Chapter 8 The efficient market hypothesis

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

EMH (efficient market hypothesis)

prices of security fully reflect available market information

meaning its impossible to outperform the market by purchasing undervalued stocks or selling stocks at inflated price

best investment strategy is low-cost, passive portfolio

random walk

notion that stock price changes are random

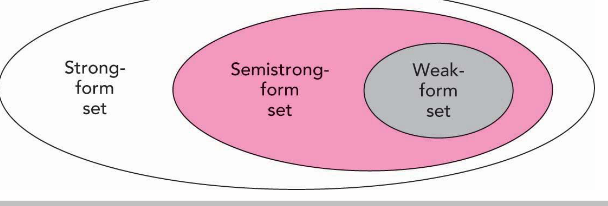

weak from EMH

Stock prices already reflect all

information contained in history of trading

semistrong-form EMH

Stock prices already reflect all public information

-passive management consistent

strong form EMH

Stock prices already reflect all

relevant information, including inside information

resistance level

unliekly for stock/index to rise above

support level

unlikely for stock/index to fall below

fundamental analysis

Research on determinants of stock value:

• Earnings, dividend prospects, future interest rate

expectations and firm risk

• Assumes stock price equal to discounted value of expected

future cash flow

index fund

Mutual fund which holds shares in proportion to market

index representation

momentum effect

Tendency of poorly- or well-performing stocks to continue abnormal performance in following periods

reversal effect

(run over long horizons)

Tendency of poorly- or well-performing

stocks to experience reversals in following periods

anomalies

Patterns of returns that seem to contradict the efficient market hypothesis

P/E effect

Portfolios of low P/E stocks have exhibited higher average risk adjusted returns that high P/E stocks