2.6 macroeconomic objectives and policies

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

23 Terms

macroeconomic objectives

environmental protection

economic growth

low inflation (2.0%)

low unemployment(Keynes - 3% labour force)

current account

balanced fiscal budget(G=T)

greater income equality

policy areas for Govt to achieve these objectives

demand side policies - designed to impact AD

supply side policies - designed to impact AS

demand side policies

monetary policy

fiscal policy

monetary policy instruments

interest rates

quantative reasoning

how are interest rates used in monetary policy

monetary policy commitee (bank of england) meet 8x a year to set a loose rate - UK 4.75% - target CPI of 2%

e.g. if inflation forecast is above target then:

increase IR - increases saving - deflationary

if inflation forecast is below target then:

decrease IR - increases consumption -inflationary

why is quantative easing used

sometime the MPC beleive that a decrease in IRs alone wont be able to stimulate AD

so mpc decide to inject liquidity(cash) into financial markets

increase cash - increase loans - increase borrowing by business + consumer - increase I + C - increase AD

how is quantative easing used in monetary policy

the bank of england create money electronically which is used to buy bonds from the financial sector - i.e giving loans to banks

increase in price of bonds - decrease in interest rate on bond(yield)

e.g. £1000 bond - £80 a year 8%

£2000 bond - £80 a year 4%

commercial banks now have more money to lend because they have sold bonds in return for cash

fiscal policy instruments

government expenditure

taxation

expansionary fiscal policy

Govt intends to increase AD in the economy and spur econ growth

budget deficit - G>T

i.e spends more than it raises - injection>leakage

contractionary fiscal policy

Govt intends to decrease AD to slow down an economy, often to combat inflation

budget surplus - G<T

i.e saves more then it spends -

injection<leakage

balanced budget fiscal policy

Govt intends to have its revenue mathc its expendiutre to acheive fiscal stability and reduce risk of debt

G=T

types of taxation

direct taxes - tax on income

indirect taxes - tax on expenditure

examples of direct taxes

income tax

corporation tax

capital gains tax

inheritence tax

examples of indirect tax

VAT

excise duties

customs duties

supply side policies

market based policies

interventionist policies

market based policies

indirect way - remove barriers to productive capacity but doesnt directly increase it

reducing government intervention and letting market forces like supply and demand guide economic activity

decrease corporation tax

removing regulations

increase privatisation + deregulation

interventionist policies

policies were the government will directly intervene to raise producitivty capacity

improve education - knowledge and skills - alsp reduces occupational mobility

improved + new infrastructure - capital goods - attracts businesses which increase I

supply side policy affect on LRAS

shift right

strengths of supply side policies

avoids conflict with other objectives

increase productive capacity of economy

lower unemployment

reduce economically inactive population

some are not expensive

weaknesses of supply side policies

tax cuts often facour high earners - increase waelth inequaility

welfare cuts - impact low earners

time-lag - takes time to have effect

can be expensive e.g. infrastructure

supply side policies that increase LRAS will only beenfit the economy if there is sufficient AD

conflicts and trade - offs between objectives

econ growth vs price stability:

rapid econ growth lead to d.pull inflation

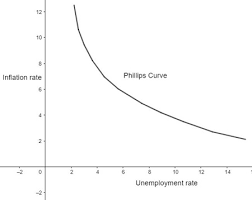

phillips curve - shows trade off between unemployment and inflation

low unemplotment vs price stability:

policies to reduce unemployment - increase inflation

econ growth vs environmental stability:

pursuing high growth - environmental degradation

econ growth vs balanced balance of payments:

high growth can lead to increase imports

unemployed vs balanced budget:

decrease unemployment - increase in G, budget deficit

short run philips curve

inverse relationship between rate of inflation and rate of unemployment

as umployment falls - TU’s and workers more bargaining power - increase wages - increase C - increase D.pull inflation

and vice versa

potential policy conflicts and trade offs

low interest rates vs contractionary fiscal policy

high interest rate vs expansionsary fiscal policy

contractionary fiscal policy vs interventionist supply side policies that require increase in G