Theme 2

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

Peer-to-peer funding

Funding from an individual that the business has no relationship with through a lending marketplace.

Business angels

Wealthy individuals that lend their disposable finance in return for shares. Small loans, but cangive knowledge and advice.

Venture capital

An established business give large sums of money in return for shares.

Business plan

A document that describeshow they propose to set up the buisness, the nature of the product/service, objectives etc.

Cash-flow forecasts

Predicts all likely inflows and outflows of a business month by month.

Sales forecast

Estimates the volume or value of future sales using market research.

Sales revenue (turnover)

Sales revenue

Sales volume x selling price

Total variable costs

Average variable cost x quantity

Calculate changes

(Difference/original) x 100

Break-even

The point at which revenue equals cost.

Contribution

The amount that each unit produced ‘contributes’ to fixed costs.

Contribution

Selling price - variable cost per item

Break-even

Fixed costs/contribution per unit

Margin of safety

Difference between break-even level of sales and actual level of sales.

Margin of safety

Actual sales - break even sales

Budget

An estimate of income or expenditure over a set period of time.

Variance

Difference between actual and budgeted income and expenditure. Favourable = underspent. Adverse = overspent.

Historical budget

Set based off data of previous performance of the business.

Zero-based budget

Set using figures based off potential performance (e.g. number of probable customers).

Statement of comprehensive income (SOCI)

Accounts UK businesses have to publish showing their profit and loss.

Gross profit

Total revenue - total variable costs (cost of sales)

Operating profit

Total revenue - total costs

Net profit

Total revenue - total costs - tax and interest

Cash and profit

Cash is the amount of money a business has currently or soon. Profit is the money left over when all expenses are paid.

Liquidity

The ability of a business to turn its assets into cash to pay off current liabilities.

Statement of financial position (SOFP)

A balance sheet which is a summary of financial balances.

Current ratio

Current assets/current liabilites

Acid test

(Current assets - inventory) / current liabilities

Business failure

When a business ceases to trade or doesn’t trade in a profitable way or makes a terrible decision.

Liquidation

The process of closing a PLC or LTD.

Offshoring

A business moves overseas.

Productivity

The output per input (person or machine) per hour.

Job production

Unique products made by skilled craftspeople.

Batch production

Goods made in batches and can be switched over to make something different on the same production line.

Flow production

Standardised goods made on production line swith continuous movement of items (capital intensive).

Cell production

Dividing a production line into separate areas responsible for different sections of work.

Capacity utilisation

(Actual level of output/maximum possible output) x 100

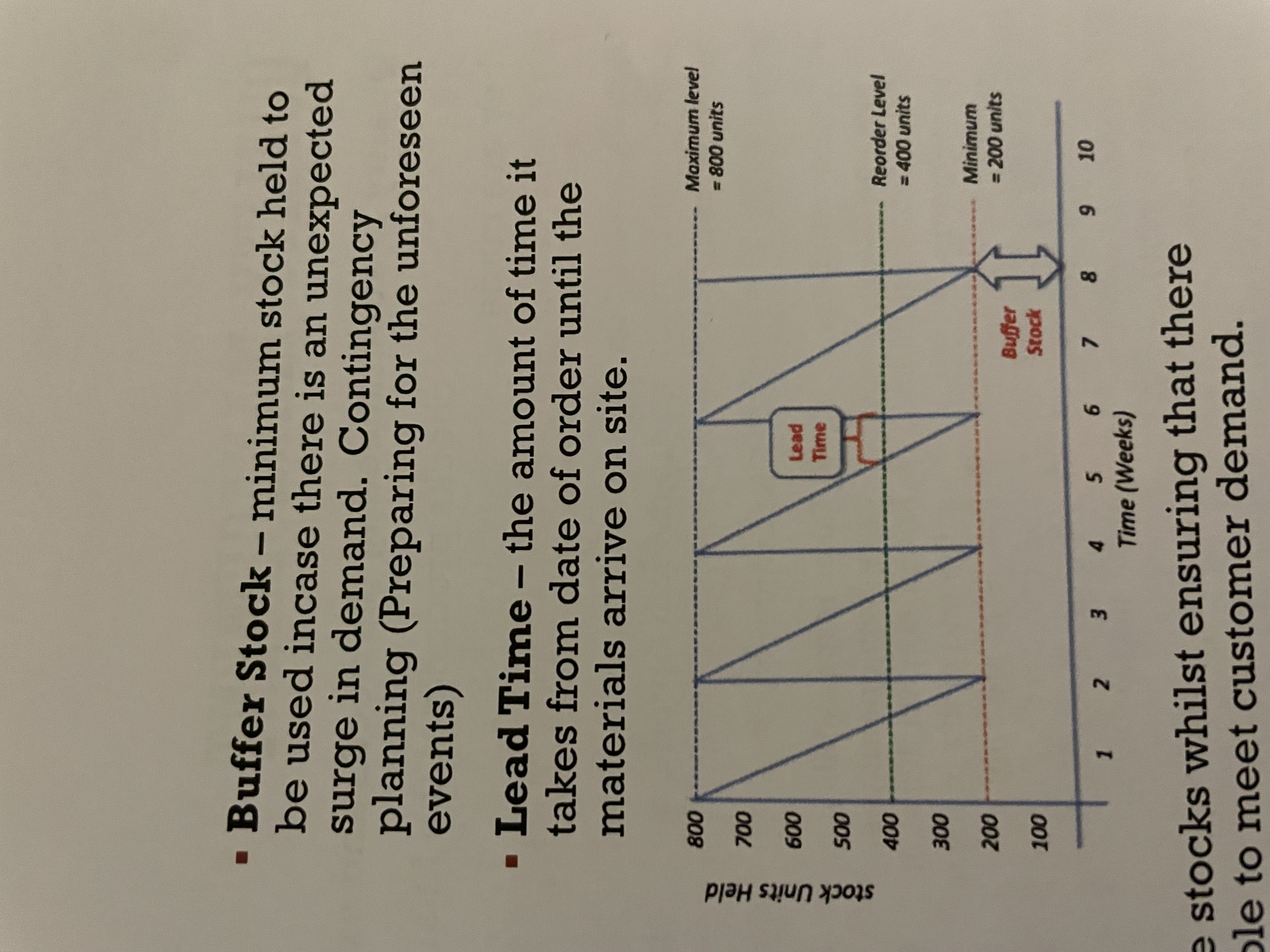

Stock control

Quality control verses quality assurance

Quality control checks products at the final stage while quality assurance ensures quality is built in at every stage.

Total quality management

Every stage of the production process is investigated to take into account quality at all times.

Benchmarking

Assessing competitors and then comparing performance standards.

Quality circles

Small groups opf workers in the same area of production meet to solve production problems.

Kaizen

‘Continuous improvement’ constantly introducing small incremental changes in a business to improve quality.

Inflation

The increas in the average price level of goods and services.

Exchange rates

The price of one currency in terms of another. SPICED.

Interest rates

Cost of borrowing and reward for saving.

Direct and indirect taxes

Direct are taxes on income e.g. income tax. Indirect are taxes on spending e.g. VAT.

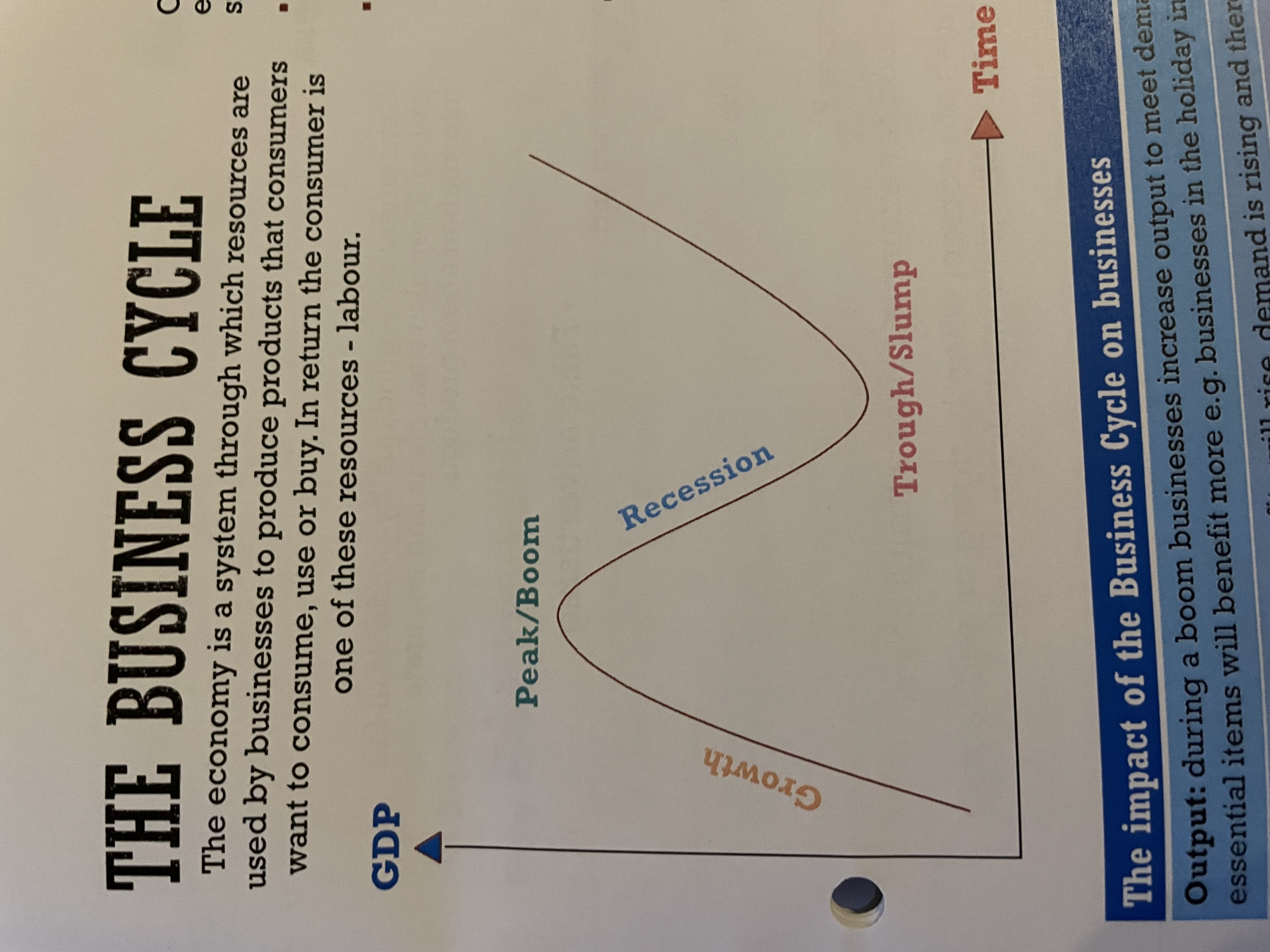

The business cycle