F5 - Investments, Income Tax, Cash Flow statements

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

61 Terms

What are debt securities?

Debt securities are loans you invest in—like bonds, notes, and T‑bills issued by governments or companies.

They pay interest and return principal at maturity.

Example:

Buying a 5‑year U.S. Treasury note that pays semiannual interest.

What are the 3 types of debt security portfolio classifications?

Trading: bought to sell soon.

Available‑for‑Sale (AFS): not trading and not HTM.

Held‑to‑Maturity (HTM): company has positive intent and ability to hold to maturity.

What are AFS debt securities and how are they recorded?

If you are the buyer, you plan to sell the bond at some point, before the debt is mature.

You record the bond at fair value

Unrealized gains/losses → OCI until realized.

Premium/discount is amortized using effective interest and affects interest income.

What are held to maturity securities? How are they recorded and amortized?

HTM debt securities are recorded at amortized cost (not fair value).

No unrealized Gain/Loss in income or OCI.

Premium/discount is amortized using effective interest and affects interest income.

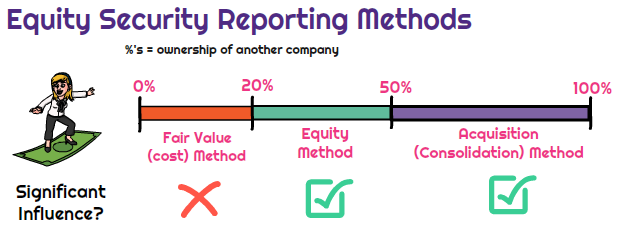

What are equity securities? How are they recorded and/or amortized?

You hold < 20% of the total value of the company.

Ownership shares (common or preferred stock)

They are measured at fair value through net income (FVTNI).

No amortization.

Dividends → income.

What is a warrant?

Long‑term option issued by a company giving the holder the right to buy shares at a fixed exercise (strike) price.

Example:

A bond issued with detachable warrants to buy stock at $20 within 5 years.

What is a stock right?

A preemptive right) lets existing shareholders buy new shares (usually at a discount) to maintain ownership %.

Rights are typically short‑term.

What is a call option?

Gives the holder the right (not the obligation) to buy a security at a fixed strike price before/at expiration.

Example:

Call 100 shares at $50; you profit if market > $50.

Think: Stock is singing: “ 🎶 Call me maybe 🙂”

What is a put option?

Gives the holder the right (not the obligation) to sell a security at a fixed strike price before/at expiration.

Example:

Put 100 shares at $50; you profit if market < $50.

Think: I’m gonna put this stock in the trash 🗑

What is FVTNI?

FVTNI = Fair Value Through Net Income.

Changes in fair value are recognized in the income statement. → like with trading securities.

What is a concentration of credit risk? + Ex

When your exposure is not diversified—a lot of credit risk is tied to one customer, industry, geography, or lender.

Example:

60% of A/R from one retailer

All deposits are at one bank above insured limits.

Who should disclose concentration of credit risk and what should they disclose?

Large entities (>$100M in assets + derivatives) with significant concentrations in financial instruments should disclose.

Disclosures include:

Nature of the concentration

Carrying amounts exposed

Maximum loss exposure (if applicable)

Policies to manage/mitigate the risk.

Disclosure of market risk is encouraged (not required).

What is equity method of investments?

When you have significant influence and/or own 20%–50% of the company.

Record the investment at cost, then:

Increase investment for your share of investee income:

Dr Investment

Cr Equity in earnings

Decrease investment for dividends received bc. they’re a return of investment

How do dividends affect investor in equity method? + JE

Under the equity method, dividends reduce the investment, not income.

JE:

Dr Cash

Cr Investment in Investee.

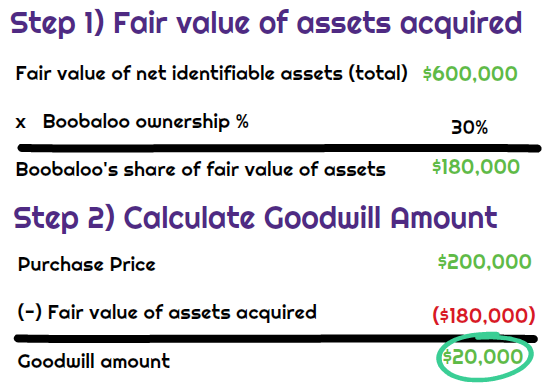

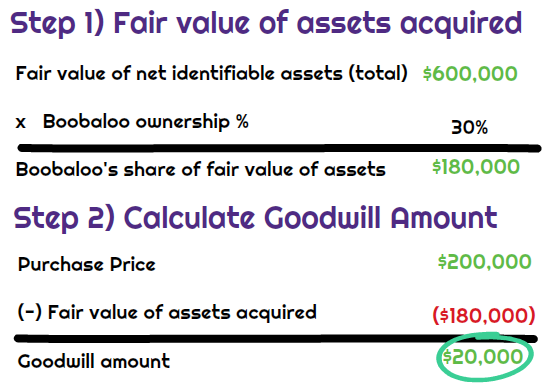

What is goodwill?

Purchase price - fair value of identifiable net assets acquired in a business combination.

It’s not amortized (GAAP) and is tested for impairment.

What is the fair value method and how does it differ from the equity method?

Fair value method (ASC 321):

<20% equity holdings

No significant influence

Carry at fair value

Changes → income

dividends → income

Equity method:

20-50% equity holdings

recognize your share of investee earnings

dividends reduce the investment.

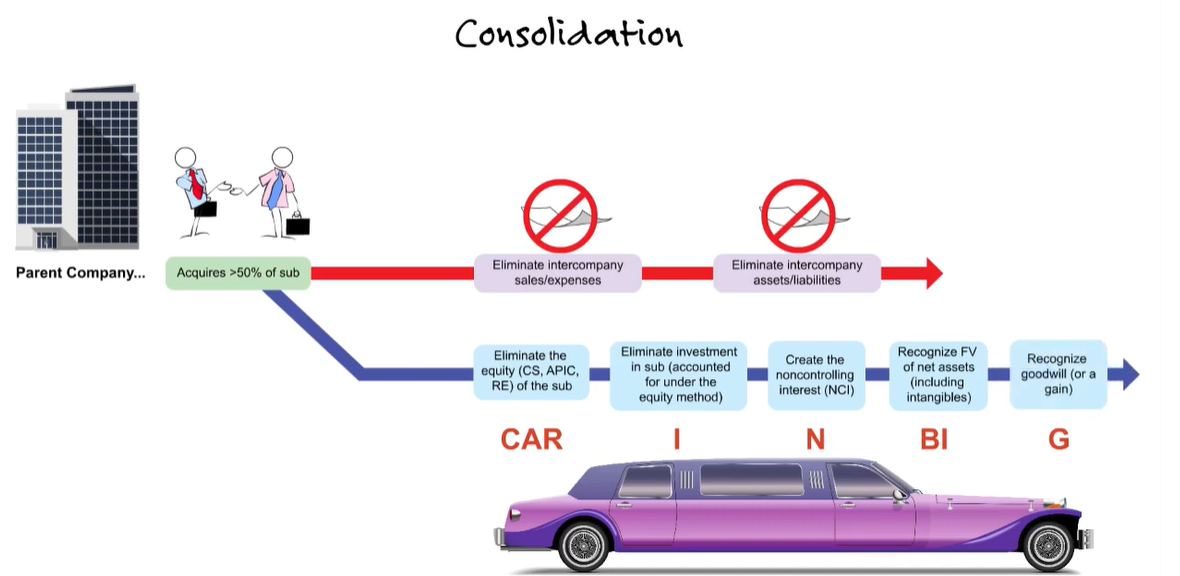

What are consolidated financial statements and when do you need them?

Consolidated financial statements present a parent and its subsidiaries as one company.

You consolidate when you control >50% voting

How should an acquiring corporation record the subsidiary in their consolidated financials?

Use the acquisition method.

CAR IN BIG

C A R: Eliminate the sub’s 🚗

Common stock

APIC

Retained earnings

IN: Eliminate

Investment in Sub

Create Noncontrolling interest (NCI) at FV.

B I G: Book

Balance‑sheet FV adjustments

Identifiable intangibles

Goodwill (or Gain on bargain purchase).

Result: Parent records identifiable net assets at FV, recognizes goodwill/gain, and presents NCI in equity.

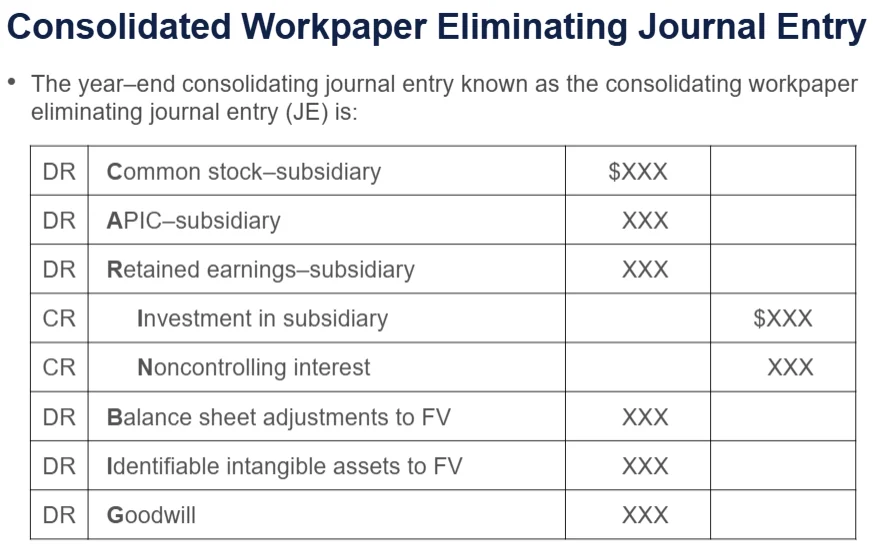

What is the consolidated workpaper eliminating journal entry?

At acquisition date (simplified):

Dr Common Stock (Sub)

Dr APIC (Sub)

Dr Retained Earnings (Sub)

Dr Identifiable assets FV step‑ups

Dr Intangibles

Dr Goodwill (if any)

Cr Investment in Sub

Cr NCI (at FV)

Cr Liability FV step‑ups (if any)

What is an intercompany transaction?

Any transaction between entities within the same consolidated group (e.g., P→S sale).

Rule: Eliminate intercompany balances, sales, expenses, and any unrealized profits.

Why? → Because consolidated financials should show the group as one company. Intercompany activity doesn’t involve outsiders, so leaving it in would double-count and overstate revenue, expenses, or profit.

How should intercompany transactions be recorded in consolidated financial statements?

They are eliminated so consolidated statements show only transactions with outsiders.

Remove intercompany receivables/payables, sales/COGS, interest, and unrealized profits in inventory or fixed assets.

What is NCI (Noncontrolling interest)?

NCI is the equity in a subsidiary not owned by the parent. (Let’s say 80% of a sub is bought out, the other 20% is NCI).

It’s shown in equity on the consolidated B/S.

Computation: NCI end = NCI beg + NCI% × Sub NI − NCI% × Sub dividends.

Describe the pattern for reporting cash flow statement with consolidated financial statements

Operating: consolidated operations after acquisition date.

Investing: acquiring/disposing of a sub is shown net of cash acquired/disposed.

Financing: dividends paid to NCI and NCI contributions are financing.

Intercompany cash flows are eliminated.

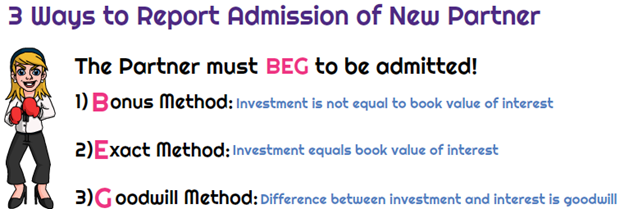

What are the 3 ways to account for a new partner in a partnership?

Exact

Bonus

Goodwill

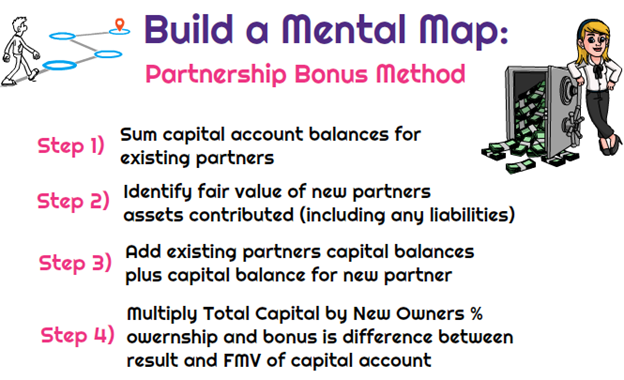

What is the bonus method?

No goodwill is recorded.

Capital is reallocated among partners so the new partner’s capital may be more or less than the cash contributed (a bonus to/from existing partners).

What is the goodwill method?

If the new partner’s contribution implies the partnership is worth more than book value, record goodwill to bump up capital so ownership % aligns with implied value.

What is the exact method?

Admit the new partner so total capital equals the sum of contributions (no bonus, no goodwill).

The new partner’s capital equals exactly what they put in.

How are income and losses distributed among partners in a partnership? What gets affected?

However the partnership agreement says, or equally distributed if no formal agreement.

Salary/interest allowances are allocations, not expenses.

Allocations increase/decrease each partner’s capital account.

What is a capital account?

Each partner’s running balance:

Beg capital + contributions + share of income − withdrawals − share of losses.

What is a withdrawal of a partnership?

A partner leaves and receives cash or assets for their capital balance (adjusted for agreed bonuses/goodwill).

What methods can be used for withdrawal of a partner and why?

Bonus →shift capital among remaining partners

Goodwill → recognize implied goodwill first. Use what the agreement specifies or what best reflects implied value.

What happens when a partnership is liquidated?

Sell assets

Pay liabilities

Distribute remaining cash per final capital balances

Losses on realization are allocated per profit‑loss ratios.

What happens during a liquidation of a partnership when partner has overdrawn balances?

A partner with a deficit must restore capital.

If they cannot, the deficit is absorbed by remaining partners per their profit‑loss ratios.

What are the 3 sections of the cash flow statement?

Operating

Investing

Financing

How is cash flow statement affected if you buy T-Bills that mature in 3 months?

If the original maturity at purchase is ≤ 3 months, it’s a cash equivalent (no investing outflow—cash just changes form).

If > 3 months, it’s an investing outflow.

What's a T-Bill

A short‑term U.S. Treasury debt security (typical original maturities 4/13/26/52 weeks).

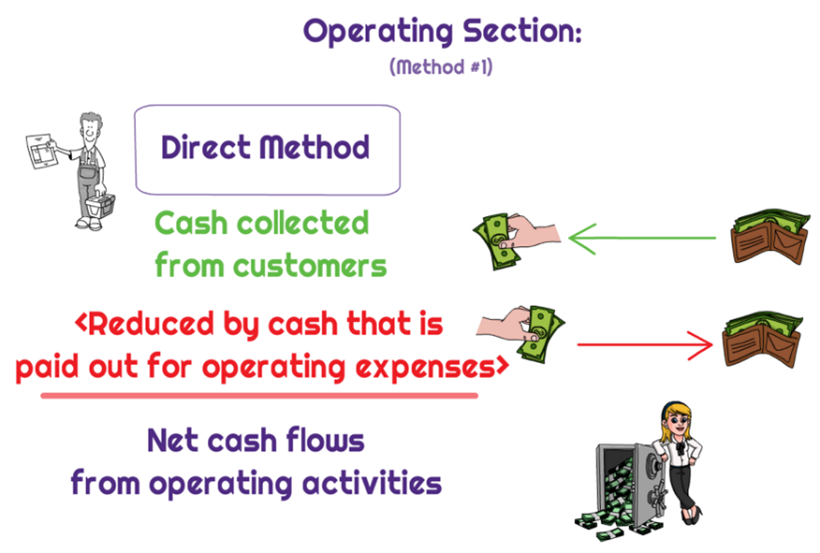

What is the direct method of preparing cash flow statement?

Shows major classes of cash receipts/payments

cash collected from customers

cash paid to suppliers

A reconciliation to net income is also presented.

What is the indirect method of preparing cash flow statement?

Start with Net Income, then adjust for:

Non‑cash items (e.g., depreciation)

Gains/losses (move to investing/financing)

Changes in current assets/liabilities.

What is the pneumonic CLAD for converting Net Income to Cash Flow?

CLAD:

Changes in current assets & liabilities

Losses & gains (remove from operating)

Amortization & depreciation (add back)

Deferred items (deferred taxes, etc.).

What affects operating cash flows?

Cash from core operations:

collections from customers

payments to suppliers/employees

interest received/paid

dividends received

income taxes

What affects investing cash flows?

Buying/selling PP&E and long‑term assets

Loans made/collected (notes receivable)

Acquiring/disposing subsidiaries (net of cash)

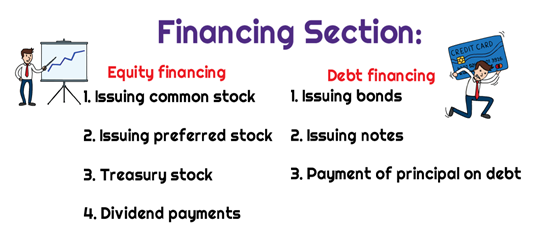

What affects financing cash flows?

Borrowings/repayments

Issuing stock

Dividends paid

Treasury stock

Cash to/from NCI.

What kinds of disclosures are needed for cash flow statement?

Noncash investing/financing activities

Cash paid for interest and income taxes (for indirect method).

Policy for cash equivalents

Reconciliation to NI if using the direct method.

What are "permanent differences" in GAAP vs Tax accounting? Why do they exist? + Examples

Items that affect book or tax income but never both, so they do not reverse and no deferred taxes.

Examples:

Municipal bond interest →

🔼 GAAP income

❌ not taxable income

Life insurance proceeds on key person →

🔼GAAP income

❌ not taxable income

Penalties/fines →

🔽 GAAP income

❌ taxable income

What are examples of temporary differences in GAAP vs Tax Accounting? Why do they exist?

Items that affect book and tax in different periods (they reverse):

Depreciation (SL vs accelerated)

Warranty expense (accrue now, deduct when paid)

Bad debts (allowance vs tax direct write‑off), -

Installment sales (book revenue now, tax when collected).

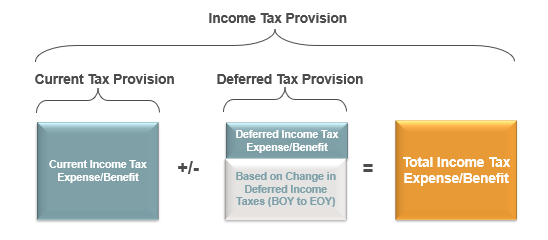

What are the two components of tax expence?

Current tax expense/benefit (based on taxable income)

Deferred tax expense/benefit (from changes in DTAs/DTLs).

What is a deferred tax liability (DTL)? + example? Why does it occur?

GAAP income > Taxable income → caused by temporary difference.

You pay less taxes now but will have to pay more later when the difference reverses.

Example:

Accelerated tax depreciation > book SL

→ Lower current taxes now bc taxable income is lower via accelerated depreciation. But, over time, the taxable income will increase again and there will be higher taxes later.

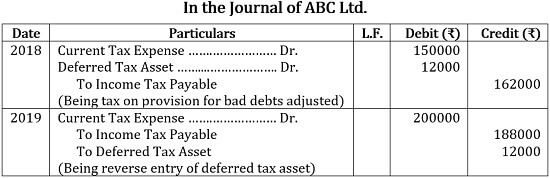

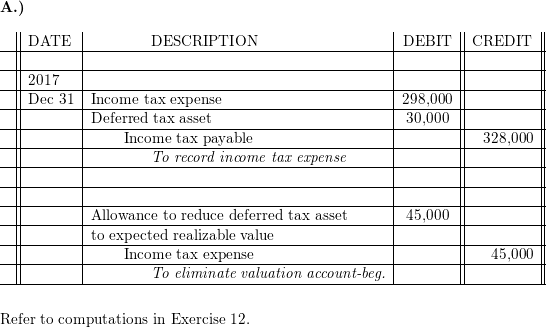

What is a deferred tax asset (DTA)? + example? Why does it occur?

GAAP income < Taxable income → caused by temporary difference.

You pay more tax now because GAAP income recognized an expense now that taxable income did not. Later when the temporary difference reverse, you will pay less taxes because of the temporary difference.

Example:

Warranty accrual expensed for book now but deductible for tax when paid.

What is a valuation allowance for a deferred tax asset?

A contra‑account to reduce a DTA when it is more likely than not ( >50% ) that some portion won’t be realized.

What is an uncertain tax position?

A tax position where the outcome is uncertain (e.g., an aggressive deduction).

Apply a two‑step model:

recognition (more‑likely‑than‑not threshold)

measurement (largest benefit with >50% probability).

What are the conditions for recognizing a tax benefit for a company's financials?

Recognize only if the position is more likely than not to be sustained on technical merits. Measure at the largest amount of benefit that has a >50% chance of being realized.

What is the enacted tax rate?

The rate signed into law for the periods when temporary differences will reverse.

Do not use proposed or expected rates.

What is the liability method in relation to deferred tax accounts?

Under ASC 740’s liability method, recognize DTAs/DTLs for temporary differences, measured with enacted rates; adjust for rate changes through tax expense.

How are deferred tax accounts shown on the balance sheet in GAAP?

All DTAs/DTLs are noncurrent.

Offset DTAs and DTLs by tax jurisdiction and present a net amount.

What is an NOL?

A Net Operating Loss occurs when

tax‑deductible expenses > taxable revenues.

It generally creates a DTA equal to the loss × enacted tax rate (subject to valuation allowance).

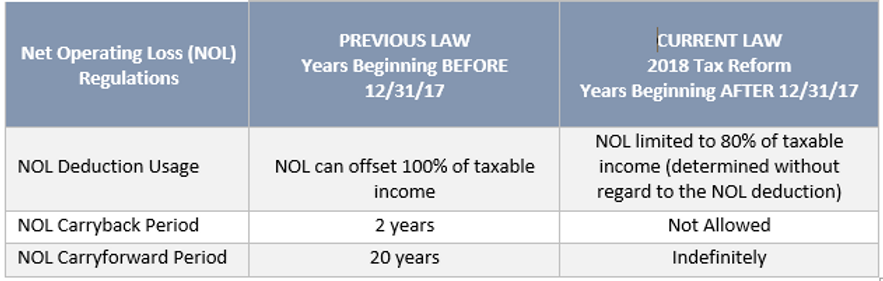

What is the rule enacted in 2018 relating to NOLs?

For losses after 2018 (TCJA):

generally no carryback

indefinite carryforward

and deduction limited to 80% of taxable income

Some exceptions exist; COVID‑era temporary rules have expired.

What are an investee's undistributed earnings?

Undistributed Profits (Retained Earnings) = Previous Retained Earnings + Net Income for the Period − Dividends Paid

Previous Retained Earnings: The amount of undistributed profits carried over from the last accounting period.

Net Income for the Period : The net income generated by the company during the accounting period under consideration.

Dividends Paid : The total dividends paid out to shareholders during the accounting period.

How do undistributed earnings affect deferred tax accounts?

Normally create a DTL bc. in GAAP equity method, income is counted.

taxed later when dividends received). Exception: no DTL if parent asserts indefinite reinvestment of those earnings, since no tax expected.

What are some important income tax disclosures?

Disclose current vs deferred tax expense

Components of DTAs/DTLs

Valuation allowance changes

Rate reconciliation (statutory to effective)

NOL carryforwards and expirations

Uncertain tax positions.

What are intraperiod tax allocations?

Distributes a period’s total income tax expense among the items that caused it (ASC 740). Ensures tax effects appear with their related items for clarity.

Tells whether the tax expense mainly applied to:

Continuing operations – regular business activities

Discontinued operations – reported net of tax

Other comprehensive income (OCI) – e.g., AFS securities, FX translation

Items to equity – e.g., prior-period adjustments

Intraperiod vs. Interperiod:

Intraperiod = within one period (split tax among components).

Interperiod = across periods (timing differences → DTAs/DTLs).

What is the “With-and-without” method of intraperiod tax allocations?

Method: “With-and-without” →

Compute total tax

Compute tax on continuing ops

Allocate the difference to discontinued ops, OCI, or equity.

With-and-without method is always used in GAAP to fairly assign tax effects. Multiplying OCI, discontinued ops, or equity by a tax rate is only a simplification when rates don’t change. Correct way = with and without method.

Purpose: Fairness in how the tax expense gets split.

If you just lumped tax expense wherever, discontinued ops or OCI could get too much or too little. The with-and-without method avoids that by:

Calculating tax with everything included.

Then calculating tax without the special item (e.g., discontinued ops).

The difference = the true tax effect of that special item.

👉 This way, each component only gets the portion of tax it actually created.