D217 - Accounting Information Systems

1/276

Earn XP

Description and Tags

wgu d217

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

277 Terms

Transaction

An event that affects or is of interest to the organization and is processed by its information system as a unit of work. There are financial and nonfinancial transactions.

Financial transaction

An economic event that affects he assets and equities of the organization, is reflected in its accounts and is measured in monetary terms.

Ex.: sales of products to customers, purchases of inventory, and cash disbursement and receipts

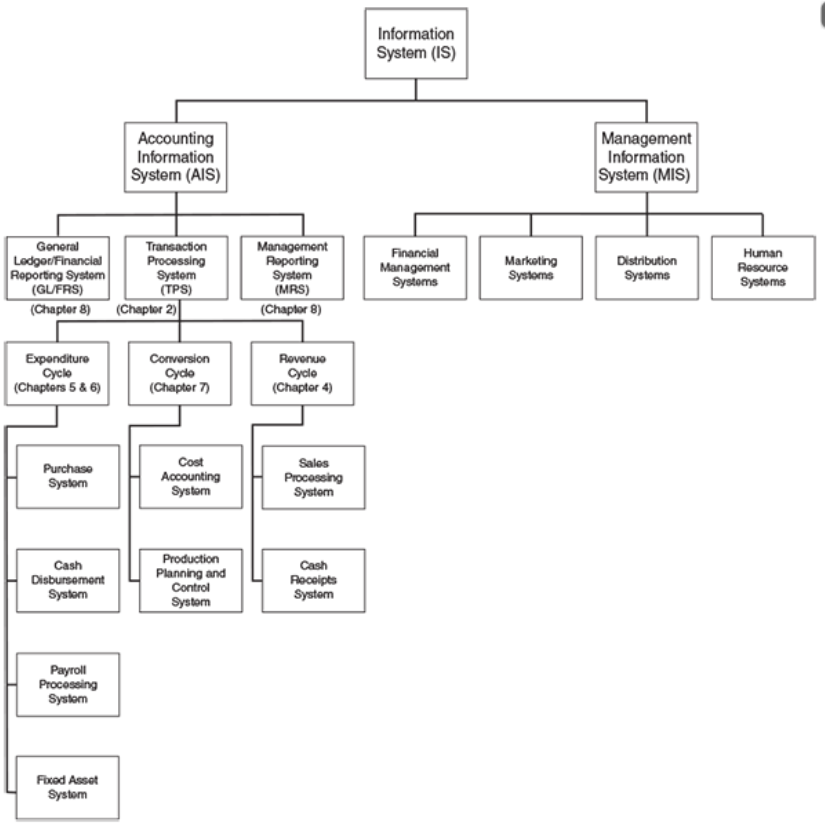

AIS Three Major Subsystems

Transaction Proessing System (TPS)

General Ledger/Financial Reporting System (GL/FRS)

Management Reporting System (MRS)

Transaction Process System (TPS)

Central to overall function of the IS

Converts economic events into financial transactions

Records financial transactions in the accounting records

Distributes essential financial information to operations personnel

Has 3 transaction cycles

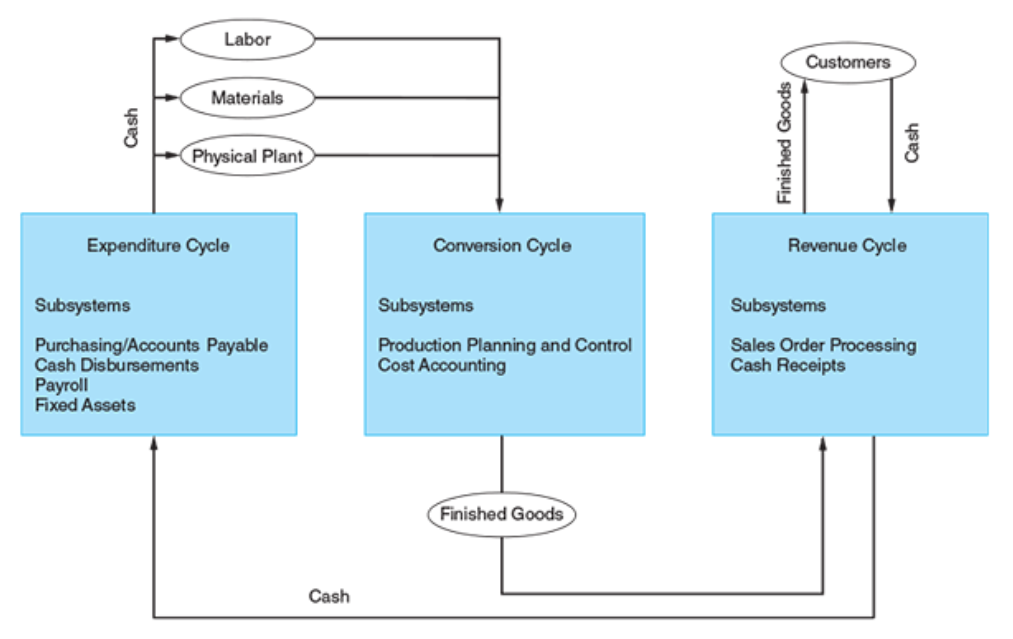

TPS 3 Transaction Cycles

The Revenue Cycle

The Expenditure Cycle

The Conversion Cycle

General Ledger / Financial Reporting Systems (GL/FRS)

Bulk of the input to the GL portion comes from transaction cycle subsystems

FRS measures the status of financial resources and the changes in those resources

Nondiscretionary reporting: organization has few or no choices in the information it provides. Much of this information consists of traditional financial statements, tax returns, and other legal documetns

Management Reporting System (MRS)

Provides the internal financial information needed to manage a business

Can include budgets, variance reports, cost-volume-profit analyses, and reports using current cost data

Processes nonfinancial transactions that are not normally processed by traditional AIS

Discretionary reporting: organization chooses what information to report and how to present it.

General Model for AIS

Means it applies to ALL AIS

Key Elements of AIS Applicaiton

End Users

Data Sources

Data Collection (First Stage)

Data Processing

Database Management

Information Generation

Feedback

1 - End Users

External: creditors, stockholders, investors, regulatory agencies, tax authorities, suppliers, and customers

Internal: management and operational

Data vs Information

2 - Data Sources

Financial transactions that enter the IS from either internal or external sources

External Financial Transaction (Most common): Sale of goods, services, the purchase of inventory, receipt of cash, disbursement of cash

Internal Financial Transaction: exchange of resources within the organization

Movement of raw materials into work-in-process (WIP), the application of labor and overhead to WIP, the transfer of WIP into finished goods inventory, and the depreciation of plant and equipment

3 - Data Collection (First Stage)

Relevant data

Efficient data

4 - Data Processing

Group that manages the computer resources used to perform day to day processing of transactions

Simple

Complex

5 - Database Management

Physical repository for financial and nonfinancial data

Organized in a logical hierarchy

Arranged as attribute, record, file

Fundamental tasks: storage, retrieval, deletion

Guidelines:

Data Attribute

Record = Collection of Attributes

File = Collection of Record

Database Management Tasks

Database Management - Data Attribute

A logical and relevant characteristic of any entity about which the firm captures data.

Database Management - Record

A complete set of attributes for a single occurrence within an entity class

Unique identifier

Database Management - File

A complete set of records of an identical class

Database Management Tasks

Storage

assigns keys to new records and stores them in their proper location in the database.

Retrieval

the task of locating and extracting an existing record from the database for processing

Deletion

the task of permanently removing obsolete or redundant records from the database

6 - Information Generation

Relevance

The contents of a report or document must serve a purpose.

Timeliness

Information must be no older than the time frame of the action it supports

Accuracy

Information must be free from material errors.

Completeness

No piece of information essential to a decision or task should be missing.

Summarization

Information should be aggregated in accordance with the user’s needs

7 - Feedback

Internal

Example: feedback will initiate the inventory ordering process to replenish

External

Example: feedback about the level of uncollected customer accounts can be used to tailor credit granting policies

The Information Environment

Information is a business resource

External users: customers, suppliers, stakeholders, or anyone who has an interest in the firm

External Users fall into two groups:

Trading partners

Stakeholders

Three Information Objectives

To support the firm’s day-to-day operations

To support management decision making

To support the stewardship function of management

An Information Systems Framework

Information System is the set of formal procedures by which data are collected, stored, processed into information, and distributed to users.

Two Broad Classes of Systems emerge from decomposition:

Accounting information Systems (AIS)

Management information system (MIS)

Segments

A functional Unit of a business organization.

Examples of Segmentations:

Materials Management

Production (*conversion cycle)

Marketing

Distribution

Personnel

Finance

Materials Management Segmentation

Subfunctions

Purchasing

Receiving

Storage

Production Segmentation (Conversion Cycle)

Two broad classes

Primary manufacturing activities

Shape and assemble raw materials into finished goods

Production support activities

Production planning

Quality control

Maintenance

Four Information Technology Functions:

Data Processing

Centralized

Distributed

Systems Development and Maintenance

Data Administration

Network Administration

Centralized Data Processing

Model under which all data processing is performed by one or more large computers, housed at a central site, that serve users throughout the organization.

Distributed Data Processing

Reorganizing the IT function into small information processing units (IPUs) that are distributed to end users and placed under their control.

Systems Development

Commercial Software

Turnkey Software

Custom Software

Enterprise Resource Planning (ERP)

Systems assembled of prefabricated software components

Systems development life cycle

Software development process

Custom syustems are more expensive

Outsourcing the IT Function

Cloud Computing

Software as a Service (SaaS)

Infrastructure as a Service (IaaS)

Platform as a Service (PaaS)

Accountants as System Auditors

External (Attestation) Audits

Internal (Operational) Audits

External (Attestation) Audits

Also known as financial audits

An independent attestation performed by an expert who expresses an opinion in the form of a formal audit report regarding the presentation of financial statements.

Attest function

Substantive tests

Attest Function

Independent auditor’s responsibility to opine as to the fair presentation of a client firm’s financial statement.

Substantive Tests

Tests that determine whether database contents fairly reflect the organization’s transactions.

The Expenditure Cycle

Incurs expenditures in exchange for resources

The Conversion Cycle

Provides value added through its products and services

The Revenue Cycle

Receives revenue from outside sources

Digital Accounting Records

Modern accounting systems store data in four types of digital computer files:

Master files

Transaction files

Reference files

Archive files

Master Files

Include account data, examples include subsidiary ledgers, general ledger

Transaction Files

Temporary file of transaction records, examples include sales orders, inventory receipts, and cash receipts

Reference Files

Stores data used as standards for processing transactions, examples include payroll program, price list, authorized suppliers, employee rosters, credit history files, freight charges

Archive Files

Contains records of past transactions that are retained for future reference, examples include journals, prior-period payroll info, former employee info, written off accounts

The Digital Audit Trail + Steps

Allows transaction tracing

Steps

Capture the economic event

Convert the source documents to digital form

Update the various master file subsidiary and GL control accounts effected, errors are detected

File can now be erased for the next batch

System Flowcharts

System flowchart is the graphical representation of the physical relationships among key elements of a system.

Revenue Cycle

It is two phases:

The physical phase involving the transfer of assets or services from the seller to the buyer

The financial phase, involving the receipt of cash by the seller in payment of the accounts receivable

Two major subsystems:

The sales order processing subsystem

The cash receipts subsystem

Data Coding Schemes

Creating simple numeric or alphabetic codes to represent complex economic phenomena that facilitate efficient data processing.

A System Without Codes

This uncoded entry takes a great deal of recording space, is time-consuming to record, and is obviously prone to many types of errors.

A System WITH Codes

Advantages of data coding in AIS are:

Concisely representing large amounts of complex information that would otherwise be unmanageable.

Providing a means of accountability over the completeness of the transactions processed.

Identifying unique transactions and accounts within a file.

Supporting the audit function by providing an effective audit trail.

Sequential Codes

Represent items in some sequential order (ascending or descending)

Advantages: Sequential coding supports the reconciliation of a batch of transactions, such as sales orders, at the end of processing.

Disadvantages: Sequential codes carry no information content beyond their order in the sequence. Also, sequential coding schemes are difficult to change.

Block Codes

Coding scheme that assigns ranges of values to specific attributes such as account classifications.

Chart of Accounts:

Advantages: Block coding allows for the insertion of new codes within a block without having to reorganize the entire coding structure.

Disadvantages: the information content of the block code is not readily apparent

Chart of Accounts:

Listing of an organization’s accounts showing the account number and name. (Critical to a firm’s financial and management reporting systems.)

Group Codes

Used to represent complex items or events involving two or more pieces of related data.

Advantages:

They facilitate the representation of large amount of diverse data.

They Allow complex data structures to be represented in a hierarchical form that is logical and more easily remembered by humans.

They permit detailed analysis and reporting both within an item class and across different classes of items.

Disadvantages: They tend to be overused.

Alphabetic Codes

Characters assigned sequentially.

Advantages: Capacity is increased by alphanumeric codes.

Disadvantages:

There is difficulty rationalizing the meaning of codes that have been sequentially assigned.

Users tend to have difficulty sorting records that are coded alphabetically.

Mnemonic Codes

Characters in the form of acronyms that convey meaning.

Advantages: does not require the user to memorize meaning

Disadvantages: they have limited ability to represent items within a class.

Revenue Cycle Activities

Data Flow Diagrams (DFDs)

Sales Order Procedures

Sales Return Procedures

Cash Receipts Procedures

Sales Order Procedures

Tasks involved in receiving and processing a customer order

Receive Order (customer order, sales order)

Check Credit (establish creditworthiness, returned approved sales order)

Pick Goods (stock release [aka picking ticket], verified stock release, possible back-order record, adjust stock records)

Ship Goods (packing slip, shipping notice, bill of lading, shipping log)

Bill Customer (sales order, S.O. pending file, sales invoice, sales journal, journal voucher, journal voucher file)

Update Inventory Records (inventory subsidiary ledger)

Update Accounts Receivable Records (AR subsidiary ledger, ledger copy)

Post to General Ledger

Sales Return Procedures

This involves reversing the previous transaction in the sales order procedure.

Prepare Return Slip

Prepare Credit Memo

Approve Credit Memo

Update Sales Journal (recorded as contra entry)

Update Inventory and AR records

Update General Ledger

Cash Receipts Procedures

They involve receiving and securing the cash, depositing the cash in the bank, matching the payment with the customer and adjusting the correct account, and properly accounting for and reconciling the financial details of the transaction.

Open Mail and Prepare Remittance List (remittance advices, remittance list)

Record and Deposit Checks (cash receipts journal, deposit slip)

Update Accounts Receivable Records

Update General Ledger

Reconcile Cash Receipts and Deposits (controller’s office, 1. A copy of the prelist, 2. Deposit slips received from the bank, 3. Related journal vouchers)

Physical Systems

Physical Accounting information systems are a combination of computer technology and human activity.

Revenue Cycle Risks

Selling to un-creditworthy customers

Shipping customers the wrong items or incorrect quantities

Inaccurately recording sales and cash receipts transactions in journals and accounts

Misappropriation of cash receipts and inventory

Unauthorized access to accounting records and confidential reports

Internal Controls for Revenue Cycle - Selling to un-creditworthy customers

Physical Control: Transaction Authorization, Segregation of Duties

IT Controls: Automated Credit Checking

Internal Controls for Revenue Cycle - Shipping customers the wrong items or incorrect quantities

Physical Control: Independent Verification

IT Controls: Scanner Technology, Automated Inventory Ordering

Internal Controls for Revenue Cycle - Inaccurately recording sales and cash receipts transactions in journals and accounts

Physical Controls: Access Controls, Segregation of duties

IT Controls: Passwords, Multilevel security

Internal Controls for Revenue Cycle - Misappropriation of cash receipts and inventory

Physical Controls: Transaction authorization, supervision, access controls segregation of duties

IT Controls: Multilevel security

Internal Controls for Revenue Cycle - Unauthorized access to accounting records and confidential reports

Physical Controls: Access Controls, Segregation of duties

IT Controls: Passwords, Multilevel security

Internal Control Activities

Physical Controls

IT Controls

Point-of-Sale (POS) Systems

Universal Product Code (UPC)

Reengineering using Electronic Data Interchange (EDI)

Devised to expedite routine transactions between manufacturers and wholesalers, and wholesalers and retailers.

Compensating Controls

Controls like supervision when you don’t have enough employees to adequately separate functions.

Two subsystems to the Expenditure Cycle

Purchases

Cash Disbursements

Purchase processing procedures

Monitor Inventory Records

Purchase Requisition

Purchase Order

Conversion Cycle

Transferring raw materials into the production process

Revenue Cycle

Selling finished goods to customer

Prepare Purchase Order

Receive Goods

Blind Copy

Receiving report

AP Pending File

Receiving Report File

Update Inventory Records

Standard Cost System

Actual Cost Inventory Ledger

Set up Accounts Payable

Supplier’s invoice

AP Packet

Open AP File

AP Subsidiary Ledger

Purchase Requisition

Document that authorizes a purchase transaction.

Purchase Order

Document based on a purchase requisition that specifies items ordered from a vendor or supplier.

Vouchers Payable System

AP dept uses cash disbursement vouchers, maintains voucher register

Post to the general Ledger

The Cash Disbursements System

Identify Liabilities Due

Prepare Cash Disbursement (check register, cash disbursements journal, update AP record, post to GL)

Greatest risk of misappropriation of funds

The greatest risk of misappropriation of funds occurs in accounts payable. This may take the form of payments for goods not ordered or received and to vendors that do not exist. The risk can be reduced through supervision, segregation of duties, independent verification, or automated processes.

Internal Control Objective

An objective of internal control is to mitigate the risk from errors and fraud.

Expenditure Cycle Transactions Risks

Unauthorized inventory purchases

Receiving wrong items, incorrect quantities, or damaged goods

Inaccurately recording purchases and cash disbursement transactions in journals and accounts

Misappropriation of cash and inventory

Unauthorized access to accounting records and confidential reports

Internal Controls for Expenditure Cycle - Unauthorized inventory purchases

Physical Controls: Transaction authorization

IT Controls: Automated purchase approval

Internal Controls for Expenditure Cycle -Receiving wrong items, incorrect quantities, or damaged goods

Physical Controls: Independent verification, supervision

IT Controls: Scanner Technology

Internal Controls for Expenditure Cycle - Inaccurately recording purchases and cash disbursement transactions in journals and accounts

Physical Controls: Transaction Authorization, accounting records, independent verification

IT Controls: Input data edits, error messages, automated postings to subsidiary and GL accounts, file backup

Following Input Data Edits Programs

Controls

Check digit

Internal Controls for Expenditure Cycle -Misappropriation of cash and inventory

Physical Controls: Supervision, Independent Verification, segregation of duties

Three-Way Match

The Purchase Order (PO)

The Receiving report

The Supplier’s Invoice

IT Controls: Automated three way match, and payment approval, multilevel security

Internal Controls for Expenditure Cycle - Unauthorized access to accounting records and confidential reports

Physical Controls: access controls, segregation of duties

IT Controls: password control, multilevel security

Payroll System General Tasks

Personnel Department (Prepare Payroll Function)

Production Department

Update WIP Account

Prepare Payroll

Distribute Paycheck

Prepare Accounts Payable

Prepare Cash Disbursement

Payroll - Personnel Department (Prepare Payroll Function)

Personnel Action Forms

Identify employees authorized to receive a paycheck

Reflect changes in pay rates, deductions, classifications

Payroll - Production Department

Job Tickets

Time the individual employee spent on each production job

Timecards

Capture the time the employee is at work.

Payroll - Update WIP Account

Forwarded to the GL function

Labor distribution Summary

Summarization of labor costs in WIP accounts

Payroll - Prepare Payroll

Prepares the payroll register showing gross pay, deductions, overtime pay, and net pay.

Enters this information into the employee payroll records

Prepares employee paychecks

Sends the paychecks to the distribute paycheck function

Files the timecards, personnel action form, and copy of the payroll register

Payroll - Distribute Paycheck

Paymaster: the individual who distributes paychecks to employees

Payroll - Prepare Accounts Payable

AP clerk reviews the payroll register for correctness

Payroll - Prepare Cash Disbursement

Payroll Imprest Account

A single account from which all paychecks for the employees are drawn.

Payroll Register

Includes: Pay rate, withholding information, and hours worked

Update General Ledger

Receives:

LABOR DISTRIBUTION SUMMARY from cost accounting,

DISBURSEMENT VOUCHER from accounts payable

JOURNAL VOUCHER from cash disbursements

Basic Technology Payroll System

Personnel action and time and attendance information from the personnel and production departments initiate the payroll process.

Payroll department reconciles this information, calculates the payroll, and sends the paychecks to the paymaster for distribution to employees.

Cost accounting receives information regarding the time spent on each job from production. This is used for posting to accounts in the WIP subsidiary ledger.

AP receives payroll summary information (payroll register) from the payroll department and authorizes the cash disbursements department to deposit a single check, in the amount of the total payroll, in a bank imprest account on which the payroll is drawn.

The general ledger department reconciles summary information from cost accounting and AP. GL accounts are updated to reflect these transactions.

Technological steps for Payroll System

Human Resources: enters data in real time

Cost Accounting

Employee Timekeeping

Data Processing

Payroll - Cost Accounting

Labor usage file: file in which the cost accounting department enters job cost data (real time or daily)

Payroll - Employee Timekeeping

Time and attendance file: generated by employees directly entering timekeeping data in real time

Biometric time clocks: verify employees’ identities by using fingerprint or hand-vein scan technology

Magnetic swipe ID cards

Proximity cards

Mobile remote devices