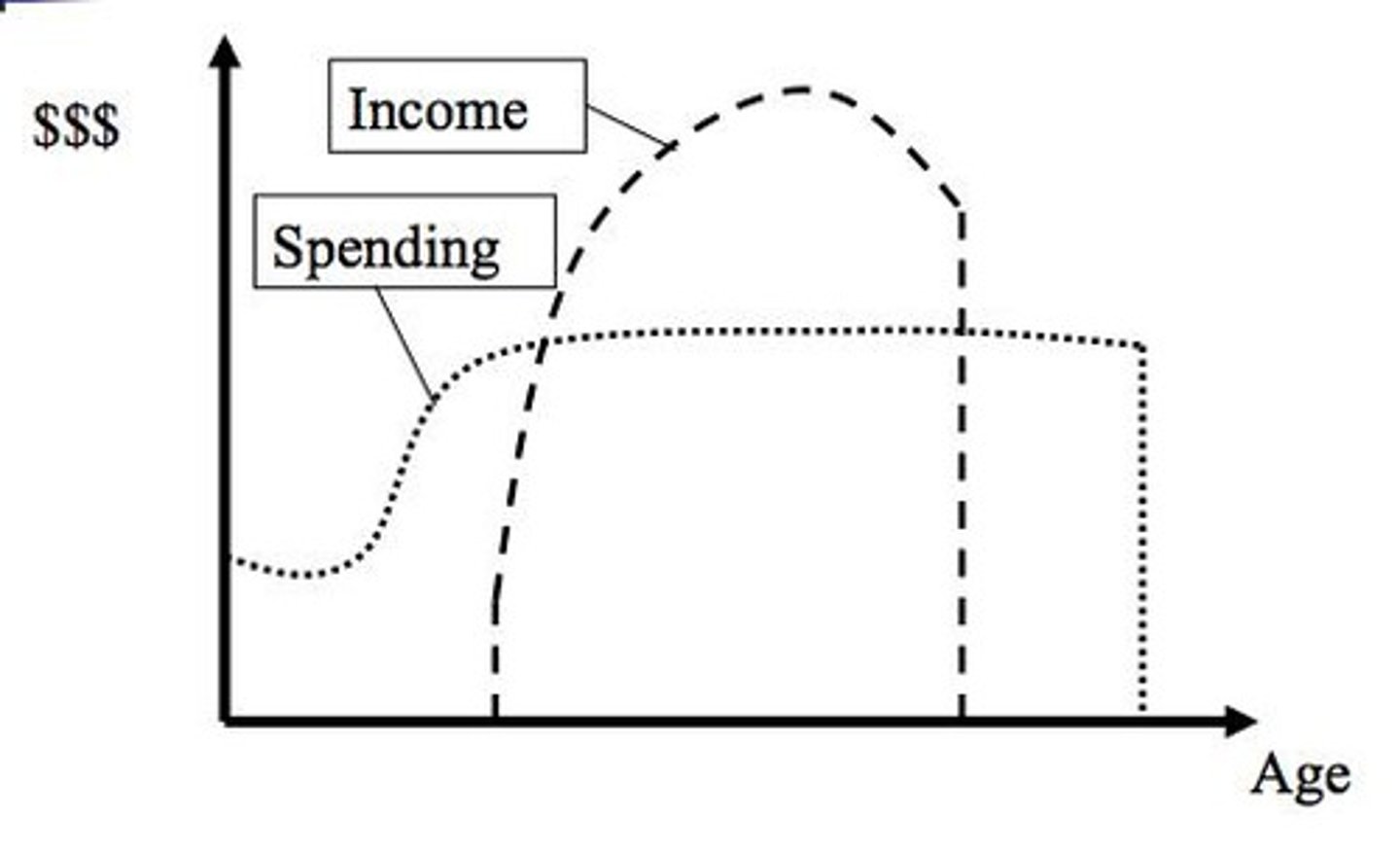

Lifetime income hypothesis

consumption is determined by the whole lifetime income rather than the level of income at a certain point of time.

Government policy

can affect spending behavior and shift the AD curve through changes in tax policy, transfers, or government spending.

Interest rates

The cost of borrowing money, which can be influenced by the price level.

Consumption behavior

Influenced by current income, wealth, and government policies.

Temporary income change

Does not significantly affect spending behavior.

Permanent income change

Can significantly affect consumption and AD.

Real wealth

The value of assets adjusted for inflation.

Capital goods

Goods used to produce other goods and services.

Depreciation

Capital that gets 'used up'

After-tax profits

Profits - Taxes + Transfers

Retained profits

Profits that are saved and reinvested

Loanable Funds Market

Market where funds are borrowed and lent

Sources of Loanable Funds

Private savings, government budget surplus, borrowing from the rest of the world

Aggregate income (Y)

Sum of spending on consumption goods and services (C), private saving (S), and taxes (T)

Aggregate expenditure

Sum of consumption plus government spending plus investment plus exports minus imports

Investment financing equation

I = S + (T - G) + (M - X)

Supply of loanable funds

Relationship between the quantity of loanable funds supplied and the real interest rate

Factors shifting loanable funds supply curve

Disposable income, expected future income, wealth, default risk

Real interest rate (r)

Nominal interest (i) rate adjusted to remove the effects of inflation (π)

Nominal interest rate (i)

The stated interest rate before adjusting for inflation

Demand for loanable funds

Total quantity of funds demanded to finance investment, government budget deficit, and international investment

Equilibrium real interest rate

Where supply intersects demand for loanable funds

Government spending (G)

A component of the government budget, which includes G, Transfers, Taxes, and Savings

Government Savings

Calculated as T (taxes) - G - Transfers.

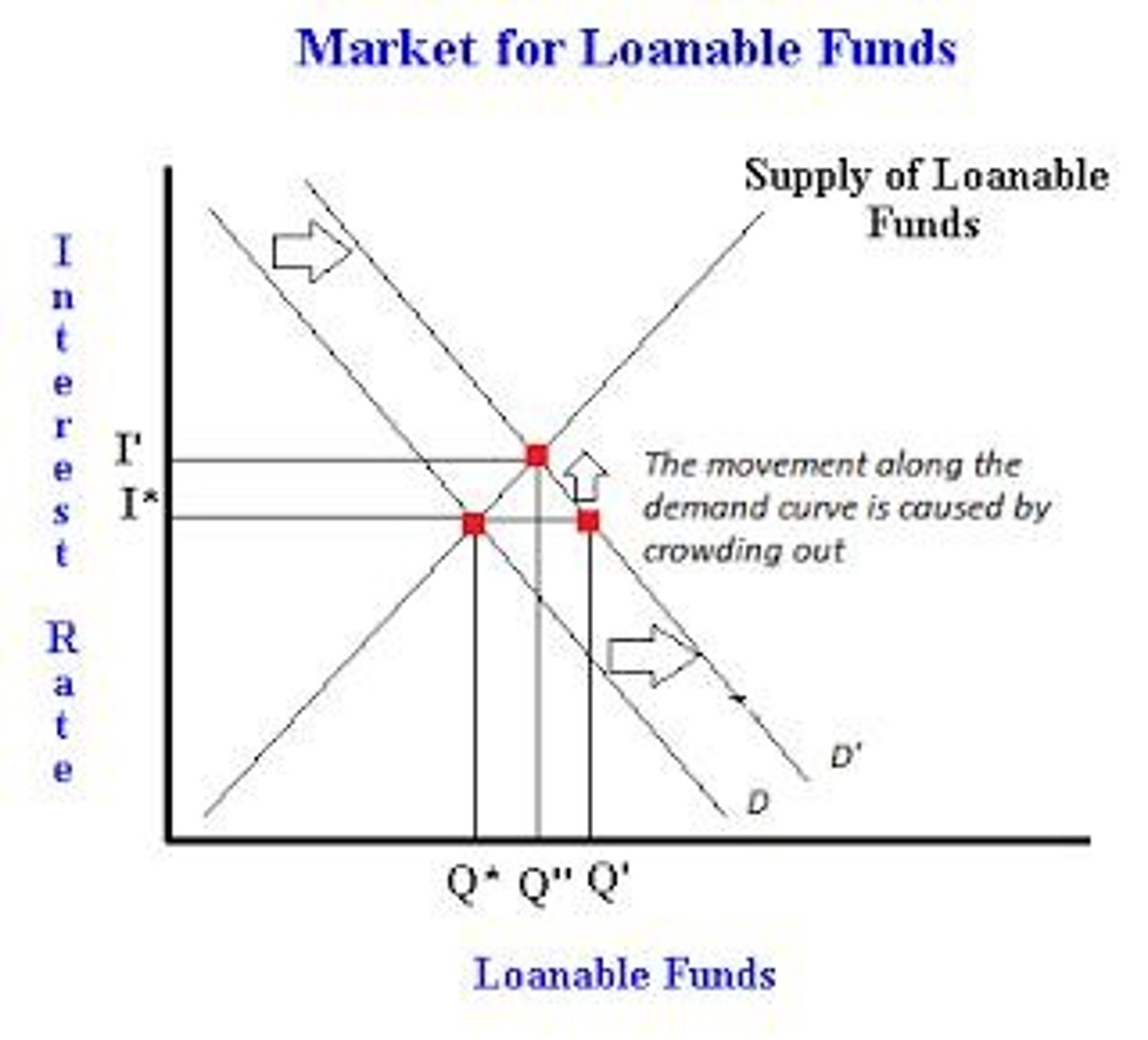

Budget deficit

Occurs when government savings are negative, leading to borrowing.

Fiscal policy

Tools exercised by the government to influence GDP through G, T, or transfers.

Crowding out effect

when G, T or transfers change because government savings would change as a result

Ricardian Equivalence

The concept that economic agents perceive an increase in G as a future decrease in G or an increase in T as a future decrease in T, leading them to consume less and save more.

Price level increase effect on exports

Makes domestic goods more expensive abroad, leading to a decrease in exports (X drops).

Price level increase effect on imports

Makes foreign goods relatively cheaper, leading to an increase in imports (M increases).

Exchange rate appreciation

When US dollars gain value against Japanese Yen, making US goods more expensive and Japanese goods cheaper, leading to decreased US exports and increased US imports.

Purchasing Power Parity (PPP)

A theory used to determine the relative value of different currencies, where a change in price level leads to a change in exchange rate that offsets it.

Law of one price

States that if an item is traded in more than one place, the price will be the same in all locations.

Arbitrage activities

Cause changes in supply and demand for currency when the law of one price is violated.

Equal value of money

The situation when two quantities of money can buy the same quantity of goods and services, known as purchasing power parity.

Price equation in Japan

Price (in Japan) = E (Exchange rate, Yen/$) * Price (in USA).

Average price levels

Considered when determining exchange rates based on relative prices of economies.

Relative prices effect on exchange rate

If PPP holds, the exchange rate should follow changes in relative prices.