MANAGEMENT ACCOUNTING

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

65 Terms

Accounting ?

It’s providing both financial and non-financial information that will help decision-makers to make good decisions

→ data that can be quantified, Ex : Tesla can quantify the number of cars they have, customer too,

Differences between Financial and Management Accounting ?

Financial accounting reports financial information for external stakeholders, while management accounting, provides detailed data for internal decision-making.

Financial statements ?

→ annually

Management accounting frequence ?

→ no requirements, can be done daily, weekly, monthly,…

Financial statements focuses on ?

→ historic information

Management accounting focuses on ?

→ past information to prepare projections of future trends

Management accounting ?

combines accounting, finance and management with the leading-edge techniques need to drive successful businesses.

direct materials ?

→ costs that are visible, directly traceable (ex. raw materials to make a product)

indirect materials ?

→ not visible, not directly traceable (ex. electricity)

direct labour ?

→ directly involved in the overall production process

indirect labour ?

→ not directly involved in the overall production of goods, (accounting, administrative, marketing staff)

Direct Expenses ?

expenses for a particular product (ex the hire of a specialist piece of equipment to manufacture a specific product.)

Indirect expenses ?

It’s all expenses that can’t be identified within a product, service or department (ex. light and heat of the factory, insurance of premises etc.)

Overheads ?

→ all indirect costs.

Indirect materials, Indirect labour and indirect expenses

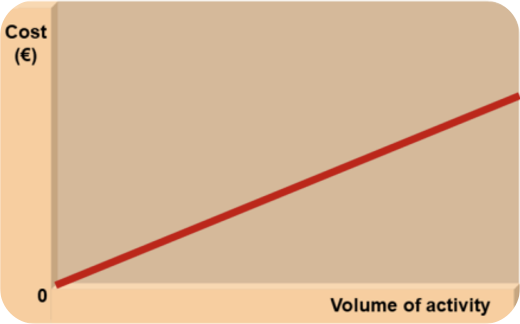

Variable costs ?

vary in direct proportion to the volume of activity. (→ direct materials and direct labour.) the more units there is, the more there will be costs.

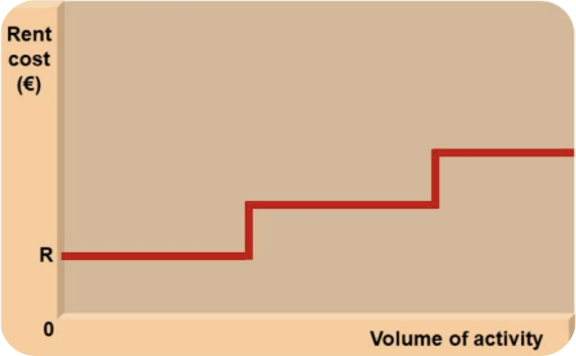

Step-fixed (semi-variable) costs ?

Costs are only fixed within the normal or relevant range of output. (→ the rent of a factory is a fixed cost for a period. If the factory receives more units than his capacity, it would need to rent extra factory space)

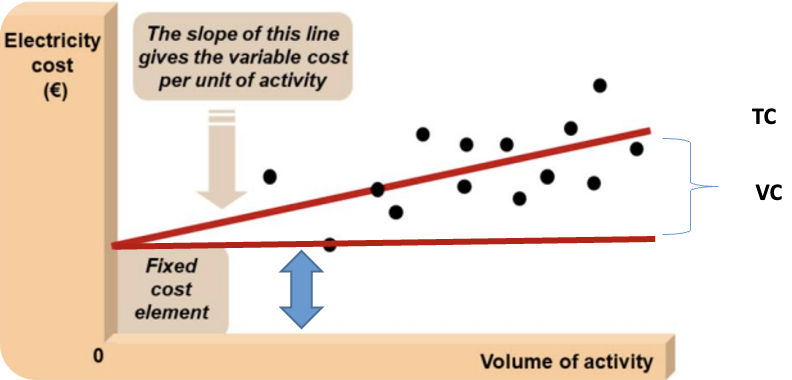

Semi-variable (Mixed) costs ?

costs that are part-fixed and part-variable. It’s a fixed cost and a variable cost (ex : electricity costs which include the supply charge and the usage charge, fixed + variable)

TOTAL COST ?

= FIXED COST + VARIABLE COST

The High-Low method ?

→ it’s selecting the periods with the highest and lowest activity levels and comparing the change in costs from both levels.

Variable cost (VC) per unit ?

Change in Costs = Variable Cost (VC)

Change in Output (units)

Marginal Cost per unit is the variable cost of ?

→ producing one extra unit (direct materials, direct labour, variable overhead)

Contribution ?

Sales - Variable cost = Contribution → It’s the difference between sales value (selling price) & marginal or variable cost of sales

Profit = ? (1)

Sales - Variable Cost - Fixed cost

Profit = ? (2)

Contribution - fixed cost

BEP in units formula ?

Fixed Cost / Contribution per Unit

Sales price per unit ?

total sales

total sales per unit

Var. cost per unit ?

total variable cost

Sales in units

BEP in sales revenue ?

Selling price * BEP in Units

Margin of safety (MOS) in Units ?

= Budgeted sales Units - BEP in units

Margin of safety (MOS) in sales revenue ?

Budgeted sales in € - BEP in €

How to have the MOS in % ?

MOS in Units

Budgeted sales Units * 100

Marginal Costing statement ?

Sales

Less variable costs

= Contribution

Less Fixed costs

= Profit (Loss)

Target Profit formula in units ?

Fixed Cost + Target Profit

Contribution per Unit

Proposed figures ?

→ Planned figures → Budgeted sales

Contribution per Unit ?

selling price - Variable cost per unit.

Break even analysis ?

→ marginal costing statement

Contribution Margin Ratio (CMR) ?

Contribution (total or per unit)

Sales (total or per unit)

Target Profit in sales revenue formula ?

Target profit in units * selling price per unit

NPV’s advantages ?

Takes into account the time value of money

Considers all future cash flows

Provides an absolute result rather than a percentage

NPV’s disadvantages ?

Can be difficult to calculate as it requires an understanding of discounting

It requires the business to have decided upon an appropriate discount rate

Layout of the cash flow ?

Years / Cash flows / Discount Factor (DF) / Present Value (PV)

Net present Value (NPV)

IRR ?

discount rate that produces a zero NPV.

To calculate IRR you should… ?

have 1 NPV answer and one negative NPV answer

If the IRR is less than the required rate of return … ?

→ the project should be rejected

Appraisal techniques used in the capital budgeting ?

Payback period, NPV, IRR

Advantages of Payback period ?

easy to use & to understand

when the payback period is shorter than the project's lifetime, it’d be accepted. If longer, reject it.

good method to use if there’s uncertainty about the future

Disadvantages of Payback period ?

Ignores cash flows after the initial cost has been recouped

Ignores the time value of money & does not discount future cash flows into their present value

Ignores the size of the investment project & its overall cost & benefit

If the NPV is at 0 … ?

→ means that the project is earning exactly the discount rate.

Positive NPV ?

→ it’s earning more than the discount rate

Negative NPV ?

→ It’s earning less than the discount rate.

For a project to be acceptable, it must earn a … ?

→ positive NPV

If 2 projects have positive NPV’s … ?

→ the project with the highest NPV will be chosen

Advantages of IRR ?

Uses the time value of money in calculations

If IRR > the required rate of return, accept the project, if not → reject.

Disadvantages of IRR ?

Can be difficult to calculate IRR & to explain it to non-finance people

Doesn’t provide results in euros but in a %

Profits retained … ?

earnings

Profites pay … ?

dividends to shareholders

retained earnings ?

Profites that the company makes

Short term ?

finance for up to one year

Medium term ?

Matching approach ?

It’s to finance non-current (fixed) assets & permanent current assets using long & medium-term sources of finance.

Aggressive approach ?

is to maximise the amount of short-term finance used and to minimise the amount of long-term finance

Conservative approach ?

is to maximise the use of long-term finance and minimise the use of short-term finance

Advantages of retained earnings ?

Doesn’t result in a dilution of ownership or change in co

There may be reduction in financial risk due to lower gearing level

No repayment date

Disadvantages of retained earnings ?

Less funds available to pay dividends

Debt capital may be more suitable if interest rates are low

It’s the case that there’s not enough retained earnings available in the form of cash balances as amounts tied up in inventory

Tighter credit control ?

is a management strategy that involves closely monitoring and restricting credit extended to customers to reduce the risk of bad debts.