AP MICRO section 9 test

1/96

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

97 Terms

Inverse

what relation does price and quantity demanded have

substitution effect

consumers substitute good that becomes relatively cheaper for good that had more expensive

willingness

lower priced items

more effective than other effect that goes hand in hand with the demand curve

Income effect

the quantity demanded results from a change in the consumer’s purchasing power when the price of the goods changes

ability

for higher priced items

reinforces another effect

normal goods

change in demand directed related to a change in income

income and substitution effect move in the same direction

lowers

when price increases what happens to purchasing power?

inferior goods

change in demand inverse related to change in income

income adn substitution effect move in opposite directions

giffen good

demand curve is upward slopping

lower priced goods (generally)

income effect outweighs substitution effect

inferior good

necessity

few substitutes

price elasticity of demand

refelects how sensitive consumers are to a change in price

absolute value

elastic demand

ped>1

inelastic demand

ped<1

unitary elastic demand

ped=1

perfectly inelastic demand

price change will have no impact on consumer

quantity demand is unchanged

ped=0

vertical

Perfectly elastic demand

price change will create an infinite quantity demand when price lowers, quantity demand will go to 0 when price goes up

quantity demand=0

horizontal

ped=infinity

higher prices

demand is elastic at

lower prices

demand is inelastic at

total revenue

total value of sales of a good or service

inelastic demand

price increases and total revenue increases

price decreases and total revenue decreases

elastic demand

price decreases and total revenue increases

price increases and total revenue decreases

unitary demand

price changes and total revenue is the same

marginal revenue is 0

at what quantity is total revenue maximized?

marginal revenue is positive; negative

On a graph, where is demand elastic? in elastic?

price effect

after a price increase each unit sold sells at a higher price which tends to raise revenue

quantity effect

after a price increase, fewer units are sold which tends to lower revenue

elastic demand

quantity effect> price effect

total revenue decreases

inelastic demand

price effect> quantity effect

total revenue increases

close substitutes

the more _____ the more elastic demand will be; ped increases

inelastic

Necessity or luxury: necessity will have more __ demand

T

The smaller portion of your income, the more inelastic demand will become; the higher share income you are going to spend the more elastic demand will become (luxury goods)

time

demands becomes elastic when consumers have more ___ to adjust to the price change

cross price elasticity of demand

measures the effect of the change in one good’s price on the quantity demanded of the other good (substitutes or complements)

no absolute value

substitutes

Exy=+

(same direction)

Complements

Exy= -

(opposite direction)

no relationship

Exy=0

Income elasticity

measures the percent change in quantity demanded when income changes (normal good or inferior good)

no absolute value

normal good

ie=+

inferior good

ie= -

luxury good, income elastic

ie>1

necessity; income inelastic

ie<1

Necessity; perfect income elastic

ie=0

price elasticity of supply

measures the responsiveness of the quantity supplied to the price of the good

elastic supply

Es>1

inelastic supply

Es<1

unitary elastic supply

Es=1

Factors impacting elasticity of supply

availability of inputs (readily available at lower cost= e; high cost= I)

Time (more time to adj=more e)

ability to store (deteriorate?—I durable?)

Mobility (more mobility=more elastic)

Technology Advances

Consumer surplus

difference between the consumers’ willingness to pay for. a good and the actual price paid by them

represents how much consumers benefit by participating in the market

willingness to pay

-height of DC=value to buyer

net gain

willing pay amount-available price

producer surplus

difference between the producers cost to sell a good and the actual price paid to them

represents how much produces benefit by participating in the market

sellers cost

-height of supply curve=cost to seller

sellers cost

lowerst price willing to sell the good

cost to seller

height of supply curve

value to the buyer

height of the demand curve

lower price

consumer surplus increases: increase in surplus for original buyers and increases surplus gained with new buyers entering the market

-producer supply decreases

higher price

producer surplus increases: increase in surplus for original sellers and increase surplus gained with new sellers entering the market

-consumer surplus decreases

welfare

how people benefit by participating in the market

at equilibrium

welfare and total surplus is maximized at…

decrease total surplus

Reallocation of Consumption Among Consumers

reallocation of sales among sellers

change in Quantity traded

efficient markets

allocates consumption of the good to potential buyers who most value it= higher will to pay

allocates sales to potential sellers who most value the right to sell- lowest cost

ensures every consumer who makes a purchase values the good more than every sell who makes a sale=beneficial transaction

ensures that every potential buyer who doesn’t make a purchase values the good less than every potential seller who doesn’t make a sale=no mutual beneficial transactions are missed

caveats of efficient markets

not necessarily fair or equity

markets can fail to deliver efficiency

equilibrium does not ensure best outcome for each consumer and producer

Trade off

equity and efficiency are a ____

regressive tax

tax that has increased income taxpayers pay a small percent of income than low income tax payers

-rise less than in proportion to income

proportional tax

tax that all taxpayers pay the same percent of their income

-rises in proportion to income

progressive tax

tax that increased income taxpayers pay a large percent of income than low income taxpayers

-rises more than in proportion to income

excise tax

tax charged on a specific good

-sin taxes

-inelastic demand

effects of excise tax

shift up supply curve

drives a wedge

creates missed opportunities—discourage, distort incentive

demand shifts left, decreases

Tax incidence

demonstrates who is paying the larger burden of the tax

Consumers

when Demand is price inelastic and supply is elastic burden falls on the____.

demand, Left

which curve shifts when the burden falls on the consumers? and where?

Producers

when demand is price elastic and the supply is price inelastic, the burden of the excise tax falls on…

supply, left

when there is tax placed on producers which curve shifts and in which direction?

Deadweight Loss

loss of total surplus in the market

Lump sum tax

tax of a fixed amount paid by all tax payers

-does not affect price or quantity, does not create DWL

administrative costs

resources used by the government to collect the tax and by taxpayers to pay or evade it, over and above the amount collected

-could be doing other stuff

utility

a measurement of a personal satisfaction received from consuming a good

-offers a way to study choices in a rational way

Utils

unit used that measure your satisfaction

Marginal utility

change in total utility when consuming an additional unit

negative slope

what slope does marginal utility have?

diminishing marginal utility

as you consume more good, marginal utility decreases

consumer equilibrium

allows consumers to obtain most possible satisfaction from their income

-reached when consumers purchases assortment of goods that best meet the satisfaction requirements within financial constraints

budget constraint

limits the cost of a consumer bundle to no more than consumer income

consumption possibilites

set all consumer bundles that are affordable to income and prevailing prices

budget line

shows all the consumer bundles available to consumer who spends all of his or her income

-always consume

affects of budget line

change in income (increases, shift right)

change in price (decrease in price, rotate line out)

optimal consumption bundle

consumption bundles maximizes the consumer total utility given budget constraint=highest total income considering the trade offs

Marginal utility per dollar

additional utility from spending one more dollar on that good or service

-used to compare what should be bought first and more of

optimal consumption rule

when a consumer maximum utility in teh face of a budget constraint the marginal utility per dollar spent on each good or service in consumption bundle is the same

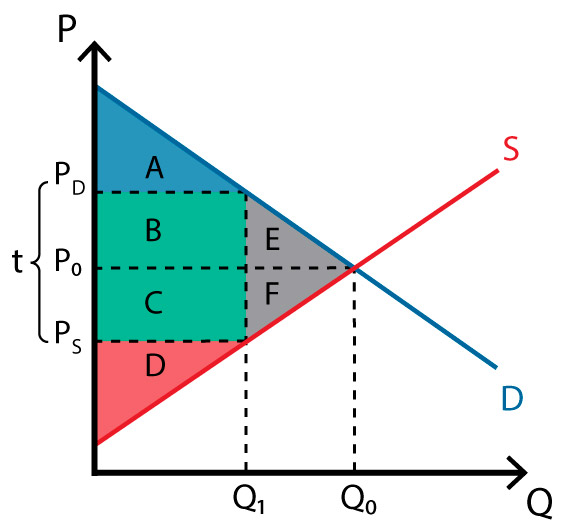

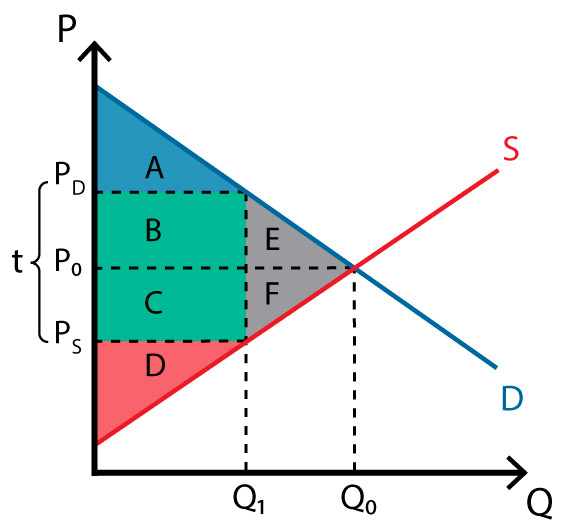

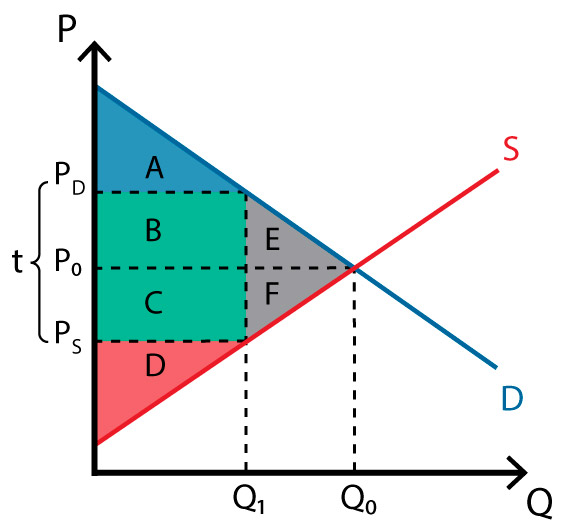

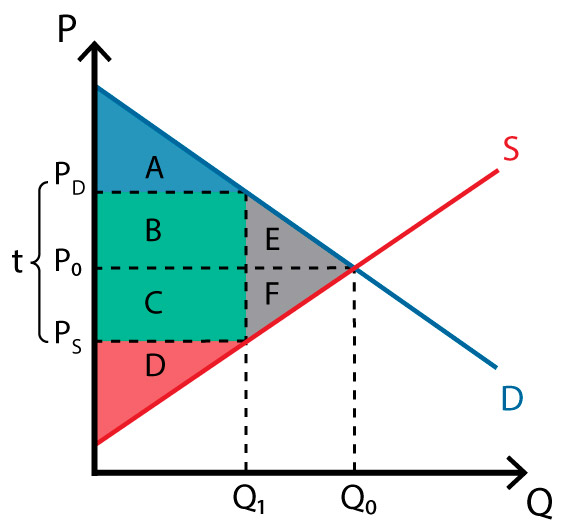

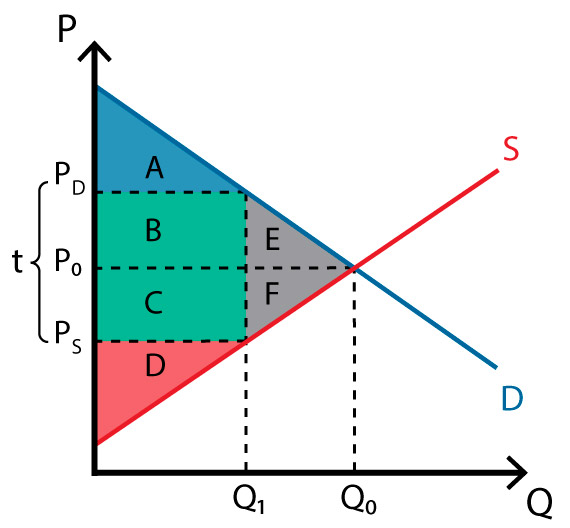

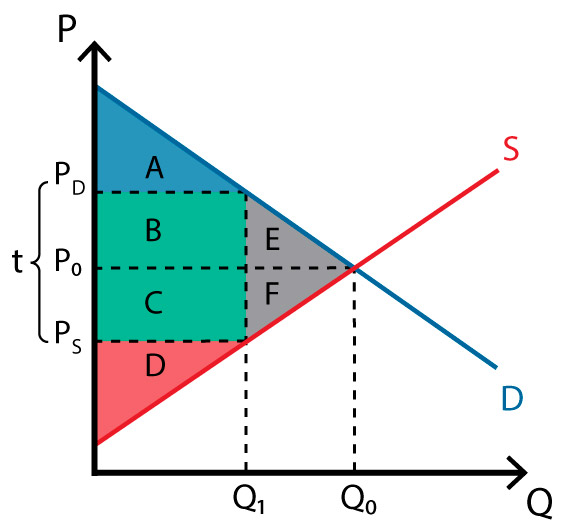

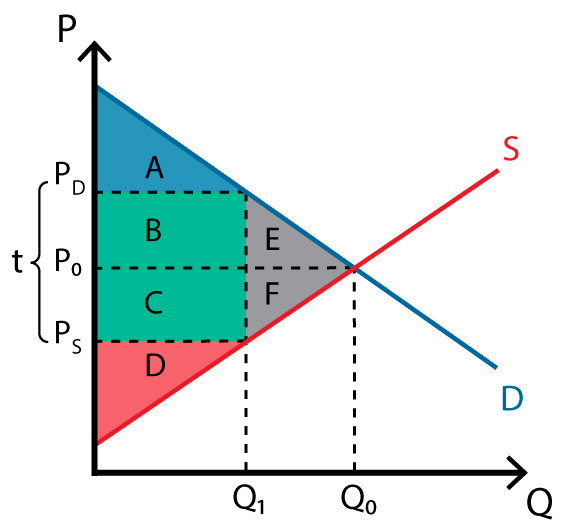

Q0 to Q1

what is the loss of economic activity?

line of Q1

what is the wedge in the market?

BC

what is the government revenue

ABE; A

what is consumer surplus before tax? after tax?

CDF; D

Producer surplus before tax? after tax?

ABCDEF;ABCD

Total surplus before tax? After tax?

EF

what is the deadweight loss?

affects of tax

loss of economic activity

wedge in market

shared burden

government revenue

loss of consumer surplus and producer surplus

dead weight loss

Increasing, Max, Decreasing

when marginal utility is positive, the total utility is___, when it is 0 it is ___, when it is negative it is___.

Marginal Rate of Substitution

Rate at which a consumer will exchange one good for another while maintaining the same level of satisfaction

-indifference curve

Diminishing MRS

as a person substitutes one good for another, they require more of the substituted good to maintain utility

-reflects diminishing marginal utility

Indifference curve

combination of two good that yield equal satisfaction. In other words, the consumer would be indifferent to these different combinations.

Tangent

to maximize utility, a consumer chooses a combination of two goods at which the indifference curve is ___ to the budget line