Exchange Rates, Balance of Payments, and Foreign Investment

1/52

Earn XP

Description and Tags

Vocabulary flashcards based on lecture notes about exchange rates, balance of payments, foreign investment and related concepts in the Australian economy.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

Exchange Rate

The price of one country's currency in terms of another country's currency.

Appreciation

A rise in the exchange rate.

Depreciation

A fall in the exchange rate.

Foreign Exchange Market

The market in which the currencies of different countries are bought and sold.

Trade Weighted Index

A basket of currencies weighted according to their importance in trade flows with Australia.

Commodity Prices

Prices for key exports like iron ore and coal that can affect the demand for AUD.

Relative Inflation Rate

Inflation rate compared to other countries, influencing the competitiveness of Australian goods.

Clean Float

When currency is allowed to float free from interference of the central bank.

Dirty Float

When the central bank intervenes to prevent the exchange rate from falling too low.

Managed Exchange Rate

Where there is official intervention in the foreign exchange market by the reserve bank.

Equilibrium Exchange Rate

The point where the quantity demanded of AUD equals the quantity supplied.

Interest Rate Differential

The difference between the Australian interest rate and foreign interest rates.

Foreign Investment Income

Income earned by Australians from investments in foreign countries, affecting the demand for AUD.

Foreign Investment into Australia (FIA)

Investment made by foreign entities in Australian assets, increasing the demand for AUD.

Australian Investment Abroad (AIA)

Australian investors investing in foreign opportunities, increasing the supply of AUD.

Trade Balance

The difference between a country's exports and imports.

Net Exports

The difference between a country's total value of exports and total value of imports.

Foreign Investment

Flows of financial capital into and out of the Australian economy.

Foreign Liabilities

Something that you owe from Inflow of money into Australia.

Foreign Assets

Something that you own or represent outflows of money out of australia.

Foreign Direct Investment (FDI)

Investment with a minimum of 10% equity, giving the investor influence over the firm's operations.

Foreign Portfolio Investment (FPI)

Investment with less than 10% ownership, primarily for financial return and diversification.

Net International Investment Position (IIP)

Calculated by subtracting Australia’s foreign assets from Australia’s foreign liabilities.

Foreign Debt

The amount of money that Australian residents owe to the rest of the world.

Foreign Equity

Represents the extent to which foreign residents own Australian assets.

Net Foreign Liabilities

Net foreign debt (borrowing) and net foreign equity (foreign ownership).

Financial Flows

Associated with the buying and selling of financial assets (outflows and inv

Current Account

Trade in goods and services, income flows, and current transfers.

Capital and Financial Account

Investment flows, loans, and financial asset transactions.

Commodities

Raw materials or primary agricultural products that can be bought and sold.

Inflation

A general increase in prices and fall in the purchasing value of money.

Trade deficit

The amount by which the cost of a country's imports exceeds the value of its exports.

Capital outflow

The movement of assets out of a country.

Capital inflow

The movement of assets into a country.

Terms of trade

The ratio of an index of a country's export prices to an index of its import prices.

J-Curve Effect

The trade balance may worsen, as higher import values outweigh export gains.

Financial Account Surplus

A net inflow of foreign investment.

Financial Account Deficit

A net outflow of foreign investment.

I-S gap

Investment - Saving

Budget Deficit

Amount by which government spending exceeds taxation revenue.

Public Debt

Debt owned by the Government

Private Debt

Debt owned by private citizens.

Multiplier Effect

An increase in spending produces an increase in national income and consumption greater than the initial amount spent.

Real Exchange rate

Nominal exchange rate adjusted for relative price between countries.

Australian assets

Property, plant and equipment and shares in companies

Investment Needs

Level of financial capital needed to expand industry and productivity.

Costs of Foreign Investment

foreign investment into areas of critical infrastructure may create a national security risk e.g. 99 year lease of Darwin port to a Chinese Company

inward foreign investment is in the form of borrowing which adds to the stock of Australia’s foreign debt which could impose a burden on the economy - borrowing is irrelevant as long as it leads to a higher national income

interest payments on foreign debt have become the largest debit item in the income category of the current account

foreign investment in Aus real estate market can ‘crowd out’ domestic residents by increasing property prices - foreign investors cannot legally by existing residential property in Australia - foreign buyers only make up 1% of Aus real estate purchases

Australia’s credit rating can be affected if the level of borrowing increases - future borrowing could be subject to higher interest rates - the higher rates would reduce the amount of foreign borrowing which is a normal market reaction

a depreciation in the Australian dollar will increase the value of Australia’s foreign liabilities (incorrect) - denominated in Australian dollars so a change in exchange rate has a minimal effect on the outstanding debt

IIP Formula

IIP = FIA - AIA

Factors that affect demand for AUD

relative price levels

commodity prices

expectations and speculation

relative interest rates

World real GDP

Factors that affect supply of AUD

relative price levels

relative interest rates

aus preferences for foreign goods and services

aus real gdp

effect on CAD

depreciation = boosts CAB

appreciation = worsens CAB

effect on CAF

depreciation = deter FIA but can make aus assets cheaper and more attractive

appreciation = improves CAF - can attract capital inflows due to expectations of currency strength and higher returns in AUD terms

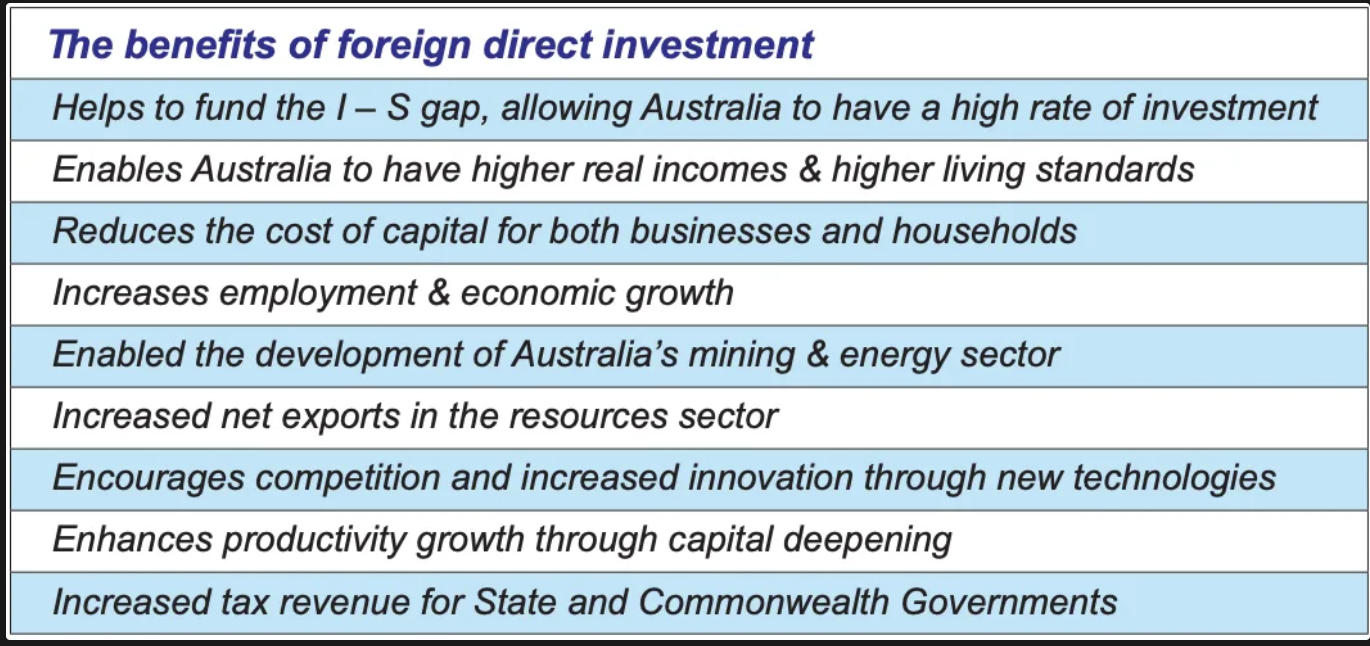

benefits of foreign investment