1.2.9a - indirect taxes

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

what is an indirect tax

a tax on expenditure

two main types of indirect tax

ad valorem = percentage

eg. VAT

specific/unit = fixed value

eg. excise duties

on whom are indirect taxes placed

the producer

effect of indirect tax

increase costs of production:

supply curve shifts LEFT

price RISES

quantity [bought/sold] FALLS

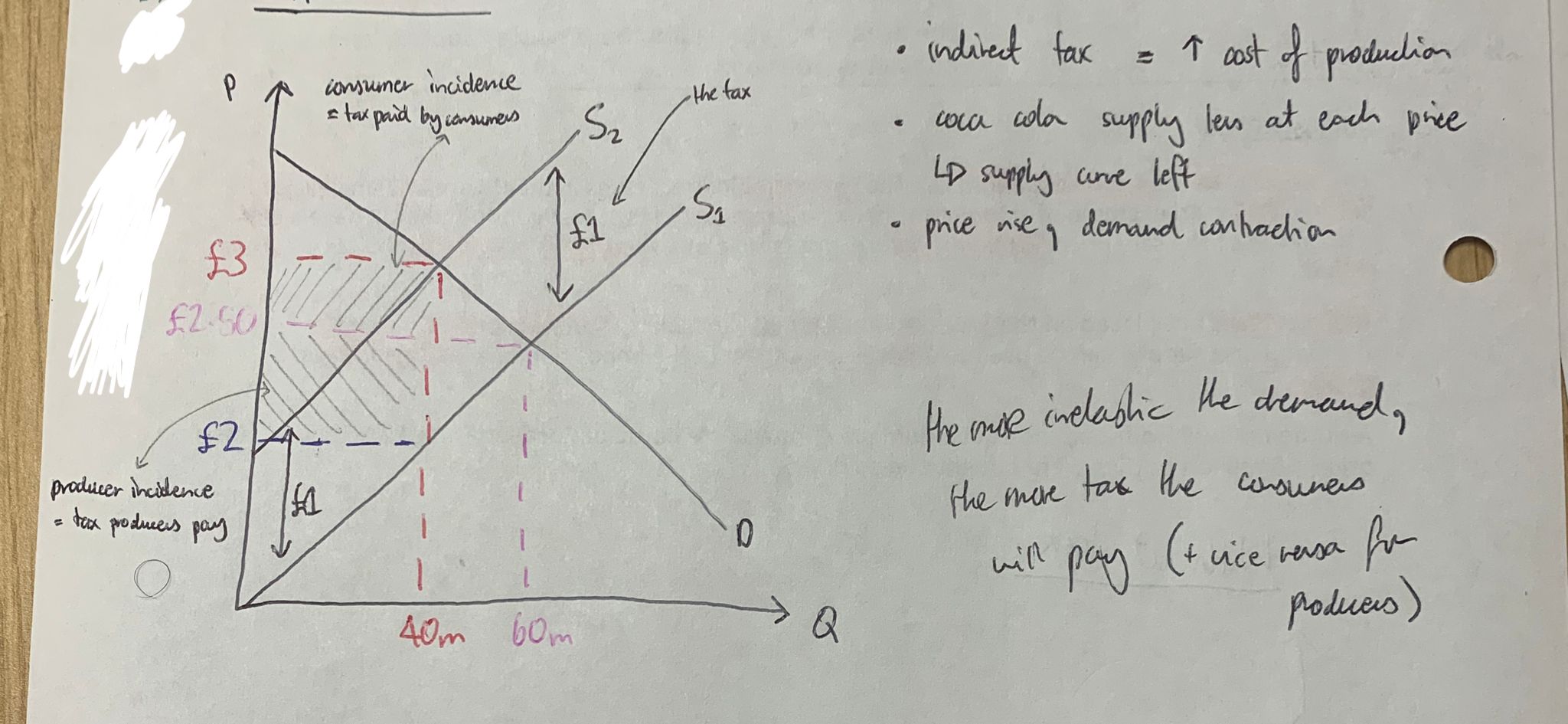

show an indirect tax diagram for SPECIFIC TAX

BEFORE TAX:

- TE = TR (total expenditure = total revenue)

AFTER TAX:

- TE reduced (price up, demand down)

- TR reduced (some of TE went to government)

- consumers paid half, producers paid half

the more inelastic the demand…

…the more tax is passed onto the consumers

(+ vice versa)

(bc the ppl don’t care what price they’ll still buy the same)

the more inelastic the supply

…the more tax is passed onto the producers

(+ vice versa)

(bc they don’t care what price they’ll still supply the same)

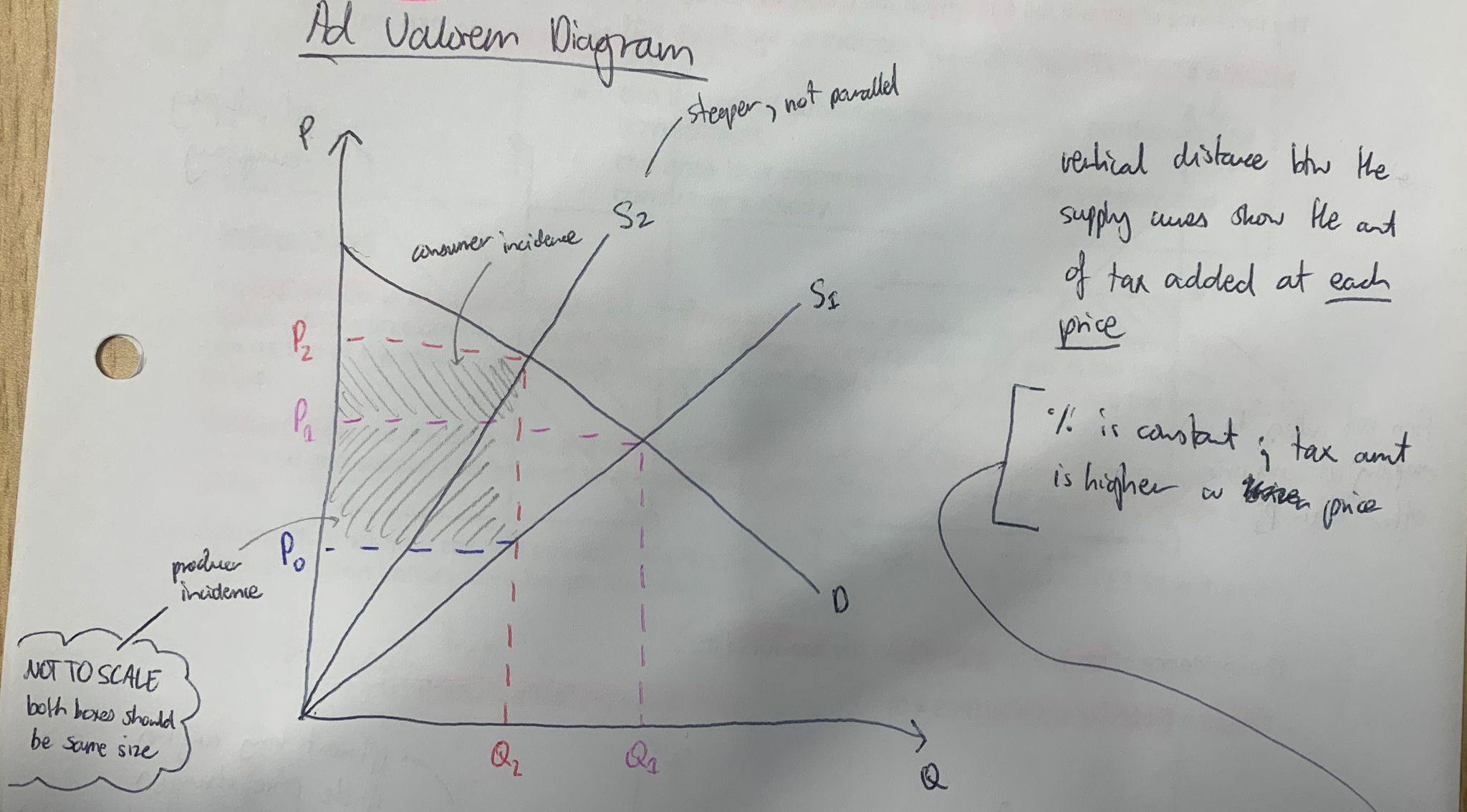

difference between specific and ad valorem tax graphs

supply curve still shifts left but at a STEEPER GRADIENT

because…

…vertical distance between the curves shows the tax, so HIGHER PRICES means vertical distance gets BIGGER because the amount of TAX RISES (bc its a percentage)

what can you also do with indirect tax diagrams

add them into externalities diagrams to show the reduction in welfare loss

4 stakeholders and the effects of indirect taxation on them

consumers | producers | government | society |

higher prices = some unwilling/unable to buy | loss of sales and revenue | will gain tax revenue | net welfare loss |

loss in consumer surplus (welfare) | will pay a proportion of the tax (producer incidence) | less neg externalities | |

will pay a proportion of the tax (consumer incidence) |