3.3 Revenue and profit

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Total revenue

The revenue received by a firm from its sales of a good or service (quantity sold multiplied by the price)

Average revenue

The average revenue received by the firm per unit of output (total revenue divided by the quantity sold)

Marginal revenue

The additional revenue received by the firm if it sells an additional unit of output

Profit

The difference between the total revenue received by a firm and the total costs that it incurs in production

Profit = total revenue − total cost

Loss

When total revenue is smaller than total costs

Accounting profit

Profit made by a business based on explicit costs incurred but excluding opportunity cost

Normal profit

The return needed for a firm to stay in a market in the long run (making back on all accounting costs + opportunity costs)

Supernormal profit

The profit above normal profits

Marginal revenue formula

Change in total revenue divided by change in quantity sold

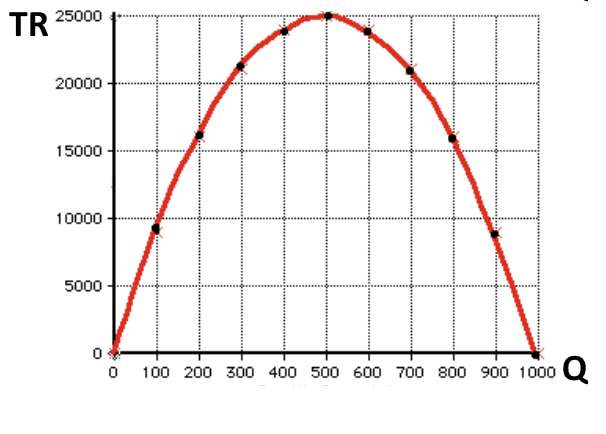

Total revenue curve

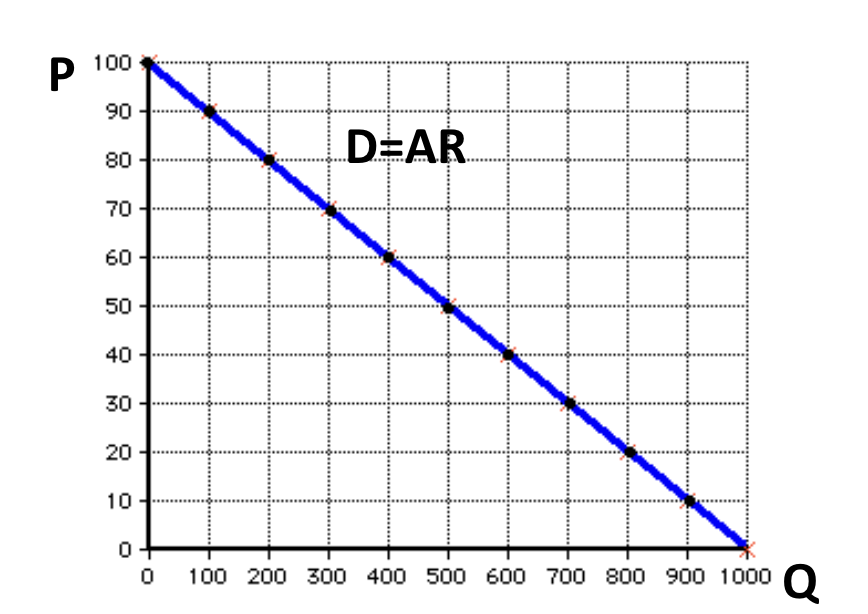

The demand curve and revenue

AR = TR/Q = P

The Demand curve tells at what price Q can be sold for

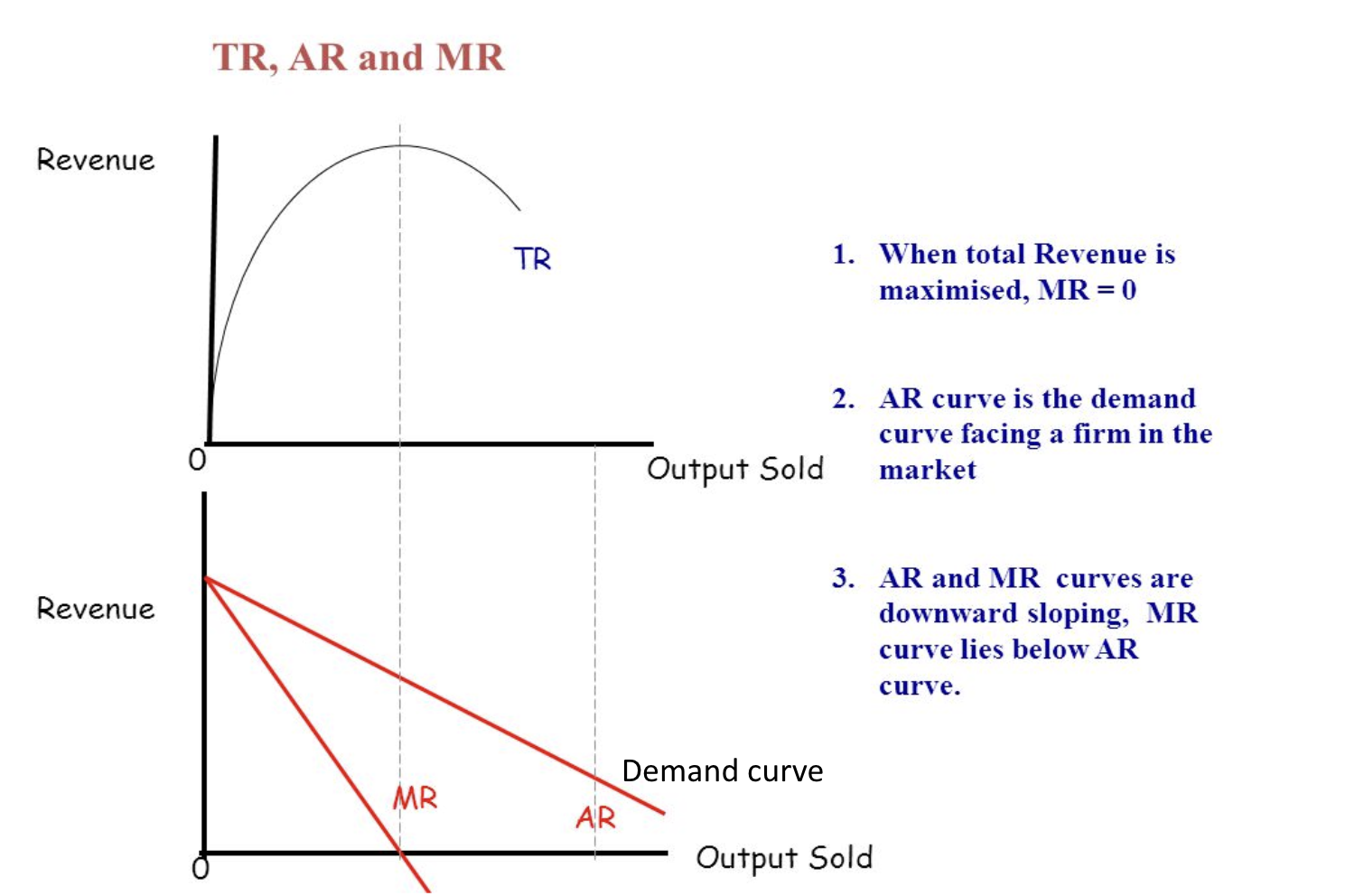

Revenue curves

MR is less than AR because the price changes as the quantity sold changes

Marginal revenue diminishes with each additional unit and will always be equal to or less than average revenue

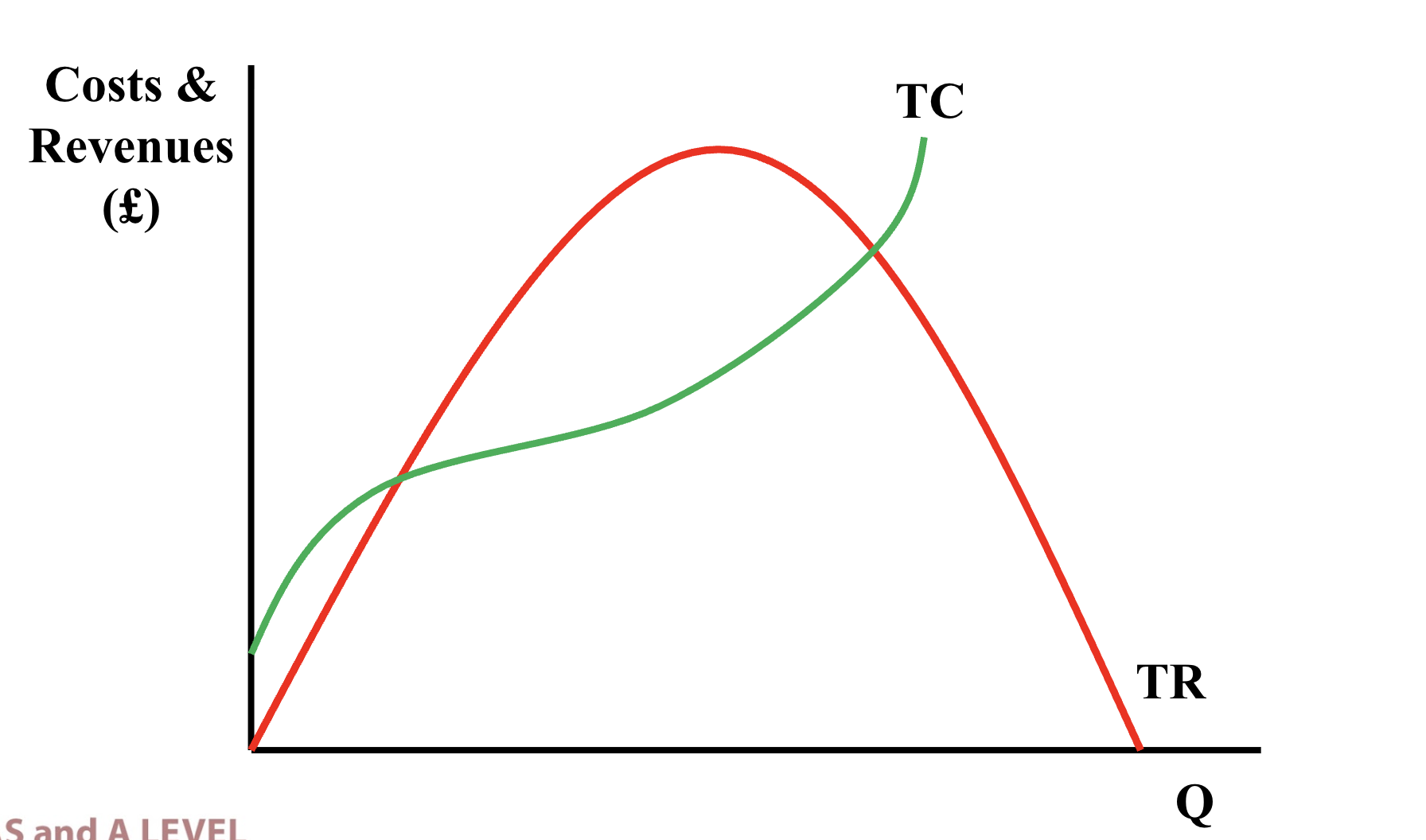

Total costs and total revenue curve

To find the quantity if sold that will maximise profits, find where the difference between TR and TC is greatest on the curve

You can also find the quantity at which marginal revenue = marginal costs (method more commonly used)

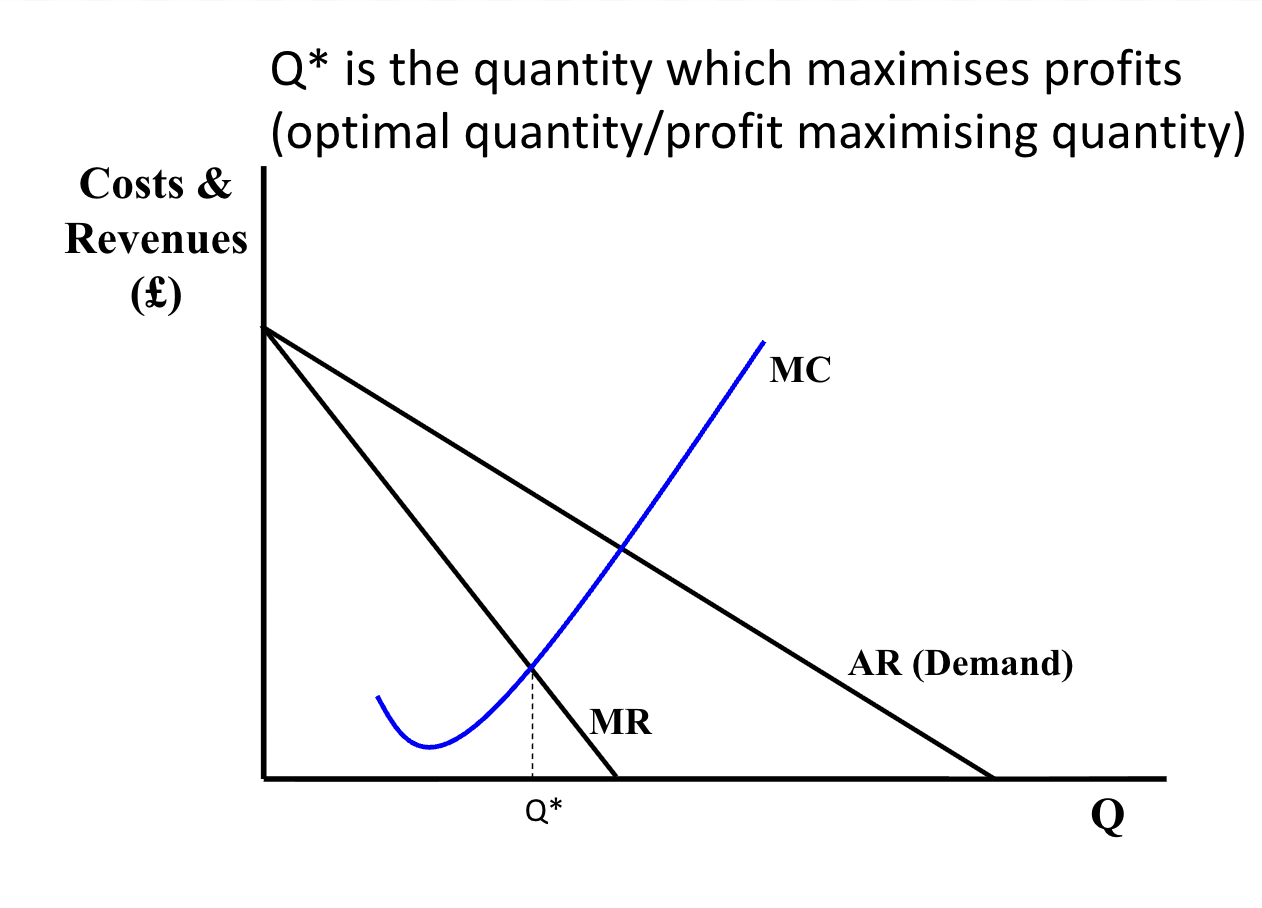

Profit maximising quantity curve

Q* is the quantity which maximises profits (where MR = MC)

P* is the price which corresponds to the optimal quantity Q*

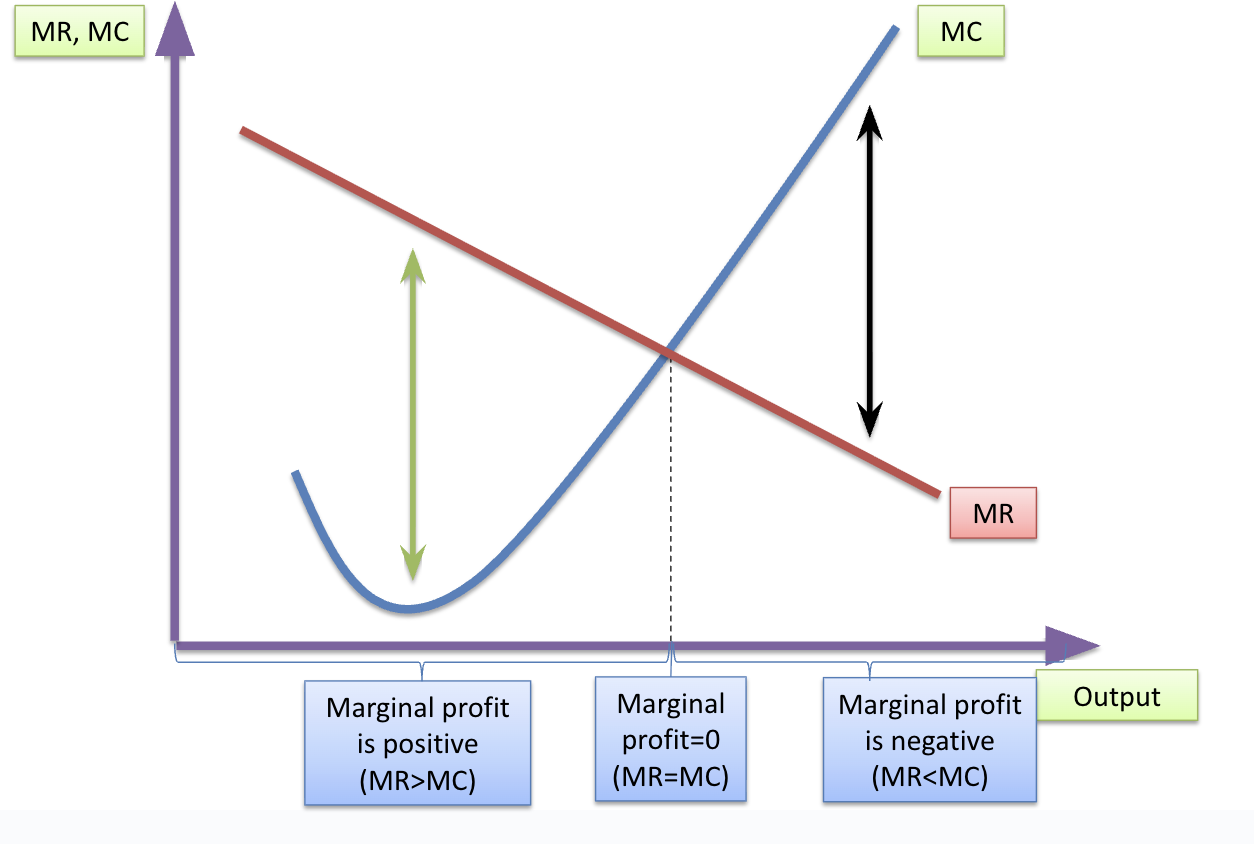

Marginal Profit

Marginal profit is the increase in profit when one more unit is sold

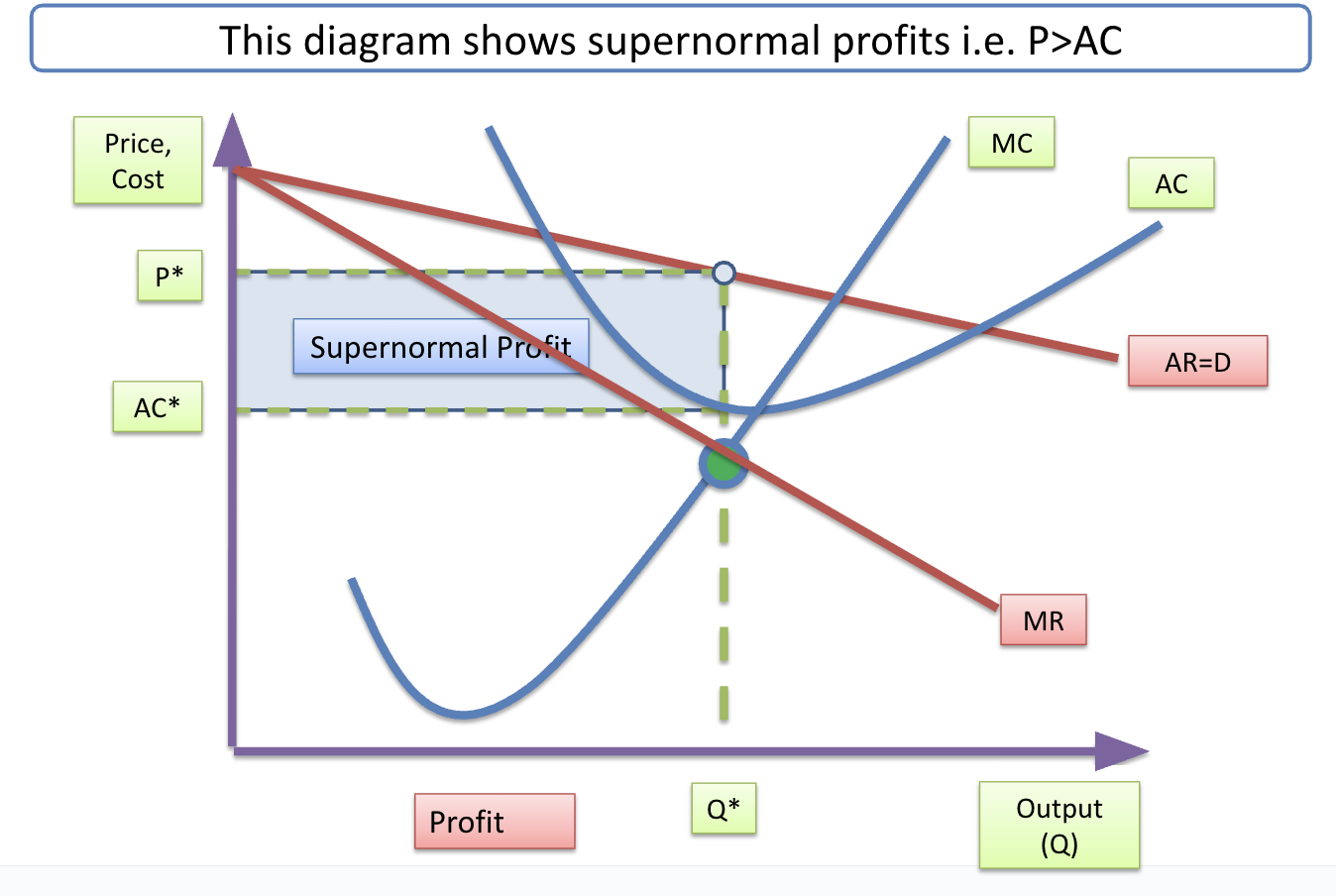

Supernormal profit curve

Profit achieved in excess of normal profit

Supernormal profits are made when P > AC

When firms are making supernormal profits, there is incentive for other producers to enter a market to acquire some of this profit

Sub-normal profit

This is profit less than normal (P < AC)

Disincentive for firms to enter the market

The Importance of Profit

Profit is an important objective of most but not all firm

Finance for capital investment and research: Retained profits are a key source of finance for businesses undertaking capital investment + funds for acquisitions

Market entry: Large/rising supernormal profits send signals to other producers within a market

Demand for and flow of factor resources: Resources flow where the risk-adjusted rate of profit is highest

Signals about health of the economy: Rising profits might reflect improvements in supply-side performance. They are also the result of higher levels of aggregate demand for example during an economic recovery.