PROJECT MANAGEMENT 2

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

Strategy

is making a decision how the organization will compete its rivals in the industry where it is participating

It is vital for success of the project to be parallel with strategic goals of the organization

Strategy Management

is responding to changes in the external environment for competitive position

A key requisite for survival to always keep updated to external changes through continuous scan of the political-legal, economic, socio-cultural, technological, and natural (PESTN) environment of the organization

Project Management Maturity

is the progressive advancement of project and multi-project management proficiency in approach, methodology, strategy, and decision-making process.

Project Maturity Model

reflects that maturity is a continuous process of improvement via identifiable incremental steps.

High Maturity

Institutionalized, seeks continuous improvement

Moderate Maturity

Defined practices, training programs organizational support

Low Maturity

Ad hoc process, no common language, little support

Project Selection

the process of appraising a project or groups of projects and afterward deciding to execute some of them in order to realize the objectives of the organization.

It appraises each project proposal and decides on the premier priority project/s for more analysis

• Follows a four-stage process namely identification of project/s, evaluation and prioritizing project/s selection and initiation of project/s and review of projects.

1 Identify projects that support the strategy

2 Evaluate and prioritize projects

3 Select and initiate projects

4 Review projects regularly

4 GENERIC PROCESS OF PROJECT SELECTION

FIRST STEP

Calls for the naming of the project concepts or ideas with a written brief description of a project

SECOND STEP

Each project is evaluated using different criteria and models and the outcomes become the basis of prioritization

THIRD STEP

Selection and initiation that logically follows evaluation and prioritization focusing mainly on the delicate decision of staffing the project teams

FOURTH STEP

A regular review of project/s which is imperative to find out if they are still in-line with the strategy of the firm

model

offers an abstraction of a more intricate reality \

• A fractional version of the certainty it intended to replicate and cannot produce an optimal decision

NONNUMERIC

Do not utilize numbers as inputs; older and simpler

NUMERIC

Make use of numbers to measure both objective and subjective criteria

Sacred Cow

A project recommended by a senior and influential official in the organization. "Sacred" in a sense that it will be maintained until the boss personally, identifies the idea as a failure and terminates it

Operating Necessity

A project is obligatory to keep the system operating; does not necessitate a great extent of formal evaluation

Competitive Necessity

A project which is founded on a desire to preserve the company's competitive position in the market 4. Product Line Extension A project to develop and distribute

Product Line Extension

A project to develop and distribute new products evaluated in the level to which it fits the firm's present product line, fill a gap, strengthens a weak link, or extends the line in a fresh, advantageous direction

Comparative Benefit Model

Often used to select from a list of projects that are complex, difficult to assess and often non comparable. The one with the most benefit to firm is selected.

. Sacred Cow\

Operating Necessity

Competitive Necessity

Product Line Extension

Comparative Benefit Model

5 NONNUMERIC MODELS

REALISM

The model should mirror the reality of manager’s decision situation together with the various objectives of both the firm and its managers

EASE OF USE

The model should be realistically convenient, not require to carry out, and be simple to employ and comprehend

CAPABILITY

The model should be complicated enough to deal with numerous time periods, simulate different situations both inside and external to the project and optimize the decision

COST

The data gathering and modelling costs should be low in relation to the cost of the project and must certainly be less than the probable benefits of the project.

FLEXIBILITY

The model should offer convincing outcomes among the conditions that the firm may experience

EASY COMPUTERIZATION

The model should be simple and suitable to collect and accumulate the information in a computer database, and to maneuver data in the model by using a commonly accessible, standard computer package programs

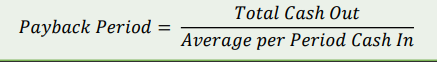

Payback Period

Measures the time it will take to recover the project investment Formula:

A shorter payback period, the better

Payback Period Interpretation

A shorter payback period, the better

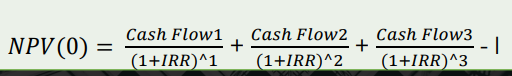

. Internal rate of Return interpretation

The discount rate which equates the present value of the future cash flows of an investment with the initial investment. It is the discount rate at which the net present value of an investment becomes zero.

Internal rate of Return

A project should only be accepted if its IRR is NOT less than the target internal rate of return. When comparing two or more mutually exclusive projects, the project having highest value of IRR should be accepted.