Lc4-pt1- Financial Analysis Cash Flow Statements

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

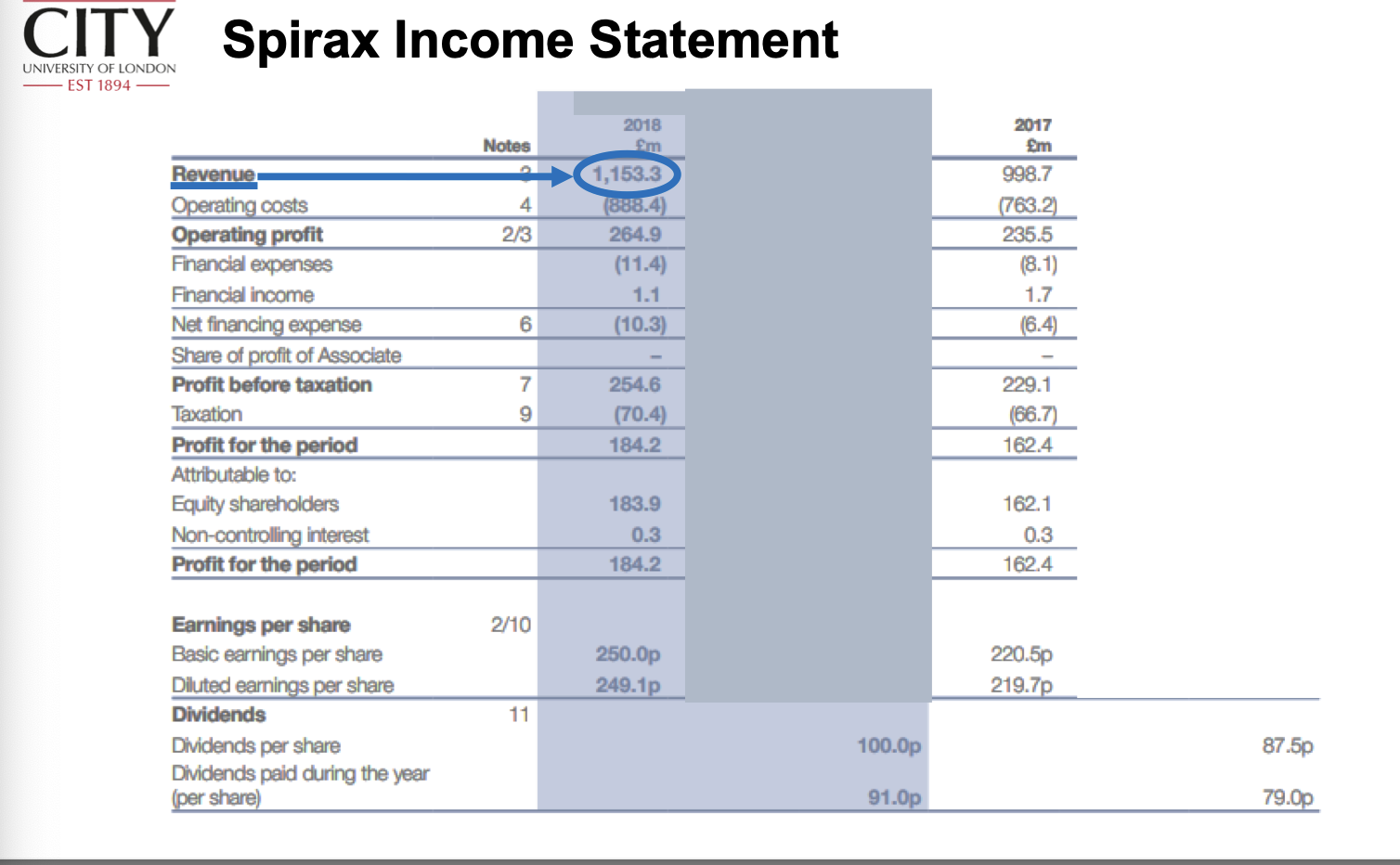

What are the three key financial statements?

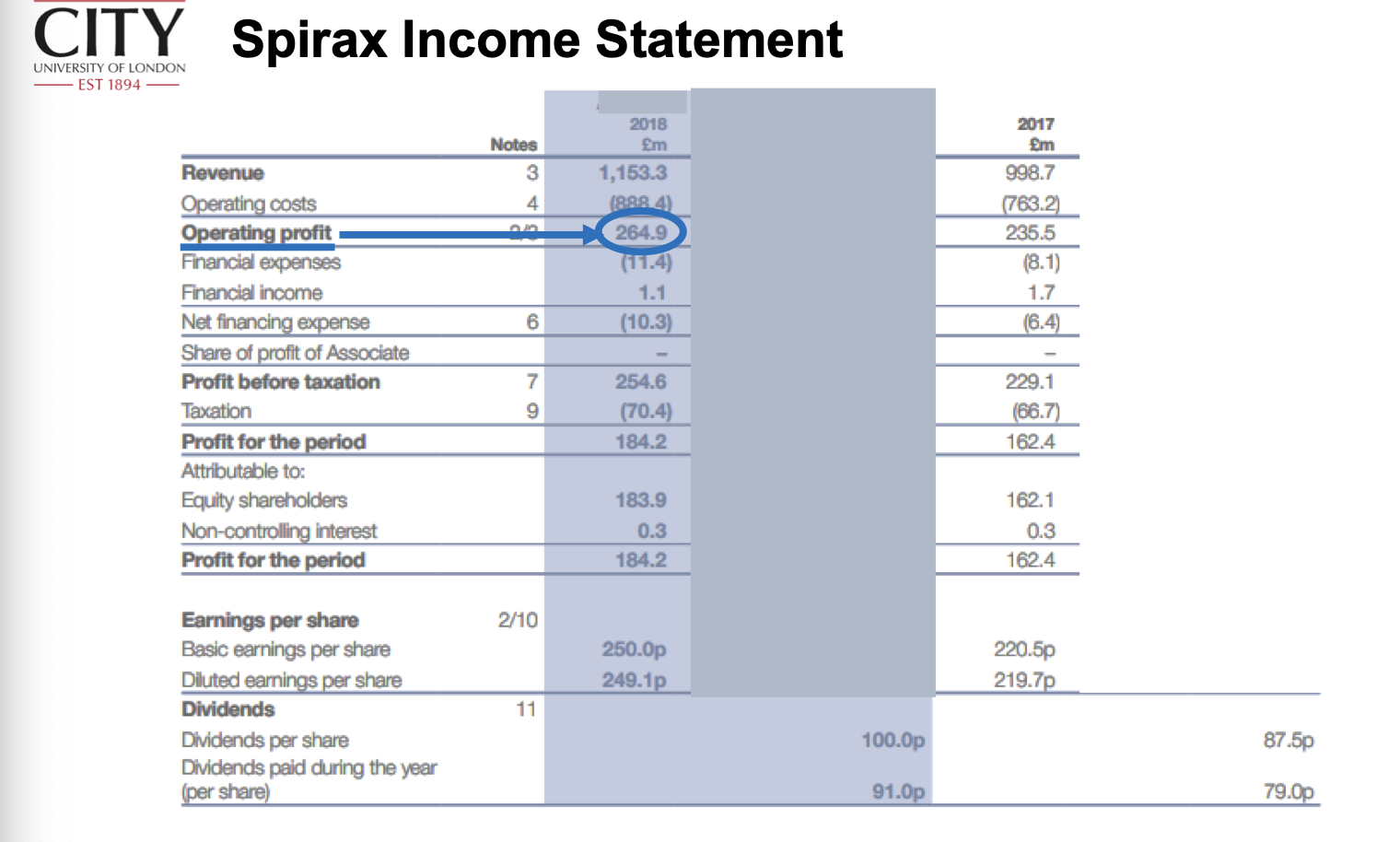

Income Statement: Like a giant subtraction sum, it "keeps score" on performance.

Balance Sheet: Like a rental flat inventory, it shows what is owned.

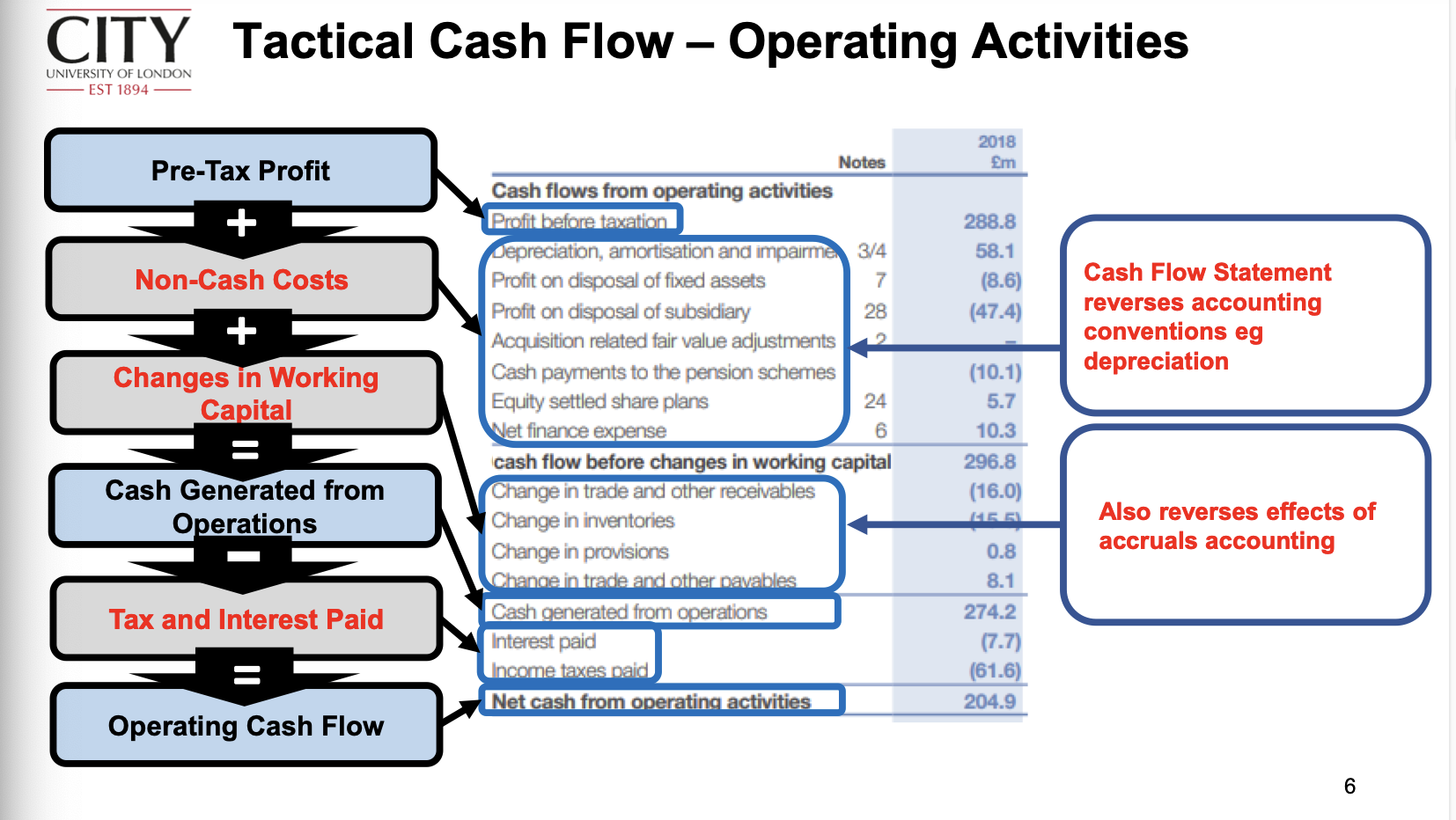

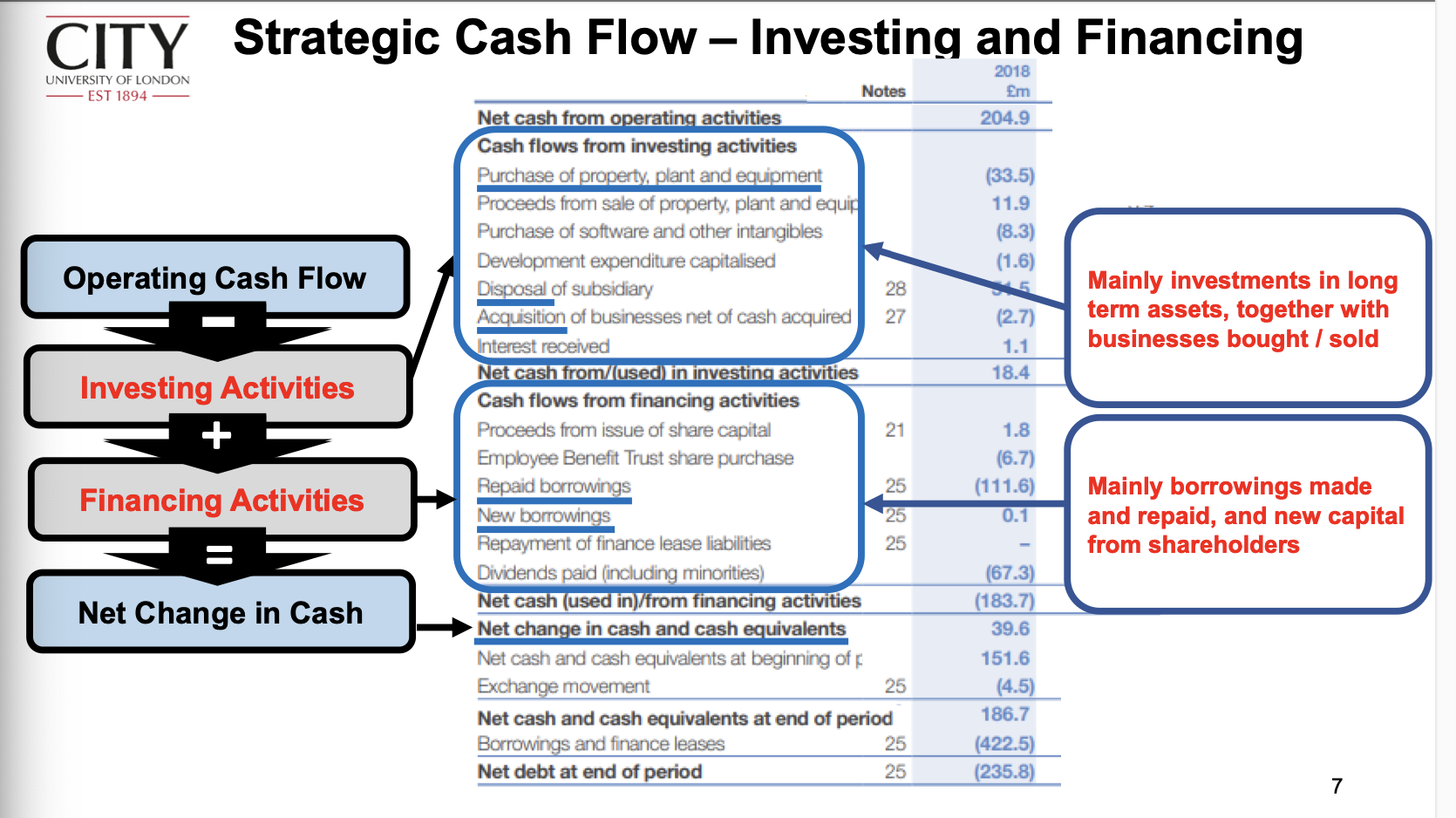

Cash Flow Statement: Like a bank statement, it explains changes in cash reserves.

Why is the cash flow statement important?

Revenues are vanity, profits are sanity, cash is reality.

It provides a clear view of cash available, removing accounting simplifications.

Critical for understanding a business's ability to operate.

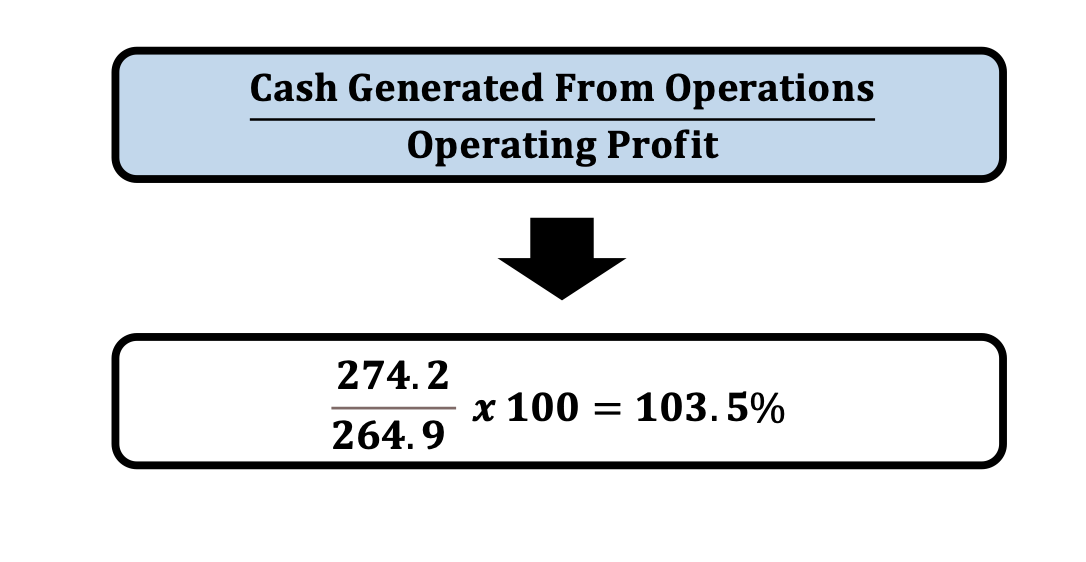

What is the formula for the Cash Conversion Ratio?

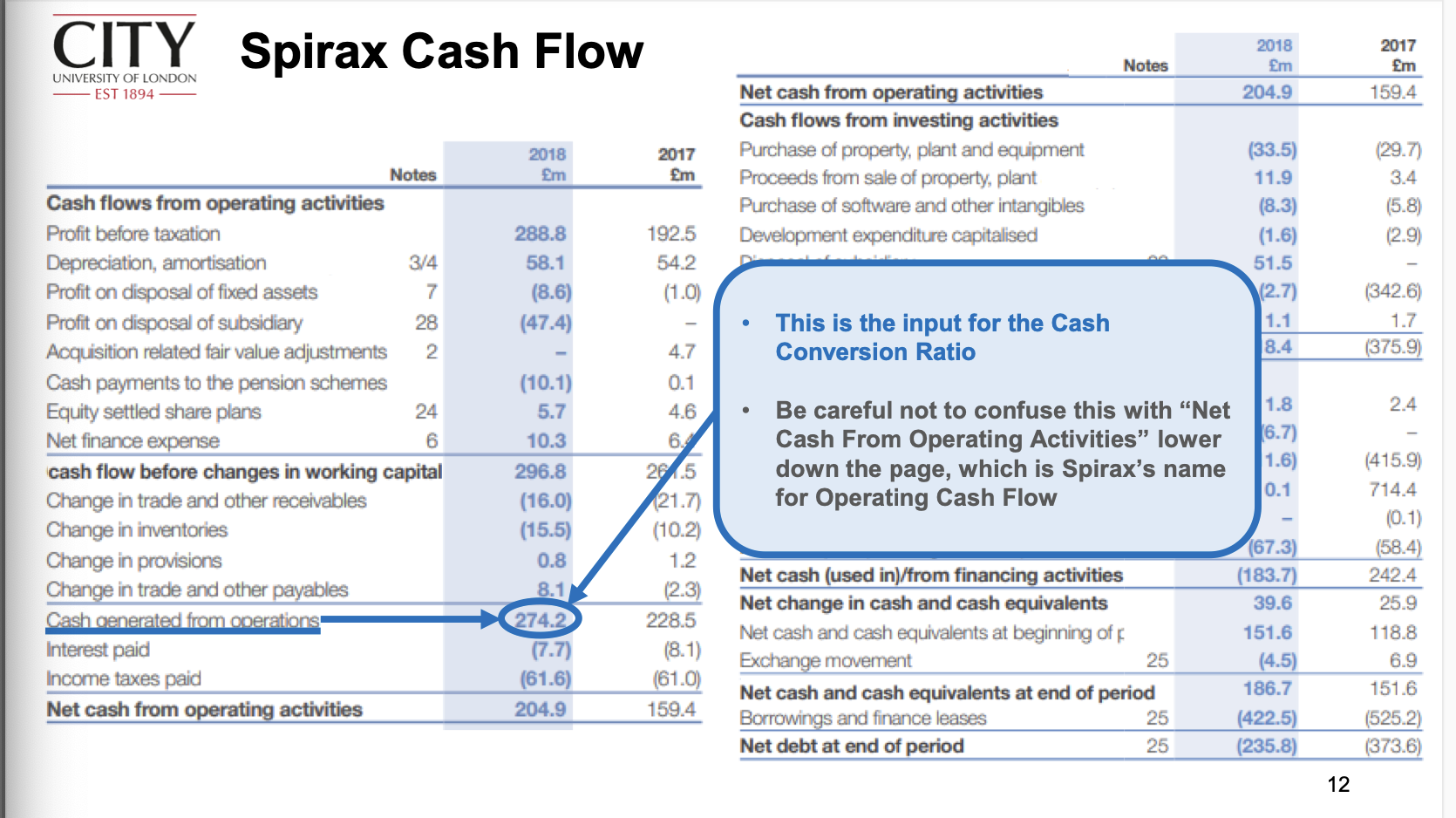

Cash Conversion Ratio = (Cash Generated from Operations ÷ Operating Profit) × 100

What does a high Cash Conversion Ratio indicate?

Indicates good alignment between cash flow and income statement.

Low ratios may suggest accounting issues.

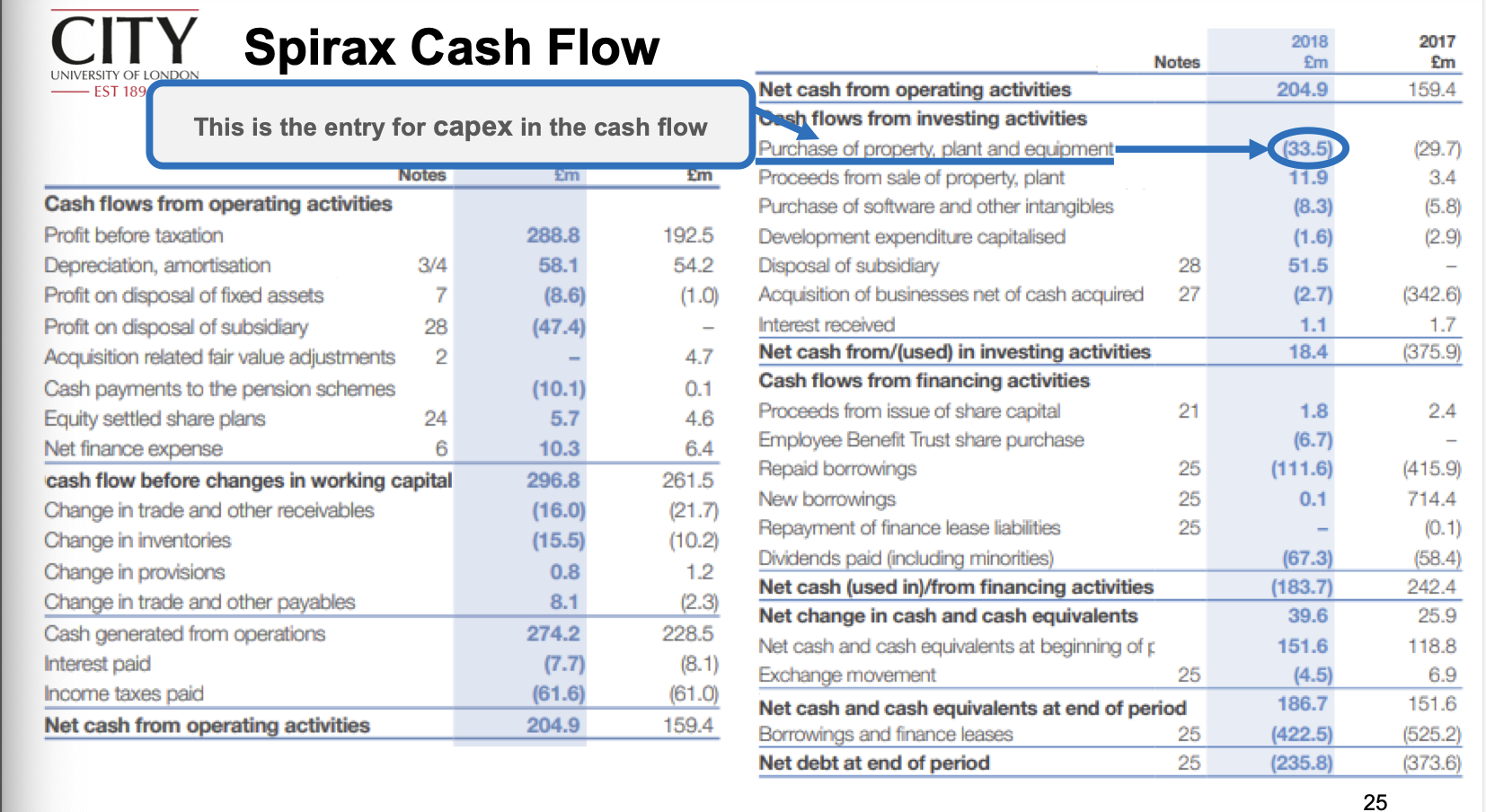

What is CAPEX?

Capital expenditure or capital investment, refers to spending on long-term physical productive assets, such as property, plant, and equipment.

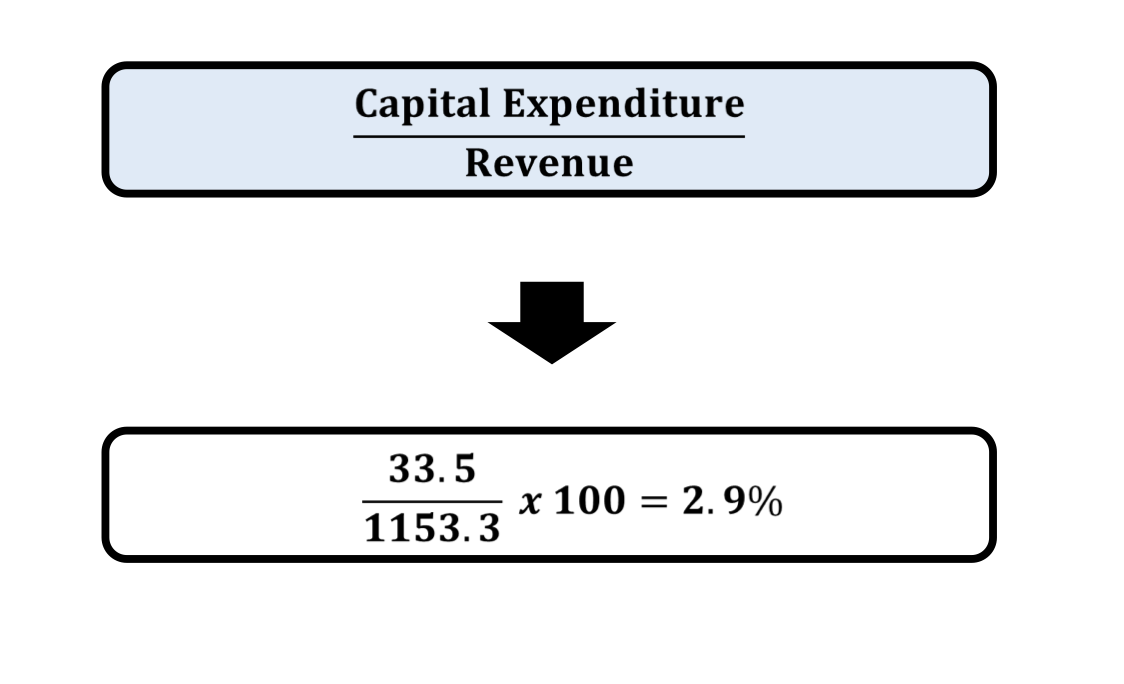

What is the formula for CAPEX to Revenue?

CAPEX to Revenue = (Capital Expenditure ÷ Revenue) × 100

What are the two specialised cash flow metrics discussed?

EBITDA: Earnings Before Interest, Tax, Depreciation, and Amortisation.

Free Cash Flow: Cash generated after accounting for CAPEX and tax.

What are the advantages of using Free Cash Flow over EBITDA?

Takes investment costs into account.

Provides a thorough and detailed measure of cash flow.

Preferred for high-growth, high-investment companies.

How do you calculate EBITDA?

EBITDA = Operating Profit + Depreciation + Amortisation

How is Free Cash Flow calculated?

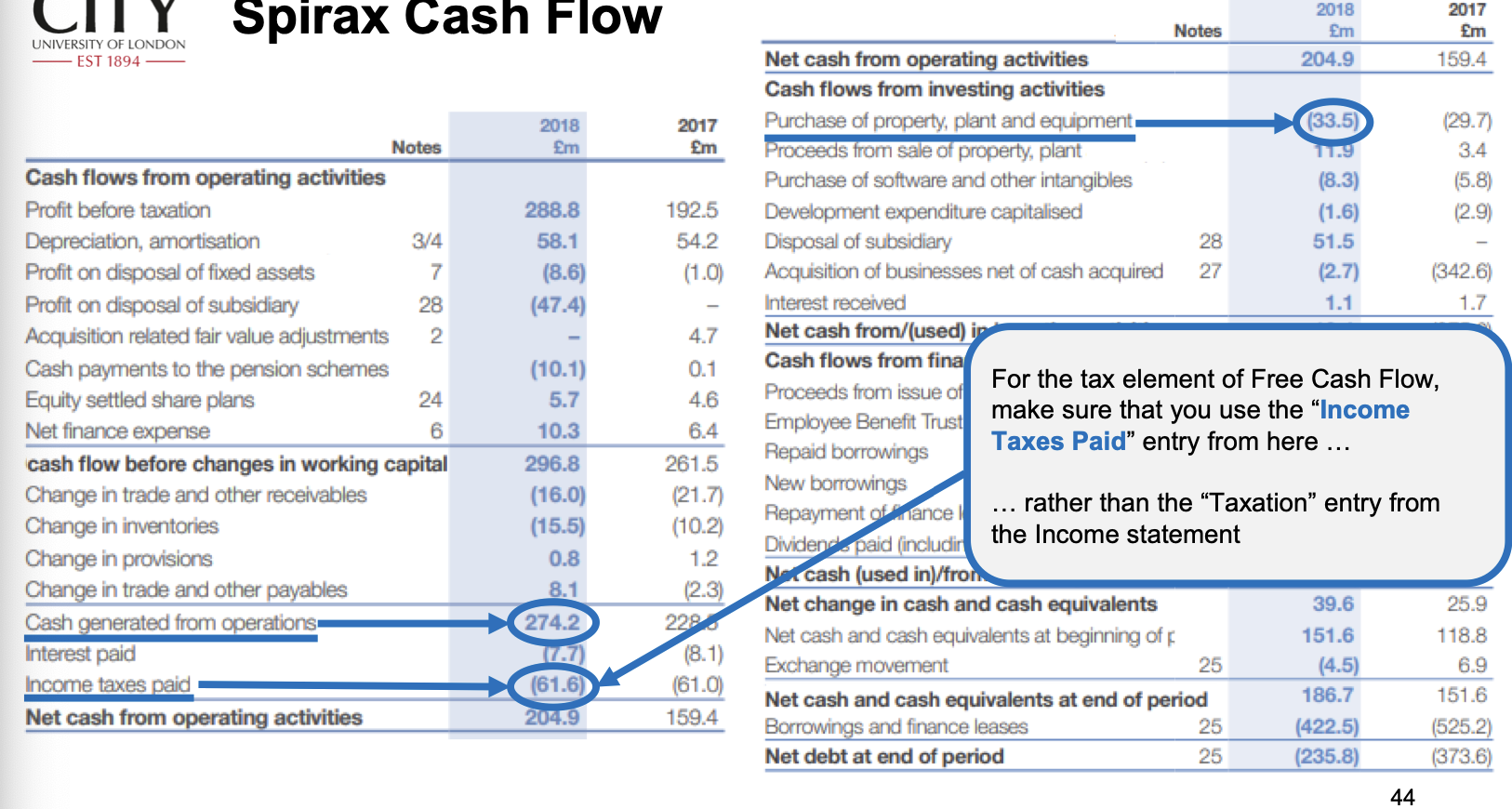

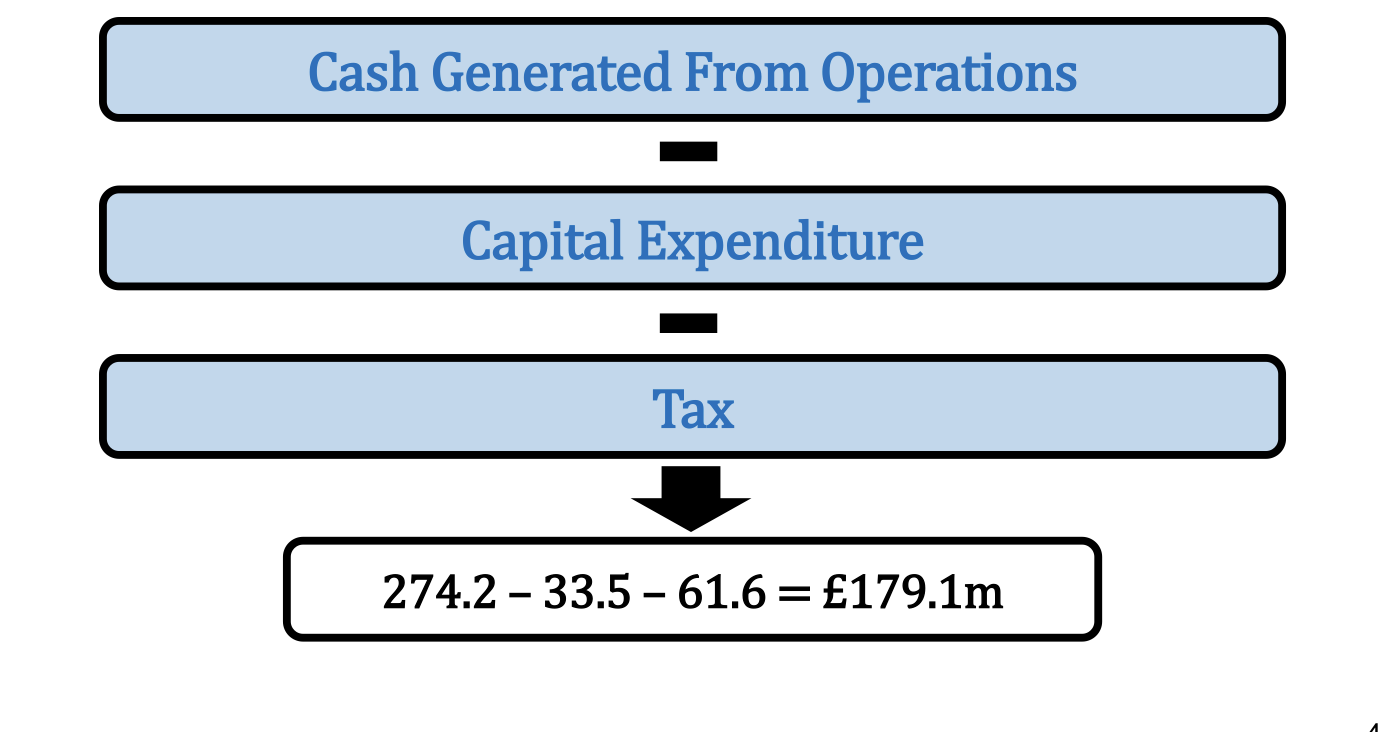

Free Cash Flow = Cash Generated from Operations − CAPEX − Tax

Importance of Capex

Higher Capex means greaterproportion of retained profits are ploughed back