microeconomics exam 2 review

1/90

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

91 Terms

total utility

consumers are trying to maximize ? (satisfaction) given their budget constraint

marginal

additional

utility

1 unit of satisfaction

marginal utility

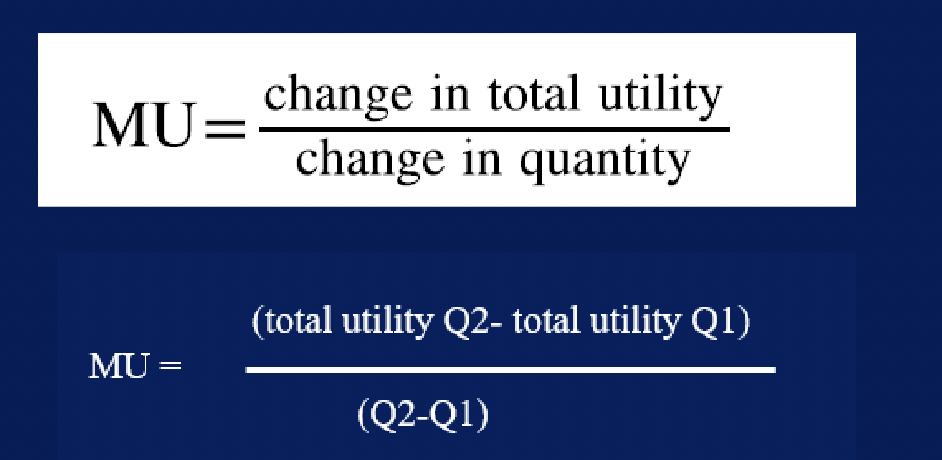

change in total utility/change in qty)

25 utils

If you consume 3 popcorn packs per week, and that will give you total utility of 60, while consuming 4 packs of popcorn will give you 85.

How much MU you got from consuming an extra pack of popcorn per week?

marginal utility

personal, nothing correct or wrong if someone is trying to maximize his/her ? different than others

substitution effect

occurs when a price changes and consumers have an incentive to consume less of the good with a relatively higher price and more of the good with a relatively lower price

income/purchase power effect

the motivation that encourages a utility-maximizer to buy more of both goods if utility rises or less of both goods if utility falls (f they are both goods)

decrease qty of goods, purchase 2 movie tickets instead of 3

$2400

Jimmy saves part of his income to entertain himself once a year. He spends some of these savings on vacation and buying new clothes.

He spent $200 on his new clothes, his marginal utility from new clothes purchases is 300 utils and his marginal utility from the vacation he went on is 3600 utils. This means that his vacation must cost:

Suppose you want to purchase an additional car, you want to make maximum utility per dollar spent.

First option you want to purchase Nissan Kicks $ 21,000 utility of 60

Second option you want to purchase Cadillac XT4 utility of 95

loss aversion

behavioral economists have conducted research that shows many ppl will feel some negative emotion, such as anger or frustration, after those 2 things happen.

we tend to focus more on the loss than the gain

$1 loss pains us 2.25 times more than a $1 gain helps us.

factors of production

natural resources (land and raw materials)

labor

capital

entrepreneurship

production fx

a mathematical expression or equation that explains the engineering relationship btw inputs and outputs

answers the q: how much output can the firm produce given different amounts of inputs?

different products have different ?

fixed costs

are the costs of the fixed inputs (e.g., capital)

bc fixed inputs don’t change in the short run, ? are expenditures that do not change regardless of the level of production

ex., once you sign the lease, the rent is the same regardless of how much you produce, at least until the lease expires

represented by a horizontal line

variable costs

costs of the variable inputs (e.g., labor)

the only way to increase or decrease output is by increasing or decreasing the variable inputs

therefore ? increase or decrease with output

ex., labor. since producing a greater qty of a good or service typically requires more workers or more work hours

ex., raw materials

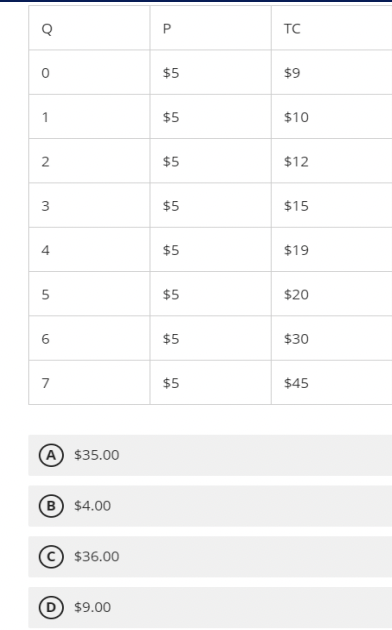

$9

what’s the fixed cost?

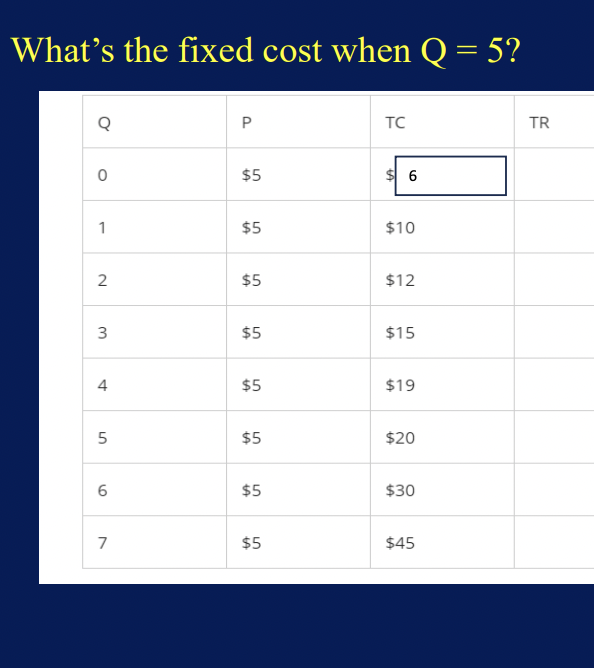

$6

what’s the fixed cost when q=5?

explicit costs

out of pocket costs (actual payments)

wages that a firm pays its employees or rent that a firm pays for its office

out-of-pocket expenses incurred by a business in the production of goods or services

implicit costs

more subtle, but just as important

represent the opportunity cost of using resources that the firm already owns

ex., usually small businesses working in the business while not earning a formal salary or using the ground floor of a home as a retail store are both implicit costs

when a company hires a new employee, there are implicit costs to train that employee

stay at current job

Eryn currently works for a corporate law firm. She is considering opening her own legal practice, where she expects to earn $200,000 per year once she establishes herself. To run her own firm, she would need an office and a law clerk. She has found the perfect office, which rents for $50,000 per year. She could hire a law clerk for $35,000 per year. If these figures are accurate, would Eryn’s legal practice be profitable?

Step 1: calculate explicit cost = 50000+35000 = 85k

Step 2: Subtracting the explicit costs from the revenue(accounting profit)= 200k-85k =115k

To open her own practice, Eryn would have to quit her current job, where she is earning an annual salary of $125,000. This would be an implicit cost of opening her own firm.

Do you think she will open her own firm? Let’s calculate her Economic profit. 115k (accounting profit)-125k(annual salary) = -10k

Do you think Eryn would open her own firm? Or stay employed and get 125k as salary.

open her own firm

Eryn currently works for a corporate law firm. If she decides to move to another state and open her own legal practice, where she expects to earn $300,000 per year once she establishes herself. To run her own firm, she would need an office and a law clerk. She has found the perfect office, which rents for $75,000 per year. She could hire a law clerk for $45,000 per year. If these figures are accurate, would Eryn’s legal practice be profitable?

Step 1: calculate explicit cost = 75k+45k= 120k

Step 2: Subtracting the explicit costs from the revenue (accounting profit)= 300k-120k= 180k

To open her own practice, Eryn would have to quit her current job, where she is earning an annual salary of $125,000, but now she wants to have 135,000. This would be an implicit cost of opening her own firm.

Do you think she will open her own firm?

Let’s calculate her Economic profit. (accounting profit)-(annual salary) = 180k-135k= 45000

Do you think Eryn would open her own firm? Or stay employed and get 125k as salary

diseconomies of scale

when a company or business grows so large that the costs per unit increase

takes place when economies of scale no longer function for the firm

higher than the optimum level

economies of scale

the fact that for many goods, as the level of production increases, the avg cost of producing each individual unit declines

less than the optimum level

perfect competition

entry→ sell at competitive price→ making profit→ encourage new firms to enter→ more supply stable demand→ profit decreases→ firms profit less than breakeven point→ exit

can earn profits in the short run, in the long run, the process of entry will push down prices until they reach the zero profit level

goal is selling products with prices greater than AVC

if profit will be less than the breakeven point (negative profit) considers shutting down or stopping production

if selling price is 3 and the AVC is 6, then shut down

if selling price is 5, and AVC is 3, then keep operating

perfect competition markets

consist of

more buyers/sellers

exact same products

no entry/exit barriers

market share % doesn’t matter

$20

In order to produce 100 oatmeal cookies, Goodie Cookie Co incurs an average total cost of $0.25 per cookie. The company’s marginal cost is constant at $0.10 for all oatmeal cookies produced. The total cost to produce 50 oatmeal cookies is

A. $25

B. $20

C. $50

D. $60

consumer goal

maximize total utility or satisfaction within their budget constraints

marginal utility

refers to the additional satisfaction or utility gained from consuming 1 more unit of a good

substitution effect

when a price change incentivizes consumers to buy less of a more expensive good and more of a cheaper alternative

income/purchase power effect

motivates a utility-maximizer to buy more of both goods if utility rises or less if utility falls, assuming both goods are normal

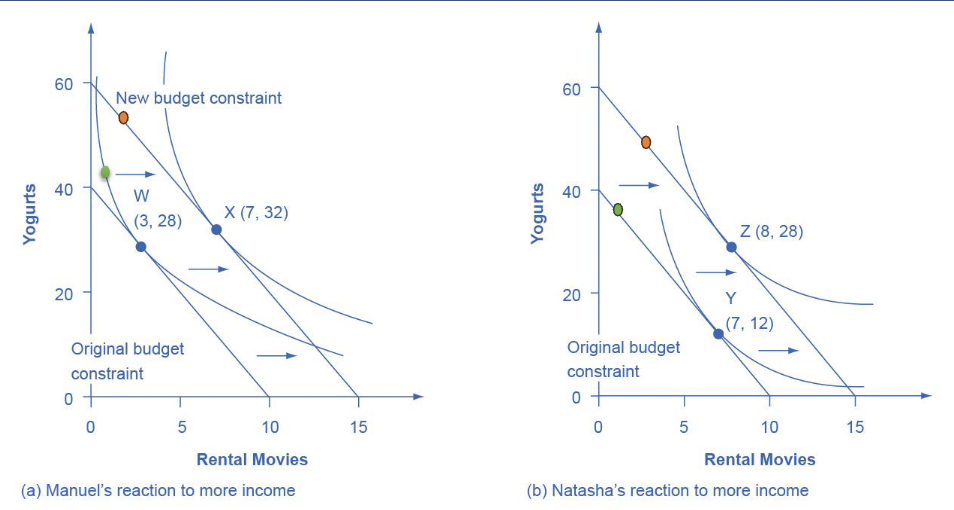

increased budget

allows consumers to reach a higher utility point, enabling them to purchase more goods or higher-quality goods

25

calculate marginal utility from consuming an additional pack of popcorn if

3 packs yield 60 total utility

4 packs yield 85 total utility

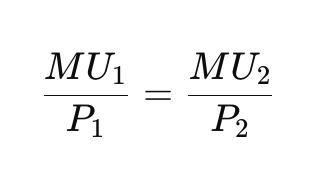

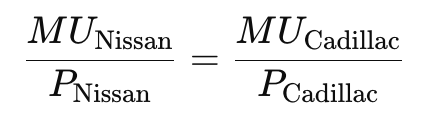

utility of car/cost and compare the ratios

how to determine maximum utility per dollar spent when purchasing a car

60/21000 =0.00286

what is the utility per dollar spent for a Nissan Kicks priced at $21,000 with a utility of 60?

95/55,000 (.00173)

what is the utility per dollar spent for a cadillac XT4 priced at $55,000 with a utility of 95?

emotional response

behavioral economists suggests that ppl often experience negative emotions, such as anger or frustration, focusing more on losses than on gains

individual income

health of the economy is determined by the level of ? and the choices consumers can make with that income

loss aversion

psychological phenomenon where a $1 loss is felt 2.25x more intensely than a $1 gain is felt positively

factors of production

divided into

Natural Resources

Labor

Capital

Entrepreneurship

production fx

a mathematical expression that explains the relationship btw inputs and outputs, indicating how much output a firm can produce with different amounts of inputs

fixed costs

remain constant regardless of the level of production as they are associated with fixed inputs that do not change in the short run

rent (remains the same regardless of the amount produced until the lease expires)

an example of a fixed cost

variable costs

expenses that change with the level of output, such as labor and raw materials, which increase or decrease as production levels change

labor

considered a variable cost bc increasing production typically requires hiring more workers or increasing work hours

explicit costs

direct, out of pocket expenses incurred by a business

implicit costs

represent the opportunity costs of using resources already owned by the firm

wages paid to employees or rent paid for office space

an example of an explicit cost

owner’s time spent working wo formal salary or using personal property for business purposes

implicit cost in a small business context

implicit costs associated w hiring a new employee

costs of resources used, such as the salary the employee could have earned elsewhere or the time spent training

explicit costs

direct, out of pocket expenses for a business

implicit costs

represent the opportunity costs of using resources that could’ve been employed elsewhere

85,000

calculate explicit costs for eryn’s legal practice if she rents an office for $50,000 and hires a law clerk for $35,000

115,000

determine eryn’s accounting profit if her expected revenue is $200,000 and her explicit costs are $85,000

salary she’d forgo from current job: $125,000

id the implicit cost eryn faces when considering opening her own legal practice

-10,000

calculate eryn’s economic profit based on her accounting profit of $115,000 and an implicit cost of $125,000

120,000

what are the explicit costs for eryn’s legal practice if she rents an office for $75,000 and hires a law clerk for $45,000

180,000

calculate eryn’s accounting profit if her expected revenue is $300,000 and her explicit costs are $120,000

new implicit cost is the salary she would forgo from her current job, which is $135,000

id the new implicit cost for eryn if she wants to earn $135,000 after opening her own firm

45,000

determine eryn’s economic profit based on her accounting profit of $180,000 and an implicit cost of $135,000

economic profit

helps determine whether a business venture is worth pursuing by considering both explicit and implicit costs, guiding decisions on resource allocation

typists

provide labor for typing services

personal computers

serve as capital to facilitate the typing and other administrative tasks

economies of scale

refer to the phenomenon where the avg cost of producing each unit decreases as the level of production increases

diseconomies of scale

occur when a company grows so large that the costs per unit increase, indicating that economies of scale are no longer effective

entry into a perfectly competitive market

increases supply, which pushes down prices until they reach the zero-profit level in the long run

breakeven point

level of production at which total revenues equal total costs, resulting in zero profit

shut down/stop production

selling price is less than average variable cost AVC, what to do?

marginal cost

cost of producing one additional unit, and it contributes to the total cost when multiplied by the qty produced

long run profits for a perfectly competitive firm

long run tend to decrease to the zero-profit level due to market entry by new firms

production levels and avg cost

as production levels increase, avg costs typically decline until reaching an optimum level, after which diseconomies of scale may occur

average total cost ATC

crucial for production decisions as it helps firms determine pricing strategies and profitability

income/purchase power effect

the motivation encourages a utility-maximizer to buy more of both goods if utility rises or less of both goods if utility falls (if they are both normal goods).

Decrease quantity of goods, purchase 2 movie tickets instead of 3

short vs long run

short run

firms can’t change the usage of fixed inputs

perfectly competitive firm can earn profits in the short run

long run

firm can adjust all factors of production

perfectly competitive firm the process of enty will push down prices until they reach the zero-profit level

goal

sell products with prices greater than ATC

if profit is less than the breakeven point (negative profit) consider shutting down or stopping production

perfect competition

entry→ sell at competitive price→ make profit→ encourage new firms to enter→ more supply stable demand→ profit decreaes→ firms profit less than breakeven point→ exit