4.1 national income

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

The multiplyer

The idea that an initial injection can result in a rise in national income greater than this injection

Marginal propensity to consume

The proportion of additional income that is spent on goods and services in the economy

Marginal propensity to save

The proportion of additional income that is saved and thus leaks out of the circular flow

Marginal propensity to import

The proportion of additional income that is spent on imports

MPC formula

Δc/Δy

MPS formula

1-MPC

MPM formula

Δm/Δy

Formula for the multiplyer

1/(mps+mpm+mpt)

Aggregate demand

The total demand for an economies goods and services at a given price level in a given time

Aggregate supply

The total output that producers in an economy are willing and able to supply at a given price level in a given time

Formula for aggregate demand

GDP

Factors that influence consumption

Level of income

Availability of credit

Interest

Income tax

Factors that influence investment

Cost of capital goods

Business people’s expectations

Government expenditure (e.g. grants)

State of technology

Factors that influence exports

Level of incomes abroad

Exchange rates

Government incentives

Competitiveness

Factors that influence imports

Availability of goods

Price of goods

Levels of income

Exchange rates

Factors that affect the rate of saving

Future expectations

Price levels

Interest rates

Demographics

Effects an increase in savings might have

Reduce spending

Reduce inflation

Exchequer: decreased VAT but increased DIRT

Economic growth

A real increase in GDP over a period of time

Recession

Two consecutive quarters of negative economic growth

Positives of economic growth

Increased employment

Improved exchequer

Improved standard of living

Decreased emigration

Negatives of economic growth

Inflationary pressure

Use of scarce resources (e.g. fossil fuels)

Increased demand for imports

Uneven distribution of wealth

Economic consequences of a recession

Reduced consumer spending

Reduced standards of living

Decline in investments

Reduced government revenue

Uses of national income statistics

Comparing the standard of living in different countries

Assist the government in formulating economic policy

Determine EU contributions/benefits

Limitations of national income statistics

Population change is not considered

Social cost (e.g. increased pollution)

Shadow economy is not taken into account

Nature of the goods produced is not considered (e.g. goods made for war)

NFIA

The difference between incomes earned by foreign factors of production in Ireland and sent abroad Vs income earned by Irish factors of production abroad and returned to Ireland

GDP

Value of all goods and services produced by Irish and foreign owned factors of production in the domestic economy

GNP

Value of all goods and services produced by Irish-owned factors of production in the domestic economy and abroad

GNI

The total income that is earned by Irish residents and businesses regardless of where that income is earned

GNI*

GNI without the influence of multinationals

GNDI

Income available to the nation for gross savings and for final consumption

Formula for GDP

Y = I+C+G+(X-M)

GNP formula

GDP - NFIA

GNI formula

GNP + EU subsidies - EU contributions

GNI* formula

GNI - Adjustments

GNDI formula

GNI* - foreign aid

Why is GDP higher

Repatriation

Remittance

Repayment of interest

Repatriation

When a company sends profits earned abroad back to its home country

Remitance

When an migrant sends money back to their country of origin

Shadow economy

All economic activity which goes unrecorded by national income statistics

Economics effects of the shadow economy

Loss of tax revenue

Decline in legitimate business

Increased government expenditure on enforcement

Standards of products declines

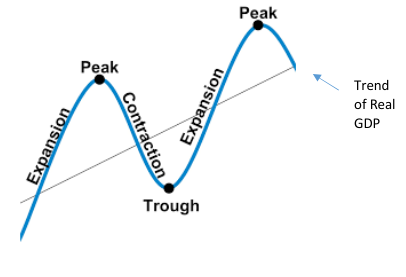

Business cycle

Features of a business cycle

Expansion

Peak

Recession

Depression

Trough

Recovery

Causes of a recession

Decline in consumer confidence

Decrease in investments

External shock

Inflation and deflation

Positive demand shock

A sudden increase in demand. This causes a shift of the AD curve to the right

Negative demand shock

A sudden decrease in demand. This causes a shift of the AD curve to the left

Positive supply shock

A sudden increase in output which causes a shift in the AS curve to the right

Negative supply shock

A sudden decreases in production causing the AS curve to shift to the left

Macro equilibrium

Where aggregate demand intersects with aggregate supply

At current market prices

This means GDP/GNP/GNI is measured using the prices that were in effect during the period measured, without adjusting for inflation

At factor prices

This means GDP/GNP/GNI is measured using the prices paid to factors of production

Expansion

Initial stages of economic growth driven by low intrest rates and prices.

This encourages consumers and firms to borrow.

This leads to increased investment and consumption

There are optimistic expectations

Peak

The economy is at its maximum capacity

Shortages occur for raw material and labour

There is inflation

Property bubbles develop

Central banks increase intrest rates leading to a fall in investment and consumption, lowering aggregate demand

Recession charectersists

A fall in real GDP for two consecuitive quarters.

The initial fall in aggregate demand fuels negative business expectations as there appears to be demand side shock

There is increased unemployment

Investment falls

Trough

Lowest point on the downward curve. It marks the point from which the economy begins to recover