ib econ- 3.4: inequality and poverty

1/17

Earn XP

Description and Tags

credits https://www.econinja.net/macroeconomics/3-4-inequality-and-poverty

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

18 Terms

what is the relationship between equality and equity?

equity means economic fairness: in other words - people who work harder jobs that require more skills earn a higher wage in order to incentivise work

this creates inequalities, as some will earn more than others

equality on the other hand, means everyone earns the same amount, so no inequalities exist.

what are the two types of economic inequality?

unequal distribution of income: inequalities present in people’s income in a society

unequal distribution of wealth: inequalities present in people’s wealth in a society

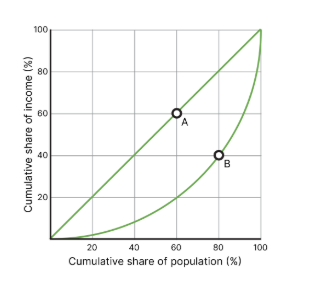

what is a lorenz curve and how does it work?

represents the inequality of income in a country by showing hoe much income certain percentage of the population have

Point A is on the linear curve, a country where everyone earns the same amount. At point A, the bottom 60% of the population make 60% of the country's income.

Point B is on the exponential curve, a country where some earn more than others. At point B, the bottom 80% of the population make 40% of the country's income.

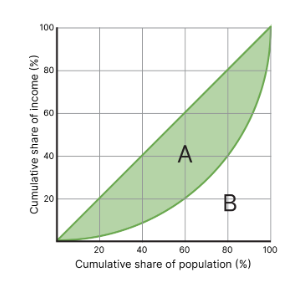

what is the gini coefficient? how is it calculated?

a value that measures income or wealth inequality, in a value ranging from 0 (perfect equality) to 1 (perfect inequality) using the lorenz curve

it does this by finding the area between the perfect equality line and the country’s actual line

the formula is A/(A+B)

what is poverty (absolute and relative)?

an economic condition of being extremely poor and unable to meet basic needs'

absolute poverty: unable to access basic human needs such as food and shelter

relative poverty: unable to reach a specified level of income (usually 50% of a countries’ average earnings)

what are two examples of a single indicator of measuring poverty?

international poverty lines: minimum threshold of income people must meet to have access to basic human needs - currently at $1.90/day - does not take infrastructure into account and is too low for wealth countries

minimum income standards: a minimum income needed for what members of the public think is an acceptable living standard

what is an example of a composite indicator of measuring poverty?

multidimensional poverty index: an index that tracks many components of poverty such as health, education and standards of living. it offers a more thorough indication of poverty

what are the difficulties in measuring poverty?

relative poverty is quite subjective

poverty is a multidimensional issue, to single indicators can be misrepresentative

the international poverty line does not account for purchasing power parity

what are the causes of poverty?

inequality of opportunity: some have less access to opportunities than others, leading to less economic prosperity

different levels of resource ownership

different levels of human capital: some people accumulate more skills, knowledge and experience

discrimination

unequal status and power

government tax and benefits policies: indirect taxes primarily affect the poor, and tax breaks for the rich makes things more unequal

globalisation and technological change: can lead to structural unemployment

market based supply side policies: they aim to remove regulations to make markets more efficient, but they generally leave poor people worse off

what is the effect of inequality on economic growth?

on one hand, it could incentivise hard work and good education, which increases aggregate supply

it could also lead to dissatisfaction, protests and more government money spent on transfer payments to the poor. may also disincentivise entrepreneurship, as small firms cannot compete with large multinational companies

what is the effect of inequalities of standards of living and social stability?

standards of living will improve more for rich people and less for the poor, exacerbating inequalities

more equal countries like the Nordics have low crime rates and higher rates of trust and respect

less equality generally leads to more unrest and violence

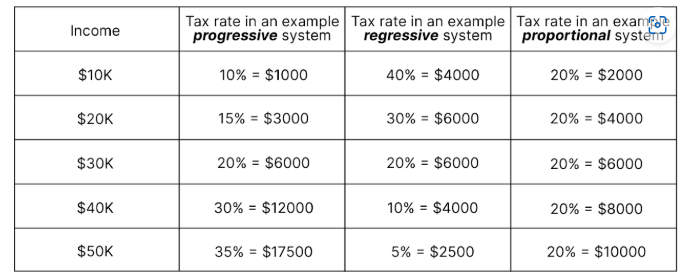

what are the three types of taxes?

progressive taxes: the more you earn, the higher of a percentage you will pay as taxes

regressive taxes: the more you earn, the lower of a percentage you will pay as taxes

proportional: everyone pays the same tax rates

what is a direct tax?

taxes imposed on income rather than expenditure (indirect)

what are the three types of direct taxes?

personal taxes

corporate income taxes

wealth taxes (taxes on assets or capital gains) - affects rich people more

are direct taxes fair? what happens when governments overtax?

relatively fair way to redistribute wealth

overtaxing leads to households and firms avoiding taxes, and hard work is disincentivised

why can indirect taxes be more effective?

harder to avoid, and wealthier people may consume more, generating more tax revenue

why can indirect taxes be inequitable?

arguably a form of regressive tax (poorer people end up spending a higher proportion of their income on taxed goods than a wealthier person)

what are some examples of other policies to reduce poverty, and income and wealth inequality?

reduce inequalities of opportunity/investment in human capital: give everyone the same access to education

transfer payments: give out money or other resources (food banks) to those who need it

targeted spending on goods and services: the government could invest in education or healthcare to increase their quality

universal basic income (ubi): give everyone a guaranteed monthly income - whilst this could eliminate poverty, it would raise inflation and increase government debt

policies to reduce discrimination

minimum wages: raises labour costs, decreasing as