Financial Statement Analysis

1/201

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

202 Terms

Financial Statement Analysis Framework

Step 1: | State the objective and context. Determine what questions the analysis seeks to answer, the form in which this information needs to be presented, and what resources and how much time are available to perform the analysis. |

Step 2: | Gather data. Acquire the company's financial statements and other relevant data on its industry and the economy. Ask questions of the company's management, suppliers, and customers, and visit company sites. |

Step 3: | Process the data. Make any appropriate adjustments to the financial statements. Calculate ratios and perform statistical analysis. Prepare exhibits such as graphs and common-size balance sheets. |

Step 4: | Analyze and interpret the data. Use the data to answer the questions stated in the first step. Decide what conclusions or recommendations the information supports. |

Step 5: | Report the conclusions or recommendations. Prepare a report and communicate it to its intended audience. Be sure the report and its dissemination comply with the Code and Standards that relate to investment analysis and recommendations. |

Step 6: | Update the analysis. Repeat these steps periodically, and change the conclusions or recommendations when necessary. |

Role of financial statement analysis

use the information in a company's financial statements, along with other relevant information, to make economic decisions

Standard-setting bodies

professional organizations of accountants and auditors that establish financial reporting standards

THEY DO NOT ENFORCE COMPLIANCE WITH THEM

Regulatory authorities

government agencies that have the legal authority to enforce compliance with financial reporting standards

Goals of IOSCO (international organization of securities commissions)

Protecting investors

Ensuring markets are fair, efficient, and transparent

Reducing systemic risk

SEC Form S-1

Registration statement before selling new securities to the public; includes financials, risks, underwriters, and use of proceeds.

SEC Form 10-K

Annual filing with audited financials, business risks, management details, and legal disclosures. Equivalent for foreign firms: 40-F (Canada), 20-F (other foreign issuers).

SEC Form 10-Q

Quarterly filing with interim financials (unaudited) and updates on legal/accounting changes. Foreign equivalent: Form 6-K (semiannual).

SEC Form DEF-14A

Proxy statement filed before shareholder meetings or votes.

SEC Form 8-K

Material event disclosure, including acquisitions, management changes, or governance updates.

SEC Form 144

Notice of intent to sell unregistered securities to qualified buyers.

SEC Forms 3, 4, and 5

Insider trading reports showing purchases/sales by company officers & directors.

Proxy Statements

issued to shareholders when there are matters that require a shareholder vote. These statements, which are also filed with the SEC, are a good source of information about the election of (and qualifications of) board members, compensation, management qualifications, and the issuance of stock options.

Financial Statement notes (footnotes)

Basis of Presentation – Covers fiscal period, IFRS/U.S. GAAP adherence, and consolidated entities.

Accounting Policies – Discloses methods, assumptions, and estimates used by management.

Additional Details – Includes info on acquisitions, legal actions, employee benefits, contingencies, major customers, related party transactions, segments, and post-balance sheet events.

Audited – Footnotes are reviewed along with the primary financial statements.

Business Segment (operating segment)

a portion of a larger company that accounts for more than 10% of the company's revenues, assets, or income. An operating segment should be distinguishable from the company's other lines of business in terms of the risk and return characteristics of the segment. Segments reported should account for a minimum of 75% of the firm's external sales.

The following must be disclosed for each segment within the financial statement notes:

Revenue (external and between segments)

A measure of profit or loss

A measure of assets and liabilities

Interest (revenue and expense)

Acquisitions of PP&E and intangibles

Depreciation and amortization

Other noncash expenses

Income tax expense

Share of equity-accounted investments results

Management Commentary (MD&A)

Shareholders Report

Purpose: Provides insights into business operations, strategy, and performance.

Key Elements (per IFRS guidance):

Nature of business & objectives

Past performance & key performance measures

Key relationships, resources, and risks

Caution: Some parts may be unaudited.

The standard auditor's opinion contains three parts and states the following:

Whereas the financial statements are prepared by management and are its responsibility, the auditor has performed an independent review.

Generally accepted auditing standards were followed, thus providing reasonable assurance that the financial statements contain no material errors.

The auditor is satisfied that the statements were prepared in accordance with accepted accounting principles and that the principles chosen and estimates made are reasonable. The auditor's report must also contain additional explanation when accounting methods have not been used consistently between periods.

Unqualified Opinion

indicates that the auditor believes the statements are free from material omissions and errors.

Qualified Opinion

statements make any exceptions to the accounting principles, the auditor may issue a qualified opinion and explain these exceptions in the audit report

Adverse Opinion

The auditor can issue an adverse opinion if the statements are not presented fairly or are materially nonconforming with accounting standards.

Disclaimer of Opinion

If the auditor is unable to express an opinion (e.g., in the case of a scope limitation), a disclaimer of opinion is issued. Any opinion other than unqualified is sometimes referred to as a modified opinion.

Segment Disclosure Requirements

Revenue (external and between segments)

A measure of profit or loss

A measure of assets and liabilities

Interest (revenue and expense)

Acquisitions of PP&E and intangibles

Depreciation and amortization

Other noncash expenses

Income tax expense

Share of equity-accounted investments results

When does an auditor need to add explanatory paragraph?

When material loss is probable and uncertainties may relate to the going concern assumption, to the valuation or realization of asset values, or to litigation.

An explanatory paragraph can be added in situations other than just adverse opinions. It's used to provide clarifications or emphasize important matters, regardless of the overall opinion (unmodified, qualified, etc.).

Key Audit Matters/ Critical Audit Matters

Accounting choices requiring significant judgment – Areas where management had to make difficult estimates (e.g., asset impairments, revenue recognition).

Significant transactions – How large or unusual transactions were recorded (e.g., acquisitions, restructurings).

Challenging or subjective areas – Items where auditors faced difficulty in assessing the accuracy of management’s reporting (e.g., fair value measurements, tax provisions).

Internal controls

processes by which the company ensures that it presents accurate financial statements. Internal controls are the responsibility of management. For publicly traded firms in the United States, the auditor must express an opinion on the firm's internal controls. The auditor can provide this opinion separately, or as the fourth element of the standard opinion.

Key Audit Matters (Internation)/ Critical Audit Matters (US)

These would include accounting choices that require significant management judgments and estimates, how significant transactions during a period were accounted for, or choices that the auditor finds especially challenging or subjective—and which, therefore, have a significant likelihood of being misstated.

Inventory Valuation GAAP vs IFRS

GAAP - FIFO, LIFO, Weighted avg

LIFRS - LIFO prohibited

Information sources aside from annual and interim financial reports

Earnings Calls

3rd party source

Proprietary 3rd party

Proprietary primary research

Revenue Recognition: Performance Obligation

Take revenue as progress move towards completion

Revenue Recognition: Acting as agent

Agents make profit of 100% for commission while principal makes the profit margin only because it incurs the costs

Revenue Recognition: Franchising and licensing

Revenue from company-owned restaurants

Franchise royalties and fees

Revenue from supplies to franchises (equipment and food materials)

Revenue Recognition: Service versus license

The software supplier will report revenue over the life of the contract.

Criteria:

The software supplier will continue to update and enhance the software over the term of the license.

Customers will be exposed to potential benefits or negative impacts from updates and enhancements.

Updates and enhancements do not result in a transfer of goods or services.

The software supplier will report revenue at the beginning of the contract.

Criteria:

The license grants the customer the right to use the software as it exists at the start of the contract ("sold as is").

A separate contract exists for enhancements and updates to the software. The revenue for support services will be recognized when provided (typically over the life of the contract).

Revenue Recognition: Bill and hold agreement

Bill and Hold allows company to mark revenue when performance has not been satisfied ONLY when customer requests this arrangement.

Matching Principle

Using the matching principle, expenses to generate revenue are recognized in the same period as the revenue. Inventory provides a good example.

Assume that inventory is purchased during the fourth quarter of one year and sold during the first quarter of the following year. Using the matching principle, both the revenue and the expense (cost of goods sold) are recognized in the first quarter of the second year, when the inventory is sold—not the period in which the inventory was purchased. Another example are goods that are sold with a warranty period. The estimated cost of repairing or replacing faulty goods under the warranty must be estimated and deducted from revenue at the time of sale, rather than when the actual costs are incurred.

Capitalization

Capitalization is an application of the matching principle whereby costs are initially capitalized as assets on the balance sheet and then expensed, using depreciation or amortization, to the income statement over the asset's life as its benefits are consumed. Property, plant, and equipment (PP&E) and intangible assets with finite lives are examples of this.

Period Costs

Period costs (expenses not directly tied to revenue generation), such as administrative costs, are expensed in the period incurred.

For example, if a firm has occupied a leased premise, one year's worth of rent should be expensed to the income statement regardless of whether the rent has been paid.

Capitalization vs. Expensing

an expenditure that is expected to provide a future economic benefit over multiple accounting periods is capitalized; however, if the future economic benefit is unlikely or highly uncertain, the expenditure is expensed in the period incurred.

Unusual or infrequent items

Gains or losses from the sale of assets or part of a business, if these activities are not a firm's ordinary operations

Impairments, write-offs, and write-downs

Restructuring costs

Any income or loss from discontinued operations is reported separately in the income statement, net of tax, after income from continuing operations. Any past income statements presented must be restated, separating the income or loss from the discontinued operations. On the measurement date, the company will accrue any estimated loss during the phaseout period, and any estimated loss on the sale of the business. Any expected gain on the disposal cannot be reported until after the sale is completed.

Measurement date

The date when the company develops a formal plan for disposing of an operation is referred to as the measurement date

Phaseout period

the time between the measurement period and the actual disposal date is referred to as the phaseout period

Retrospective application

With retrospective application, any prior-period financial statements presented in a firm's current financial statements must be restated, applying the new policy to those statements as well as future statements.

Change in accounting policy

Standard-setting bodies, at times, issue a change in accounting policy. Sometimes, a firm may change which accounting policy it applies, for example, by changing its inventory costing method or capitalizing rather than expensing specific purchases. Unless it is impractical, changes in accounting policies require retrospective application.

Change in accounting estimate

Generally, a change in accounting estimate is the result of a change in management's judgment, usually due to new information. For example, management may change the estimated useful life of an asset because new information indicates that the asset has a longer or shorter life than originally expected. Changes in accounting estimates are applied prospectively and do not require the restatement of prior financial statements.

Prior Period adjustment

A correction of an accounting error made in previous financial statements is reported as a prior-period adjustment and requires retrospective application. Prior-period results are restated. Disclosure of the nature of any significant prior-period adjustment and its effect on net income is also required.

Change in scope

Accounting standards do not require firms to disclose the impact on their financial statements of changes in scope or exchange rates, but analysts must be alert to their effects. In this context, "changes in scope" refer to how acquiring another company affects the size of the combined entity. Mergers and acquisitions can dramatically reduce comparability of company financial statements before and after the acquisition date.

Stock dividend

A stock dividend is the distribution of additional shares to each shareholder in an amount proportional to their current number of shares. If a 10% stock dividend is paid, the holder of 100 shares of stock would receive 10 additional shares.

Stock split

A stock split refers to the division of each "old" share into a specific number of "new" (post-split) shares. The holder of 100 shares will have 200 shares after a 2-for-1 split, or 150 shares after a 3-for-2 split.

Common-size income statement

A vertical common-size income statement expresses each category of the income statement as a percentage of revenue. The common-size format standardizes the income statement by eliminating the effects of size. This allows for comparison of income statement items over time (time-series analysis) and across firms (cross-sectional analysis).

Gross profit margin

Margin ratios can be used to measure a firm's profitability quickly. Gross profit margin is the ratio of gross profit (revenue minus cost of goods sold) to revenue (sales):

Net profit margin

Net profit margin is the ratio of net income to revenue:

Identifiable intangible asset

can be acquired separately or are the result of rights or privileges conveyed to their owner.

Examples of identifiable intangibles are patents, trademarks, and copyrights.

Unidentifiable intangible assets

cannot be acquired separately and may have an unlimited life.

The best example of an unidentifiable intangible asset is goodwill.

Goodwill

Balance sheet goodwill results from acquiring another business. Goodwill is the amount by which the purchase price is greater than the fair value of the acquired company's identifiable net assets (assets minus liabilities).

Economic goodwill

Accounting goodwill should not be confused with economic goodwill. Economic goodwill derives from the expected future performance of the firm, while accounting goodwill is the result of past acquisitions.

Held-to-maturity securities

Under U.S. GAAP, debt securities acquired with the intent to hold them until they mature are classified as held-to-maturity securities and measured at amortized cost. Amortized cost is equal to the original issue price minus any principal payments, plus any amortized discount or minus any amortized premium, minus any impairment losses. Subsequent changes in market value are ignored.

Mark-to-Market Accounting

Financial assets measured at fair value, also known as mark-to-market accounting, include trading securities, available-for-sale securities, and derivatives.

Trading securities

Trading securities (also known as held-for-trading securities) are debt securities acquired with the intent to sell them in the near term. Trading securities are reported on the balance sheet at fair value, with unrealized gains and losses (changes in market value before the securities are sold) recognized in the income statement. All equity securities holdings with quoted market prices (except those that give a company significant influence over a firm) are treated this way. Unrealized gains and losses are also known as holding period gains and losses. Derivative instruments are treated the same as trading securities.

Available for sale securities

Available-for-sale securities are debt securities that are not expected to be held to maturity or traded in the near term. Like trading securities, available-for-sale securities are reported on the balance sheet at fair value. However, any unrealized gains and losses are not recognized in the income statement, but are reported in other comprehensive income as a part of shareholders' equity.

Loans, notes receivable, debt securities held to maturity and unlisted securities (GAAP vs IFRS)

Both measured as amortized Costs

Debt securities intended to collect interest and sell (GAAP vs IFRS)

Measured at fair value on BS and P/L through other comprehensive income

Equity Securities (GAAP vs IFRS)

GAAP - all equities must be classified as trading securities (FVNI)

IFRS - irrevocable decision for trading securities (FVNI) or available for sale (FVOCI)

Financial assets not fitting other classifications (GAAP vs IFRS)

GAAP - generally measured FVNI

IFRS - FVPL (IFRS version of FVNI)

Irrevocable choice for financial assets (GAAP vs IFRS)

GAAP - must be FVNI

IFRS - irrevocable choice to FVPL or keep as its own category

common-size balance sheet

A vertical common-size balance sheet expresses each item of the balance sheet as a percentage of total assets. The common-size format standardizes the balance sheet by eliminating the effects of size. This allows for comparison over time (time-series analysis) and across firms (cross-sectional analysis).

Balance Sheet ratios

The percentages on a common-size balance sheet are examples of balance sheet ratios, which compare one balance sheet item to another balance sheet item (total assets in this case). Balance sheet ratios, along with common-size analysis, can be used to evaluate a firm's liquidity and solvency. The results can be compared over time and across firms.

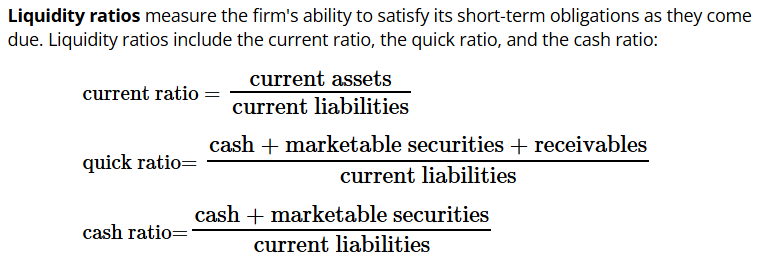

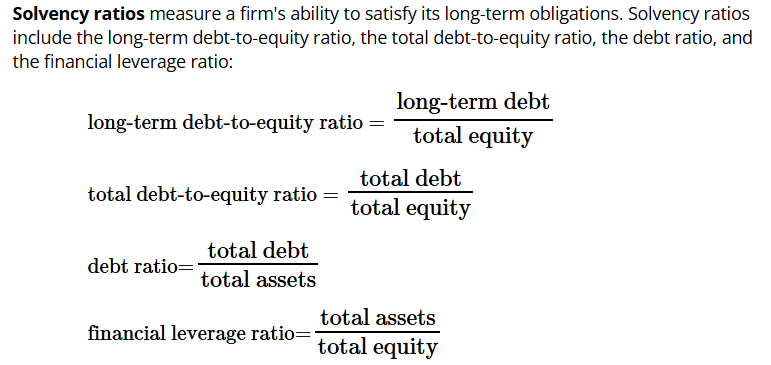

Liquidity ratio

Solvency Ratio

Cash Flow

The cash flow statement provides information for a reporting period beyond that available from the income statement, which is based on accrual, rather than cash, accounting. Analysts use cash flow statements to understand:

A company's cash receipts and cash payments during an accounting period

A company's operating, investing, and financing activities

The impact of accrual accounting events on cash flows

A company's quality of earnings

Quality based on earnings and CF

Earnings are considered to be of high quality when operating cash flows, which can also be called cash flow from operations (CFO), are close to or higher than reported earnings. If earnings are consistently higher than CFO, their quality is lower because the accruals-based earnings are not backed by cash creation from operating activities.

Accruals between IS and CF

Accruals mean companies recognize revenue & expenses when they happen, not when cash moves.

Net income ≠ cash flow because non-cash transactions (like accounts receivable, depreciation, and prepaid expenses) affect IS but don’t immediately impact cash.

Financing & investing activities (like loans, asset purchases, and dividends) can change cash flow without affecting the IS right away.

Operating vs Investing activities in relation to assets and liabilities

Operating activities relate (with a few exceptions) to the firm's current assets and current liabilities.

Investing activities typically relate to the firm's noncurrent assets, and financing activities typically relate to the firm's noncurrent liabilities and equity.

Investment in working capital

The net change in a company's total operating assets and liabilities is known as its investment in working capital.

Direct Cash Flow Steps

Step 1: Start at the top of the income statement with revenue.

Step 2: Examine the balance sheet for any assets or liabilities (typically current) relating to the income statement item.

Step 3: Compute the change in the balance sheet asset or liability.

Step 4: Adjust the income statement for the change in the balance sheet amount using the following rules:

Subtract an increase in an asset (a use of cash), or add a decrease in an asset (a source of cash).

Add an increase in a liability (a source of cash), or subtract a decrease in a liability (a use of cash).

For these rules to work consistently, we must treat expense items as negative numbers (e.g., cost of goods sold, wages and salaries) before we adjust them.

Step 5: After adjusting the income statement item for the change in the balance sheet asset or liability, move to the next item in the income statement.

Step 6: Ignore any noncash charges (e.g., depreciation, gains and losses on asset disposal). A noncash charge is any amount in the income statement that is due to accounting treatment rather than actual cash flows.

Step 7: Once all income statement items have been adjusted for accruals, total the amount to get CFO.

Indirect Cash Flow Steps

Step 1: | Begin with net income. |

Step 2: | Add back all noncash charges to income (such as depreciation and amortization) and subtract all noncash components of revenue. Subtract gains or add losses that resulted from financing or investing cash flows (such as gains from sale of land). |

Step 3: | Adjust for working capital by adding or subtracting changes to balance sheet operating accounts as follows:

|

Cash Flow from investing

Cash flow from investing activities (CFI) consists of the cash inflows and outflows that result from acquiring or disposing of long-term assets and certain investments.

Interest Received: Cash Flow (GAAP vs IFRS)

CFO - GAAP

CFO/CFI - IFRS

Interest Paid: Cash Flow (GAAP vs IFRS)

CFO - GAAP

CFO/CFF - IFRS

Dividends recieved: Cash Flow (GAAP vs IFRS)

CFO - GAAP

CFO/CFI - IFRS

Dividends paid: Cash Flow (GAAP vs IFRS)

CFF - GAAP

CFO/CFF - IFRS

Free Cash Flows

Free cash flow is a measure of cash available for discretionary use, after a firm has covered its capital expenditures. This fundamental cash flow measure is often used for valuation. Analysts have several ways to measure free cash flow. Two of the more common measures are free cash flow to the firm and free cash flow to equity.

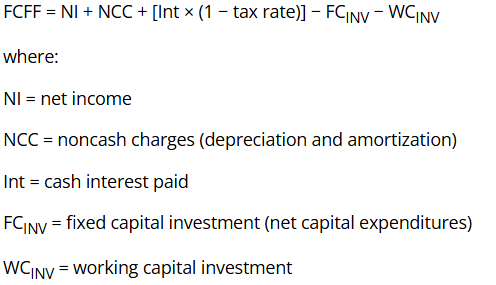

Free cash flow to the firm (FCFF)

Free cash flow to the firm (FCFF) is cash available to all investors, both equity owners and debtholders. FCFF can be calculated by starting with either net income or operating cash flow. FCFF is calculated from net income as follows:

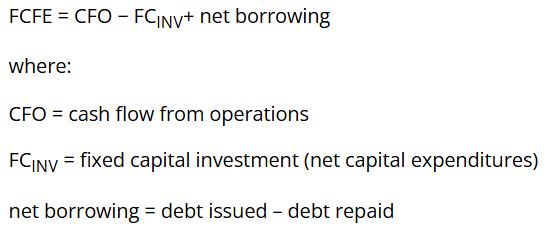

Free cash flow to equity (FCFE)

Free cash flow to equity (FCFE) is the cash flow available for distribution to common shareholders. FCFE can be calculated as follows:

Common-size format

A common-size cash flow statement can be presented in three ways:

% of Revenue – Each cash flow item is shown as a percentage of total revenue. Helps compare efficiency across companies.

% of Inflows – Each cash inflow is shown as a percentage of total cash inflows. Helps analyze where cash is coming from.

% of Outflows – Each cash outflow is shown as a percentage of total cash outflows. Helps see where cash is spent.

Inventory Disclosures

Cost flow method (LIFO, FIFO, etc.) used

Total carrying value of inventory, with carrying value by classification (raw materials, work in progress, and finished goods), if appropriate

Carrying value of inventories reported at fair value less selling costs

The cost of inventory recognized as an expense (COGS) during the period

Amount of inventory write-downs (valuation allowances) during the period

Reversals of inventory write-downs during the period, including a discussion of the circumstances of reversal (IFRS only because U.S. GAAP does not allow reversals)

Carrying value of inventories pledged as collateral

lower of cost or NRV— IFRS

Net realizable value (NRV) is equal to the expected sales price less the estimated selling costs and completion costs.

NRV = Expected selling price - total sales price

Lower of cost or market — GAAP

Market value is based on replacement cost, subject to two limits:

Ceiling (Upper Limit) = NRV

Floor (Lower Limit) = NRV - Normal Profit Margin

Future of write downs

For periods that follow a write-down of inventory to NRV, COGS may be decreased by lower inventory carrying values, which will increase profitability. Together with the decreases in assets and equity from the write-down, an increase in net income from decreased COGS will increase reported ROA and ROE in subsequent periods.

LIFO vs FIFO ratios (profit, liquid, activity, solvency)

Profitability - FIFO > LIFO

Liquidity - FIFO > LIFO (more in inventory)

Activity - FIFO < LIFO (more COGS)

Solvency (debt ratio) - FIFO < LIFO (higher assets— equity — D/E lower)

LIFO liquidation

When LIFO firm’s inventory quantities decline — temporary boost in net income due to draining older/cheaper goods.

High inventory turnover red flags

A firm with an inventory turnover ratio that is too high may not be carrying enough inventory to satisfy customers' needs, which can cause the firm to lose sales. High inventory turnover may also indicate that inventory write-downs have occurred. Write-downs are usually the result of poor inventory management.

Acquistion method

Goodwill = purchase price - fair MV of net assets - fair MV of identifiable intangibles

Impairment

An impairment is an unanticipated decline in an asset's value, causing it to fall below the carrying value.

An impairment loss essentially indicates that the firm has not recognized sufficient depreciation or amortization expense, and has overstated earnings as a result.

Intend for sale asset

If a firm intends to sell an asset, it is probable that the asset will be sold, and the asset is available for immediate sale, then it must be reclassified from held for use to held for sale. When a firm reclassifies an asset as held for sale, the asset is no longer depreciated or amortized. The held-for-sale asset is impaired if its carrying value exceeds its fair value less selling costs. If impaired, the asset is written down to net realizable value, and the loss is recognized in the income statement.

Derecognition

Derecognition occurs when an asset is disposed of or retired.

Spinoff

A spinoff is the transfer of assets that constitute an entire division or subsidiary into a new legal entity, upon which the shares of the spinnee are subsequently distributed to its shareholders, and the shareholders do not surrender any stock of the spinnor.1 See Spinoff as follows.

Why LIFO over FIFO

LIFO minimizes tax which leads to higher CFO

Must list LIFO reserve in footnotes when using LIFO under GAAP

The advantages of leasing rather than purchasing an asset may include the following:

Less initial cash outflow. Typically, a lease requires only a small down payment, if any.

Less costly financing. Because a lease is effectively secured by the leased asset if the lessee defaults, the interest rate implicit in a lease contract may be less than the interest rate would be on a loan to purchase the asset.

Less risk of obsolescence. At the end of a lease, the lessee often returns the leased asset to the lessor, and therefore, does not bear the risk of an unexpected decline in the asset's end-of-lease value. Given that the lessor bears the risk of obsolescence, this increases the lessor's risk and is reflected in a higher implicit interest rate within the lease. Some leases include guaranteed residual income clauses, whereby the lessee guarantees a minimum value for the leased assets at the end of the lease term. In this case, the risk of obsolescence remains with the lessee.

Finance lease

Under IFRS and U.S. GAAP, any lease in which both the benefits and the risks of ownership are substantially transferred to the lessee is classified as a finance lease.

Operating Lease

If either the benefits or the risks of ownership are not substantially transferred to the lessee, a lease is classified as an operating lease.

Ownership of the leased asset transfers to the lessee.

The lessee has an option to buy the asset and is expected to exercise it.

The lease is for most of the asset's useful life.

The present value of the lease payments is greater than or equal to the asset's fair value.

The lessor has no other use for the asset (i.e., the asset is of a specialized nature only suitable for use by the lessee).