Ch 0 Notes: Analyze Business Transactions

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

Accounting Transactions

- economic events that require recording in the financial statements

- occurs when assets, liabilities, or SE items change as a result of some economic event

Basic Accounting Equation

Assets = Liabilities + Stockholders' Equity

Transaction Analysis

- The process of identifying the specific effects of economic evens of the accounting equation

Dual Effect

- The accounting equation must always balance

- each transaction has a dual (double-sided) effect on the equation

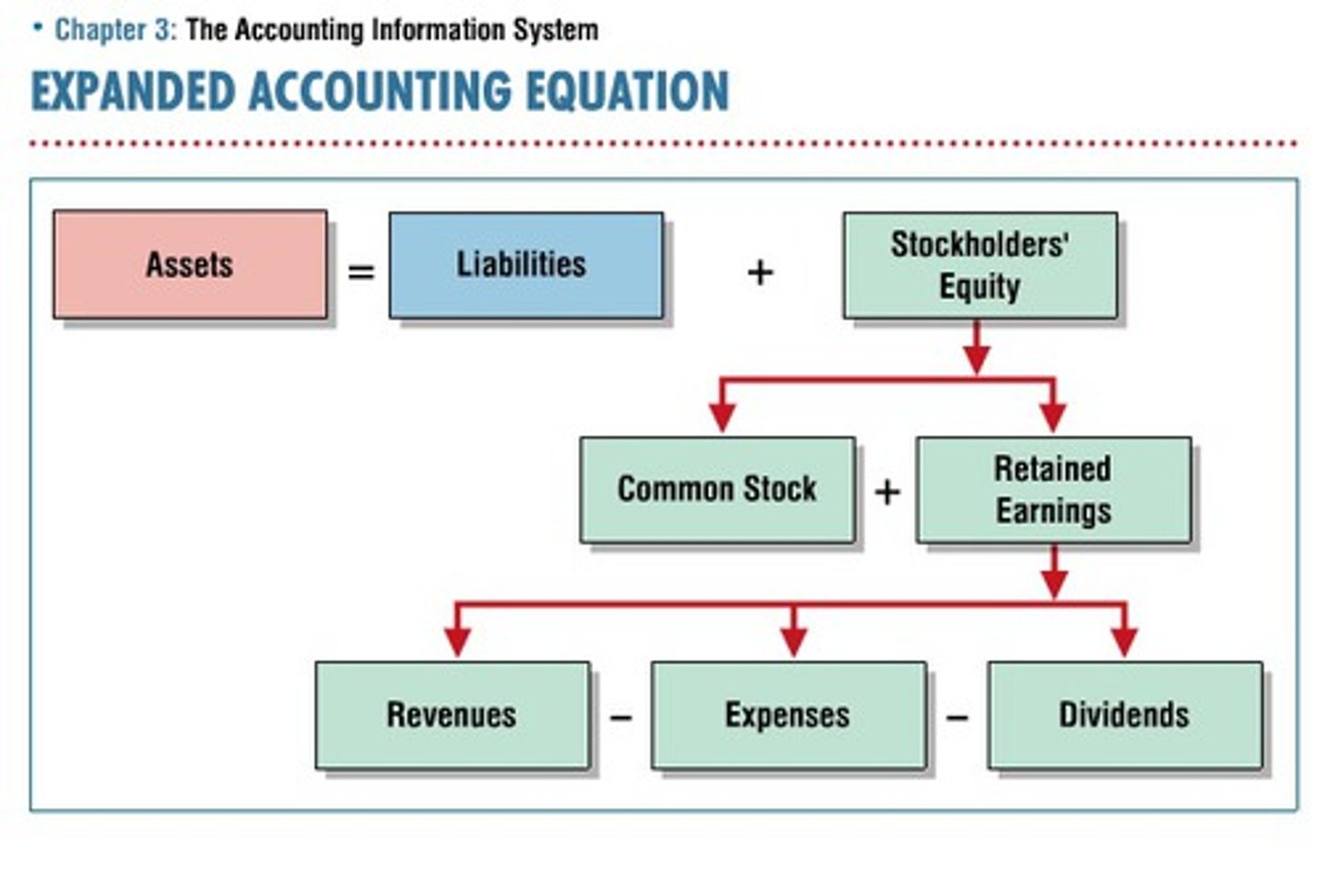

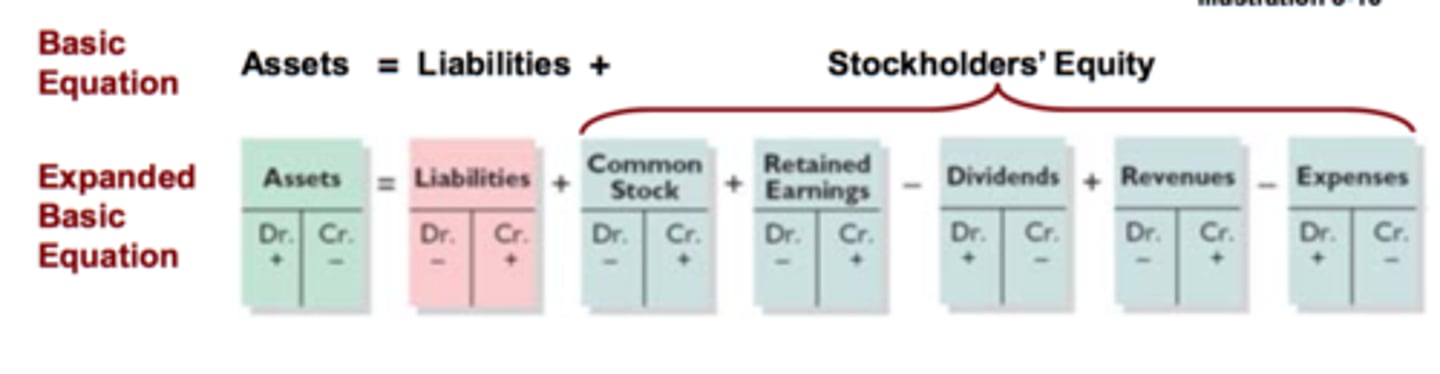

Expanded Accounting Equation (also included how the aspects of SE are affected)

- Common stock is affected when the company issues new shares of stock in exchange for cash

- Retained Earnings is affected when the company recognizes revenue, incurs expenses, or pays dividends

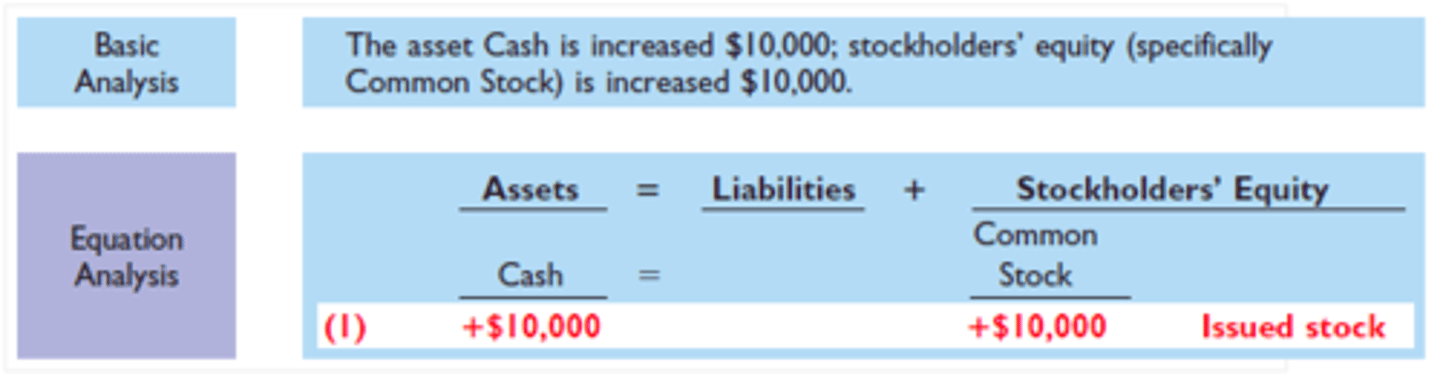

Event (1). Investment of Cash by Stockholders.

On October 1, cash of $10,000 is invested in the business by investors in exchange for $10,000 of common stock

Event (2). Note Issued in Exchange for Cash.

On October 1, Sierra borrowed $5,000 from Castle Bank by signing a 3-month, 12%, $5,000 note payable

Basic Analysis: The asset Cash is increased $5,000; the liability Notes Payable is increased $5,000

Total assets are now $15,000, and liabilities plus stockholders' equity also total $15,000.

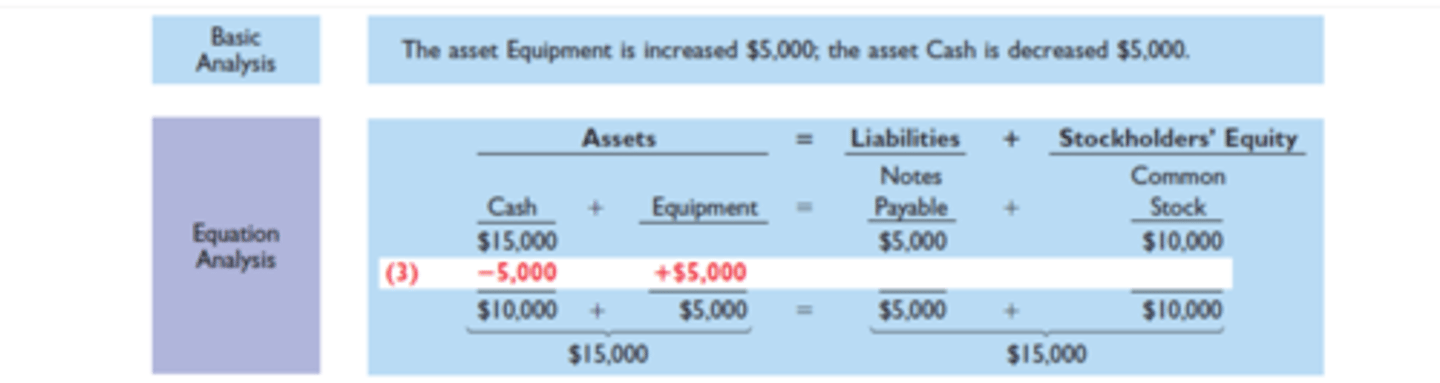

Event (3). Purchase of Equipment for Cash.

On October 2, Sierra purchased equipment by paying $5,000 cash to Superior Equipment Sales Co

Event (4). Receipt of Cash in Advance from Customer.

On October 2, Sierra received a $1,200 cash advance from R. Knox, a client. Sierra received cash (an asset) for guide services for multi-day trips that it expects to complete in the future

Although Sierra received cash, it does not record revenue until it has performed the work. In some industries, such as the magazine and airline industries, customers are expected to prepay. These companies have a liability to the customer until they deliver the magazines or provide the flight. When the company eventually provides the product or service, it records the revenue.

Since Sierra received cash prior to performance of the service, Sierra has a liability for the work due.

- Basic Analysis: The asst Cash is increased $1,200; the liability Unearned Service Revenue is increased $1,200 because the service has not been performed yet. That is, when an advanced payment is received, unearned revenue (a liability) should be recorded in order to recognize the obligation that exists

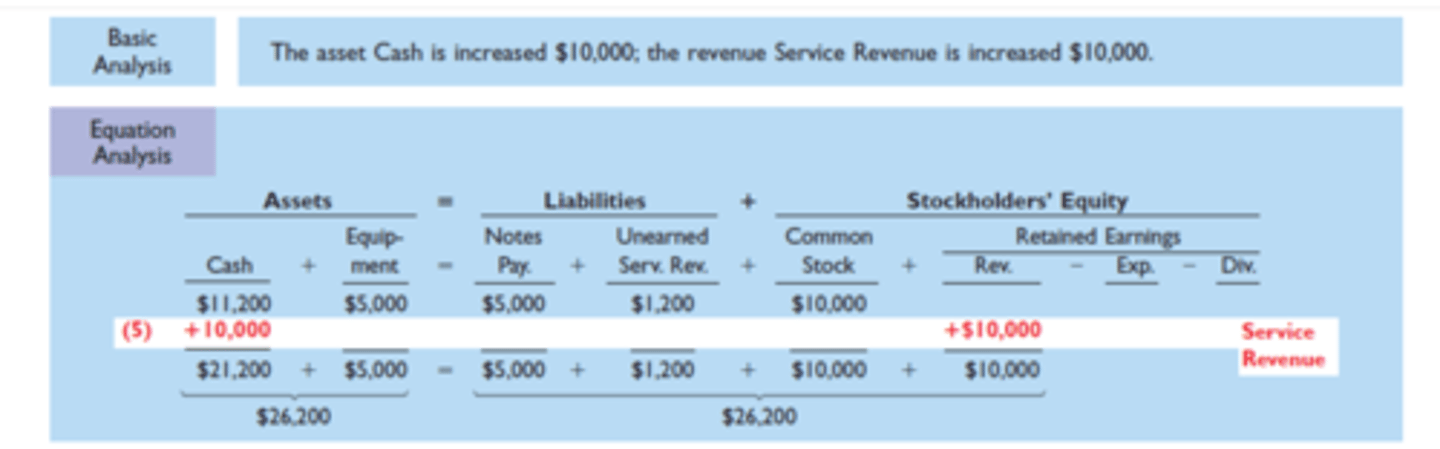

Event (5). Services Performed for Cash.

On October 3, Sierra received $10,000 in cash (an asset) from Copa Company for guide services performed for a corporate event. Guide service is the principal revenue-producing activity of Sierra.

- Revenue INCREASES stockholders equity

Often companies perform services "on account." That is, they perform services for which they are paid at a later date. Revenue, however, is recorded when services are performed. Therefore, revenues would increase when services are performed, even though cash has not been received. Instead of receiving cash, the company receives a different type of asset, an account receivable. Accounts receivable represent the right to receive payment at a later date. Suppose that Sierra had performed these services on account rather than for cash.

-Later, when Sierra collects the $10,000 from the customer, Accounts Receivable decreases by $10,000, and Cash increases by $10,000.

Debit vs Credit

debit left side, credit right side

double-entry accounting

- the two sided effect of each transaction

- debits equal credits

- helps ensure accuracy and detect errors

Normal Balances

DEALOR

- RE has has CR NB

Subdivisions of SE are in various places in the financial statements

- CS and RE: in SE section of BS

- Dividends: on RE statement

- Rev and Exp: on IS

- Div, Rev, and Exp are transferred to RE at end of the period

summary of debit/credit rules

Three basic steps in the recording process

1. Analyze each transaction for its effects on the accounts.

2. Enter the transaction information in a journal (book of original entry).

3. Transfer the journal information to the appropriate accounts in the ledger (book of accounts).

- begins with a transaction. Evidence of transaction comes from a source doc. Evidence is analyzed to determine effect it has on specific accounts/ Entered into a journal and then to a ledger

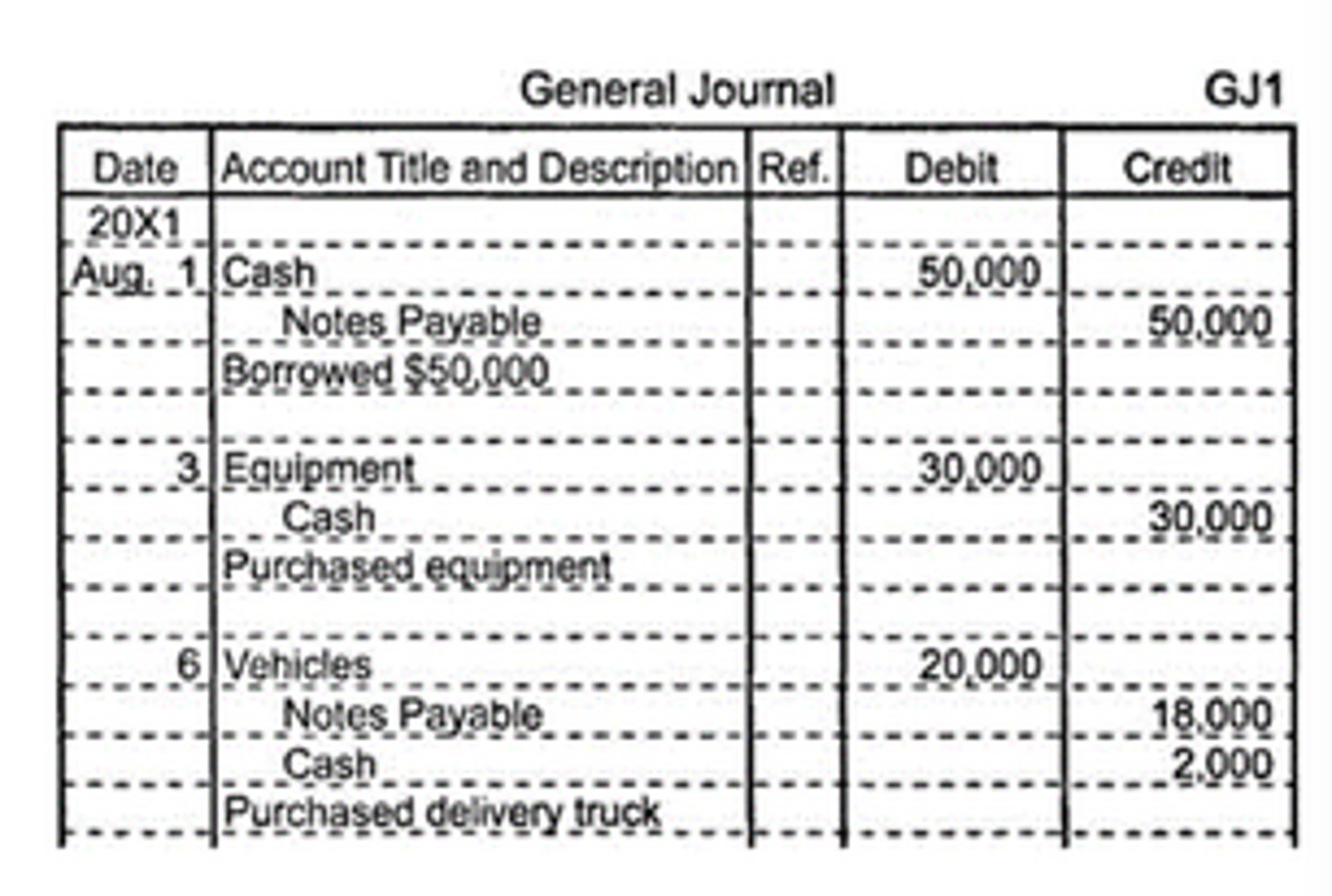

General Journal

- discloses in one place the complete effect of a transaction

- provides a chronological record of transactions

- helps prevent or locate errors bc the dr and cr amounts can be readily compared

- Features: date, account titles, amounts, brief explanation

General Ledger

- all assets, liabilities, se, rev, and exp accounts (kinda like what we do with t accounts)

Chart of Accounts

a list of accounts used by a business

Posting

the procedure of transferring journal entry amounts to the ledger accounts

- accumulates the effects of journalized transactions in the individual accounts

- two steps:

1. in the ledger, enter in the appropriate columns of DR account(s) the date and dr amount shown in the journal

2. do the same for the credited account(s)

Purpose of transaction analysis

to identify the type of account involved and to determine whether a debit or credit is required

Trial Balance

a list of accounts and their balances at a given time

- prepared at end of period

- proves dr equal cr mathematically

- can uncover errors in journalizing and posting. and helps prepare financial statements

Limitations of a Trial Balance

- does not prove that all transactions have been recorded or that the ledger is correct

- TB may balance even when any of the following occurs:

1. A transaction is not journalized

2. A correct journal entry is not posted

3. A journal entry is posted twice

4. Incorrect accounts are used in journalizing or posting

5. Offsetting errors are made in recording the amount of a transaction

Periodicity Assumption

An assumption that the economic life of a business can be divided into artificial time periods.

- month, quarter of year

Revenue Recognition Principle

The principle that companies recognize revenue in the accounting period in which the performance obligation is satisfied.

Expense Recognition Principle

Match expenses with revenues in the period when the company makes efforts to generate those revenues

Accrual vs Cash Basis

- Accrual: transactions that change a company's financial statements are recorded in the periods in which the events occur, even if cash was not exchanged (recognizing rev when they perform a service even if cash was not received)

Cash: companies record rev at the time they receive cash -- No in accordance to GAAP

Adjusting Entries

- Ensure that rev recog and exp recog principles are followed

- necessary bc the TB might not contain up to date info

- some events are not recorded daily (use of supplies and wages)

- some costs are not recorded during the period bc the costs expire with the passage of time (equipment, rent, insurance)

- some items may be unrecorded (utility service bill that will not be received until the next accounting period

- every adjusting entry will include one IS and one BS account

Types of Adjusting Entries

deferrals and accruals

Deferrals vs Accruals

- Deferrals:

1. Prepaid Exp: exp paid in cash before they are used or consumed

2. Unearned Rev: Cash Received before services are performed

- Accruals:

1. Accrued Rev: Rev for services performed but not yet received in cash or recorded

2. Accrued Exp: Exp incurred but not yet paid in cash or recorded

Prepaid Expenses/Prepayments

expenses paid in cash before they are used or consumed

- asset is debited to show the service or benefit that the company will receive in the future

- prepaid exp are costs that expire either with the passage of time (rent and insurance) or through use (supplies)

- companies postpone the recognition of such cost expirations until they prepare financial statements and make adjusting entries to record the esp applicable to the current accounting period and to show the remaining amounts in the asset accounts

Prepaid Insurance

- the cost of insurance (premiums) paid in advance is recoded as an inc (dr) in the asset account prepaid insurance

- at the financial statement date, companies increase (dr) insurance exp and decrease (cr) Prepaid Insurance for the cost of insurance that has expired during the period

Depreciation Expense

- the period of service is referred to as the useful life of the asset

- bc a building is expected to be of service for many years, it is recorded as an asset, rather than an expense, on the date its acquired

- comp record it at cost as required by the historical cost principle

- to follow the exp during each period of the asset's useful life

- depreciation is the process of allocating the cost of an asset to expense over its useful life

***Depreciation is an allocation concept not a valuation concept. Depreciation does not attempt to report the actual change in the value of the asset

Accumulated Depreciation

A contra asset account representing the total depreciation taken to date.

- discloses the original cost of the equipment and the total cost that has expired to date

Book/Carrying Value

- difference btwn the cost of any depreciable asset and its related accumulated depreciation

Unearned Revenue

- companies record cash received before services are performed by increasing (cr) a liability account called unearned rev

- company has a performance obligation to transfer a service to one of its customers

- opposite of prepaid exp

cash advance

Accrued Revenues

- revenues for services performed but not yet recorded at the statement date

- may accumulate with the passing of time

- may also result from services that have been performed but not yet billed or collected

- an adjusting entry for accured rev is an increase to an asset and an inc to a revenue

Accrued Expenses

- exp incurred but not yet paid or recorded at the statement date

- adj entry: inc to exp and inc to a liability

Summary of Adjusting Entries

Prepaid expenses: Assets overstated. Expenses understated.

Dr. Expenses

Cr. Assets or Contra Assets

Unearned revenues: Liabilities overstated. Revenues understated.

Dr. Liabilities

Cr. Revenues

Accrued revenues: Assets understated. Revenues understated.

Dr. Assets

Cr. Revenues

Accrued expenses: Expenses understated. Liabilities understated.

Dr. Expenses

Cr. Liabilities

Adjusted Trial Balance

- shows the balance of all accounts, including those adjusted, at the end of the period

- proves the equality of the total dr and cr

- primary basis for the preparation of financial statements

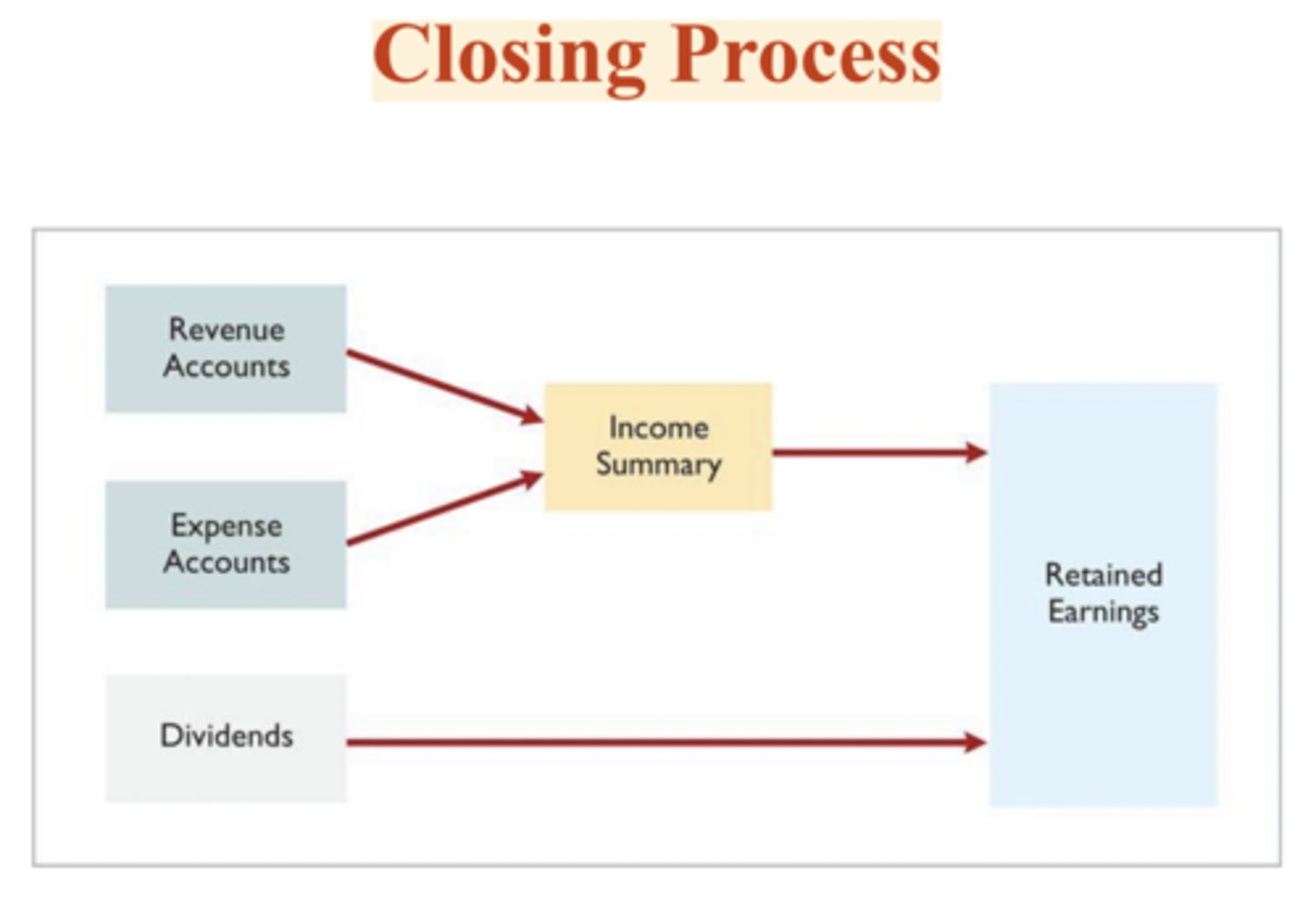

Closing the Books: Temporary (Nominal) or Permanent (Real) Accounts

- Temp: rev, exp, and div

- Per: all BS accounts; balances are carried forward into the future accounting periods

Closing Entries

- transfer net income (or net loss) and dividends to Retained Earnings, so the balance in RE agrees with the retained earning statement

Post-Closing Trial Balance

- list of all permanent accounts and their balances after closing entries are journalized and posted

- only permanent BS accounts

type of adjusting entry and the related accounts for:

A/R

Prepaid Insurance

Equipment

Accumulated Depreciation- equipment

N/P

Interest Payable

Unearned Service Rev

- A/R: Type of Adjustment: Accrual (Revenue earned but not yet recorded)

Related Accounts:

Debit: Accounts Receivable

Credit: Service Revenue (or Sales Revenue)

- Prepaid Insurance: Type of Adjustment: Deferral/ Prepaid Exp (Expense incurred but previously paid)

Related Accounts:

Debit: Insurance Expense

Credit: Prepaid Insurance

- Equipment: Type of Adjustment: Usually no adjustment unless adding purchases (already recorded as asset)

Related Accounts: Typically none (unless capitalization needed)

- Accumulated Depreciation- equipment: Type of Adjustment: Depreciation (Expense recognition)

Related Accounts:

Debit: Depreciation Expense

Credit: Accumulated Depreciation - Equipment

- N/P: Type of Adjustment: Accrual (Interest expense incurred but not yet recorded)

Related Accounts:

Debit: Interest Expense

Credit: Interest Payable

- Interest Payable: Type of Adjustment: Accrual (to recognize interest expense at period end)

Related Accounts:

Debit: Interest Expense

Credit: Interest Payable

- Unearned Service Rev: Type of Adjustment: Deferral (Revenue earned that was previously received)

Related Accounts:

Debit: Unearned Service Revenue

Credit: Service Revenue

When do you recognize revenue? Southwest Airlines sells you an advance-purchase airline ticket in September for your flight home in December.

(September, November, December)

December

When do you recognize revenue? Ultimate Electronics sells you a home theater on a "no money down and dull payment in three months" promotional deal.

At time of delivery

When do you recognize revenue? The Toronto Blue Jays sell season tickets online to games in the skydome. Fans can purchase the tickets at any time, although the season doesn't officially begin until April. The major league baseball season runs from April through October

(April, October, Per game basis over the season)

Per game basis over the season

When do you recognize revenue? You borrow money in August from RBC Financial Group. The loan and the interest are repayable in full in November.

(August, Evenly over the loan term, November)

Evenly over the loan terms

In August, you order a sweater from Sears using online catalog. The sweater arrives in September, which you charged to your sears credit card. You receive and pay the Sears bill in october

(September, October, August)

September

For each List the assumption, principle, or constraint that has been violated, if any:

a) Gomez inc is carrying inventory at its original cost of 100,000. Inventory has a fair value of 110,000

b) Chieu comp has inventory on hand that cost 400,000. Chieu reports inventory on its balance sheet at its current fair value of 425,000

c) Supply Corporation reports only current assets and current liabilities on its BS. Equipment and bonds payable are reported as current assets and current liabilities, respectively. Liquidation of the company is unlikely.

a) no violation

b) Historical cost principle

c) economic entity assumption

Type of Adjustment and Accounts Before Adj (under/over stated)

Services performed but unbilled totals 600

Type of Adjustment: Accrued Revenues

Accounts Before Adj:

Accounts Receivable (Understated) (because the earned revenue hasn't been recorded as receivable yet)

Service Revenue (Understated) (because revenue earned hasn't been recognized yet)

Type of Adjustment and Accounts Before Adj (under/over stated)

Store supplies of 160 are on hand. The supplies account shows a 1900 balance

Type of Adjustment: Prepaid Expenses

Accounts Before Adj:

Supplies Expense (Understated) (because the cost of supplies used hasn't been recorded yet)

Supplies (Asset) (Overstated) (because the full $1,900 is still recorded, but only $160 remains on hand)

Type of Adjustment and Accounts Before Adj (under/over stated)

Utility expenses of 275 are unpaid

Type of Adjustment: Accrued Expenses

Accounts Before Adj:

Utilities Expense (Understated) (because the expense incurred hasn't been recorded yet)

Utilities Payable (a liability) (Understated) (because the obligation to pay hasn't been recorded yet)

Type of Adjustment and Accounts Before Adj (under/over stated)

Service performed of 49 collected in advance

Type of Adjustment: Unearned Revenue

Accounts Before Adj:

Unearned Service Revenue (Liability) (Overstated) (because part of it has now been earned)

Service Revenue (Understated) (because the earned portion hasn't been recorded yet)

Type of Adjustment and Accounts Before Adj (under/over stated)

Salaries of 620 are unpaid

Type of Adjustment: Accrued Expense

Accounts Before Adj:

Salaries Expense (Understated) (because the cost of labor incurred hasn't been recorded yet)

Salaries Payable (Liability) (Understated) (because the obligation to pay hasn't been recorded yet)

Type of Adjustment and Accounts Before Adj (under/over stated)

Prepaid insurance totaling 400 has expired

Type of Adjustment: Prepaid Expenses

Accounts Before Adj:

Insurance Expense (Understated) (because the expired cost hasn't been recorded as an expense yet)

Prepaid Insurance (Asset) (Overstated) (because it still includes the $400 that has already expired)