module 25 - monetary policy

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

wealth effect

when the price levels falls, consumers feel wealthier, which stimulates consumer spending and increases the quantity of goods and services demanded

interest rate effect

when the price level falls, people need to hold less money, which can be loaned out, lowering interest rates and stimulating investment spending

increasing quantity of goods and services demanded

one of the most important effects!

exchange rate effect

when price level falls, domestic interest rates fall, leading to a depreciation of the domestic currency

stimulates net exports and increases quantity of goods and services demanded

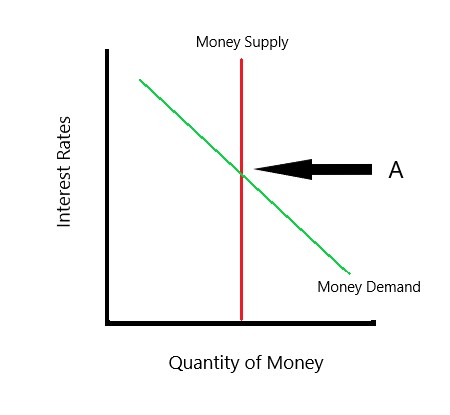

theory of liquidity preference

keynes’ theory that interest rate adjusts to bring supply and money demand into balance

assumes the expected rate of inflation is constant

money supply

the quantity of money available in the economy, controlled by the federal reserve (fed)

fixed by the fed policy and does not vary with interest rate

money demanded

quantity of money people want to hold

interest rate is opportunity cost of holding money, so money demand curve slopes downward

increase in interest rates raise the costs of holding money and reduces the quantity of money demanded

equilibrium interest rate

interest rate at which quantity of money demanded exactly balances the quantity of money supplied

monetary policy

setting of the money supply by the fed

influences ad and as

federal funds rate

interest rate that banks charge one another for short term loans

fed targets this rate through open market operations to adjust the money supply

fiscal policy

the government’s decisions regarding the level of government spending and taxation

it can shift ad through multiplier effect and crowding out effect

multiplier effect

additional shifts in ad that result when expansionary fiscal policy increases income and thereby increases consumer spending

investment accelerator

a positive feedback from demand to investment, where higher government demand leaders to higher demand for investment goods

marginal propensity to consume (mpc)

fraction of extra income that consumers spend

size of spending multiplier depends on mpc

large mpc leads to large multiplier

spending multiplier

calculated as 1/(1/ - mpc)

indicates that 1 dollar of government purchases (or consumption, investment, exports) can generate more than 1 dollar of ad

crowding out effect

offset in ad that results when expansionary fiscal policy raises interest rate, thereby reducing investment spending

increase in gov spending increases income, which increases money demand and raises interest rate, partially offsetting the initial increase in ad

automatic stabilizers

changes in fiscal policy that stimulate ad when the economy goes into recession, without policymakers having to take any deliberate action (like tax system or gov spending)