2. How the Macroeconomy works (AS)

1/151

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

152 Terms

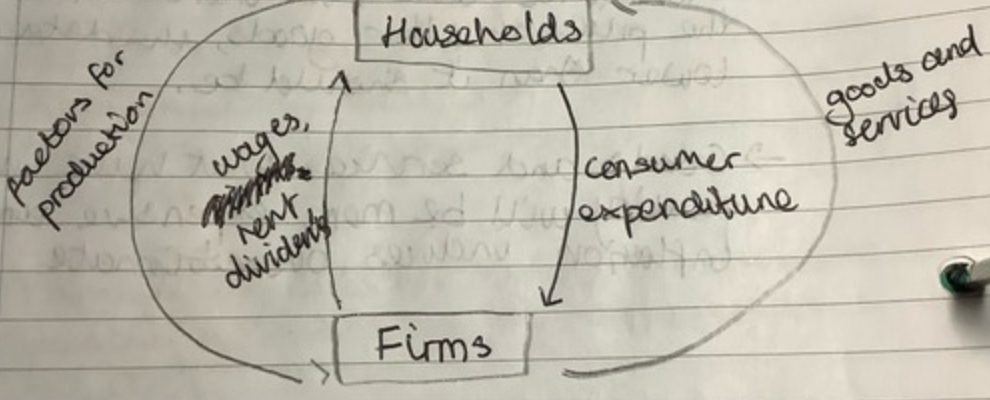

The circular flow of income

How money, goods and services circulate within an economy between households, firms and the government

Economic agents

Groups that play a role in the economy by producing, buying or selling

Examples of economic agents

Firms, governments, households/consumers, workers

Circular flow of income model + assumptions

Model 1 (Closed Economy) assumptions:

No foreign trade

No government

All income and revenue spent

Factors of production (resources)

Land, Labour, Capital, Enterprise

Factors of production rewards

Land --> Rent.

Labour --> Wages.

Capital --> Interest.

Enterprise --> Profit.

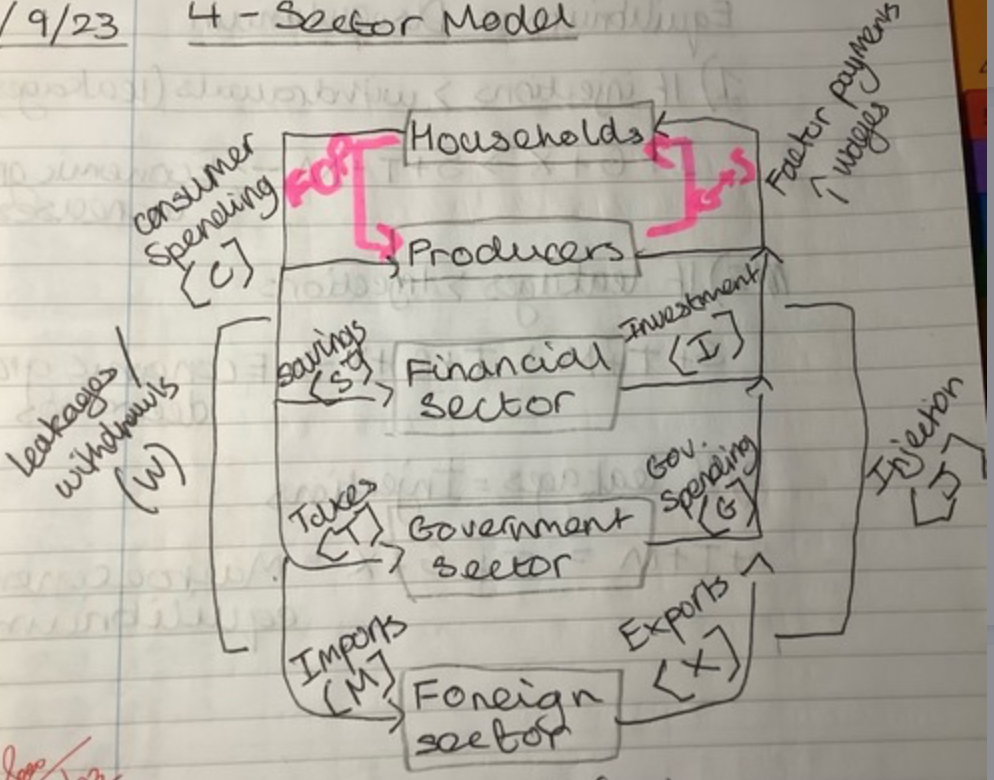

4 sector model

Households, firms, financial sector, government sector

Equilibrium: S + T = I + G

Aggregate Demand

the total demand for final goods and services in an economy at a given time

Aggregate Supply

the total amount of goods and services in the economy available at all possible price levels

AD is the same as

National income which also = Real GDP

AD=

C+I+G+(X-M)

C+I+G+(X-M)

consumption + investment + government spending + (exports - imports)

(X - M) or (Exports - Imports)

Net exports

If injections > leakages

I + G + X > S + T + M —> Economic growth increases

If Leakages > Injections

S + T + M > I + G + X —> Economic growth decreases

If leakages = injections

S + T + M = I + G + X —> Macroeconomic equilibrium

S, T, M

Savings, Taxes, Imports (Leakages)

I, G, X

Investment, Government spending, Exports (Injections)

Living standards/ Standard of living

The amount of goods and services available to produce in a country which measures material wealth

Two most common ways to measure standard of living

1) Real GDP per capita

2) Gross National Income (GNI)

Limitations of GDP per capita as a measure of standard of living (Give 3)

-Doesn't count unpaid work such as family care, housework and volunteering

-Doesn't effectively measure pollution, safety and health

-Assumes production rewards are divided equally among everyone

-Ignores distribution of income

-Ignores changes in working hours + leisure hours + working conditions

-Rising GDP may be unsustainable, negative externalities (pollution)

-Ignores improvements in life expectancy

-Defensive expenditures do not improve SofL

-Ignores innovation and improvements in product quality

-Ignores non-monetary factors: freedom of speech, corruption, gender equality, crime rate, homelessness, shadow economy

-Regional inequalities

-Doesn't measure deprecation of capital

-Doesn't measure debt value

-Doesn't measure free services on the web

Shadow economy

illicit economic activity existing alongside a country's official economy, e.g. black market transactions and undeclared work.

3 other ways to measure Standard of Living/Quality of Life

-Human development index (HDI)

-Purchasing Power Parity (PPP)

- Gallup's standard of living (U.S.)

- Gross National Income (GNI)

Gross National Income (GNI)

The value of the output of goods and services produced in a country in a year, including money that leaves and enters the country

Which country has the highest standard of living, using different measures.

- GDP per capita=Luxembourg

- World Bank=Macao (China)

- U.N. Development Index=Norway

Why is GDP a useful measure of Standard of Living (Give 3)

-Quantitative

-Internationally agreed standards

-National income data helps to make cross-country comparisons

- GDP can be used to satisfy wants and needs because increase in GDP=increase in disposable income

-Indicates when a country is materially better or worse off in terms of jobs and incomes

-Good measure of production

-Increase in GDP= better education, healthcare and environmental protection

Income as a measure of standard of living

-GNI per head at PPP

-GNI is a better measure as it reflects spending power

Health as a measure of standard of living

-Life expectancy at birth

-Proxy measure, e.g. number of doctors, sanitation, etc.

Education as a measure of standard of living

-Expected mean years of schooling for children and actual mean years of schooling for adults.

-Previously "adult literacy rate"

National income

Measures the monetary value of the flow of output of goods and services produced in an economy over a period of time.

Most commonly used measure of national income is

GDP

Gross National Income (GNI) measures

The final values of incomes flowing to UK owned factors of production, whether they are in the UK or overseas

GNI=

GDP + Net property income from overseas

Primary income can come from overseas investments such as

Interest, profits and dividends

The income method as a measure of national income

Adding up all the money earned by people and firms in producing this year's output, wages and salaries+ rent+ profits+ interest

The output method as a measure of national income

Combined value of the new and final output produced in all economy sectors: manufacturing, financial services, transport, leisure and agriculture

The expenditure method as a measure of national income

A method used to measure the value of aggregate output of an economy, which adds up all spending on final goods and services produced within a country within a given time period. C+I+G+(X-M)

Purchasing Power Parity (PPP)

How many units of one country's currency are needed to buy the same basket of goods and services as can be bought with a given amount of another currency.

Example of PPP

If Coca Cola price in UK was £1, and $1.50 in U.S. then exchange rate=1.50 (US price/UK price)

Aim of PPP

To make comparisons between two currencies

PPP is used by

World bank, United Nations, European Union

The Big Mac index

Tool for calculating purchasing power parity that compares prices of a Big Mac throughout the world. Extent to which market exchange rate result in goods costing the same

When was the Big Mac index published

1986, the Economist

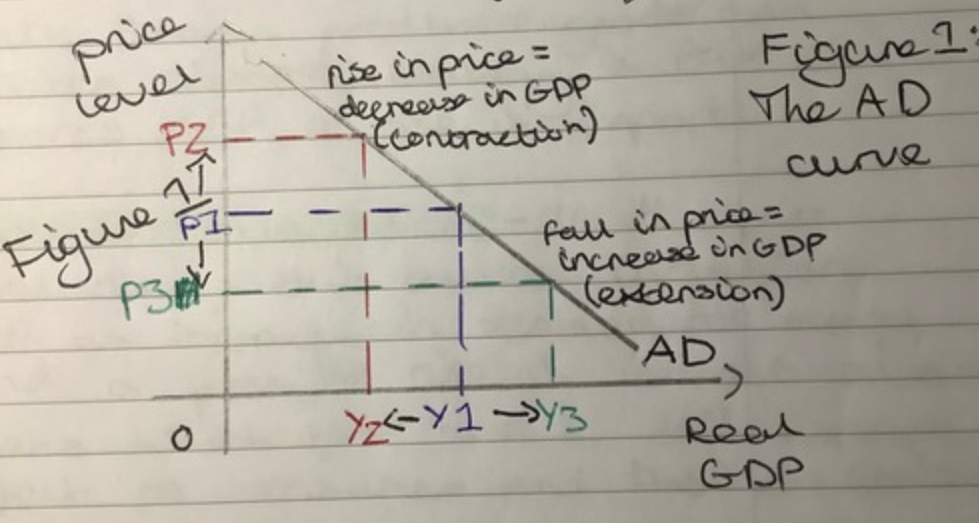

AD Curve

The AD curve shows

the quantity of all goods and services demanded in the economy at any given price level

AD-AS model shows the relationship between

Price level and real GDP

Why does the AD curve slope downward?

wealth effect, interest rate effect, exchange rate/trade effect

AS Curve is

Upward sloping

Wealth effect

As price level rises, the real value of income falls and consumers are less able to buy what they want or need.

Exchange rate effect/trade effect

A rise in the price level of country x could make foreign produced goods and services cheaper, causing a fall in exports and a rise in imports

interest rate effect

if the price level rises, causes inflation and an increase in demand for money and a possible rise in the interest rates or loans which then has a deflationary effect on aggregate demand

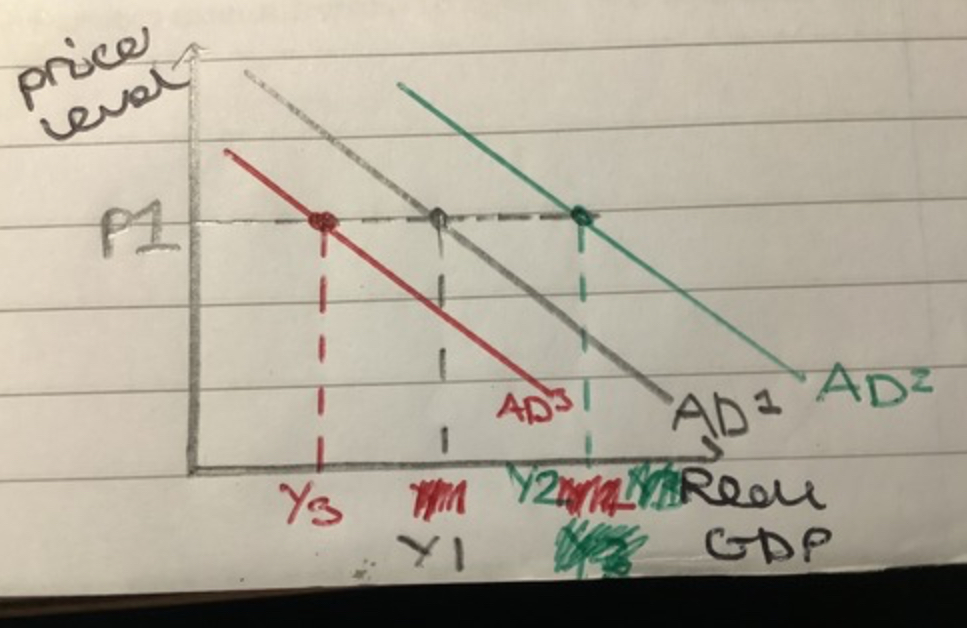

Shift in AD

Increase moves from AD1 to AD2, outward shift to the right

Decrease moves from AD1 to AD3, inward shift to the left

AD curve is

Downward sloping

Determinants of consumption (C) (Give 3)

Real disposable income - income tax

Employment and job security

Interest rates and availability of credit

Household wealth and indebtedness

Consumer confidence (linked to job prospects and level of unemployment

Asset prices (the wealthier people are, the more likely they are to spend money)

Increase in GDP - consumption chain of analysis

Increased consumption, higher disposable income, AD increases

Stock market crash - consumption chain of analysis

Less consumer spending, low confidence, decreases AD

Increase in all income tax rates - consumption chain of analysis

Lower consumer spending, lower disposable income, AD decreases

Increase in funds available for lending by banks - consumption chain of analysis

More willing to lend, Increase consumer spending, AD increases

Low consumer confidence - consumption chain of analysis

Less consumer spending, hold off purchases because concerned about future income losses, decreases AD

Decrease in interest rates - consumption chain of analysis

Increases consumer spending, lower cost of borrowing and reward for saving, AD increases

Increase in benefits payments - consumption chain of analysis

Increased consumer spending, higher disposable income for benefit recipients, AD increases

Deregulation of rules around credit card limits - consumption chain of analysis

Increased consumer spending, lend larger amounts, AD increases

Over 8 months of deflation - consumption chain of analysis

Fall in consumer spending, hold off on purchases due to expecting further deflation, AD decreases

Rise in house prices - consumption chain of analysis

Increased consumer spending, higher confidence due to higher wealth, Increases AD

Investment (I)

The addition of capital stock to the economy or expenditure by firms on capital.

Examples of investment

-GM spends $250 million to build a new factory in Michigan

-New factories and other buildings for machinery or research+development

What do firms do when they can't afford investment

Borrow

What is capital investment vital to

Long-run economic growth

investment in human capital

Investment in education and training of workers (apprenticeship)

gross investment

the total amount spent on purchases of new capital and on replacing depreciated capital

Depreciation of capital

the decrease in the value of a nation's capital stock over time

net investment=

gross investment - depreciation

Gross investment > deprecation

Net investment positive

Depreciation > Gross investment

Net investment negative

Factors affecting investment

- Interest Rates

- Real disposable incomes

- Capacity utilisation - full employment

- Profit levels

- Corporate tax rates

- Access to credit

- Price of capital equipment

- Expectations of future demand

Government spending (G)

Spending by the public sector (government) on goods and services such as education, healthcare and defence

Total UK gov spending in 2015

£745bn, 43% of GDP

Increased gov spending leads to

Increased AD, high short term growth, potential inflation

Current spending (public services)

Salaries paid to NHS workers, drugs used in healthcare, road maintenance budget, army logistics supplies

Capital spending (public infrastructure)

Construction of new motorways bridges and airports, new NHS equipment, flood defence schemes, extra defence equipment

Transfer payments (welfare made available through social security system

Job seekers allowance, child benefit, state pension, housing benefit, income support

Public Sector Net Cash Requirement (PSNCR)

The amount that the UK government needs to borrow every year to pay for public spending when its expenditure is more than income

Factors influencing levels of government spending

Politics, fiscal policy measures, cost of borrowing, level of economic activity, population/demographic changes, trade openness

Net exports positive

trade surplus

Net exports negative

trade deficit

The UK has had a trade XXX since XXX

Deficit, 2000

Exports are

goods produced domestically and sold overseas, represent an injection into circular flow of income, boost AD

Imports are

Purchasing foreign foods rather than domestic goods, purchased overseas, leakages from the circular flow of income

Factors influencing net exports

High levels of economic growth, increase in real disposable income, exchange rate, inflation rate, increase in productivity, degree of protectionism, international competitiveness

The multiplier effect

Injections of new demand for goods and services into the circular flow of income stimulate further rounds of spending.

Who founded the multiplier effect

John Maynard Keynes

Multiplier=

1/(1-MPC)

Marginal Propensity to Consume (MPC)

Measures the degree to which a consumer will spend or save in relation to a raise in pay

Change in national income=

Value of multiplier (k) x Change in injections

MPC=

change in consumption/change in income

If an individual gains an extra £10 and spends £7.50, then the MPC will be

7.5/10 = 0.75

Marginal Propensity to Save (MPS)

Change in savings following a change in income

MPS=

change in saving/change in income

MPC+MPS=

1

Average propensity to consume (APC)=

total consumption/disposable income